Auto Suppliers Rise to Prominence

![]() 05/09 2025

05/09 2025

![]() 492

492

Collaborative Growth Across the Entire Industry Chain

Traditionally, the auto industry's spotlight has been on automakers. However, suppliers are now stepping into the limelight.

This shift was evident at the recently concluded Shanghai International Automobile Industry Exhibition. Both established players such as Bosch, Horizon Robotics, Huawei, and CATL, as well as numerous innovative newcomers, were present.

'In the past, ToB technology companies like us received little attention. Now, we must cater to both enterprise customers (ToB) and end consumers (ToC),' NavInfo CEO Cheng Peng told China News Weekly. 'Only by deeply understanding end-user needs can we help automakers create better products.'

From core component R&D to cutting-edge innovations in intelligent driving and smart cabins, to advancements in supporting industries like charging infrastructure, China's auto industry's true growth stems not just from automakers' expansion but from the collaborative rise of the entire industry chain.

Image generated by Doubao AI with prompt: Auto supply chain

Industry Upgrade 'Accelerator'

On the eve of the auto show, major suppliers announced significant products and technologies.

Horizon Robotics unveiled its latest L2 urban area assisted driving system—HSD, available in HSD 300, HSD 600, and HSD 1200 versions, forming a comprehensive 'family pack' solution catering to affordable to high-performance, full-scenario needs.

Image source: Huawei Kunlun Intelligent Auto Solutions

Huawei Kunlun Intelligent Auto Solutions also officially launched its high-speed L3 commercial solution ADS 4 before the auto show. Jin Yuzhi, CEO of Huawei Intelligent Auto Solutions BU, stated at the launch, 'Huawei invests 99% of its R&D resources to overcome 1% of extreme scenarios, ensuring that L3 commercialization withstands market scrutiny.' Simultaneously, Huawei Kunlun joined forces with 11 automotive brands, including GAC, SAIC, JAC, to release the 'Intelligent Assisted Driving Safety Initiative,' emphasizing safety.

The auto show featured a significantly expanded automotive technology and supply chain exhibit area, spanning approximately 100,000 square meters across four halls, making it one of the most technology-dense sections. This represents a leapfrog growth from 30,000 square meters in 2023. Additionally, 23 suppliers exhibited in the complete vehicle hall, covering key aspects of smart electric vehicles from intelligent driving solutions to smart cabins, automotive-grade chips to power batteries and charging piles, competing alongside complete vehicle enterprises.

In intelligent driving, providers like Momenta and Pony.ai showcased forward-looking technologies. In cabin and interactive technology, Sony, iFLYTEK, and Banma Network presented innovative achievements. Intel and AIChip emerged in automotive-grade chips, while SUNWODA, EVE Energy, and Star Charge exhibited strengths in new energy technology solutions. Notably, with the acceleration of automotive intelligence, companies like Huawei Kunlun, Momenta, and Pony.ai demonstrated robust growth momentum.

AIChip released its new generation of automotive chip products, the M57 series, targeting the global market. The M57 series achieved significant breakthroughs in computing power, with NPU computing power increased to 10 TOPS, natively supporting mixed precision and being compatible with popular BEV algorithms, providing robust computing support for assisted driving functions.

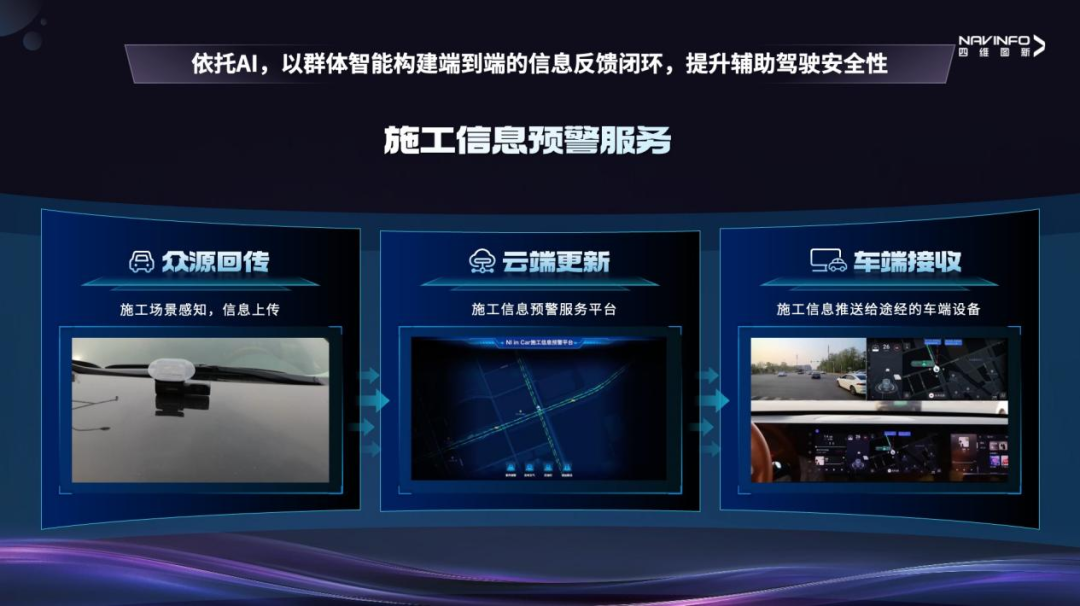

Image source: NavInfo

With the theme 'Digital Intelligence Coexistence,' NavInfo launched a new mass production solution for its cabin and driving product matrix, deepening cooperation with Qualcomm. It introduced new mid-to-high-end assisted driving products focusing on 'integrated driving and parking' and 'integrated cabin and parking.' Meanwhile, leveraging its AI and data infrastructure services, NavInfo proposed a safe development proposition for the intelligent driving industry. Data reveals that from 2024 to the first quarter of 2025, NavInfo's assisted driving products achieved a breakthrough of 3.6 million new mass production orders, successfully transforming into a new-type Tier 1 supplier.

Cheng Peng disagrees with automakers' 'full-stack in-house R&D' approach, advocating for 'full-stack controllability.' He explained that suppliers concentrate R&D investments and sell products to multiple automakers, effectively sharing costs. During the auto show, NavInfo also collaborated with Volcano Engine, DJI, and HSAE, reducing costs through ecological cooperation and avoiding supplier squeeze, which could lead to industry-wide losses.

Amid the automotive intelligent transformation wave, automakers are realizing the importance of partnering with leading supply chain enterprises. Suppliers are frequently taking center stage at automaker launches. For instance, during the Shanghai Auto Show, Momenta announced further strategic cooperation with six brands, including SAIC-GM-Wuling, FAW-Toyota, and Honda China. The new brand AUDI partnered with Momenta to create the industry's first intelligent assisted driving solution combining 'German electric luxury standards + Flying Wheel large model.' During the new car launch, Momenta CEO Cao Xudong and Nie Yi, Director of Product Marketing at Huawei Intelligent Auto Solutions BU, were invited to speak as technical support representatives. When Denza Auto launched its new product, Huawei executives were present to support, with Denza Auto even proclaiming 'Left hand Denza Super Range Extension, right hand Huawei Kunlun Intelligence' as a product endorsement, highlighting the depth and tightness of their cooperation.

China's entire auto industry chain is moving towards a new global stage. As China's auto industry gains prominence internationally, its supply chain is also going global. According to the China Association of Automobile Manufacturers, China's auto exports reached 5.859 million units in 2024, a 19.3% year-on-year increase. From the 2024 annual reports of A-share auto industry chain companies, 'export business growth' has become a key factor in many companies' positive performance. The growth in new energy vehicle exports has also driven the export growth of core components like lithium batteries, with China's lithium battery exports increasing by 18.8% year-on-year in the first quarter of this year. Wu Guohua, former Deputy Director of the Department of Circulation of the Ministry of Commerce, stated that the current automotive aftermarket faces opportunities and challenges when going overseas.

He noted that global automotive market demand is growing, particularly in developing countries like India and Brazil, where auto sales are increasing annually. According to the United Nations Statistics Division, global auto sales are expected to reach 140 million units by 2025, with developing countries accounting for over half. At this year's Shanghai International Automobile Industry Exhibition, SAIC Motor officially released its overseas 3.0 strategy, a combination of 'global + local' strategies. As of the end of 2024, SAIC had delivered over 5.5 million vehicles in overseas markets. Han Dehong, Deputy General Manager of SAIC-GM-Wuling, also said, 'In addition to localizing our products and their ecological transformation, we have localized our core supply chain.'

Image source: AIChip

At the auto show, Qiu Xiaoxin, founder and chairman of AIChip, revealed that the first mass production model based on the M57 chip has been designated for development and will soon be launched in Europe. It is reported that AIChip is forming a 'domestic and international dual-circulation' market structure. On one hand, it is rooted in China, collaborating with leading domestic algorithm providers to realize the cooperative development and mass production of various assisted driving solutions. On the other hand, it is expanding overseas, joining hands with global Tier 1 suppliers and algorithm providers to break down barriers for product exports, build overseas supply chains, and actively participate in overseas projects of OEMs at home and abroad.

Many suppliers continue investing in technological R&D and product innovation, providing strong support for China's auto industry's development. Battery suppliers like CATL continuously improve battery performance indicators, while intelligent driving technology solutions from companies like Huawei and Horizon Robotics become increasingly mature and widely applied.

With China's auto industry chain and technological strength continuously improving, the pace of the entire industry chain going overseas is accelerating. Chinese auto enterprises are witnessing continuous sales growth in overseas markets, gradually expanding their market share, and supply chain providers are also expanding their overseas business. It is foreseeable that with technological, cost, and innovative advantages, China's entire auto industry chain will occupy an increasingly important position in the global auto industry landscape, opening up broader space for sustainable industry development.