Kingdee's half-year loss of 317 million yuan, still wandering in the 'cloud'

![]() 08/27 2024

08/27 2024

![]() 671

671

Consecutive losses and share price halved

Yet Xu Shaochun says the 'golden decade' has arrived

Original by Youdianshu · Digital Economy Studio

Author | Uncle You

WeChat ID | yds_sh

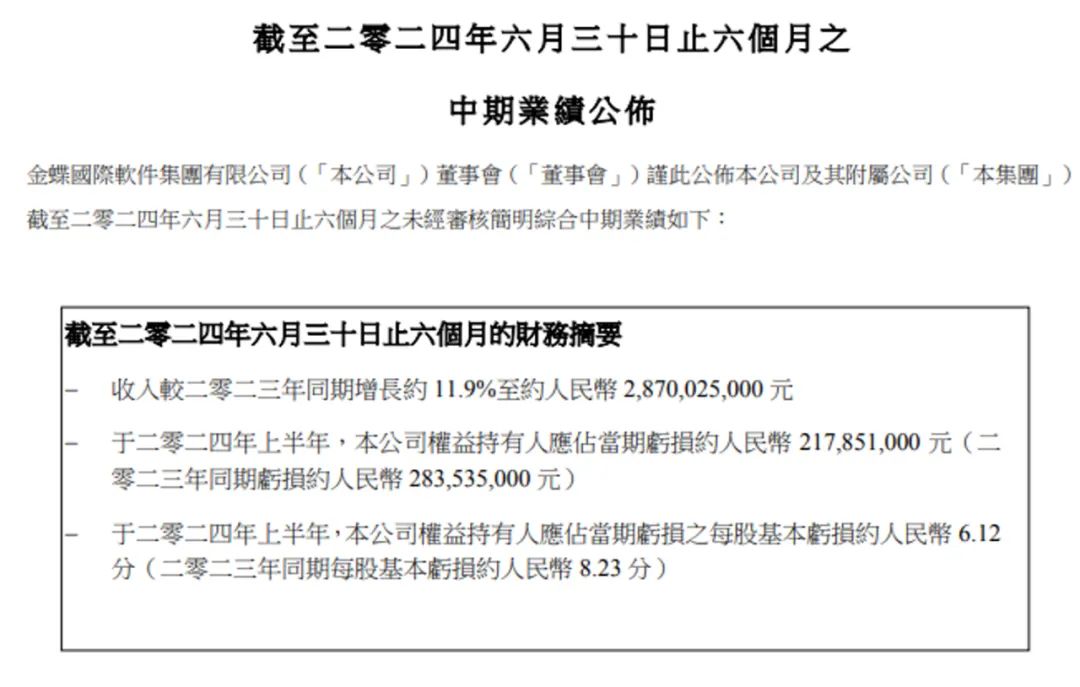

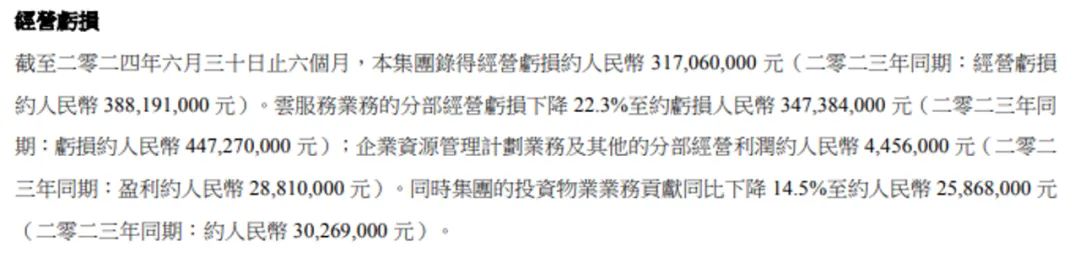

Kingdee International (00268.HK) recently released its financial report for the first half of 2024, showing double-digit revenue growth but still failing to turn a profit. During the reporting period, Kingdee International achieved revenue of 2.87 billion yuan, a year-on-year increase of 11.9%; the loss attributable to equity holders was approximately 218 million yuan, a year-on-year narrowing of 23.2%. Notably, Kingdee's operating loss for the first half of the year was 317 million yuan, with cloud services contributing the largest share of losses at 347 million yuan, becoming the primary factor dragging down the company's overall performance. Since the beginning of the year, Kingdee International's share price has fallen from around 10 yuan to around 5 yuan, almost halving.

Persistent losses in cloud services and declining profits in traditional businesses

Cloud transformation has been a strategic route chosen by many domestic software enterprises in recent years, and Kingdee is no exception. The half-year report shows that cloud service revenue increased by 17.2% year-on-year to 2.39 billion yuan, accounting for 83.2% of Kingdee Group's revenue. Transitioning from ERP to enterprise cloud services, Kingdee has become a cloud service company centered on the subscription model, with a compound annual growth rate of 35.6% in cloud service revenue over the past seven years.

Surprisingly, however, Kingdee's cloud service business remains unprofitable and has become the primary drag on the company's performance. In the first half of the year, Kingdee International's cloud service business lost 347 million yuan, narrower than the 447 million yuan loss in the same period last year but still the most significant loss among the company's business segments. This figure reflects that Kingdee International's investment in cloud services has not yet fully translated into revenue, and the business's scale effect has not fully materialized.

Industry insiders attribute the persistent losses in cloud services to several factors. Firstly, the cloud service market is highly competitive, and Kingdee International needs to continuously invest significant funds in technology research and development and marketing to maintain its competitiveness. Secondly, it takes time for customers to accept and develop habits for using cloud services, which affects the profitability of cloud service businesses. Additionally, the profit model for cloud service businesses differs from that of traditional software businesses, and balancing short-term investments with long-term returns is a significant challenge for Kingdee International.

In contrast to the cloud service business, Kingdee International's traditional Enterprise Resource Planning (ERP) business, while profitable, has seen a marked decline in profitability. During the reporting period, the ERP business generated a profit of 4.456 million yuan, a sharp 84.5% decrease from the 28.81 million yuan in the same period last year.

This figure reflects the pressure faced by Kingdee International's traditional business. On the one hand, as cloud computing technology becomes more prevalent, more enterprises are turning to cloud-based solutions, slowing growth in the traditional ERP software market. On the other hand, Kingdee International may have allocated more resources to its cloud service business during its cloud transformation, weakening support for its traditional business.

Although Kingdee International has yet to achieve overall profitability in the first half of the year, the financial report data indicates that the company has made progress in cost control and revenue structure optimization.

During the reporting period, Kingdee International's cost of sales was 1.055 billion yuan, a year-on-year increase of 7.87%, lower than the 11.9% revenue growth rate. This suggests that the company has taken effective measures to control costs. Simultaneously, the company's gross margin increased by 1.3 percentage points from 2023, primarily due to an increase in the proportion of subscription revenue. The subscription model not only brings stable cash flow to the company but also helps improve customer loyalty, positively impacting long-term profitability.

Kingdee International's financial report for the first half of 2024 reflects the opportunities and challenges faced during its cloud transformation. The continuous revenue growth and narrowing losses demonstrate some success in the company's strategic transformation. However, the persistent losses in the cloud service business and declining profitability in traditional businesses also expose issues during the transformation process.

Huawei enters the ERP market, intensifying industry competition

Kingdee is emblematic of SaaS concept stocks, which generally face high sales and administrative expenses, leading to consecutive losses. This reflects that the domestic SaaS industry has yet to enter a stage of large-scale commercialization, and profitability remains a pain point. Moreover, competition in this field is intensifying.

At the end of June this year, China General Nuclear Power Corporation (CGNPC) announced procurement results, with Huawei winning the bid for the company's new-generation ERP product pre-research technical support service project. The contract was awarded as a sole source procurement with a price of 20 million yuan. While this order's value is not substantial in the context of large-scale ERP projects, it attracted significant attention as Huawei's first disclosed external customer for its MetaERP service.

Both Yongzhong and Kingdee have been focusing on top-tier central government and state-owned enterprise customers in recent years. Notably, CGNPC, for which Huawei won the bid, is also a benchmark customer for Yongzhong and Kingdee. In September 2023, Yongzhong announced the successful launch of CGNPC's smart treasury system billing service. In the same year, Kingdee assisted CGNPC in successfully building a tax digitization platform.

The Miracle of Huawei MetaERP Replacement, written by Huawei's senior advisors including Tian Tao, describes the development of Huawei's MetaERP. Huawei originally used Oracle ERP, but after being sanctioned by the United States, Huawei's ERP system faced supply disruptions, posing a severe threat to the company's survival. Huawei considered adopting domestic software packages as alternatives, conducted tests and verifications, but due to the complexity of its global business scenarios, domestic software packages were difficult to match, requiring extensive customization. In late 2019, Huawei decided to develop its ERP system in-house. After more than three years of hard work, this project, likened to "forcibly crossing the Dadu River," was launched for Huawei's core businesses, covering 100% of the company's business scenarios and 80% of its business volume.

After Huawei completed its internal ERP replacement, it began the productization stage for external customers. It has been reported that MetaERP has focused on a handful of clients over the past two years. CGNPC appears to be one of them, but other clients have not been disclosed. In addition to Huawei, some state-owned enterprises are also developing high-end ERPs independently. Less than ten days after Huawei announced the completion of MetaERP, Kunlun Digital Intelligence, a subsidiary of PetroChina, also announced that Kunlun ERP had successfully operated on a single track at Daqing Petrochemical.

Huawei's 20 million yuan contract indicates that the large enterprise market is starting to take notice of MetaERP, which may lead to a decline in market share for Kingdee and Yongzhong, directly impacting their share prices. Huawei's focus on the large enterprise market for ERP will likely attract more partnerships from these enterprises. While Kingdee and Yongzhong still have the small and medium-sized enterprise market, the more diversified needs of these enterprises make it more challenging to provide tailored solutions.

Intensifying industry competition has led to pessimistic forecasts from research institutions. A previous report by CLSA noted that macroeconomic uncertainties may affect investment sentiment and financial performance towards Kingdee International, and downgraded its sales and net profit forecasts for 2024 to 2026.

Another brokerage firm, CICC, pointed out that Kingdee International's revenue for the first half of 2024 would increase by 12% year-on-year to 2.87 billion yuan, lower than previously expected. The reason for the lower-than-expected growth was the macroeconomic environment, which may have slowed new signings among small and medium-sized enterprises.

The macroeconomic environment in 2024 is fraught with uncertainties, with small and micro-enterprises facing tighter IT budgets, and large enterprises' authorized product procurement significantly weaker than expected.

Despite Chairman and CEO Xu Shaochun of Kingdee Group stating at the earnings call that the 'golden decade' for Chinese enterprise software SaaS has arrived, the SaaS industry is far from rosy, with most leading enterprises mired in losses. They are exploring ways to break the deadlock, transitioning from pursuing scale to Refined operation , and shifting focus from small and medium-sized enterprises to larger clients. Kingdee International's ability to accelerate profitability in its cloud service business while maintaining stable development in traditional businesses will directly impact the company's long-term prospects.