Fengchao's IPO Becomes a "Gamble", Wang Wei and Shen Nanpeng Join the "Poker Table"

![]() 09/09 2024

09/09 2024

![]() 657

657

Produced by | Bullet Finance

Designed by | Qian Qian

Reviewed by | Song Wen

The express locker downstairs in the community is heading for the capital market.

On August 30, Fengchao Holdings Limited (hereinafter referred to as "Fengchao") submitted its listing application to the Hong Kong Stock Exchange, with Huatai International as the sole sponsor.

As a solution to the pain point of the "last mile" of express delivery, express lockers have penetrated people's daily lives. However, people may not realize that these ordinary compartments not only hold parcels but also are filled with capital and have sparked capital battles.

In June 2015, SF Express, STO Express, Yunda Express, ZTO Express, and GLP co-invested in Fengchao Technology; in 2017, SF Express and Cainiao repeatedly confronted each other over issues such as Fengchao locker information interfaces, with hidden tensions brewing.

A year later, in 2018, STO Express, Yunda Express, and ZTO Express collectively withdrew from Fengchao. The prospectus disclosed by Cainiao showed that the "Tongda System" had long been listed as shareholders of Cainiao.

Today, Wang Wei, the leader of SF Express, has taken up the mantle. Before the IPO, Wang Wei controlled 48.45% of Fengchao's voting rights, with well-known investment institutions such as Shen Nanpeng's Sequoia China, state-owned China Post, Trustbridge Partners, and Asia Investment Partners also appearing on the shareholder list.

After Cainiao voluntarily withdrew its IPO application, can Fengchao successfully enter the capital market as desired?

1. Accumulated losses of nearly 7 billion, finally turning a profit this year

As a leading enterprise in the express locker sector, as of May 31, 2024, Fengchao's smart lockers reached 330,200 units, covering 209,000 communities.

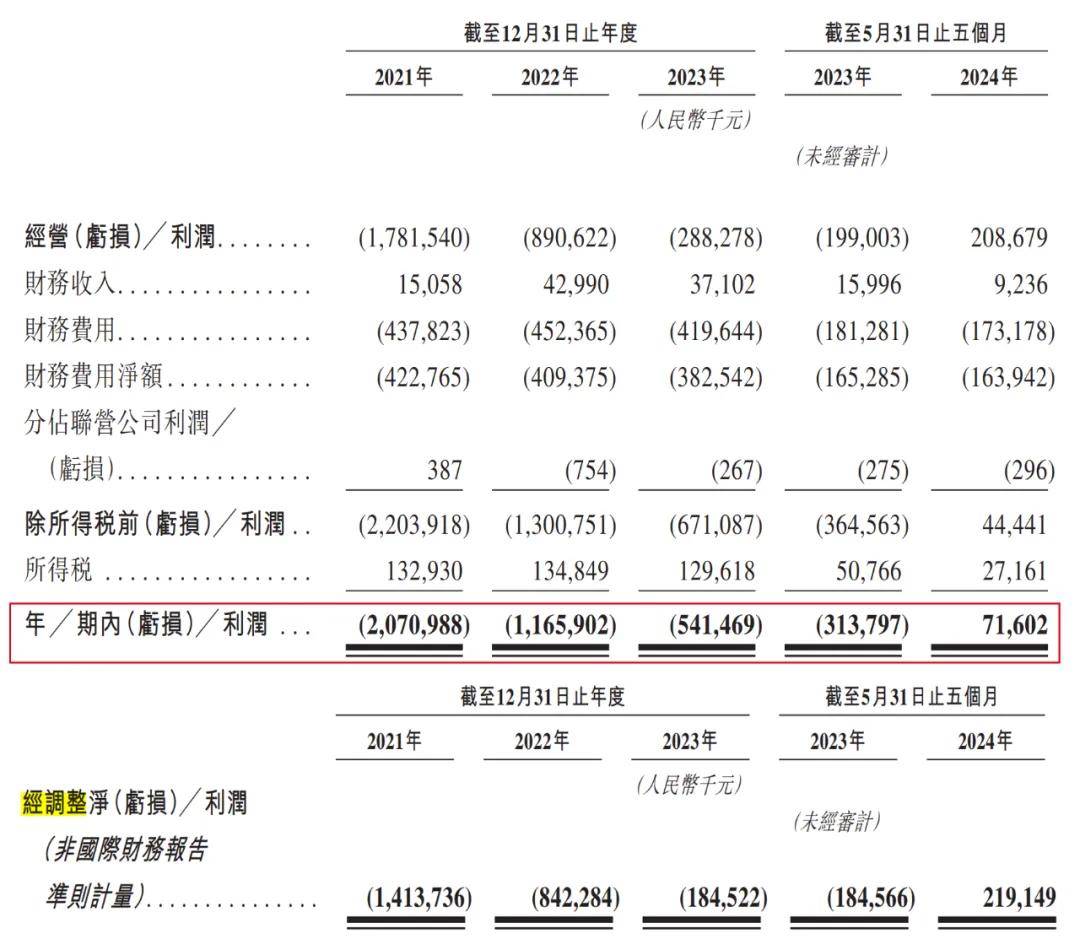

Correspondingly, Fengchao's revenue has soared. According to the prospectus, from 2021 to the first five months of 2024 (hereinafter referred to as the reporting period), Fengchao achieved revenues of RMB 2.526 billion, RMB 2.891 billion, RMB 3.812 billion, and RMB 1.904 billion, respectively.

(Image / Fengchao Prospectus)

It can be said that in recent years, with the explosive growth of e-commerce, express lockers have developed rapidly, and Fengchao has also grown accordingly. However, while the industry has developed rapidly, the topic of whether express lockers should charge fees has repeatedly become a focus of attention.

In fact, behind the controversy over charging fees lies the fact that express lockers are too "burn rate-intensive." From 2021 to 2023, Fengchao's profits were losses of RMB 2.071 billion, RMB 1.166 billion, and RMB 541 million, respectively; adjusted net profits were losses of RMB 1.414 billion, RMB 842 million, and RMB 185 million, respectively.

(Image / Fengchao Prospectus)

Faced with huge losses, Fengchao had to seek more outlets.

Externally, Fengchao considered strengthening overseas service capabilities, including potentially expanding its business through independent operations, joint ventures with overseas partners, or technology exports, and expanding its smart locker network overseas to seize opportunities arising from the booming cross-border e-commerce industry.

Internally, relying on its in-depth community network layout, Fengchao is expanding its diversified service models, such as interactive media services, laundry services, and home delivery services.

After "walking on multiple legs," Fengchao's performance did indeed change. In the first five months of this year, Fengchao achieved its first profit during the reporting period. For the first five months of 2024, Fengchao achieved a profit of RMB 71.602 million.

Fengchao explained that the profit was primarily due to increased profitability in last-mile delivery services, growth in consumer smart delivery services and value-added services, and improved operational efficiency.

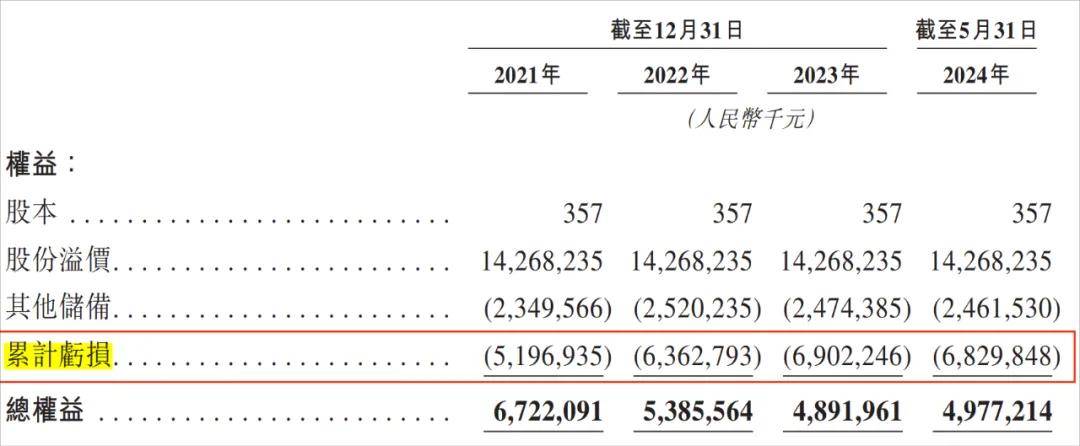

However, this profit can only be considered a "drop in the ocean" compared to the years of accumulated huge losses. As of May 31, 2024, Fengchao's accumulated losses attributable to shareholders amounted to RMB 6.83 billion.

(Image / Fengchao Prospectus)

If Fengchao successfully goes public this time, Wang Wei will harvest his fifth listed company after SF Holding, SF REIT, Kerry Logistics, and SF Express. Many investors are also eagerly awaiting this day, not just Wang Wei.

2. Wang Wei "forced" to take control, once fought with Cainiao

It is widely believed that Fengchao was originally jointly established by SF Express, STO Express, Yunda Express, ZTO Express, and GLP. However, according to information disclosed by Fengchao, this statement is not entirely accurate.

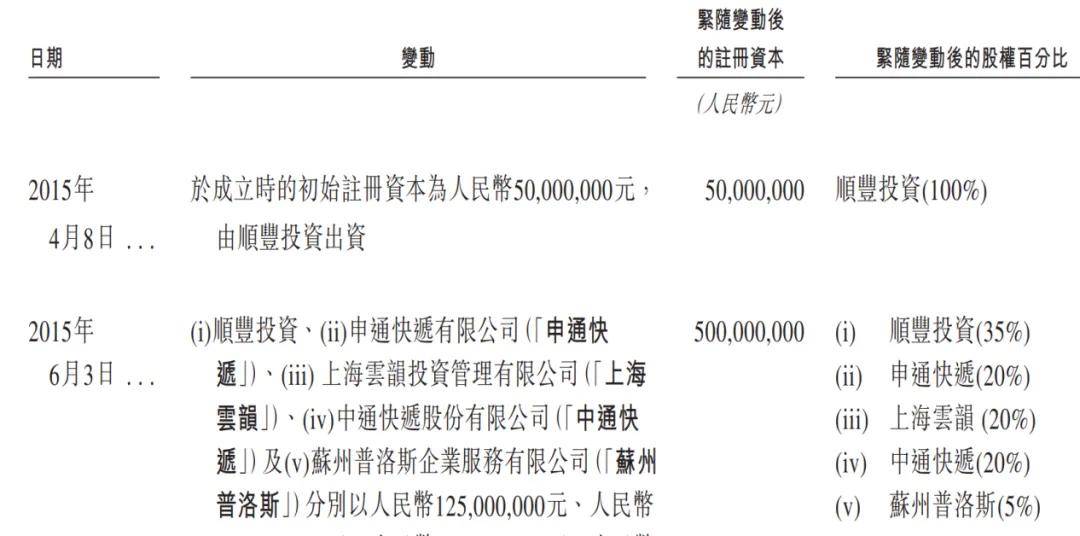

In fact, Fengchao Technology, the predecessor of Fengchao, was first established by Xu Yubin in April 2015 with a registered capital of RMB 50 million, although the funds were contributed by SF Investment, which held 100% of the equity.

Two months later, SF Investment, STO Express, Yunda Express, ZTO Express, and GLP jointly subscribed to an additional RMB 450 million in registered capital for Fengchao Technology. After the capital increase, SF Investment became the largest shareholder with a 35% stake, while ZTO Express, STO Express, and Yunda Express each held 20% stakes.

(Image / Fengchao Prospectus (Note: "Shanghai Yunyun Investment Management Co., Ltd." in the image is a subsidiary of Yunda Express))

Since then, these shareholders have frequently increased their capital contributions to Fengchao Technology.

According to incomplete statistics from Bullet Finance, in May 2016, these five shareholders jointly increased their capital contributions to Fengchao Technology by RMB 500 million; in March 2017, SF Investment, STO Express, Yunda Express, and multiple investors jointly subscribed to additional registered capital for Fengchao Technology; in March 2018, Ningbo Fushan, subsidiaries of STO Express and Yunda Express, continued to increase their capital contributions to Fengchao Technology.

The turning point in this positive development occurred in 2018.

From June to July 2018, ZTO Express, STO Express, and Yunda Express (hereinafter collectively referred to as "Er Tong Yi Da") collectively transferred their shares and exited Fengchao.

Among them, ZTO Express transferred all of its equity in Fengchao Technology (i.e., 7.75% equity) for RMB 698 million; STO Express transferred all of its equity in Fengchao Technology (i.e., 9.09% equity) for RMB 819 million; Yunda Express, together with its wholly-owned subsidiaries Shanghai Yunyun and Ningbo Fushan, transferred all of their equity in Fengchao Technology (approximately 13.46% equity) for RMB 1.212 billion in total; these shares were all acquired by Weirong Development. According to the prospectus, Weirong Development is a wholly-owned subsidiary of Mingde Holdings, which is 99.9% owned by Wang Wei.

Having taken over so many shares, Wang Wei now controls Fengchao. According to the prospectus, before the IPO, Wang Wei controlled 48.45% of the voting rights through a unanimous action agreement signed by Mingde Holdings, SF Express, and Fengchao executives, making him one of the company's controlling shareholders.

At that time, ZTO Express had not yet listed on the Hong Kong Stock Exchange (Editor's note: it was only listed on U.S. stock exchanges at the time), and both STO Express and Yunda Express, which were listed on the A-share market, stated in their announcements that the move was to optimize asset allocation structures and achieve reasonable investment returns.

However, it is worth noting that before "Er Tong Yi Da" collectively exited Fengchao, SF Express and Cainiao had some "unpleasantness."

Rewind to 2017. On June 1 of that year, Cainiao Network's official Weibo account announced the suspension of SF Express's logistics data interface.

Subsequently, SF Express responded on its official Weibo account that Cainiao had requested Fengchao to provide customer privacy data unrelated to it based on its own commercial interests since May 2017. After Fengchao refused this request, Cainiao unilaterally cut off Fengchao's information interface at 00:00 on June 1, 2017.

In this battle, the two sides exchanged blows relentlessly until the State Post Bureau intervened to mediate.

Essentially, Cainiao Post and Fengchao locker services are similar, both committed to solving the pain point of the "last mile" of express delivery and both holding vast amounts of user data. Behind them stand Alibaba and SF Express, two major capital forces, and the competition between them naturally intensified as they vied for more voice and interests.

Moreover, the relationship between "Er Tong Yi Da" and Alibaba has always been close. In addition to Alibaba being a shareholder of ZTO Express, Yunda Express, and STO Express, Bullet Finance found in Cainiao's prospectus that as early as March 2016, after Cainiao's first round of capital increase, YTO Express and ZTO Express had already become shareholders of Cainiao.

After Cainiao's second round of capital increase in 2017, Yunda Express and STO Express also joined the shareholder ranks. Until Cainiao submitted its listing application to the Hong Kong Stock Exchange in 2023, "Er Tong Yi Da" remained shareholders of Cainiao.

Compared to Fengchao, Cainiao, with revenues approaching RMB 100 billion, is significantly larger in scale. If Cainiao successfully goes public, investors could reap substantial returns. Unfortunately, Cainiao ultimately chose to withdraw its listing application, and investors can only continue to wait.

However, when "Er Tong Yi Da" exited Fengchao, they had already made a substantial profit. From their initial capital increase in Fengchao to their collective exit, ZTO Express, STO Express, and Yunda Express earned approximately RMB 500 million, RMB 389 million, and RMB 545 million, respectively, with the three companies collectively taking away investment returns exceeding RMB 1.4 billion.

3. Extending the deadline for the gambling period by two years, no new financing for three years

Although "Er Tong Yi Da" chose to withdraw, Fengchao, nurtured by Wang Wei, still has no shortage of investors.

From May 2015 to January 2021, Fengchao received a total of five rounds of financing from well-known investment institutions such as China Post, Chuanfa Longmeng, Trustbridge Partners, CDH Investments, Asia Investment Partners, Changshi Capital, and Sequoia China.

The substantial funds obtained from investors provided the foundation for Fengchao's expansion. According to Frost & Sullivan, in terms of revenue in 2023, Fengchao has become the largest provider of end-to-end logistics solutions in China and the world's largest operator of smart locker networks in terms of parcel volume in 2023.

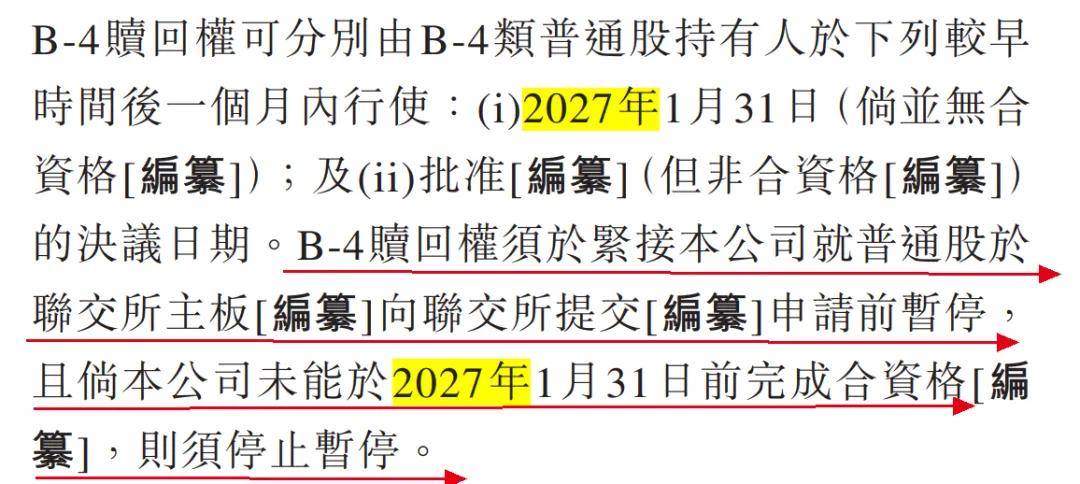

However, profit-driven capital also imposes requirements on Fengchao. For example, according to the shareholders' agreement (as amended by the 2024 Amended Agreement), multiple B-4 class ordinary shareholders, including Asia Investment Partners, Sequoia China, and Trustbridge Partners, have redemption rights.

(Image / Fengchao Prospectus (B-4 Class Ordinary Shareholders))

In January 2021, the company entered into an investment agreement with B-4 class ordinary shareholders to increase Fengchao's capital by USD 400 million. The agreement mentions that one scenario in which the redemption right can be exercised is if Fengchao fails to achieve a qualified listing within four years of the investment (i.e., by January 27, 2025).

(Image / Fengchao Prospectus)

On August 26, just before the submission of the listing application, this agreement was urgently amended. According to the new regulations, the redemption rights of B-4 class ordinary shareholders were suspended before the company submitted its listing application to the Hong Kong Stock Exchange. If the company fails to complete a qualified listing by January 31, 2027, the redemption rights will resume.

(Image / Fengchao Prospectus)

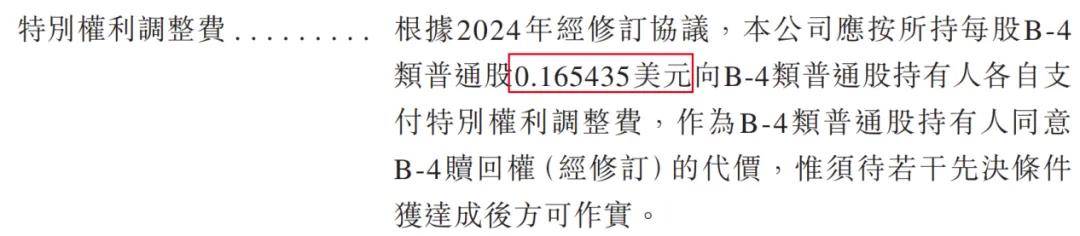

Extending the gambling period by two years comes at a cost. According to the 2024 Amended Agreement, the company shall pay a special rights adjustment fee to each B-4 class ordinary shareholder at USD 0.165435 per share, as compensation for the B-4 class ordinary shareholders' agreement to the amended B-4 redemption rights.

(Image / Fengchao Prospectus)

According to the prospectus, the investment cost per share during the B-4 round of financing was USD 0.8272. Based on this calculation, the cost of this amendment is equivalent to 20% of the investment cost.

In other words, to extend the gambling period, the company must first pay 20% of the funds to B-4 class ordinary shareholders, equivalent to approximately USD 80 million (approximately RMB 569 million based on the exchange rate on September 4, 2024).

This poses a significant financial pressure on Fengchao.

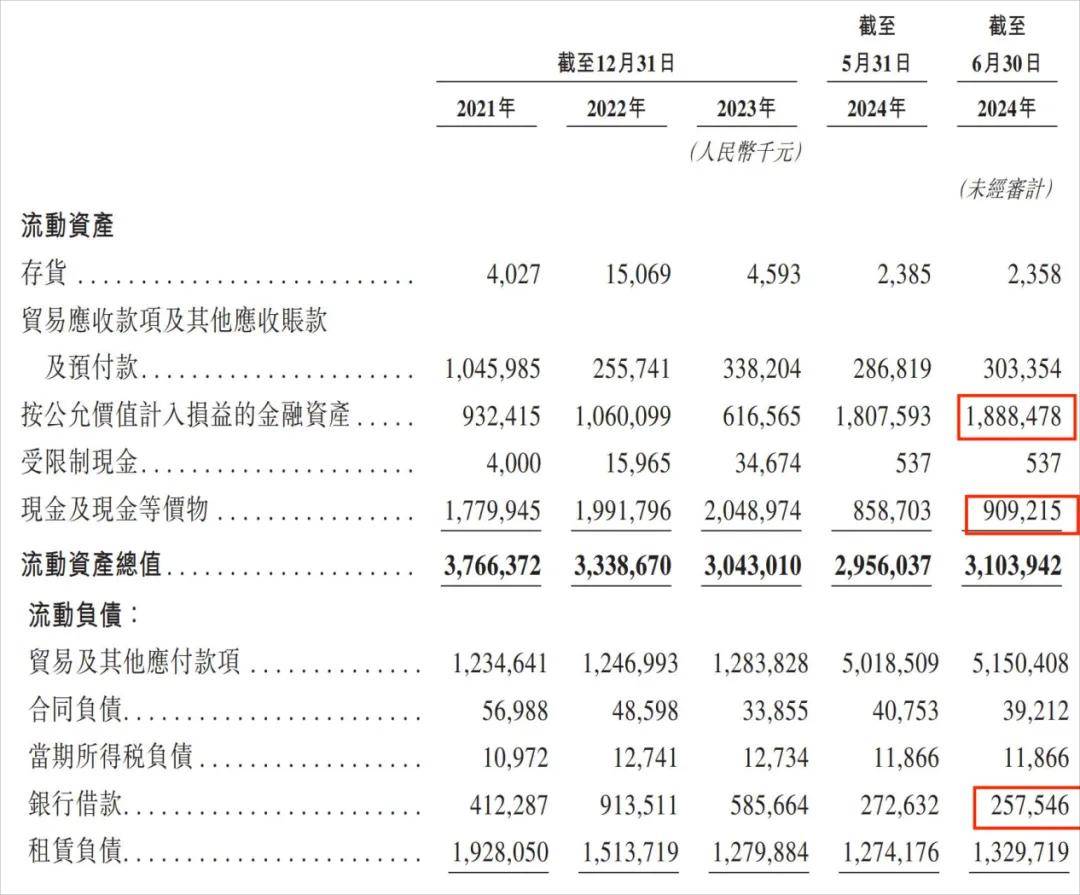

As of June 30, 2024, Fengchao had cash and cash equivalents of RMB 909 million and short-term bank borrowings of RMB 258 million, leaving some room for cash flow. However, paying such a substantial revision redemption fee at this time would undoubtedly test Fengchao's cash flow.

On the bright side, Fengchao still has financial assets of RMB 1.888 billion; otherwise, the company's cash flow pressure would be even greater. However, the concern is that Fengchao has not received any new financing in three years since 2021, and the anxiety behind this is perhaps clearest to Wang Wei.

(Image / Fengchao Prospectus)

Although Fengchao claims that the company's working capital can meet its needs for the next 12 months, Fengchao's pace towards going public cannot stop. After all, whether Fengchao can successfully go public within the remaining less than two and a half years will determine its fate.

*The featured image in this article is from Jiemian News' image library.