Car sea tactics vs. popular models, who will win in the end?

![]() 09/03 2024

09/03 2024

![]() 568

568

Original article by New Energy Insight (ID: xinnengyuanqianzhan)

Recently, a plan for Chery to intensively launch new vehicles was exposed. Among them, new energy vehicles account for the majority, specifically including the Tiggo 9 C-DM, Tiggo 8 C-DM, Tiggo 7 C-DM, and Arrizo 8 C-DM.

In this era of market saturation, it's not just Chery playing the "car sea tactics"; many traditional automakers are also frequently launching new models in a short period to compete for the benefits of the new energy vehicle market.

However, with the prevalence of new energy vehicles, the competitive landscape in China's automobile market has significantly changed from the era of gasoline-powered vehicles. Facing the "boutique strategy" of emerging brands like Lixiang, Wenjie, and Xiaomi Automobile, will the traditional automakers' "the more children, the merrier" strategy still hold true?

1. Relying on chance to build cars? More "children" won't help

In the cutthroat competition of the new energy vehicle market, it is understandable that automakers want to boost sales by launching multiple models, as user demand is diverse.

However, it is essential to clarify that if an automaker wants to maintain a frequent and intensive launch rate of "dozens of new models per year," trade-offs must be made. The gain is in the layout of multiple market segments, and the sacrifice is the investment of effort and resources in product development.

In the eyes of Lei Jun, who spent three years building a car, this is not about making products seriously but relying on chance, leading to severe homogenization.

Looking back, the "car sea tactics" is not a recent phenomenon. It has been a favored competitive means for many traditional automakers since the era of gasoline-powered vehicles. Naturally, many models born from this strategy have ultimately disappeared due to poor sales, such as Geely Borui, Chery Arrizo 7, and BYD Sirui.

Nowadays, the causal effects of relying on chance in car manufacturing are also evident in the new energy market.

Models like the Ora Black Cat/White Cat, BYD Song New Energy, and BYD e5 have seen consistently low sales due to a lack of design advantages compared to competitors in the same segment, ultimately leading to production cessation.

Image/Ora Black Cat and White Cat

Source/Screenshot from New Energy Insight

Of course, more "homogenized" models remain lukewarm or even struggling to survive. For example, from January to July this year, Chery successively launched Fengyun T9, Fengyun A8, and Tan Suo 06 C-DM, but so far, none of them have achieved monthly sales exceeding 10,000 units; R Flying and IM Motors, two new energy brands under SAIC Motor, have successively launched multiple models since their inception, but few have achieved monthly sales of 3,000 units.

Image/Fengyun T9

Source/Screenshot from New Energy Insight

Zhou Zhi (pseudonym), a post-90s individual, recently considered changing cars. He told New Energy Insight, "For my next new energy vehicle, I will prioritize brands like Lixiang and Tesla. After all, a model that has survived and sold well for so many years must have its unique advantages; at the same time, although these popular models are regularly updated, their appearance changes little, making them less prone to obsolescence."

More than half of the dozens of new energy vehicle owners contacted by New Energy Insight indicated that they would prioritize popular models when selecting a car.

Therefore, whether in the era of gasoline-powered vehicles or the new energy era, automakers' reliance on chance to build models is unadvisable, as it wastes resources and dilutes brand value. In the long run, this approach may hinder sustainable development and risk elimination from the market.

2. Less is more; one model can dominate

Indeed, for a new energy brand, having too many models can distract from each model's exposure, making it difficult to form a distinctive "label" that consumers will remember and gain market recognition.

An overview of the automotive market reveals a common trait among the top-selling new energy brands—they embrace the "boutique strategy."

Specifically, AITO, one of the players with the fewest models in the new energy market, currently sells the AITO M7, M5, and M9. Notably, each model is a hit in its respective segment, with the AITO M7 leading the pack. As of August 13, the cumulative annual deliveries of the new AITO M7 exceeded 130,000 units, making it the sales champion among new force models in the first half of the year.

Image/Cumulative annual deliveries of the new AITO M7 exceed 130,000 units

Source/AITO Official Weibo, Screenshot from New Energy Insight

The Lixiang L6 has surpassed 20,000 monthly sales for three consecutive months, helping Lixiang Automobile surpass the 50,000-unit monthly sales mark and set a new record for monthly deliveries among Chinese new force brands.

Since its establishment in 2003, Tesla has five models, including the Cybertruck, which is delivered in limited quantities in the North American market. Among them, the Model Y, as the sales champion in the new energy market, sold 36,299 units in July.

These brands are also among the few profitable players in the new energy vehicle sector. Thus, the importance of popular models to new energy automakers is self-evident.

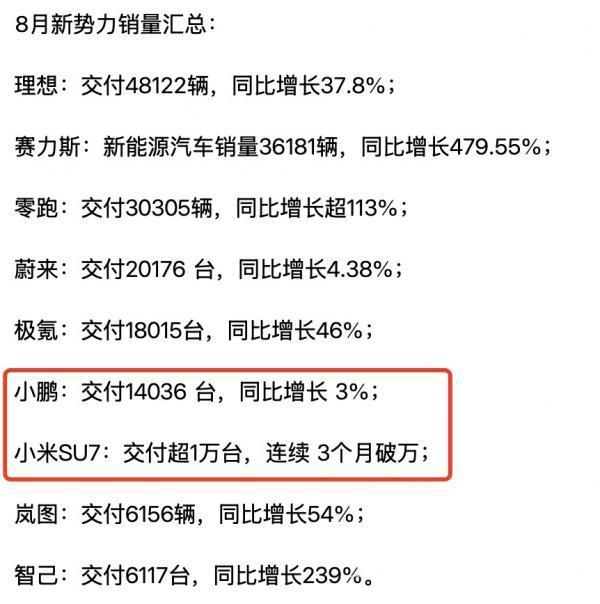

In contrast, XPeng, though an early entrant in the new energy market with a presence in sedans, SUVs, and MPVs, has seen its sales performance continue to decline. Currently, the combined monthly sales of all its models barely match those of popular models like Xiaomi SU7.

Image/August 2024 Sales of XPeng and Xiaomi

Source/Zhang Damao Talks Cars, Screenshot from New Energy Insight

Why is this so?

In terms of market positioning, these popular models succeed because they focus on user needs from the outset, creating unique and differentiated vehicles that stand out among competitors in the same segment.

In terms of product design, an automaker spends significantly more effort and resources crafting one model over three years than launching three models in one year. Therefore, models refined through technical precision are inherently superior in appearance, interior, quality, and safety to homogenized models aimed at rapid market penetration.

Mr. Cheng (pseudonym), an owner of the Lixiang L7, candidly stated, "What impresses me most about Lixiang is its definition of family. The comfort of the L7's interior is ideal for families with children like ours."

Ms. Wang (pseudonym), an owner of a Tesla Model 3, believes, "People say Tesla is lazy, with only a handful of models over the years. But not only me but also my friends agree that when buying a car, we should choose an 'evergreen' model that offers reassurance in all aspects."

3. The boutique strategy: the optimal solution for building a moat?

In the fiercely competitive new energy market, automakers cannot rely solely on product diversity to succeed in the long run. After all, the key to a brand's success lies not in the number of products but in their quality.

Why is this so?

Tracing the roots, the birth of a popular model not only enhances a brand's market recognition but also exposes other models within the same brand, fostering their growth. Meanwhile, a diversified product lineup means automakers will invest more in research and development. In the long run, automakers that constantly launch new models to attract the market without any enduring hits may struggle with profitability.

So, how can automakers "unlock" popular models?

First, automakers must understand that success achieved through blindly stacking product lines is bound to be fleeting, and the advantage of the "car sea tactics" pales in comparison to absolute product strength. Therefore, automakers' top priority is to learn to "let go"—to abandon the urge for rapid expansion and instead focus all resources on refining a single excellent product. Remember, attempting to run before one can walk is bound to lead to a fall.

Second, automakers should prioritize user needs when creating products, clarifying the user profiles of each model to avoid potential positioning confusion in the market.

Finally, prioritizing ultimate safety never goes out of style. While intelligence is a strength of new energy vehicles, batteries are their Achilles' heel. As the primary power source, battery quality determines a vehicle's performance and safety, a crucial factor in a model's popularity.

It's evident that new energy brands with popular models, such as AITO, Xiaomi, and Zeekr, have put thought into selecting their vehicle batteries.

Image/2024 Zeekr 001

Source/Screenshot from New Energy Insight

Specifically, most of their models use CATL batteries, which boast core R&D technologies in fire-retardant insulation materials, battery management systems, and structural design, significantly reducing the risk of vehicle fires or spontaneous combustion.

Thanks to their safety leadership, brands like AITO and Zeekr have easily "unlocked" popular models, earning lasting consumer trust.

However, it's crucial to note that in today's era of technological equality, popular models that fail to evolve with the times cannot become timeless classics and risk obsolescence over time.

To adapt to the market, Tesla, Lixiang, Zeekr, and other automakers have successively upgraded their popular models. On August 26, the new AITO M7 Pro was officially launched, featuring the ADS basic system and CATL LFP batteries. With over 6,000 pre-orders in 48 hours, its future performance is eagerly anticipated.

Image/AITO New M7 Pro

Source/Screenshot from New Energy Insight

In summary, whether in the past, present, or future, automakers that excel at "planning before acting" and focus on "fewer but better" models are more likely to capture consumers' hearts. However, while replicating successful cases, automakers must remember that while popular models emerge every year, "evergreen" hits are rare.