Smart driving: the battle between the old and new forces

![]() 08/23 2024

08/23 2024

![]() 442

442

Despite Wang Chuanfu of BYD proclaiming that "the first half is electrification, and the second half is intelligence," the discourse power of "intelligence" largely rests in the hands of new-energy vehicle brands. In particular, smart driving, the crown jewel of this sector, is largely dominated by XPeng and Huawei, with little controversy. Beyond these two brands, other new-energy players like NIO and Lixiang also come to mind when discussing smart driving, while traditional automakers have failed to gain any significant advantage in this battle for public opinion.

The reality is that smart driving is gradually emerging as an important selling point, second only to basic features like driving range and charging performance. For pure electric vehicles in particular, smart driving serves as a crucial motivator for consumers to opt for EVs despite range anxiety. For long-term considerations, it's not difficult to understand why traditional automakers are eager to catch up and make a mark in smart driving, aiming to regain market dominance.

Among traditional Chinese automakers, BYD, Great Wall Motor, and GAC Group (Aion & Aion LX Plus) have been the most active players in smart driving this year. As the peak sales season of "Golden September and Silver October" approaches, BYD and Great Wall Motor have made new moves.

At the Denza Tech Day, BYD introduced the concept of "BAS 3.0+", claiming to elevate smart driving from "human-like" to "superhuman" levels, presenting a new and visionary concept representing the future direction of development. On August 21, Great Wall Motor unveiled the Blue Mountain smart driving edition, with Wei Jianjun, the company's chairman, appearing at the launch event for the first time in six years. Speaking confidently about the vehicle's smart driving capabilities, Wei stated, "This is number one. You can remove the word 'tier.'"

Seeing the confidence exuded by these two leading traditional automakers, one can't help but wonder if the smart driving arena is finally set to be dominated by traditional players. Given more time, could traditional automakers truly stage a comeback?

Traditional automakers lost the first round in terms of vision

New-energy vehicle brands have long led the way in smart driving technology, largely due to their visionary approach to shaping industry trends. For instance, the smart driving technology framework adopted by mainstream automakers was first proposed by Tesla, with BEV (Bird's Eye View) and Transformer serving as the pillars supporting the fundamental operational logic of modern smart driving systems.

Certainly, under the influence of large AI models (especially the "end-to-end" technology trend), companies like XPeng and Huawei have discovered new possibilities. A notable feature of Huawei's ADS 3.0 smart driving system is its use of two end-to-end models to replace the traditional BEV+Transformer architecture, facilitating the integration of perception and execution logic, resulting in more efficient system decision-making.

From this perspective, new-energy players continue to update the underlying concepts of smart driving systems and explore more efficient and superior implementation methods. For traditional automakers to lead the smart driving industry, they cannot merely follow the technological solutions of new-energy players; it is crucial to propose new concepts and put them into practice.

This is why I was pleasantly surprised when BYD introduced the concept of "BAS 3.0+" at the Denza Tech Day. As the proponent of the idea that "the second half is intelligence" and a de facto leader in new energy vehicles, BYD's ability to transcend the existing "follower" framework and propose new concepts is undoubtedly heartening. However, upon closer inspection, it becomes apparent that BYD's vision for the future of smart driving differs from that of most automakers.

In simple terms, while other automakers focus on iterating and upgrading the underlying algorithms and logic of smart driving, BYD places greater emphasis on integrating vehicle capabilities when considering the future development of smart driving. Yang Dongsheng explained that the most significant feature of BYD's next-generation smart driving technology, "BAS 3.0+", is its further integration with the underlying Xuanji electronic and electrical architecture and electrification technology, enabling smart driving to reach "superhuman" levels through upgraded vehicle perception and control capabilities.

Through the Denza Z9GT, we can glimpse BYD's innovative ideas. This vehicle has even achieved the feat of "unmanned moose test," demonstrating that in emergency situations, the smart driving system can take over vehicle control to avoid risks, thereby reaching "superhuman" levels of performance.

However, honestly speaking, I believe that other mainstream new-energy players are not on the same wavelength as BYD when it comes to smart driving. New-energy automakers tend to focus more on the iterative capabilities of smart driving itself, whereas BYD considers the integration of vehicle capabilities within the smart driving system, undoubtedly at a higher level. Nevertheless, the underlying capabilities of smart driving are also crucial. So, what are BYD's plans in this regard?

Unfortunately, I'm not yet aware of the specifics. Judging from the current situation, BYD's smart driving capabilities still primarily follow industry mainstream technology trends. During the presentation, BYD mentioned technical features such as "end-to-end on-vehicle" integration, but did not propose more advanced concepts akin to NIO's "One Model" or Li Auto's "Nio World Model."

Certainly, based on the information released by BYD so far, their current BAS 3.0 version has successfully integrated end-to-end large models and mapless technology, and is expected to achieve "nationwide full-scenario navigation" by the end of this year, which is a remarkable achievement. However, when discussing industry leadership, we must focus more on "how it can change the industry." Our expectations for BYD are not only for smart driving solutions but also for new vehicle-level capabilities. Currently, BAS 3.0+ only addresses the latter, and the former remains to be seen.

As for Great Wall Motor, strictly speaking, it has merely managed to "quickly catch up with industry trends" and has yet to make any groundbreaking contributions. In summary, if traditional automakers aspire to truly become leaders in the smart driving arena, we would expect them to propose some "foundational" new ideas. In this regard, BYD has partially achieved this, while other traditional automakers still have a way to go.

In terms of technological capabilities, new-energy players no longer hold a significant advantage

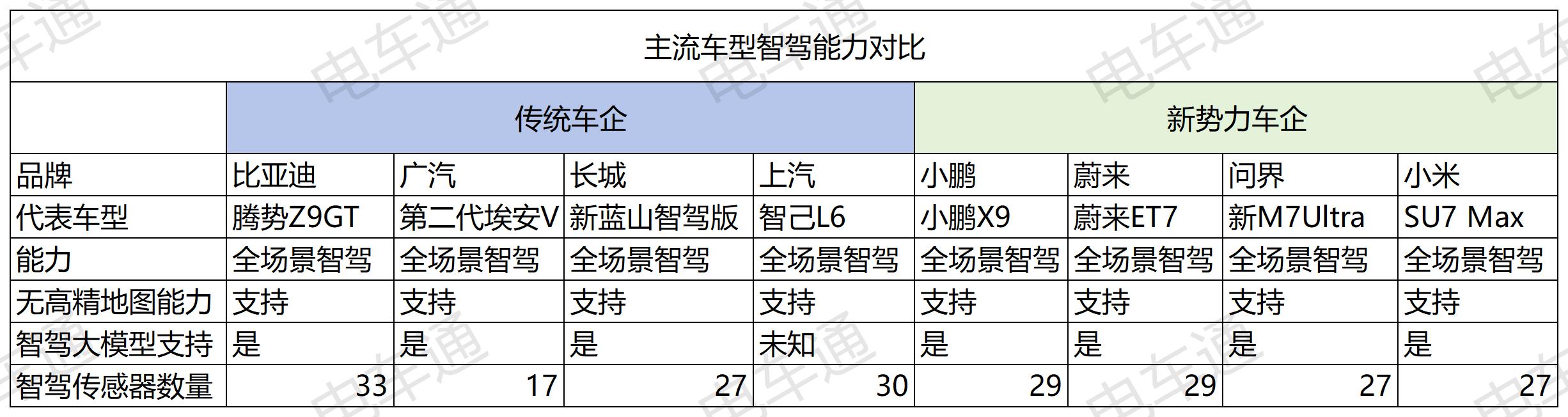

Technologically speaking, we can conclude that through increased investment in human and material resources, traditional automakers have caught up with new-energy players in terms of specific technical indicators, eliminating any theoretical generational gap between leading traditional and new-energy automakers.

Let's start with the underlying technology. Currently, the mainstream approach to smart driving relies on three frameworks: BEV+OCC+Transformer, utilizing different rules and modules to enable smart driving with the assistance of AI large models in some cases. Traditional automakers, including BYD, Great Wall Motor, GAC Group, and others, have already applied these technological frameworks to their mainstream models, thereby achieving a crucial technical indicator in smart driving: navigating urban areas without relying on high-precision maps.

Certainly, in terms of timelines, traditional automakers lag behind new-energy players in terms of implementing smart driving in urban areas. With the exception of a few brands like Xiaomi and ZEEKR, most new-energy players have already achieved smart driving coverage in both highways and urban areas, ready for immediate use. On the other hand, traditional automakers like BYD, GAC Group, and SAIC Motor have set their target for implementing mapless smart driving in urban areas for the end of this year. Great Wall Motor is slightly ahead, having already conducted tests in multiple cities like Chongqing and expecting to roll out the urban NOA feature to users as early as autumn.

Regarding another technical indicator, the "smart driving large model," traditional automakers are not far behind new-energy players. For example, Great Wall Motor's new Blue Mountain smart driving system utilizes the SEE smart driving large model, and BYD and GAC Group's smart driving technologies also employ large models. It can be seen that traditional automakers have caught up with the mainstream level of new-energy players in terms of underlying smart driving technology. While there is still a generational gap compared to the next-generation smart driving systems of XPeng and Huawei, there is currently not much difference in actual experience (when both are available).

As for another directly comparable indicator, "number of perception sensors," traditional automakers are also quite generous with their hardware. According to our statistics, the flagship models of traditional automakers are not just "on par with new-energy players" in terms of smart driving perception hardware but are even more lavish. For instance, the Denza Z9GT is equipped with 33 perception sensors, the most among the eight models listed.

Finally, let's look at solutions, which I believe is the biggest difference between traditional and new-energy automakers.

In simple terms, new-energy automakers' smart driving solutions are mostly developed in-house, allowing them to effectively manage technology upgrades and apply cutting-edge technologies. In contrast, traditional automakers tend to follow the traditional mindset of "integrating suppliers." For example, BYD, GAC Group, and SAIC Motor all have ties with Momenta, while Great Wall Motor's rapid progress in smart driving can be attributed in part to its incubator, Homa Auto, and secondary supplier, Yuanrong Qixing.

While there are pros and cons to both in-house development and partnering with suppliers, BYD's recent announcement that it will switch to an in-house solution indicates that traditional automakers may ultimately return to this path if they truly want to lead the smart driving development or successfully implement new ideas.

Overall, compared to earlier years when traditional automakers were virtually absent from the smart driving scene, their competitiveness in this area has significantly improved. In particular, through relentless investments in hardware, they have caught up in terms of basic capabilities, which is also a reflection of their emphasis on smart driving.

However, objectively speaking, such performance may still be insufficient for traditional automakers to truly become leaders in the smart driving field. After catching up, traditional automakers have merely reached the same starting line as most new-energy players. Nevertheless, they must recognize that some "top students" have already gained a head start, and to truly become leaders, traditional automakers must overtake XPeng and AITO.

The battle for the voice in smart driving: new-energy players have a solid foundation, while traditional automakers have staying power

In my opinion, the role of "leader" is unlikely to come from automakers' self-promotion but rather requires spontaneous followership from other players in the industry and recognition from consumers through word of mouth. At present, the biggest challenge for traditional automakers in smart driving is a lack of audience and user reputation. Merely relying on press conferences and self-proclaimed titles is hardly convincing.

At least for the next year or two, some new-energy automakers (like XPeng, HarmonyOS Intelligent Driving, NIO, and Li Auto) will maintain their leading edge due to their first-mover advantage. We can also see that they have unique insights into specific smart driving routes, such as the application of end-to-end capabilities and the evolution of algorithms, which are quite forward-thinking.

However, what's crucial is that they have delivered actual products based on these theories. XPeng's new-generation XNGP smart driving system has already been rolled out, and Huawei's ADS 3.0 is also in mass production. With concrete products to support their claims, consumers can easily perceive their technological advancements, eventually leading to brand reputation through word of mouth.

Optimistically, traditional automakers are paying increasing attention to smart driving, and with their vast resources (including cash reserves), they may develop unique advantages when the competition in smart driving fully shifts to a battle of talent, manpower, and even data and computing resources. Taking BYD as an example, Yang Dongsheng revealed in an interview that BYD's smart driving team comprises over 4,000 people, with monthly salaries exceeding 1 billion yuan.

The most important task for traditional automakers is not self-promotion but rather focusing on the basics, such as expediting technology implementation and making high-level smart driving accessible to consumers. Traditional automakers inherently have the advantage of scale. As long as the experience is excellent, it will be easier to generate a reputation effect, and automakers can also obtain larger feedback samples for targeted improvements.

In conclusion, opportunities always exist for traditional automakers, and they should inherently have an advantage. It could be due to early neglect or misjudgment of the situation that they fell behind in crucial areas like smart driving. Returning to the core issue, do traditional automakers have a chance to become leaders? In my opinion, it depends on how the smart driving industry develops in the future.

If the smart driving industry continues to be driven by new technologies and concepts, new-energy automakers that actively explore technological boundaries and are more sensitive to cutting-edge technologies may continue to play a leading role. However, if the underlying development of smart driving technology gradually reaches a bottleneck, turning the competition into a "war of attrition," financially strong traditional automakers may catch up and even surpass their competitors.

Source: Leitech