Revenue grows steadily, technology leads, shipments exceed 6 million, Horizon Robotics leapfrogs towards the "intelligent driving horizon"

![]() 08/28 2024

08/28 2024

![]() 658

658

Recently, domestic intelligent driving chip supplier Horizon Robotics (hereinafter referred to as "Horizon") obtained the "listing permit". According to Beiduo Finance, Horizon submitted its prospectus in March 2024, preparing for a listing on the main board of the Hong Kong Stock Exchange.

Not long ago, the overseas listing filing notification issued by the China Securities Regulatory Commission showed that Horizon plans to issue no more than 1.154 billion overseas listed ordinary shares. The proceeds from this listing will be used by Horizon for advanced driver assistance systems, high-level autonomous driving solutions, core technology research and development, joint venture investments, etc.

With the continuous penetration of intelligent driving technology, the popularity of "intelligent driving" has continued to rise this year, with good news frequently reported. Among them, RoboSense, specializing in autonomous driving LiDAR and perception solutions, went public at the beginning of 2024, and Black Sesame Technology, which is also in the intelligent driving chip sector like Horizon, also went public on the Hong Kong Stock Exchange in August.

In addition, multiple autonomous driving solution providers such as Youjia Innovation, Zongmu Technology, and Pony.ai are sprinting towards listings. Not long ago, general autonomous driving service provider WeRide (NASDAQ: WRD) launched its IPO and plans to list on NASDAQ.

Behind the wave of listings is the further intensification of the market competition as intelligent driving technology transitions from small-scale testing and demonstration to commercialized landing operations. Standing at an industry turning point and about to embark on a new round of "arms race", what highlights does Horizon have that the market can look forward to?

I. Intelligent Driving Chip "Unicorn" with a Star-Studded Investor Lineup

According to the prospectus, Horizon was established in 2015 and positions itself as a provider of advanced driver assistance systems (ADAS) and high-level autonomous driving (AD) solutions for passenger vehicles. It is committed to enhancing driver and passenger safety and experience through the integration of algorithms, proprietary software, and high-performance hardware.

The prospectus shows that Horizon is the first Chinese company to offer front-loaded mass-produced ADAS and AD solutions, with a vast customer base including China's top ten OEMs and tier-one suppliers. In 2023 alone, the company secured over 100 new vehicle model designations, and its system efficiency, performance, and cost-effectiveness have been universally recognized by the market.

Currently, Horizon's "Journey" series of in-vehicle intelligent computing solutions has surpassed 6 million shipments, with over 30 automakers and brands partnering for front-loaded mass production. It has accumulated over 270 designated models and over 130 mass-produced models, with Horizon's automotive-grade chips visible in vehicles such as the Roewe RX5 and Lixiang L8 Pro.

According to the "2023 China Passenger Vehicle Front-Loaded Standard NOA (Navigated On-Autopilot) Computing Solution Market Share Ranking" by the Gaogong Institute, Horizon's market share increased to 35.49% in 2023, the fastest-growing among the top five suppliers, and the gap with NVIDIA is narrowing.

Furthermore, according to the latest industry rankings for the first half of 2024 by the Gaogong Institute, Horizon topped the rankings for intelligent driving computing solutions in self-owned brand passenger vehicles and front-view all-in-one computing solutions in China, with market shares of 28.65% and 33.73%, respectively.

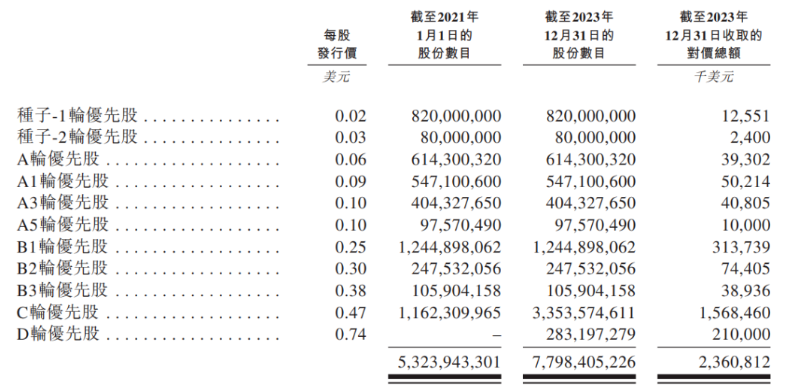

Horizon's impressive market performance has garnered significant capital interest. Since its establishment, Horizon has completed 11 funding rounds, with investors including renowned institutions such as Hillhouse Capital, CICC Capital, Sequoia China, as well as industry leaders like CATL and BYD, raising over USD 3.4 billion in cumulative funding.

Horizon's latest funding round, disclosed in November 2022, was led by Chery Automobile, with the funds primarily used for the research and development, iteration, and mass production of in-vehicle intelligent chips. Following this funding round, Horizon's post-investment valuation soared to USD 8.71 billion, equivalent to over RMB 60 billion, making it a genuine "unicorn" company.

II. Exponential Revenue Growth with Industry-Leading Gross Margin

As its market value and position rise, Horizon's performance is also outstanding.

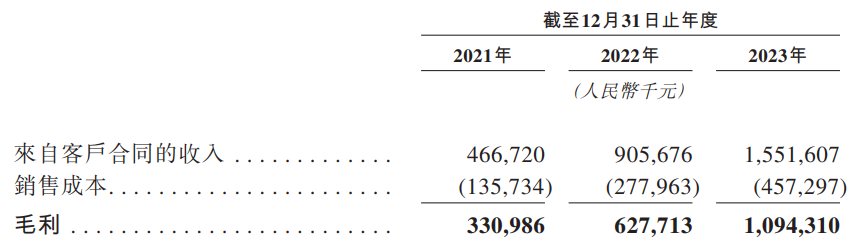

The prospectus shows that Horizon's revenue from customer contracts increased from RMB 467 million in 2021 to RMB 906 million in 2022, a growth rate of 94.1%. In 2023, revenue surpassed the RMB 1 billion mark, reaching RMB 1.552 billion, a year-on-year increase of 71.3%.

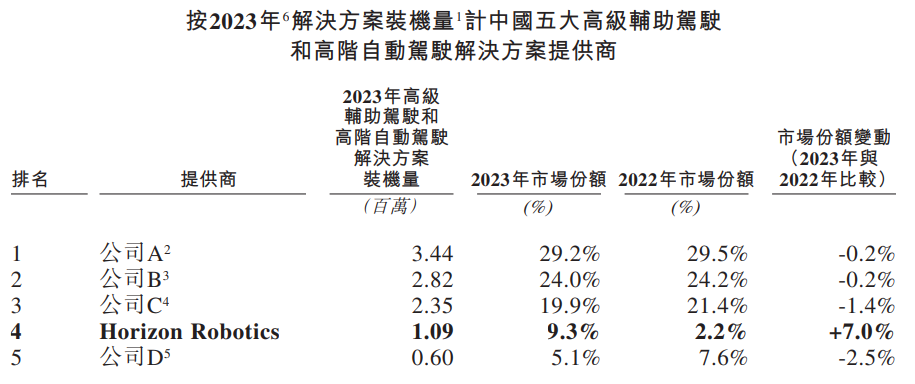

Currently, the domestic ADAS and AD market supply side is still dominated by foreign suppliers, with Horizon being the only Chinese company among the top five. According to the Gaogong Institute, Horizon's J5 chip ranked fifth in China's intelligent driving domain controller chip installations in 2023 with 172,700 units shipped.

Simultaneously, Horizon's ADAS and AD solution installations also quadrupled to 1.09 million units, with market share rising from 2.2% in 2022 to 9.3% in 2023, an increase of 7 percentage points. Standing out in a market dominated by foreign enterprises, Horizon has become China's fourth-largest ADAS and AD solution provider.

By business type, automotive solutions are the core driver of Horizon's revenue growth. This segment generated RMB 410 million, RMB 801 million, and RMB 1.47 billion in revenue from 2021 to 2023, respectively, with the revenue share increasing from 87.9% in 2021 to 94.8% in 2023, demonstrating robust growth momentum.

Moreover, Horizon maintains a high gross margin level, with gross profits of RMB 331 million, RMB 628 million, and RMB 1.094 billion during the reporting period, representing a compound annual growth rate of 81.8%. During the same period, gross margins were 70.9%, 69.3%, and 70.5%, respectively, significantly higher than the approximately 30% gross margin of comparable companies in the same industry.

Horizon disclosed in the prospectus that over 50% of its designated models have yet to enter mass production as of the end of 2023, indicating ample order reserves. Furthermore, the company's stable customer cooperation channels and the vitality of new geographical market development have also contributed to its steady growth in brand influence.

According to Frost & Sullivan data, the total market size of China's ADAS and AD solutions has grown from RMB 3.9 billion in 2019 to RMB 24.5 billion in 2023, with a compound annual growth rate of 57.8%. It is expected that by 2030, the market size will grow to RMB 407 billion, with a compound annual growth rate of 49.4%.

Driven by both internal and external factors, Horizon, as the industry leader, is poised to continue its revenue growth trajectory in the foreseeable future, leveraging industry tailwinds to boost performance and tap into the development potential of the trillion-yuan market.

III. Sustained R&D Momentum to Expand Diversified Markets

Horizon's founder Yu Kai has publicly emphasized that technology companies must maintain technological leadership at all times, as lagging behind could lead to obsolescence, while an ecosystem can serve as a "moat" for enterprises. As such, since its inception, Horizon has focused on building a technological ecosystem foundation to facilitate the full-chain flow of innovation capabilities.

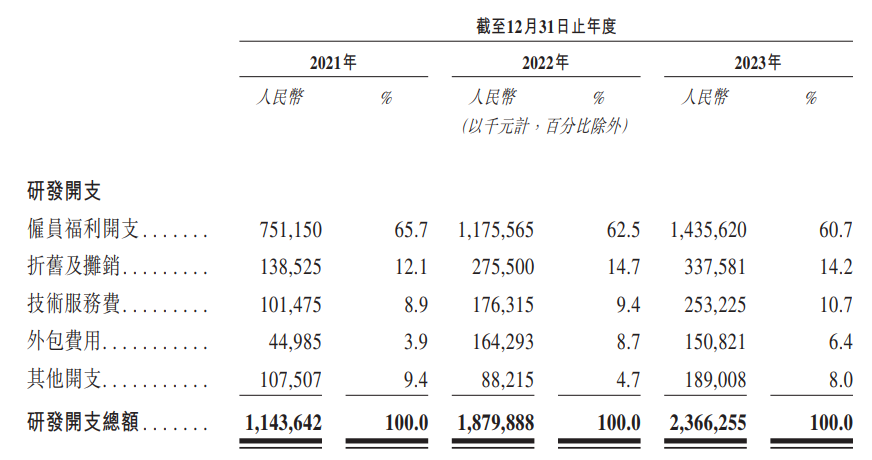

From 2021 to 2023, Horizon's R&D expenses amounted to RMB 1.144 billion, RMB 1.88 billion, and RMB 2.366 billion, respectively, with the three-year total exceeding twice the company's cumulative revenue. Its R&D expense ratio decreased from 245.0% in 2021 to 152.5% in 2023, indicating a notable increase in the efficiency of research outcomes amidst rising revenue.

Beiduo Finance found that over 60% of Horizon's R&D expenses were allocated to employee benefits. As of the end of 2023, 1,478 of Horizon's 2,066 employees were full-time R&D personnel, accounting for 71.5% of the total workforce, underscoring the company's robust R&D capabilities.

Currently, Horizon offers intelligent driving solutions including Horizon Matrix Mono, Horizon Matrix Pilot, and Horizon Matrix SuperDrive, catering to diverse needs. The commercial potential of its core technologies such as algorithms, BPU, Horizon Tian Gong Kai Wu, Horizon Ta Ge, and Horizon Eddie remains untapped.

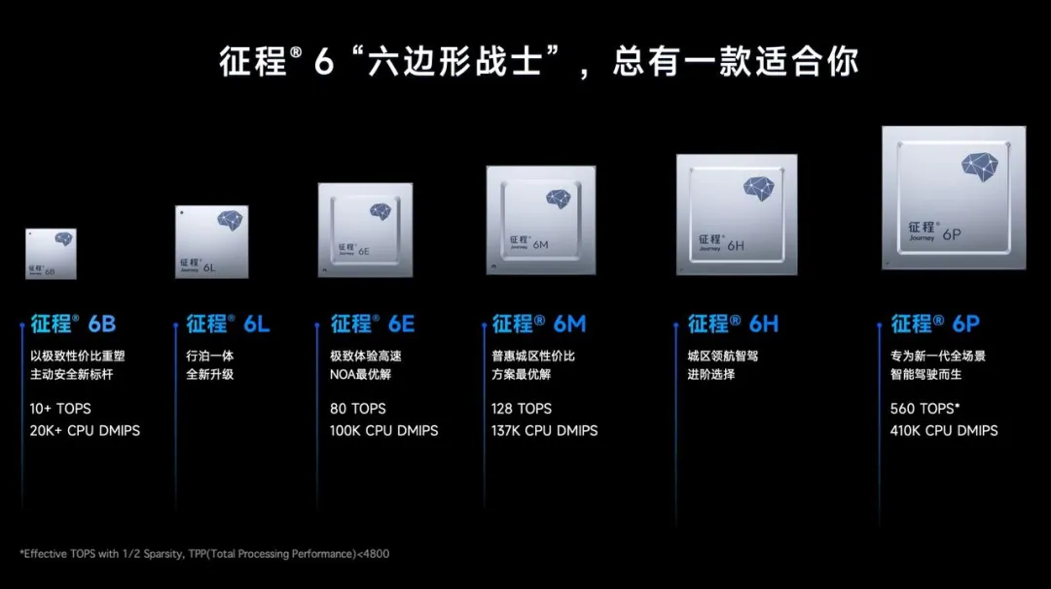

At the 2024 Intelligent Driving Technology Product Launch in April, Horizon also unveiled its new generation of in-vehicle intelligent computing solution, Journey 6 series, and the Horizon SuperDrive™ all-scenario intelligent driving solution based on its self-developed end-to-end perception architecture, pushing the boundaries of intelligent driving experiences.

According to Horizon, it has established collaborations with multiple Tier-1 partners and hardware/software providers such as Bosch, TZTEK, Jianzhi Robotics, and Qingzhou Zhihang based on the Journey 6 platform. Additionally, over 10 automakers have signed mass production agreements with Horizon for the Journey 6 series, with the first front-loaded mass-produced models expected to be delivered within the year.

To prioritize the development of high-level intelligent driving, Horizon reorganized its intelligent driving algorithm team in July, merging the Mono low-level solution team, previously part of the "Software Platform Product Line," with the SuperDrive high-level solution team. This consolidation of resources aims to expedite the development of high-level intelligent driving technologies and accelerate market penetration of new products.