Mobile phone market bounces back, but OPPO lags behind

![]() 08/30 2024

08/30 2024

![]() 521

521

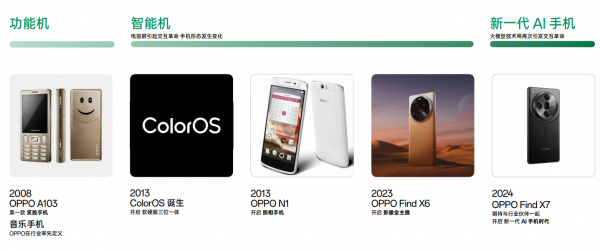

New cycle, intensified competition

Written by Xing Wan

Edited by Chen Dengxin

Typeset by Annalee

Global smartphone shipments in the second quarter of 2024 have been released, with a total shipment of 290 million units, achieving an 8% year-on-year rebound. Among them, Samsung and Apple maintain their strong positions, accounting for 21% and 17% of the market share, respectively, while Xiaomi closely follows with a 15% market share, ranking third. All brands are resonating with the market, feeling the continuous recovery of the smartphone market.

However, not all manufacturers are celebrating. Amidst the jubilation, OPPO stands out as the only brand among the top ten to experience an annual decline.

Despite the overall recovery of the mobile phone market, OPPO has failed to leverage this growth momentum, instead experiencing a reverse decline. From product lines to business layouts, its performance seems unsatisfactory, gradually slipping from its former leading position.

Industry insiders analyze that OPPO's Find series struggles to uphold its high-end status, while the Reno series lacks distinctiveness, and the A series has an inadequate reputation. Furthermore, OPPO's sub-brands lag far behind competitors, resulting in an overall blurred positioning and internal competition among its product lines.

Meanwhile, OPPO's once ambitious self-developed chip business and XR business have been successively shut down. The only remaining visible ambition is OPPO's determination to enter the era of AI phones. However, as users are still in the exploratory phase of AI features and lack rigid demand, where does OPPO find its breakthrough?

Challenges in Pursuing High-End Markets

After two years of downturn, the global smartphone market has maintained a recovery trend for three consecutive quarters. According to the Q2 2024 global smartphone shipment report by market research firm TechInsights, global smartphone shipments rebounded 7.6% year-on-year to 289.6 million units, finally emerging from the winter.

Yet, OPPO seems to have been left behind in the shadows. In this report, OPPO is the only brand with declining shipments, with OPPO brand shipments down 5% year-on-year and sub-brand OnePlus down 22% year-on-year.

Even in the domestic market, OPPO's performance is similar.

In Q2 2024, Chinese smartphone shipments grew 8.9% year-on-year, with OPPO falling to third place with a 15.7% market share. A year ago, OPPO led the rankings with a 17.7% market share, and its dual-flagship Find X6 series and Find N2&Flip series helped OPPO rank among the top three in the high-end market above $600, with Find N2 Flip becoming the top-selling foldable phone in the first half of the year. At that time, OPPO was hailed as a beacon through the winter.

In just a year, OPPO has quickly fallen behind, plunging into a new panic beyond the normal cycle.

The turning point may have occurred in Q3 2023. On one hand, Honor captured 18% of the market share with shipments of 11.8 million units, overtaking OPPO for the top spot.

On the other hand, Huawei's return with Kirin chips and the popularity of the Mate60 series were undeniable. The launch of OPPO Find N3 Flip and OPPO Find N3 clashed with the release of Huawei Mate60 Pro and Mate X5, affecting their heat and sales. From this moment on, OPPO's path to high-end markets became increasingly difficult.

Huawei Mate60 series nearly dominated the heat of the same period

The struggles in the high-end market have triggered a series of chain reactions. The OPPO Find X6 series saw significant price drops in the secondary market less than a month after its launch, and rumors circulated that employees could purchase new phones at half price. The extent of price drops for flagship phones speaks volumes about the market's recognition of OPPO's high-end line.

Positioning in the high-end market cannot be achieved in isolation. During Huawei's sanctions, many sought to capture more market share with high-end products, but as Yu Chengdong put it, "When Huawei falls, Apple eats well."

Key Projects Abruptly Halted

Leveraging the reputation and technological advantages of Kirin chips and HarmonyOS, Huawei has returned stronger than ever, demonstrating that core technologies are essential for domestic mobile phone manufacturers to compete in the high-end market, with systems and chips forming a complementary key factor.

However, OPPO has been somewhat indecisive in this regard.

In 2019, when Huawei and its affiliates were first added to the US restriction list, OPPO announced that it would invest 50 billion yuan in R&D over the next three years to explore cutting-edge technologies.

The following year, OPPO released an article titled "Reflections on Building Core Technologies," outlining the "Mariana Plan" for chips. The Mariana Trench, the deepest part of the ocean, symbolizes OPPO's determination and courage to tackle challenging tasks.

Image source: "AI Mobile Phone White Paper"

This decision later contributed to OPPO's product enhancement, with the launch of self-developed chips Mariana X and MariSilicon Y marking tangible achievements in OPPO's three-year plan. Data shows that in 2021 and 2022, OPPO filed 6,789 and 5,765 domestic patents in the telecommunications industry, respectively, second only to Huawei.

However, in the first half of 2023, when OPPO was topping various lists, it suddenly announced the closure of its chip subsidiary ZEKU. "In light of global economic uncertainties and the volatile mobile phone market, after careful consideration, the company has decided to terminate the ZEKU business," OPPO stated in an announcement.

The abrupt closure sparked speculation, given the initial ambition behind OPPO's self-developed chip project. While the specific reasons remain unclear, Jiang Bo, OPPO's Senior Director of Chip Products, once mentioned that chip manufacturing was not cost-effective in terms of investment returns.

OPPO's indecisiveness is also evident in its foldable phone strategy. The OPPO Find N2 Flip and OPPO Find N3 Flip once gave OPPO a 31.4% market share in the domestic vertical foldable phone market. However, with the recent launches of Honor, Huawei, and Xiaomi's vertical foldables, OPPO is rumored to be exiting this market despite its previous dominance.

OPPO's share in the foldable phone market declines

Although OPPO quickly denied these rumors and stated that its commitment to foldable technology remained unchanged, the delay in new product launches has already impacted its market share. On August 21, market research firm CINNO Research released Q2 2024 sales figures for China's foldable phone market, reporting total sales of 2.62 million units, a year-on-year increase of 125%. Huawei led with sales of approximately 922,000 units (35.2% market share), followed by vivo with 836,000 units (31.9% market share). OPPO ranked fourth with 291,000 units (11.1% market share), narrowly trailing Honor by just 0.7% market share.

The recovering smartphone market is intensifying competition, and OPPO seems to be paying the price for its indecisive decisions.

Is Betting on AI the Future?

At the beginning of 2024, OPPO unveiled its new plan. In an internal letter titled "Embracing the New Era of AI Phones," OPPO's CEO Chen Mingyong wrote, "2024 marks the first year of AI phones, and OPPO is committed to becoming a leader and popularizer of AI phones."

Chen Mingyong gave a two-year timeline, believing that a deeper understanding of this decision would emerge by then.

OPPO's AI aspirations are focused on self-developed large models, culminating in the launch of AndesGPT after three years of effort. Technically, OPPO's AndesGPT model comes in three versions: Tiny with 7 billion parameters, Turbo with 70 billion parameters, and Titan with 180 billion parameters. To date, OPPO holds over 5,000 AI patents.

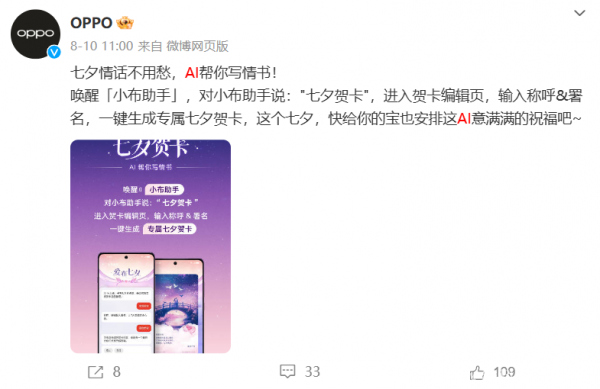

Breeno Assistant is OPPO's built-in AI assistant

Based on three years of R&D, the Find X7 series is equipped with the generative AI chip Dimensity 9300, leading in AI computing power among Android devices. At launch, the Find X7 highlighted AI call summaries, image removal, and a new AI assistant as its main selling points. While OPPO marketed the phone as an "AI experience," subsequent quarters' shipment figures suggest that this highly anticipated AI phone failed to bring new opportunities for OPPO.

Currently, various industries and brands are betting on AI. Foreign media revealed that OPPO plans to introduce over 100 AI features this year, integrate AI into 50 million devices by the end of 2024, and prioritize India as a key market for its AI strategy. Clearly, OPPO views its AI bets as a last-ditch effort.

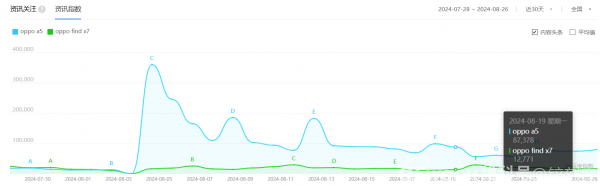

OPPO A5 garners more attention than OPPO Find X7

The AI device race is fiercely competitive, involving not only mobile phone manufacturers but also traditional home appliance and internet companies. This competition resembles a marathon, testing endurance and long-term strategic allocation. While it's uncertain if any brand will overtake through AI, in the short term, AI phones are not yet a rigid demand for consumers.

Despite OPPO's efforts to break through with new spokespersons and AI bets, the OPPO Find X7 seems to garner less attention than the OPPO A5, which many consumers find amusing. The heavily promoted AI features have yet to significantly differentiate OPPO's phones from competitors, making it difficult for consumers to prioritize OPPO when purchasing. Capturing consumer minds is a long-term endeavor, and the current solution may not lie solely in AI.