Not an easy task to manage charging piles

![]() 08/27 2024

08/27 2024

![]() 561

561

Introduction

Introduction

Is managing charging piles profitable, and why are companies still entering this market?

With the rapid growth of the new energy vehicle market, the construction of charging infrastructure has become crucial. On August 6, the National Development and Reform Commission, the National Energy Administration, and the National Data Administration jointly issued the "Action Plan for Accelerating the Construction of a New Power System (2024-2027)", aiming to promote the construction of a new power system through nine special actions.

These include a focus on expanding the electric vehicle charging infrastructure network. The plan clarifies that public charging facilities will be deployed in residential areas, office areas, commercial centers, industrial centers, leisure centers, etc., based on actual conditions. At the same time, coverage of highway charging networks will be strengthened, and charging facilities in rural areas will be improved.

According to statistics, as of the end of June this year, the number of charging piles nationwide has reached 10.244 million, with an annual growth rate of 54%. Among these, there are 3.122 million public charging piles and 7.122 million private charging piles, meeting the charging needs of 24 million new energy vehicles.

To further satisfy the long-distance travel needs of new energy vehicles, the National Energy Administration has installed 27,200 charging piles in highway service areas, achieving basic nationwide coverage. Simultaneously, the Administration actively promotes the construction of charging infrastructure in counties and townships, with more than one-third of provinces in the country having deployed charging facilities in all townships, providing strong support for the popularization of new energy vehicles in rural areas.

As everyone knows, the construction and operation of charging piles nationwide is a monumental task that cannot be accomplished without the joint efforts of the State Grid and charging pile companies.

As a large state-owned enterprise, the State Grid has a nationwide power network, enabling it to deploy and construct charging piles across the country. Whether in cities or rural areas, the State Grid can leverage its vast network resources to provide convenient charging services for electric vehicles.

Charging pile companies not only provide diverse charging pile products and solutions but also actively promote technological innovation and development in the charging pile industry. For example, some charging pile companies have developed charging piles with flexible matrix switching, which can automatically match the power demand of the vehicle side, improving power utilization and making charging more intelligent and convenient.

Industry landscape seems to be settled

The charging pile industry chain consists of upstream, midstream, and downstream segments, with the downstream segment, involving charging service operators and end-users, being the most accessible. In this segment, there are diverse operating enterprises, including specialized operators such as Telai, Yunkuaichong, Xiaoju Charging, Xingxing Charging, and Ewe Energy, as well as state-owned enterprises like the State Grid, China Southern Power Grid, and Potevio, and automakers like BYD, Tesla, NIO, Xpeng, and SAIC Motor.

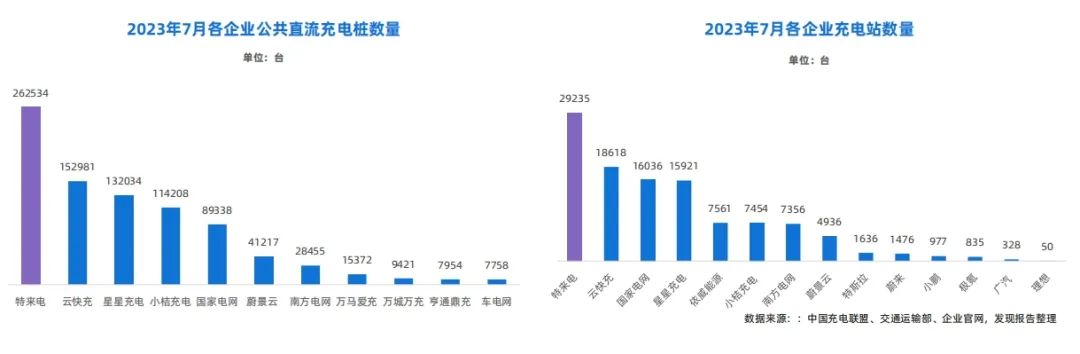

From an overall market perspective, the domestic public charging service market exhibits a significant concentration effect. According to statistics from the China Charging Alliance, as of June 2023, the top three operators held a market share of 54.1%, the top five held 68.7%, and the top ten accounted for 86.2% of the market. Leading operators like Telai and Xingxing Charging maintained a stable market share of around 20%, demonstrating their solid market position.

As the number of new energy vehicles increases and their battery capacity grows, the revenue of charging service operators is expected to surge significantly. Meanwhile, with the gradual introduction of government subsidy policies, the profitability of operators is projected to improve. It is estimated that by 2027, the market space for this industry will reach 307.6 billion yuan, with an anticipated annual compound growth rate of 47% over the next five years.

For instance, in mid-August, the Xiamen Municipal Development and Reform Commission and the Municipal Finance Bureau issued the "Notice on the Measures for Supporting and Subsidizing Electric Vehicle Charging Facilities in Xiamen," which clarified the power requirements, scale requirements, subsidy standards, and upper limits for charging facility operation subsidies. The aim is to establish a high-quality charging infrastructure system with extensive coverage, moderate scale, reasonable structure, and improved functions.

In the field of electric vehicle charging, Telai and Xingxing Charging are undoubtedly two leading enterprises. As a subsidiary of TGOOD, Telai pioneered the industry since its establishment in 2014, leading the bidirectional interaction between new energy and new transportation through technological innovations such as the "integration of four networks." Xingxing Charging, also founded in 2014, has secured a market position with its comprehensive charging solutions and exceptional equipment performance.

Telai, affiliated with the TGOOD Group, has not only pioneered a new industrial model integrating charging networks, microgrids, energy storage networks, and data networks but also promoted the bidirectional interaction between new energy and new transportation. Its diverse product line includes group charging, low-power charging, automatic charging, and single-pile charging stations, widely used in highway service areas, public parking lots, enterprise and institution parks, etc.

As of July 2023, Telai had established an extensive charging network with 262,534 public DC charging piles and 29,235 charging stations, ranking first in China. Its charging network layout is quite mature, and given the limited geographical resources, Telai's dominant position in the market is unlikely to be replaced in the short term.

Similarly, Xingxing Charging, which emerged in 2014, focuses on providing comprehensive charging solutions, equipment, and operational services to users. Its goal is to build a service platform covering the entire life cycle of user charging. Notably, Xingxing Charging leads the public charging pile market in terms of market share, with the second-highest total number of charging piles after Telai.

In terms of industry standards, Xingxing Charging also plays a pivotal role. The company has received multiple national project certifications from the National Energy Administration and the Ministry of Industry and Information Technology and is one of the formulators of domestic charging standards. As the leading unit designated by the National Standards Committee for high-power charging equipment, Xingxing Charging has also participated in drafting international standards on behalf of China. The hardware quality and system compatibility of its charging equipment have become the gold standard in the industry.

Moreover, Xingxing Charging's proposed V2X concept further expands the traditional V2G scope, viewing each new energy vehicle as a mobile energy storage unit. Under this concept, users can generate, store, transmit, and manage electricity according to their individual needs. This concept encompasses seven application scenarios ranging from vehicle-to-building (V2B) power supply to vehicle-to-home (V2H) power supply, showcasing Xingxing Charging's forward-thinking approach to power management and consumption.

New entrants still face challenges

Currently, charging pile operators strive to turn their business into a lucrative venture through innovative strategies such as improving charging pile utilization rates and promoting the integration of photovoltaic, energy storage, and charging systems. However, the industry's profit model is relatively simple, and the return period is relatively long, posing significant challenges for operators seeking profitability.

Especially in the second half of this year, the cost of public charging piles across the country has generally increased, quickly pushing charging operators into the spotlight and becoming a focus of public attention. The rise in costs not only affects car owners' daily travel expenses but also triggers discussions about charging facility construction, operation, and market regulation.

However, Telai, founded in 2014, remains unprofitable after nine years. Investors have questioned its operational efficiency, particularly after reviewing the Charging Alliance's June 2024 data, which shows that while Telai's charging power reached 20.86 million kWh, with an average power of 35 kWh per charging pile, the daily average utilization rate was less than 2 hours. Improving the daily average utilization rate of charging piles and reducing operating costs have become critical issues for Telai.

In response, Telai stated that its strategy of "one city, one policy" implemented in recent years, which involves precise investment and operation, has achieved remarkable results. Data shows that the utilization rate of charging piles in 2023 increased compared to the same period in 2022, leading to improved profitability for Telai, which even turned a profit in 2023.

Another undeniable fact is that from a supply perspective, the charging pile market still requires significant investment. The potential and business opportunities in this field have attracted numerous players, leading to intense market competition. To survive in this competitive market in the long term, latecomers must have a clear strategic positioning and unique competitive advantages.

Perhaps the development journey and achievements of Lvchongchong can offer some insights to new entrants. Established in 2018, this company quickly became an industry leader in two-wheeled vehicle charging piles by leveraging its strengths in youth appeal and research and development. Recognizing the rapid development of new energy vehicles, the company promptly shifted its focus to automotive charging piles.

On its official website, Lvchongchong has been recognized as a national intellectual property advantage enterprise, a specialized little giant enterprise in Jiangxi Province, and a potential gazelle enterprise in Jiangxi Province. Its charging pile products have received honors such as "Jiangxi Excellent Product," "Jiangxi Famous Brand Product," and "Jiangxi Green Ecological Product."

However, theoretical knowledge alone is insufficient. Each company's introduction paints a rosy picture, but what truly enables Lvchongchong to quickly establish itself in the automotive charging pile market is its profound insight into competitors like Telai and Xingxing Charging and the implementation of precise competitive strategies. For instance, when compared to Xingxing Charging, Lvchongchong demonstrates unique competitive advantages in several aspects.

Firstly, it has a significant advantage in charging pile pricing. Xingxing Charging's equipment prices are on the higher side, and as an industry leader, it is reluctant to easily reduce prices. Such a high-price strategy undoubtedly lengthens the payback period for customers and increases investment risks. In contrast, Lvchongchong offers more affordable pricing, helping customers achieve a quicker return on investment.

In terms of business models, Lvchongchong also demonstrates unique thinking. It avoids competing with operators by investing heavily in charging stations, a strategy that contrasts sharply with Xingxing Charging and facilitates maintaining cooperative relationships with operators. Additionally, Lvchongchong adheres to a unified pricing strategy, enhancing customer trust and earning a good market reputation. In contrast, Xingxing Charging's regional and channel sales strategies result in inconsistent pricing, potentially eroding customer trust.

Of course, similar to the automotive industry, the competitiveness of a single product cannot solely determine sales success. Only by surpassing competitors in 90% of factors can a company truly break through. It is believed that the same holds true in the automotive charging pile industry, where latecomers represented by Lvchongchong must work harder to compete with traditional enterprises like Telai and Xingxing Charging that have already established early advantages.

New entrants to the industry need not only to delve into market demands, accurately grasp user pain points, and win user trust and support through technological innovation and service optimization but also closely monitor industry dynamics and flexibly adjust business strategies to adapt to the ever-changing market environment. In this process, sustained technological investment and innovation will be crucial for latecomers to establish themselves in the market.