Can Lixiang have a good time after being 'stomped' by Huawei?

![]() 08/29 2024

08/29 2024

![]() 484

484

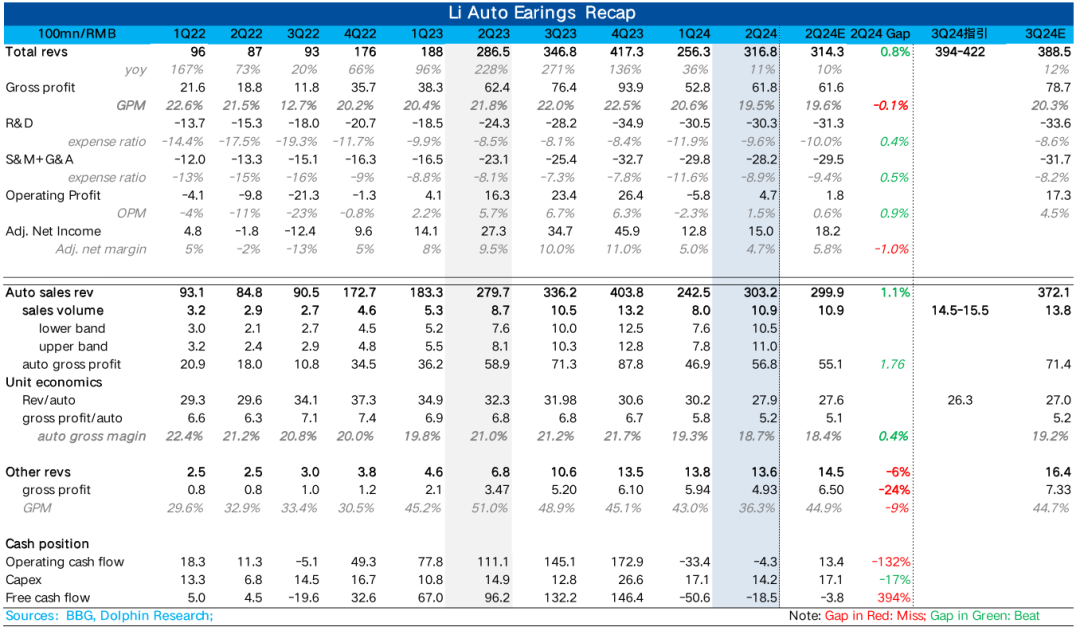

Lixiang Auto (LI.O) released its second-quarter 2024 financial report after the Hong Kong stock market closed and before the U.S. stock market opened on August 28, Beijing time. While the company has overcome the setback with its pure electric Mega model, its high-end hybrid models have been outcompeted by Huawei, resulting in a generally in-line performance that did not disappoint:

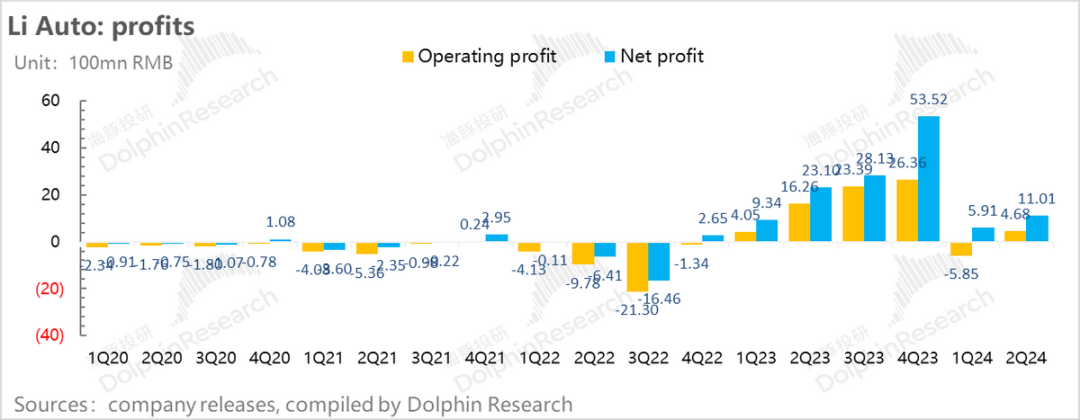

1. Operating profit turned from -600 million to nearly +500 million, slightly better than the expected 200 million. However, the improvement in profitability is mainly due to cost containment in operations, as the company has significantly reduced R&D, marketing, and administrative expenses compared to the first quarter, following the setback with the Mega model. This narrow beat is not enough to fundamentally convince the market of Lixiang's turnaround.

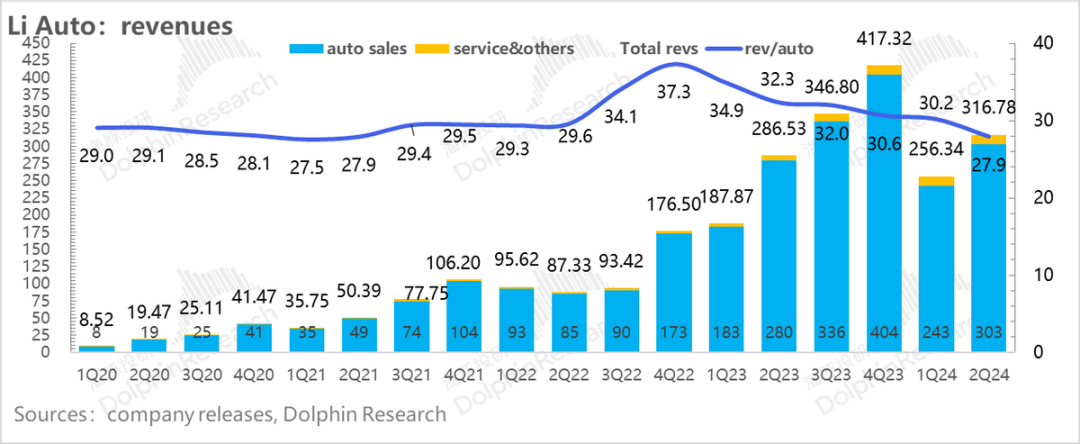

2. Average vehicle price is "decent," with slightly higher revenue: Sales grew 25% YoY, and revenue for the second quarter reached 31.6 billion yuan, up 11% YoY and 200 million yuan more than expected. This is due to the slightly higher average vehicle price than market estimates.

3. A gross margin per vehicle of 18.7% indicates recovery from the Mega setback: Due to a) the interception of L8 and L9 by M9, leading to slower sales of high-end models; b) price cuts across the L series except L6; and c) a significant increase in L6 sales, pushing down the overall price range. The average vehicle price fell from over 300,000 yuan to 279,000 yuan, slightly below market expectations of 276,000 yuan. However, the gross margin per vehicle of 18.7% was slightly better than market expectations of around 18.4%.

4. The actual average vehicle price fell from over 300,000 yuan to 279,000 yuan, slightly lower than market expectations of 276,000 yuan. Correspondingly, the gross margin per vehicle of 18.7% was slightly better than market expectations of around 18.4%.

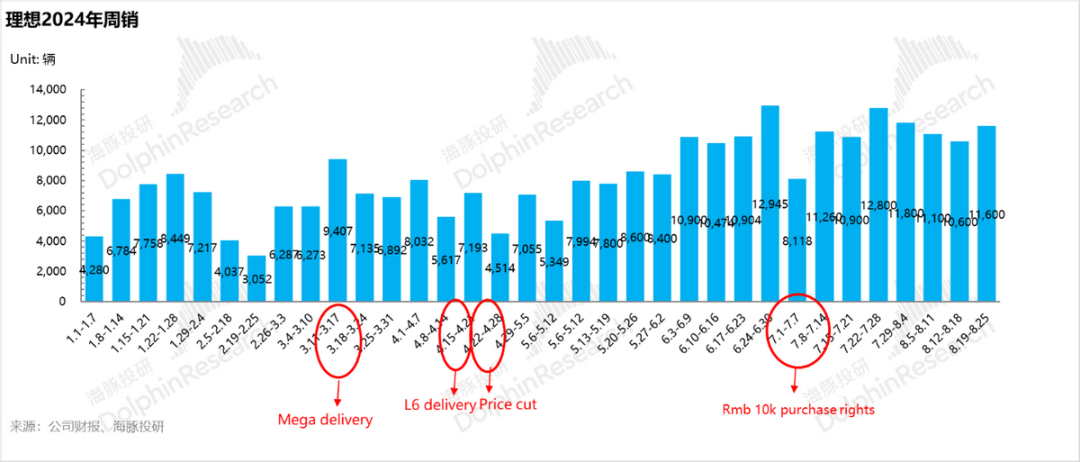

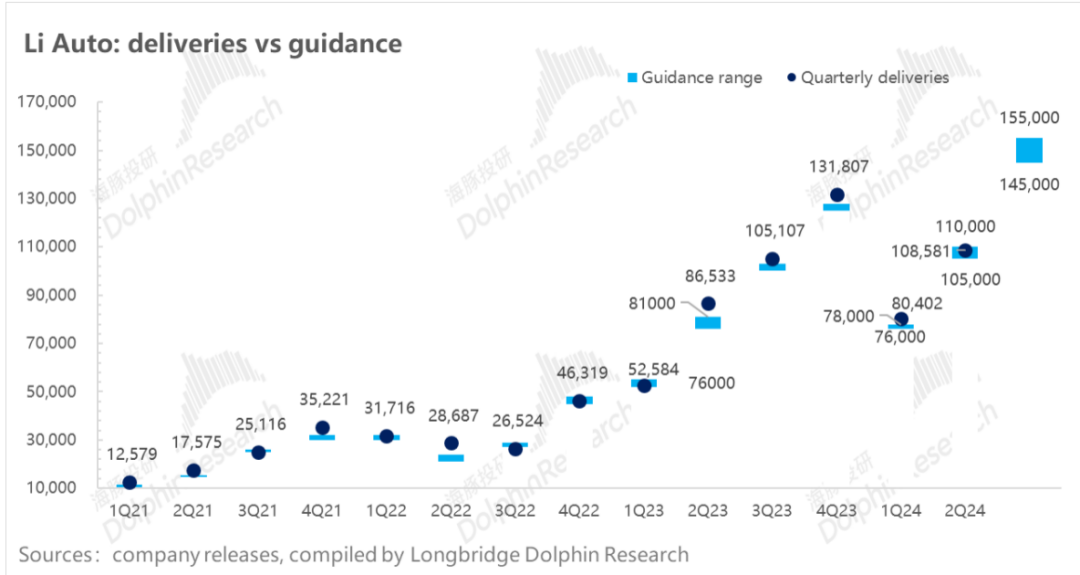

5. Lack of confidence in third-quarter sales guidance: With July and August largely behind us, assuming Lixiang can maintain its current weekly sales trend, Dolphin Insights estimates third-quarter sales to be between 145,000 and 155,000 units. However, Lixiang's guidance for this quarter is 145,000 to 155,000 units, with a wide range of 10,000 units despite only one month remaining. This raises questions about Lixiang's confidence in achieving its targets, especially with a lower bound of 145,000 units implying a possible decline in weekly sales in September.

6. Is Lixiang's average vehicle price heading towards 260,000 yuan quickly? The lack of confidence in guidance is also evident in the implied average vehicle price of only around 263,000 yuan based on the revenue guidance of 39.4 to 42.2 billion yuan. This is significantly lower than both the second-quarter average of 279,000 yuan and market expectations of 270,000 yuan.

With such a decline in implied average price, the market naturally worries about further sales pressure on L8/9 from M9, passive growth in L6 sales, potential price cuts, and whether gross margins can reach 19-20% as expected.

Dolphin Insights' Overall View:

From an expectations perspective, Lixiang's slight beat in its second-quarter automotive business was neither outstanding nor disappointing. However, the widened sales guidance range and implied lower average selling price for the third quarter indicate that Lixiang is less confident in its ability to execute its plans and compete in an increasingly competitive market. Further price cuts cannot be ruled out.

While the setback with the pure electric Mega model is largely behind Lixiang, the decline in its average vehicle price reflects the challenges it faces. Its failed foray into pure electric vehicles at the beginning of the year, combined with the intense competition from Huawei's Wenjie brand with its M9 model, has put pressure on Lixiang's L8 and L9 sales. Without new models this year, Dolphin Insights is concerned about the sustainability of L6 orders and the possibility of further price cuts.

In the second half of the year, while Lixiang is not introducing new pure electric models, it is investing heavily in charging infrastructure. Meanwhile, Huawei's Wenjie brand's success in hybrids has dealt a blow to Lixiang's confidence. The pressure on Lixiang remains high in 2024.

Fortunately, from a valuation perspective, the market has fully recognized Huawei's threat and priced it into Lixiang's share price. Lixiang's sales and gross margins are improving, and its performance is trending upwards. However, for investors to feel confident in holding Lixiang shares, a clear turning point has yet to emerge. This may only become apparent next year, depending on Lixiang's ability to make a surprise breakthrough with its pure electric models.

Here's a detailed analysis:

With Lixiang's sales figures already announced, the key marginal information lies in: 1) the gross margin for Q2; and 2) the outlook for Q3 2024.

I. Gross Margin on Auto Sales: 18.7%, Slightly Higher Than Market Expectations of 18.4%

Since Lixiang previously provided guidance for its automotive gross margin for Q2, which anticipated a decline to around 18% due to the increased contribution from L6, market consensus expectations were around 18.4%. In actuality, Lixiang's automotive gross margin for Q2 was 18.7%, a slight improvement over guidance and market expectations, primarily due to a higher-than-expected average selling price.

(Note: Gross margin data for Q3 2022 excludes the impact of over 800 million yuan in contract losses, and Q4 2023 excludes 400 million yuan in warranty deposits.)

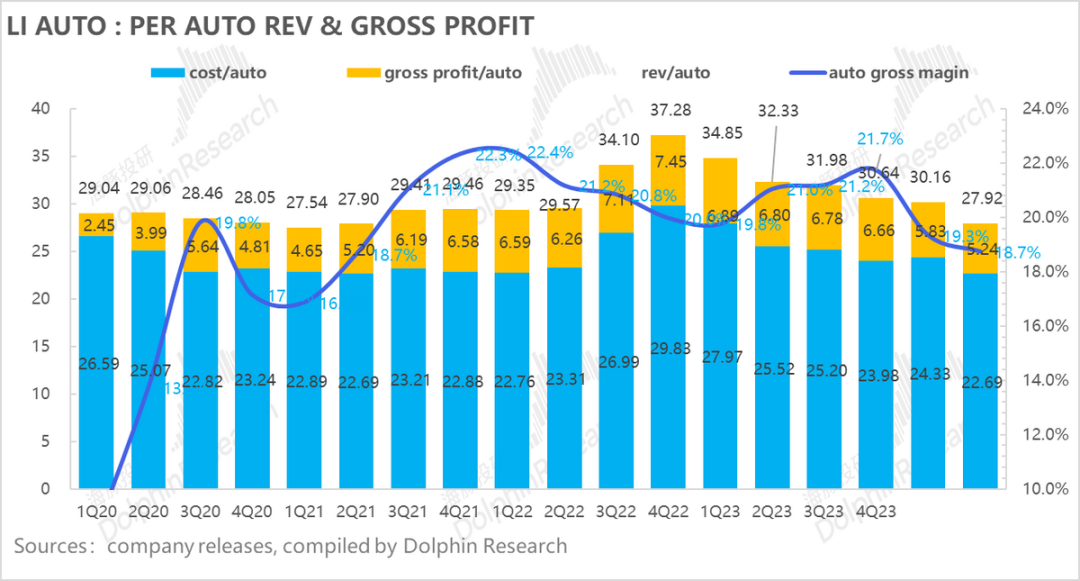

From a per-vehicle economics perspective:

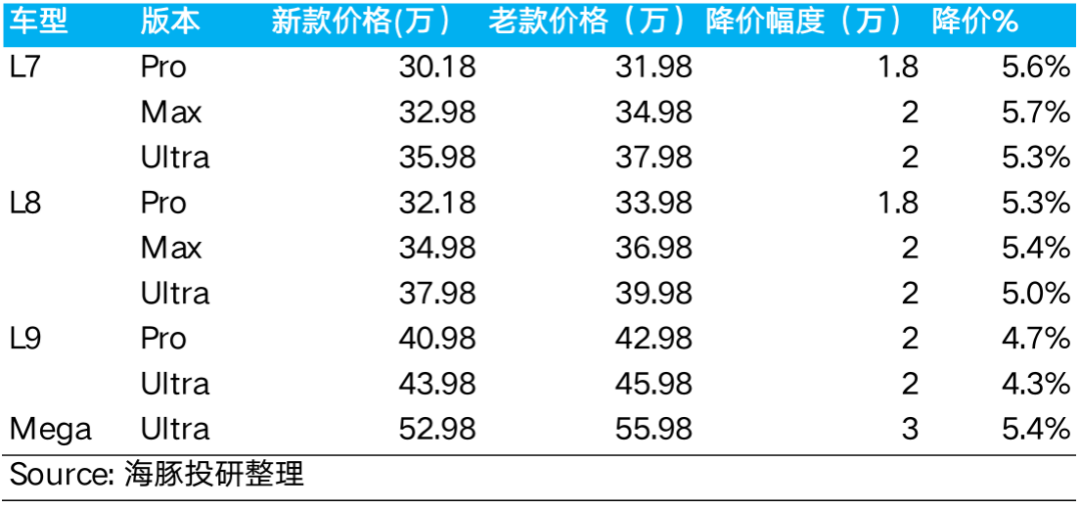

1. Across-the-board price cuts and an increased proportion of lower-priced L6 models led to a 22,000 yuan sequential decline in the average selling price per vehicle. The Q2 average selling price per vehicle was 279,000 yuan, a 22,000 yuan decrease from the previous quarter and exceeding market expectations of 276,000 yuan as well as Dolphin Insights' estimate based on Q2 guidance of 272,000 yuan. This decline was primarily driven by three factors:

a) Lixiang implemented price cuts of 18,000 to 30,000 yuan across its entire model range on April 22, representing a 4% to 6% reduction.

b) Compensation was provided to owners of Mega and 2024 series L models who purchased their vehicles before the price cuts, in the form of cash rebates ranging from 15,000 to 30,000 yuan.

c) The proportion of lower-priced L6 models, which launched in April with a price range of 249,800 to 279,800 yuan, increased to 36% in Q2, while the proportion of L8 and L9 models declined significantly due to competition from Huawei's Wenjie M9.

2. Increased sales volumes led to economies of scale, reducing the cost per vehicle by 16,000 yuan sequentially. The cost per vehicle for Q2 was 227,000 yuan, a 16,000 yuan decrease from the previous quarter. As sales volumes increased by 35% QoQ, economies of scale were realized, leading to a reduction in the cost per vehicle.

3. Finally, the gross profit per vehicle for Q2 was 52,000 yuan. In terms of profitability per vehicle, Lixiang generated a gross profit of 52,000 yuan per vehicle in Q2, a 6,000 yuan decrease from Q1. Overall, the automotive gross margin declined from 19.3% in Q1 to 18.7% in Q2.

II. Muted Q3 2024 Sales Guidance, with Implied Lower Average Selling Prices

a) Q3 2024 automotive sales target: 145,000 to 155,000 units, lower than Dolphin Insights' expectation of 156,000 units. In Q2, Lixiang delivered 109,000 vehicles, a 35% increase QoQ, driven by across-the-board price cuts of 18,000 to 30,000 yuan and the rapid ramp-up of L6 sales. However, Lixiang's Q3 delivery guidance of 145,000 to 155,000 units represents a 33% to 42% increase from Q2's 109,000 units. Dolphin Insights views this guidance as a sign of lack of confidence, particularly given the wide range of 10,000 units, which is unusual compared to past guidance ranges of just a few thousand units. Based on current sales trends, with 51,000 deliveries in July and an estimated 51,000 to 52,000 deliveries in August, deliveries in September are expected to be only 42,000 to 52,000 units, indicating little to no growth and potentially even a decline.

b) The implied average selling price continues to decline sequentially, falling below market expectations of 270,000 yuan. In addition to sales guidance, revenue guidance for Q3 is 39.4 to 42.2 billion yuan. After accounting for other business revenue of 1.38 billion yuan, the implied automotive revenue per vehicle is only 263,000 yuan, a sequential decline of 16,000 yuan from Q2 and still below market expectations of 270,000 yuan. The reasons for this decline include:

1) The proportion of L6 models in the product mix is expected to continue increasing (already up to 50% in July), while the proportion of higher-priced, higher-margin L9 models may decline further under competition from Huawei's Wenjie M9.

2) Lixiang offered limited-time promotions for its entire model range from July 1 to July 15, including a 10,000 yuan Limited time car purchase rights (including a 5,000 yuan optional equipment fund, a 5,000 yuan 7kW charging pile, or a direct 5,000 yuan deposit deduction) and financing subsidies for zero-down and 2.5% interest rate purchases.

However, the significant sequential decline in the implied average selling price for Q3 raises concerns among investors: Will L8/9 sales continue to be squeezed by M9, leading to passive growth in L6 sales? Will further price cuts be necessary? Can gross margins return to the targeted 19-20% range?

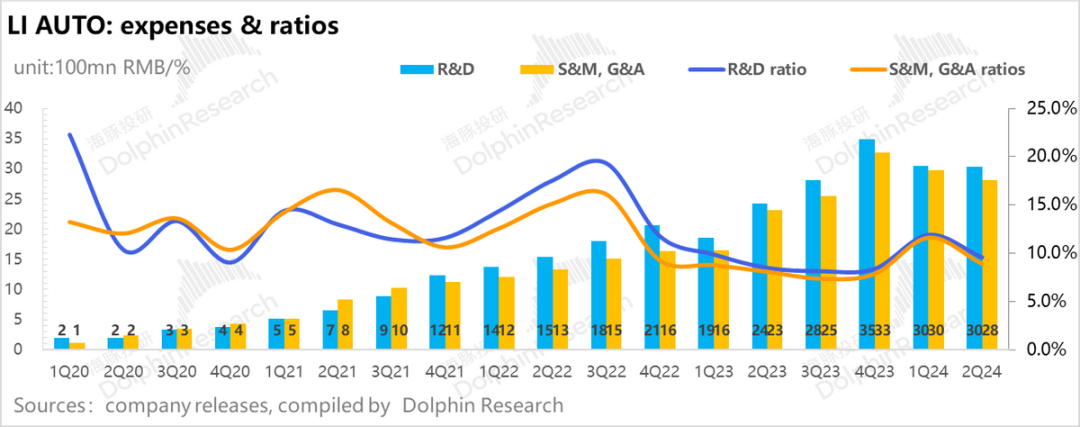

IV. Cost Control Leads to Restrained Operating Expenses

1) R&D Expenses: Essentially Flat QoQ

R&D expenses for Q2 were 3.03 billion yuan, essentially flat QoQ and slightly below market expectations of 3.1 billion yuan. While Q1's R&D expenses were based on the original sales target of 650,000 to 800,000 units, Q2's expenses were mainly impacted by reduced salaries for R&D personnel due to layoffs, which were offset by increased expenses to support product portfolio and technology expansion (investment in pure electric platforms and intelligence).

In terms of intelligence advancements, Lixiang has rolled out nationwide NOA capabilities for AD MAX users, gradually catching up with leading players like Xpeng in terms of city coverage. This upgrade is expected to increase the proportion of AD Max models in Lixiang's sales mix (Lixiang expects AD Max models to account for approximately 70% of total orders for vehicles priced above 300,000 yuan).

In terms of autonomous driving algorithms, Lixiang is shifting its focus from rule-based algorithms to end-to-end large model solutions, similar to those adopted by Tesla. End-to-end algorithms require fewer personnel than rule-based algorithms, leading Lixiang to reduce its autonomous driving team from 2,000 to 1,000 members.

2) Sales and Administrative Expenses: Layoffs and Reduced Marketing Activities Lead to Lower Expenses QoQ

Sales and administrative expenses for Q2 were 2.82 billion yuan, a 160 million yuan decrease QoQ and below market expectations of 2.95 billion yuan. This decrease was primarily due to reduced marketing and promotional activities and lower salaries for sales and administrative personnel as a result of layoffs.

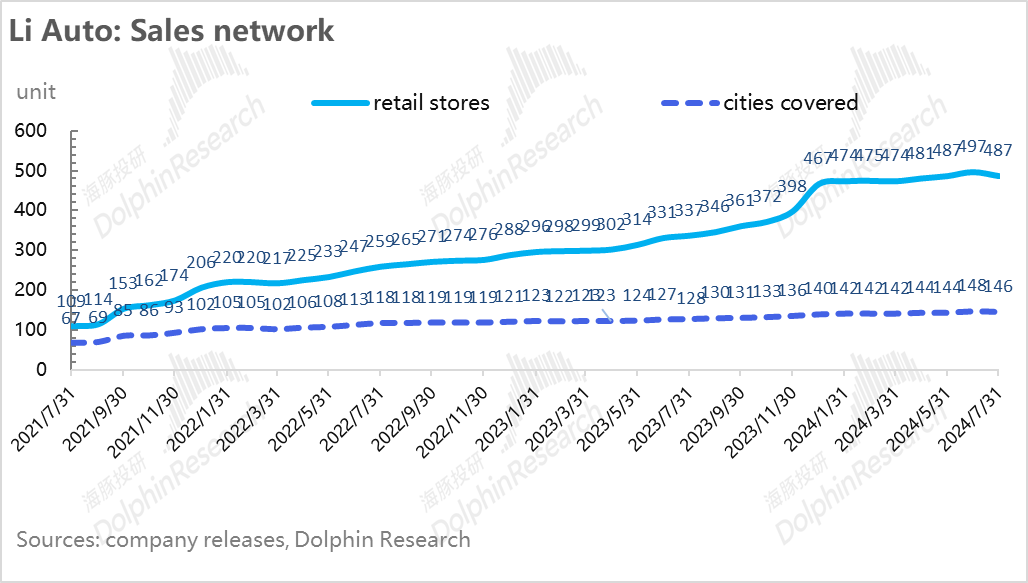

In terms of store expansion, Lixiang has been more restrained, adding only 23 new stores in Q2, a significant slowdown from the peak of 106 new stores added in Q4 2022. In July, Lixiang closed 10 direct-operated stores and focused on increasing single-store sales revenue and improving after-sales service (65 new after-sales service centers were added in Q2).

V. Revenue and Gross Margin Largely in Line with Market Expectations

With sales figures already announced, Lixiang's total revenue for Q2 was 31.7 billion yuan, up 24% QoQ and slightly above market expectations of 31.4 billion yuan. The slight revenue beat was primarily due to a higher-than-expected average selling price for automotive sales, offset by a 2,000 yuan sequential decline in other business segments (insurance, used cars, etc.), which fell short of market expectations of 1.45 billion yuan.

Overall, Lixiang's gross margin for Q2 was largely in line with market expectations, with automotive gross margin slightly exceeding expectations but other business gross margin declining 6.7% QoQ to 36.3%, below market expectations of 44.9%. As a result, Lixiang's overall gross margin for Q2 was 19.5%, essentially meeting market expectations of 19.6%.

VI. Cost Reduction and Operating Leverage Lead to Positive Operating Profit in Q2

Lixiang turned its operating profit positive in Q2, with absolute operating profit increasing by 1 billion yuan QoQ to 470 million yuan. Operating margin improved from -2.3% in Q1 to 1.5% in Q2, exceeding market expectations by 0.6%. While gross margin declined slightly QoQ, cost reduction measures and increased sales volumes led to lower operating expenses and improved operating leverage, ultimately driving the increase in operating margin.

This quarter's net profit increased by only 500 million yuan quarter-on-quarter, primarily due to a significant decline in interest income, which dropped from 1.07 billion yuan in the previous quarter to 370 million yuan in this quarter. After adjusting for SBC, the net profit was 1.5 billion yuan, and despite the decrease in interest income + SBC quarter-on-quarter, it increased by only 230 million yuan compared to the previous quarter.

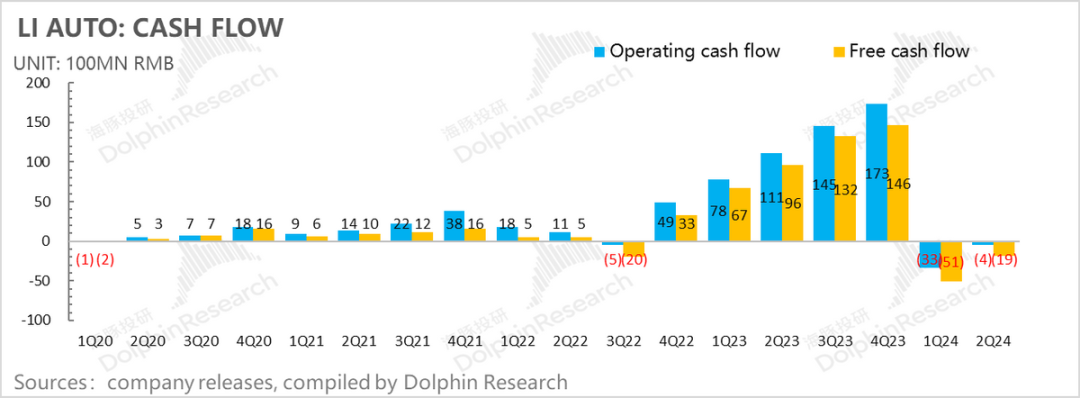

VII. However, operating cash flow remains negative

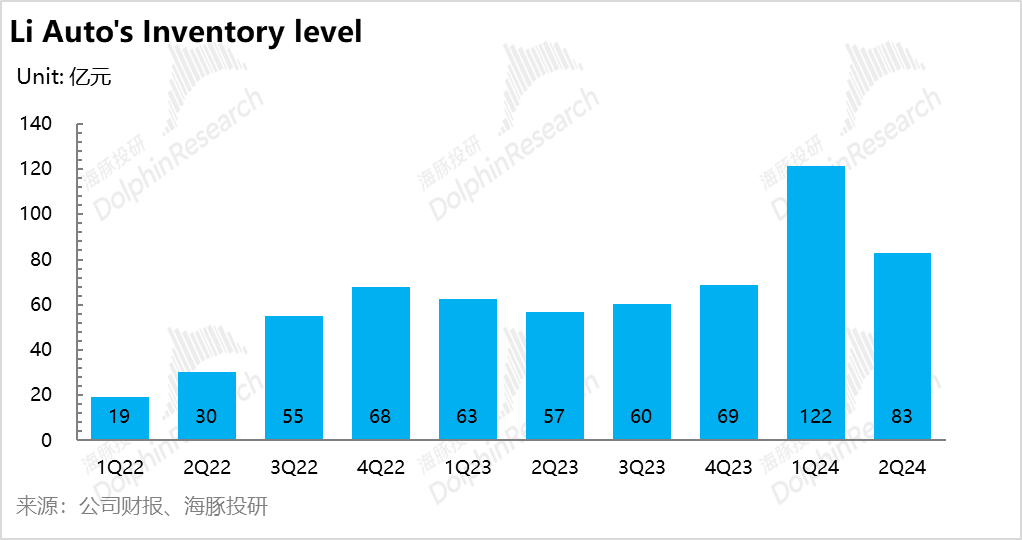

This quarter's operating cash flow was -430 million yuan, an improvement of 2.9 billion yuan from the first quarter's -3.3 billion yuan, but it remains negative. This is mainly due to two factors: while the operating profit margin improved significantly, the Non-GAAP net profit increased by only 230 million yuan quarter-on-quarter despite the decrease in interest income + SBC. Additionally, while the inventory issue improved this quarter (due to overly optimistic sales forecasts leading to doubled inventory levels), inventory levels are still at historically high levels (8.3 billion yuan this quarter), and the company is still in the process of digesting inventory.

This quarter's capital expenditure was 1.4 billion yuan, a decrease of 300 million yuan quarter-on-quarter and below market expectations of 1.7 billion yuan. Capital expenditure this quarter was primarily invested in supercharger stations, with 257 new supercharger stations and 1,182 new supercharger piles added in the second quarter, almost doubling the number. This prepares for the launch of the Mega and all-electric vehicles in the first half of next year. LIXIANG's previous guidance for this year's Capex included an estimated total investment of approximately 1.5 billion yuan for supercharger stations.

The quarter-on-quarter decrease in capital expenditure this quarter may be due to the postponement of mass production of electric vehicles to the first half of next year, which automatically delays the investment in Capex.