2025 Shanghai Auto Show - Joint Venture Brands Sound the Horn for Counterattack

![]() 04/25 2025

04/25 2025

![]() 665

665

The 2025 Shanghai International Auto Show, under the theme "Embrace Innovation, Win the Future," has emerged as the epicenter of technological innovation and market rivalry in the global automotive landscape. Amidst the ascendancy of independent brands in the new energy vehicle sector, joint venture brands have mounted a comprehensive counterattack with a distinctly "more Chinese" strategic stance, reshaping the market competition landscape through localized R&D, intelligent upgrades, and the deep integration of the supply chain.

Brands like Volkswagen, Buick, Nissan, Toyota, and Honda have unveiled their heavyweight models, showcasing groundbreaking achievements in intelligence and electrification. This article delves into the product technologies of joint venture brands at the 2025 Shanghai Auto Show, sharing their core advantages and future prospects: Core Models and Technological Highlights of Joint Venture Brands, In-depth Empowerment of China's Supply Chain, Core Advantages and Future Prospects of Joint Venture Brands. We aim to help readers re-evaluate joint venture brands and reflect on their latest counterattacks. At the end of the article, you'll find a survey: Will you buy an electrified and intelligent joint venture brand? Core Models and Technological Highlights of Joint Venture Brands

Volkswagen: Localized Technology Matrix and Concept Car Cluster

Volkswagen has unveiled three new concept cars at this auto show, catering to diverse market segments:

ID.AURA (FAW-Volkswagen): A compact pure electric sedan built on the CMP platform and CEA architecture, targeting young family users. It features an advanced driver assistance system (ADAS) jointly developed with CoreChip, a joint venture with Horizon Robotics, supporting autonomous learning capabilities.

ID.ERA (SAIC Volkswagen): A full-size extended-range SUV with a CLTC range exceeding 1,000 kilometers, optimized for Chinese road conditions. It caters to long-distance travel scenarios and may share the same platform architecture as the Xpeng G9, suggesting that its intelligent driving, cabin systems, and electronic and electrical architecture could originate from Xpeng.

ID.EVO (Volkswagen Anhui): An all-time connected pure electric SUV that integrates cooperative technology from Xpeng and Volkswagen, emphasizing an intelligent connected ecosystem.

Volkswagen plans to launch over 30 new energy vehicle models in the next three years, encompassing pure electric, plug-in hybrid, and extended-range powertrains, accelerating technological iteration through China's local supply chain.

Buick: High-end New Energy Sub-brand "ZhiJing" and GL8 Lushang

Buick has introduced a new high-end new energy sub-brand "ZhiJing" and unveiled the plug-in hybrid MPV GL8 Lushang. Equipped with the "ZhenLong" plug-in hybrid system (1.5T engine + electric motor), it offers a pure electric range of 111 kilometers and a comprehensive range of 1,420 kilometers.

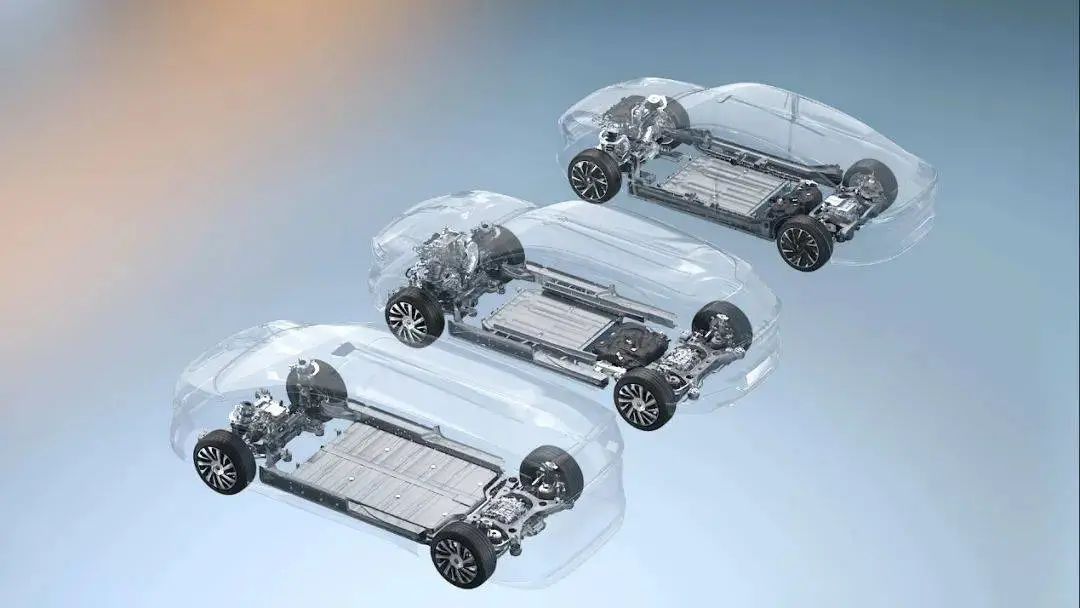

The newly upgraded Ultium 2.0 multi-drive platform, based on Buick's "Xiaoyao" architecture, supports diverse new energy drive technologies like pure electric, plug-in hybrid, and extended range. Its electronic and electrical architecture is the CLEA architecture independently developed by SAIC-GM in China, with intelligent assisted driving adopting Momenta's local technology, and the chip platform potentially based on Qualcomm's SA8775 chip, NVIDIA's Orin platform, or even Momenta's independent chip.

Its intelligent cabin features a locally designed 9.9-inch LCD instrument and waterfall central control screen, equipped with triple-layer soundproof glass technology, highlighting luxury and practicality. Buick plans to launch six new energy vehicle models in the "ZhiJing" series within the next 12 months, comprehensively covering the high-end market.

Nissan: TianYan Architecture and N7 Pure Electric Sedan

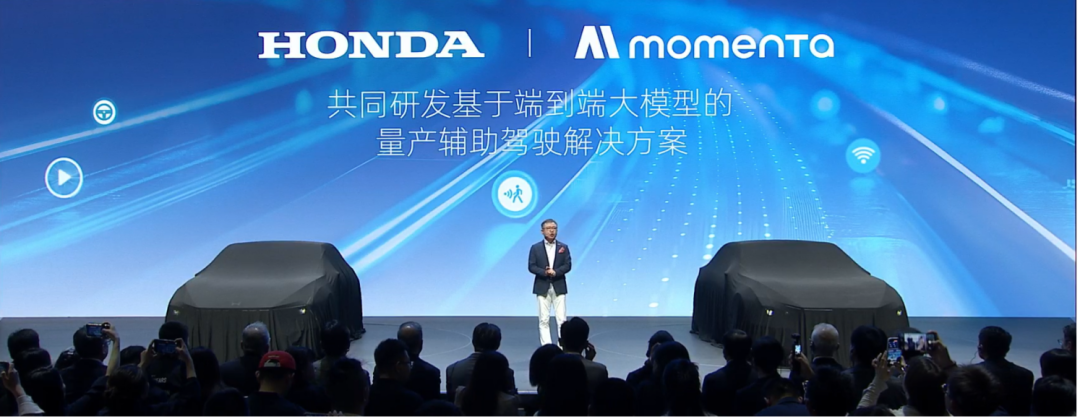

Nissan has released the N7, its first pure electric sedan based on the all-new "TianYan" new energy architecture developed by Dongfeng Nissan's local team. It uses Qualcomm's cockpit and intelligent driving platform, equipped with an end-to-end intelligent driving large model provided by Momenta, supporting city memory pilot functionality.

Sharing a platform with Dongfeng eπ007, it uses CATL's ternary lithium batteries, demonstrating a strategy of "rapid implementation of readily available technology."

Toyota: BoZhi 7 and HarmonyOS Ecosystem Integration

GAC Toyota has globally unveiled the BoZhi 7, a D-class flagship pure electric sedan equipped with Huawei's HarmonyOS cockpit and Momenta's LiDAR intelligent driving system, enabling full-scenario intelligent driving assistance.

Its development cycle has been shortened by 40%, and localization adaptability improved by 60%, showcasing the technological generational advantage under the "China Speed" powered by BYD and GAC Group's jointly developed power battery technology. Meanwhile, BoZhi 3X's orders exceeded 20,000 units within two months of its launch, verifying its market competitiveness.

Honda: Ye GT and Localized Design

Honda has launched the Ye GT mass-produced coupe SUV, designed by the Chinese team and equipped with a CATL 90kWh ternary lithium battery, offering a pure electric range of 620 kilometers.

For intelligent assisted driving, it features Momenta's intelligent driving algorithm.

Its cabin adopts a 41.9-inch HUD head-up display and waterfall screen design, deeply integrating Chinese users' needs for intelligent interaction, highlighting Honda's localization strategy of "starting from user needs."

Apart from these traditional joint venture sales giants, luxury car brands such as Mercedes-Benz's CLA and Audi's AUDI four-letter models have also adopted China's intelligent or battery supply solutions to launch new models.

In-depth Empowerment of China's Supply Chain

Throughout this auto show, the new models of joint venture brands were inseparable from China's electrified and intelligent supply chain.

Joint venture brands achieved rapid technological iteration and cost optimization through collaborative innovation with China's local supply chain:

Intelligent Ecosystem Cooperation: Toyota accesses the HarmonyOS system, Volkswagen jointly develops ADAS with Horizon Robotics, and Nissan adopts Momenta's intelligent driving solution, all relying on the algorithm and chip support of Chinese technology enterprises.

Localization of Three-Electric Systems: BYD Fudi Battery, CATL, and other enterprises provide core power batteries to Toyota and Honda, reducing dependence on overseas supply chains.

Transformation of the R&D System: Toyota introduced the "Chief Engineer in China (RCE)" system, and Volkswagen established China Technology Co., Ltd., with decision-making power shifting towards local teams, shortening the R&D cycle and improving adaptation efficiency.

These initiatives embody the concept of "in China, for China," moving beyond mere slogans.

Core Advantages and Future Prospects of Joint Venture Brands

Joint venture brands possess significant advantages in automotive manufacturing, from quality control to quality, currently surpassing domestic enterprises that started later. Here are their core advantages:

Manufacturing and Quality Control Accumulation: Relying on centuries of automotive manufacturing experience, German and Japanese brands maintain a leading position in precision manufacturing, safety testing (like FAW-Volkswagen's "Everest" plan), and other fields.

Corporate Culture: These century-old enterprises have robust systems from employee care to corporate management, fostering a more caring environment, which reduces product flaws.

Globalization Resource Integration: Leveraging the global technology reserves of multinational automakers combined with China's supply chain's cost and efficiency advantages, they create differentiated competitiveness.

These joint ventures have enjoyed rapid growth in China but also experienced sharp declines. However, given the latest scenario, it's challenging for these foreign joint venture brands to abandon China, given its enormous market size as the world's largest single market, and their significant prior investments here.

Therefore, looking ahead, these foreign enterprises will:

Deepen Localized R&D: Joint venture brands will further expand their R&D investment in China. For example, Toyota plans to increase its production capacity in China to 3 million vehicles and establish a global export base. Meanwhile, Toyota's recent brand, Lexus, has settled in Jinshan, Shanghai.

Race in the Intelligent Track: As Chinese automakers' technologies like LiDAR, 800V high-voltage platforms, and end-to-end intelligent driving models accelerate in popularity, joint venture brands will inevitably join the competition with independent camps, shifting focus to software-defined vehicle capabilities.

Ecological Layout: Volkswagen, Toyota, and others are building a full-link intelligent travel experience from hardware to services by integrating ecosystems such as HarmonyOS and Huawei's intelligent driving.

For Chinese brands, the next round of competition will undoubtedly intensify, not just with new technology products but also in products, quality, and culture. The era of rough and extensive development is coming to an end.

Conclusion

The 2025 Shanghai Auto Show marks a strategic turning point for joint venture brands, transitioning from "defense" to "counterattack." Through deep integration into China's industrial chain and accelerated technology localization, companies like Volkswagen and Toyota are reshaping their competitiveness with a "more Chinese" stance.

In the future, their ability to continue breakthroughs in both intelligent and electric tracks will determine whether joint venture brands can regain discourse power in the game between stock and incremental markets.

Regardless, this situation will once again propel China's automobile industry forward, achieving comprehensive improvements across products, quality, and culture.

Reproduction and excerpts are strictly prohibited without permission. Join our knowledge platform to download a vast amount of first-hand data on the automotive industry, including the above reference materials.