iFLYTEK's large model is still in the investment phase

![]() 08/28 2024

08/28 2024

![]() 619

619

Author: Hao Xin

Editor: Wu Xianzhi

This year, domestic large models have entered a new stage of accelerated commercialization. There are fewer and fewer companies that focus purely on technology, replaced by the need for practical applications. In search of relatively certain monetization models, many players continue to draw on their experience from the internet era, exploring the boundaries of new technology and business in both the B-end and C-end markets.

Among them, iFLYTEK stands out as particularly unique, embodying the intersection of two AI eras and serving as a case study for observing how new technologies reshape businesses and drive revenue growth in the era of large models.

On August 22, iFLYTEK released its semi-annual report for 2024. During the reporting period, iFLYTEK's operating revenue reached 9.325 billion yuan, an increase of 18.91% year-on-year. Net profit attributable to shareholders of listed companies was a loss of 470 million yuan, a decrease of 644.59% year-on-year.

The financial report shows that its operating costs were 5.577 billion yuan, an increase of 18.8% year-on-year, but the profit loss from its main business expanded from 433 million yuan last year to 541 million yuan this year. In the first half of the year, iFLYTEK's credit impairment loss reached 343 million yuan, directly contributing to the net profit loss, with accounts receivable bad debt losses accounting for 359 million yuan of this figure.

To date, iFLYTEK, which has been chasing after ChatGPT and striving in both B-end, G-end, and C-end markets with its software and hardware offerings, remains in an investment phase characterized by significant expenditures. The current state of iFLYTEK mirrors that of many large model companies in the market. The difference lies in iFLYTEK's ability to generate revenue through its education business, while other prominent startups rely on financing for survival.

There is growing consensus on increasing investments in AI and large models, with giants like Microsoft and Google repeatedly reiterating their commitment to ALL in AI during recent earnings calls. However, it's crucial to be mentally prepared for the fact that substantial investments in large models may not yield significant returns in profit growth for a long time to come.

'Reaching for the Skies and Standing Firmly on the Ground' Through Spending

iFLYTEK may be the most dedicated domestic company to the 'OpenAI' narrative, having set its sights on 'surpassing GPT' since the launch of its Spark large model. Following last year's GPT-3.5, iFLYTEK has focused this year on catching up with GPT-4, successively achieving goals such as 'reaching GPT-4 Turbo levels in certain capabilities,' 'comprehensively benchmarking GPT-4 Turbo,' and 'benchmarking GPT 4o.'

Similarly to the AI 1.0 era, iFLYTEK embarked from the outset on a path to monetize its large models for B-end and G-end customers, driving the industrial application of large models, which iFLYTEK itself describes as 'reaching for the skies and standing firmly on the ground.'

As it turns out, 'reaching for the skies and standing firmly on the ground' is a colossal money-eater. During the earnings call, iFLYTEK revealed that total investments related to large models exceeded 1.3 billion yuan in the first half of the year. Specifically, R&D investments in general large models increased by 400 million yuan, while investments in engineering the large model training and inference platform increased by 160 million yuan. Additionally, investments in large model promotion and application promotion increased by 120 million yuan, and investments in productizing large models across various BGs and BUs exceeded 600 million yuan. 'After deducting these expenses, the company's other expenses did not increase but rather decreased relatively.'

According to financial report data, iFLYTEK's total R&D investment in the first half of the year was 2.191 billion yuan, an increase of 32.32% year-on-year, accounting for 23.5% of revenue.

It is normal for large models to consume significant investments. However, curiously, compared to the industry average, iFLYTEK's R&D expenses and cost expenses have increased relatively steeply this year.

Taking Baidu, which also recently released its Q2 financial report, as an example, its sales and administrative expenses this year were 5.7 billion yuan, a decrease of 10.5% year-on-year, while its R&D expenses were 5.889 billion yuan, a decrease of 7.7% year-on-year, accounting for 17.4% of revenue.

Last year was a year of rapid technological iteration. Taking OpenAI as an example, it Intensive release GPT-4, DALL-E 3, GPT-4 Turbo, and GPTs in 2023. This year, however, it has essentially run out of new products to release, leading to jokes about 'carving flowers on dog shit.'

As a follower of OpenAI's technology, iFLYTEK has made loud proclamations, but a review of last year's financial report reveals that its R&D expenses were 3.481 billion yuan, an increase of only 11.89% compared to 2022, when it had not yet fully invested in large models, and accounting for just 17.7% of revenue. This cannot be compared to this year's expenditures, suggesting that iFLYTEK's investments in large models were relatively modest last year. This year, its substantial investments are both a catch-up effort and a strategic response to the commercialization trend of large models for B/G-end customers, leading to a decisive increase in productization and promotion expenses for large models.

The productization and promotion of large models correspond to iFLYTEK's 'standing firmly on the ground' strategy, which is currently sales-driven and affects its final profits. iFLYTEK emphasizes: 'If expenses related to the R&D and promotion of the Spark large model are deducted, the company's non-GAAP profit for the first half of the year will increase year-on-year.'

Growth Without Profits

The open platform and consumer business best reflect the practical application of iFLYTEK's large models. This business segment comprises two parts: the open platform and intelligent hardware.

Based on its open platform, iFLYTEK has opened up 708 AI capabilities and large model technical capabilities, offering a helper ecosystem, API matrix, and third-party plugin market to developer teams. Financial report data shows that within five months, the number of developers on the open platform increased from 5.98 million to 7.06 million, an increase of over 1.08 million. There are over 400,000 overseas developers on the open platform, with 580,000 large model developers.

Intelligent hardware, paired with iFLYTEK's proprietary software, has become a carrier for the practical application of large models, driving a new wave of growth in office and education hardware. According to the financial report, GMV for smart notebooks, translators, and digital voice recorders increased by 43% year-on-year during the entire 618 period.

While the results indicate that large models have indeed presented iFLYTEK with new growth opportunities, the financial reality of large model investments is clear: they can buy future potential but do not yield short-term profits.

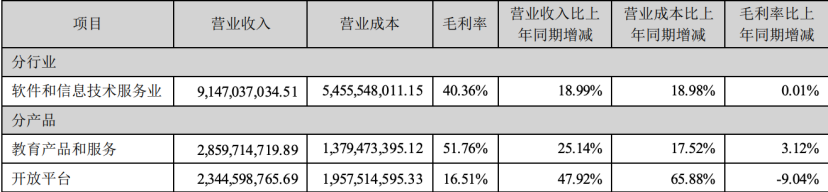

Behind the revenue generation of the open platform lies uneven cost investments. While revenue increased by 47.92% year-on-year, cost expenditures increased by 65.88%, resulting in a significant decrease in product gross margins. iFLYTEK's gross margin for the first half of 2024 was 40.19%, roughly the same as last year, but the gross margin for open platform products was only 16.51%, a decrease of 9.04% year-on-year.

The decline in gross margins is closely related to the development pace of the large model industry. Large models are increasingly becoming like infrastructure, and revenue from API calls made through the open platform has a limited impact on driving overall revenue. Over the past year, the focus has been on building the underlying infrastructure for large models, with orders from central and state-owned enterprises starting to come in only in the second half of last year and the first half of this year. There is a lag in the delivery cycle for G-end customers, and the revenue included in the financial report for the first half of this year is most likely from orders placed last year. According to our understanding, the budgets allocated to large models by central and state-owned enterprises and ordinary enterprises were relatively limited last year, gradually increasing this year. This portion of revenue may not be reflected until the annual report.

According to financial report statistics, corporate accounts receivable totaled 13.134 billion yuan in the first half of 2024, accounting for 34.33% of total assets, an increase of 20.77% from 10.875 billion yuan in the same period last year.

Sales Drive Large Model Adoption in the G-end Market

Drawing on its experience from the AI 1.0 era, iFLYTEK places significant emphasis on commercialization while developing large model technologies. Leveraging its strengths and the development of the large model market, iFLYTEK initially targets orders from central and state-owned enterprises in the G-end market.

Technology and sales are parallel tracks. In the first half of the year, iFLYTEK increased its technical staff by 507 and its sales staff by 108. While R&D expenses for the large model base increased by 400 million yuan, marketing expenses related to large models also increased by 120 million yuan.

In terms of sales, iFLYTEK has borrowed from Huawei's army model to tackle the demand for large model adoption by central and state-owned enterprises. In July last year, after launching the Spark large model, iFLYTEK integrated resources from its research institute and related business units to establish the 'Spark Army.' According to official information, this army has two primary responsibilities: firstly, to support related products and solutions within the group related to large models; secondly, to provide strategic support for large model businesses across iFLYTEK's various business sectors and build a base and toolchain based on the Spark language large model.

According to media reports, the team has grown from over 80 people last year to over 300 people this year, attempting to secure orders through sheer manpower. Compared to startups entering the market with a lean approach, iFLYTEK's method is not cost-effective. We understand that some startups targeting the G-end market do not even have a sales team, opting instead to collaborate with larger companies that act as intermediaries. These startups only need to fulfill specific demands, allowing them to shorten service cycles to two weeks and significantly reduce costs.

After a year of market education, some central and state-owned enterprises are placing greater emphasis on efficiently addressing needs during the implementation process, and they are Disgusting to sales-driven large model product promotions. 'I don't want to know what you have; I want to know what problems you can solve.'

According to incomplete statistics, iFLYTEK won a total of 15 bids in the first half of this year, ranking at the top of the industry. Orders were concentrated in the telecommunications, finance, and central and state-owned enterprise sectors. Demand for orders was largely focused on intelligent outbound calls and customer service, highlighting iFLYTEK's strengths in voice technology, but there were relatively few orders involving large model understanding and analysis.

However, iFLYTEK still faces numerous challenges. On one hand, there are nearly 400 million yuan in bad debts from corporate accounts receivable left by industry solution business customers and development platform and consumer customers. On the other hand, there are signs of a decline in the G-end business, with its share dropping from 35% in the same period last year to 27%.

The period required for large models to translate into profits still needs to be waited out, but what's crucial is having the support to stay in the game until profits are realized.