"Cyclical recovery combined with domestic substitution as dual drivers, semiconductor equipment boom is expected to continue

![]() 09/06 2024

09/06 2024

![]() 420

420

Recently, SEMI pointed out that the global semiconductor equipment market is expected to grow slightly by 3% to $109.5 billion in 2024 compared to last year. In 2025, driven by new production line construction, capacity expansion, and technology migration, the equipment market may grow again by 16% to reach a scale of $127.5 billion.

China Merchants Securities noted that based on the annual interim reports disclosed by various equipment manufacturers at home and abroad and the gradual recovery of downstream demand, 2024 may be a transitional year for global semiconductor equipment, with a clearer recovery expected in 2025.

Domestic equipment manufacturers benefit from both the cyclical recovery of the industry and the logic of domestic substitution, potentially ushering in a new round of development opportunities.

[AI Demand Drives a New Growth Curve, Continuing the Recovery Trend in the Global Semiconductor Industry]

Entering 2024, with terminal manufacturers and supply chain companies actively promoting inventory destocking, coupled with AI-driven industry innovation and chip demand, factors such as the launch of a new round of phone and PC replacements have led to the recovery of the semiconductor industry.

Recently, China Merchants Securities conducted a follow-up analysis of the global semiconductor boom from five dimensions: demand, inventory, supply, price, and sales. It was found that the marginal demand for semiconductor consumer products is gradually improving, and there are significant signs of a recovery in the overall boom cycle of the industry.

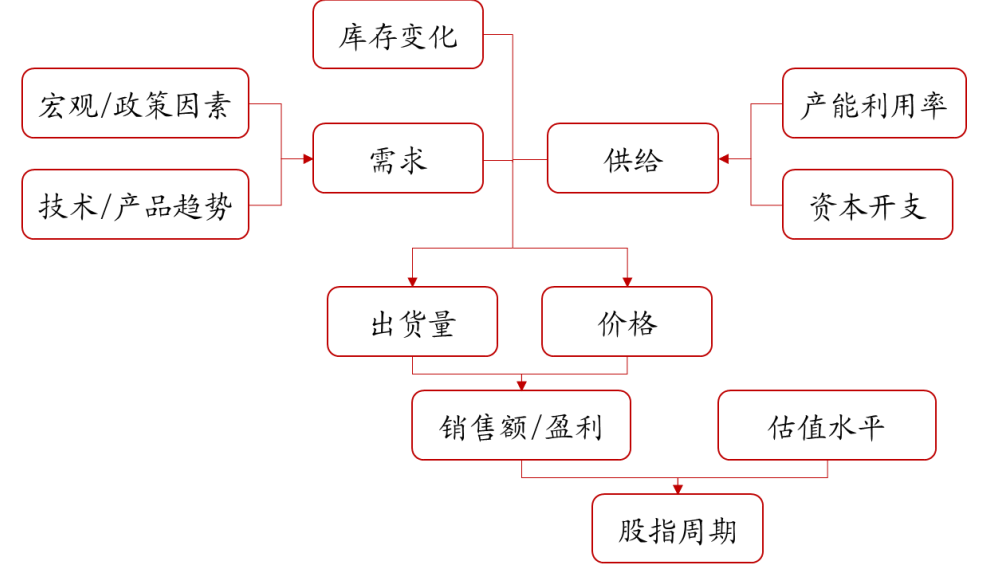

Figure: Semiconductor Industry Boom Analysis Framework

Source: China Merchants Securities, September 5, 2024

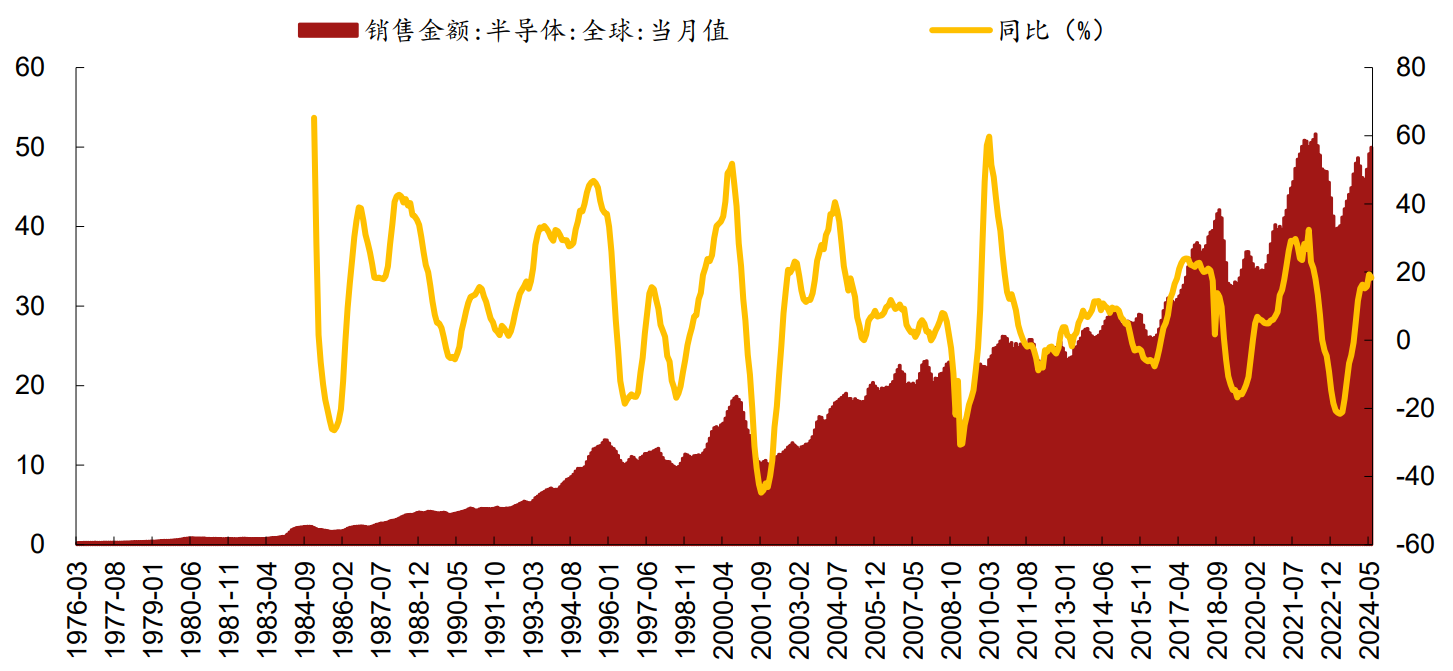

The latest data from SIA also showed that global semiconductor sales in June 2024 amounted to $49.98 billion, a year-on-year increase of 18.3%, marking the eighth consecutive month of positive year-on-year growth with a relatively high growth rate. Month-on-month, there was a 1.7% increase, marking three consecutive months of positive month-on-month growth. In the first half of the year (January-June), the total monthly global semiconductor sales amounted to $286.05 billion, a year-on-year increase of 17.06%.

Figure: Global Semiconductor Sales (in billions of US dollars, as of June 2024)

Source: China Merchants Securities, September 5, 2024

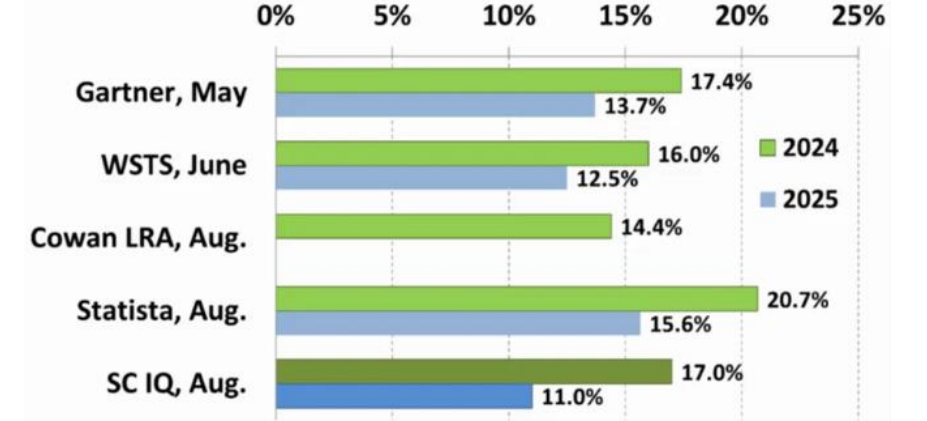

Not only SIA, but also several mainstream semiconductor institutions at home and abroad have predicted that global semiconductor revenue will grow by more than 15% in 2024.

According to semiconductor industry observations, Gartner, WSTS, Cowan LRA, Statista, and SCIQ forecast that global semiconductor revenue in 2024 will increase by +17.4%, +16%, 14.4%, 20.7%, and 17% year-on-year, respectively. Although the year-on-year growth rate in 2025 will slow down, it will remain robust overall.

Figure: Revenue Growth Forecast of the Mainstream Semiconductor Market Globally

Source: China Merchants Securities, September 5, 2024

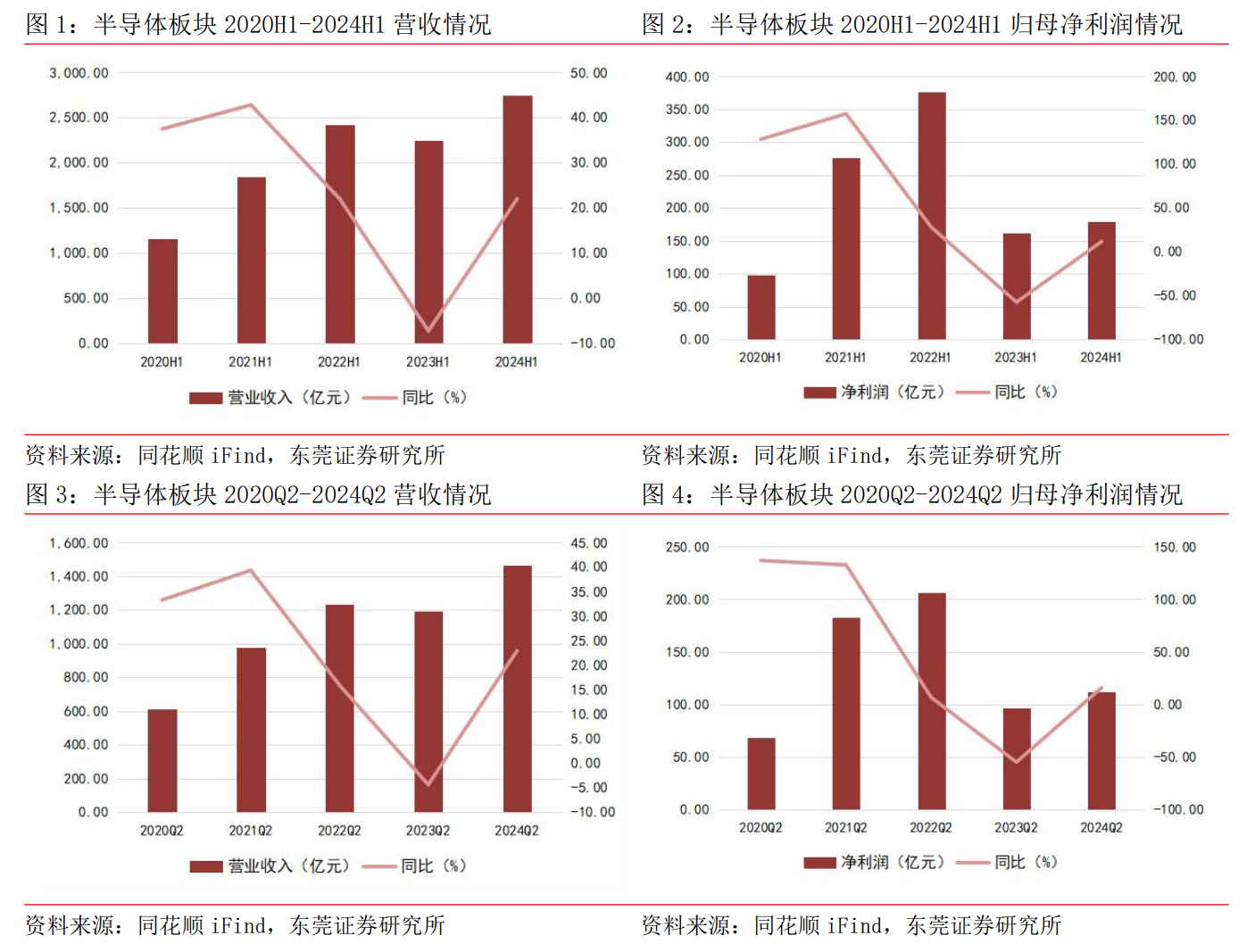

Domestically, the interim reports and second-quarter results of A-share semiconductor companies show that both quarterly revenue and net profit have achieved year-on-year and quarter-on-quarter growth, with profitability rebounding, continuing the recovery trend in the domestic semiconductor industry.

After the interim reporting season ended, Dongguan Securities selected all listed companies from Shenwan Semiconductor to compile statistics on the performance of the semiconductor sector in the first half of 2024.

The statistics revealed that the semiconductor sector in the first half of 2024 generated a revenue of RMB 278.831 billion, a year-on-year increase of 22.01%, and achieved a net profit attributable to shareholders of RMB 17.921 billion, a year-on-year increase of 11.61%. On a quarterly basis, the semiconductor sector generated revenue of RMB 146.521 billion in the second quarter, a year-on-year increase of 22.94% and a quarter-on-quarter increase of 15.09%; net profit attributable to shareholders reached RMB 11.138 billion, a year-on-year increase of 15.91% and a quarter-on-quarter increase of 64.21%, indicating significant profit improvement.

Figure: Revenue and Net Profit of Shenwan Semiconductor Companies in the First Half and Second Quarter

Source: Dongguan Securities, September 4, 2024

Dongguan Securities noted that the semiconductor industry began to recover in 2024. Looking ahead to the second half of the year, with the dual support of AI development and domestic substitution, the semiconductor industry is expected to continue its recovery trend, and sector performance may improve quarter by quarter.

Ping An Securities also believes that the AI-driven computing power industry chain continues to benefit, and the semiconductor industry is currently in a recovery phase. Coupled with the warming up of consumer electronics and the continuous advancement of localization, this may drive a new upcycle for semiconductors.

[Benefiting from Accelerated Domestic Substitution, Domestic Semiconductor Equipment Manufacturers Continue to Grow]

In recent years, due to external influences, major semiconductor countries have continuously tightened restrictions on semiconductor exports. As China's semiconductor industry started late, high-end products still rely on imports. Restrictions in key areas have continually driven China's semiconductor industry to accelerate the construction of an independent and localized supply chain system, making domestic substitution imperative.

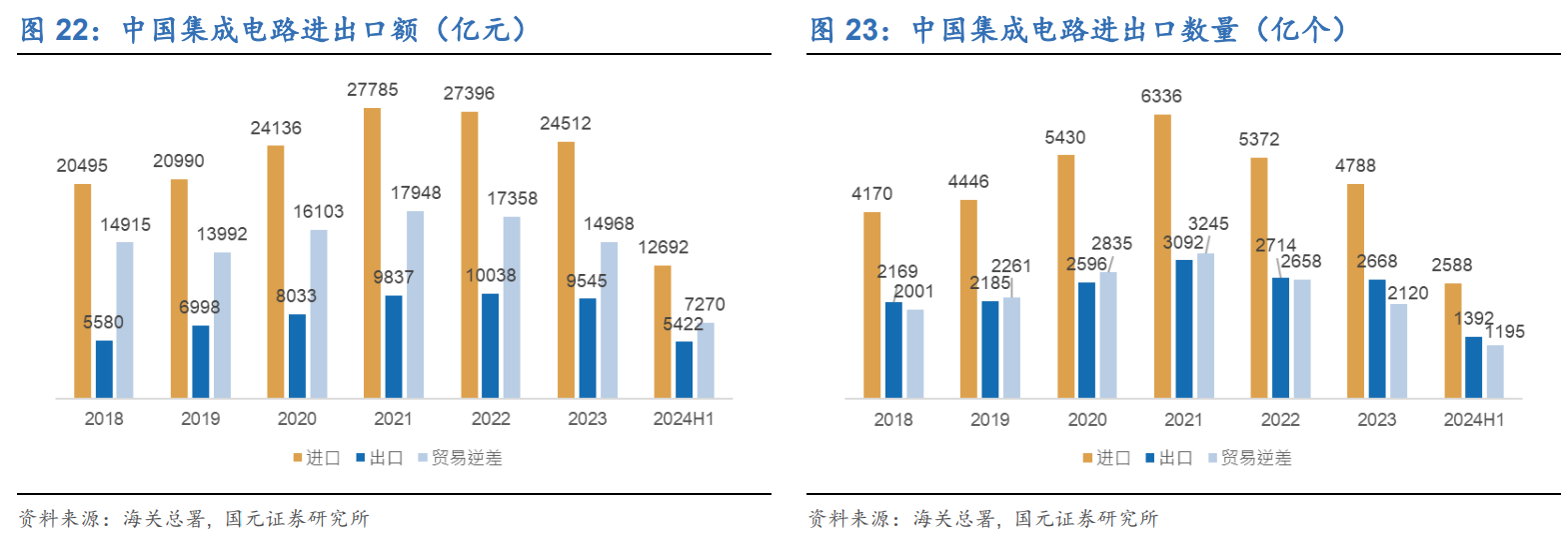

As can be seen from the trend of China's integrated circuit imports and import volumes in recent years, Chinese semiconductor manufacturers are gradually shifting towards domestic substitution to escape restrictions. In the future, as China's semiconductor industry catches up technologically, the pace of domestic substitution is expected to continue to accelerate.

Source: Guoyuan Securities, September 3, 2024

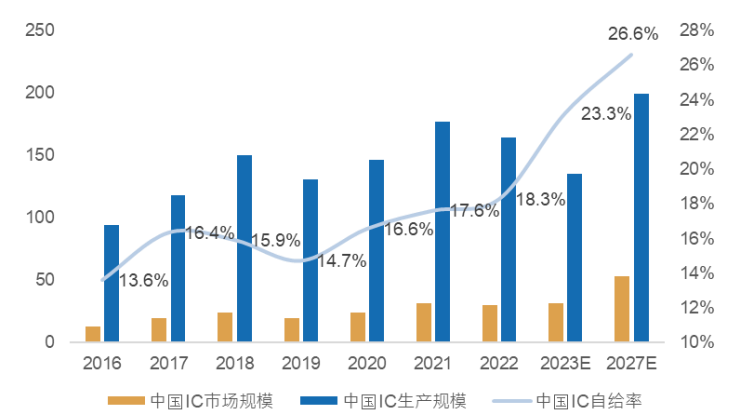

Data from TechInsights also shows that China's integrated circuit self-sufficiency rate has been gradually improving in recent years. It is estimated that China's IC self-sufficiency rate will be 23.3% in 2023 and may rise to 26.6% by 2027, although it is still at a relatively low level.

China's IC Market Size, Production Scale, and Self-Sufficiency Rate (in billions of US dollars)

Source: Guoyuan Securities, September 3, 2024

Upstream semiconductor equipment and materials, as important cornerstones of the industry chain with high proportions, high investments, and high technical barriers, have gradually become the main battleground for "domestic substitution" in recent years.

Data from China's General Administration of Customs shows that from January to July this year, China imported semiconductor manufacturing equipment worth nearly $26 billion (approximately RMB 185.19 billion), exceeding the previous record high set in the same period in 2021 ($23.8 billion).

The latest data published by SEMI also revealed that China's spending on semiconductor manufacturing equipment reached $25 billion in the first half of 2024 (approximately RMB 178.055 billion) and continued to maintain strong spending in July, potentially setting a new annual record.

The organization further noted that China is expected to spend a total of $50 billion on semiconductor manufacturing equipment in 2024, making it the largest investor in building new chip factories. Against the backdrop of a global economic slowdown, China was the only region to continue to increase spending on semiconductor manufacturing equipment year-on-year in the first half of this year.

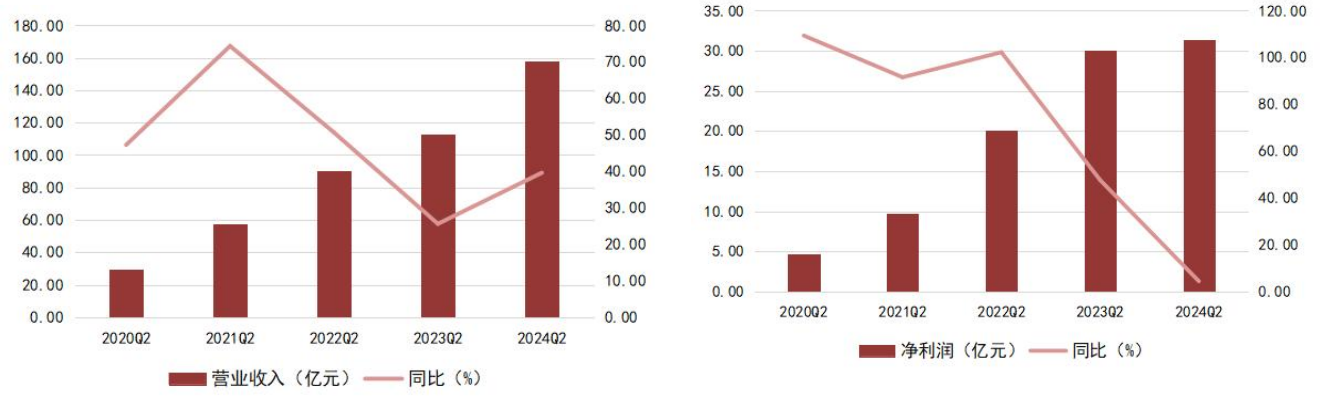

In terms of performance, Dongguan Securities recently selected semiconductor equipment from the tertiary industry of Shenwan as a representative and compiled statistics on the sector's performance in the first half of 2024. The statistics showed that the semiconductor equipment sector generated revenue of RMB 28.761 billion in the first half of 2024, a year-on-year increase of 38.45%, and net profit attributable to shareholders of RMB 5.125 billion, a year-on-year increase of 11.95%.

On a quarterly basis, the sector generated revenue of RMB 15.758 billion in the second quarter, a year-on-year increase of 39.58% and a quarter-on-quarter increase of 21.19%; net profit attributable to shareholders reached RMB 3.133 billion, a year-on-year increase of 4.39% and a quarter-on-quarter increase of 57.38%.

Figure: Revenue and Net Profit of Shenwan Semiconductor Equipment in the First Half of the Year

Source: Dongguan Securities, September 4, 2024

Dongguan Securities noted that benefiting from the continuous construction of wafer fabs and the increased share of domestic semiconductor equipment in domestic wafer fabs, the revenue and net profit attributable to shareholders of the Shenwan semiconductor equipment sector achieved year-on-year and quarter-on-quarter high growth in the second quarter of 2024, accelerating the process of industry autonomy.

Guosen Securities also believes that with the recovery of terminal demand in the first half of 2024, coupled with the continuous introduction of AI+ terminal applications, various sub-sectors of the semiconductor industry have reached an inflection point. Among them, the equipment sector has performed remarkably well, benefiting from the accelerated demand for domestic autonomy and substitution in China's semiconductor industry.

[How to Seize Opportunities in Upstream Equipment and Materials Development? Perhaps ETFs Can Be Used to Focus on Low-Valuation Equipment Leaders]

Overall, semiconductor equipment manufacturers have reported good orders and inventory conditions in their interim reports, and the gradual acceptance of orders is expected to drive subsequent high growth in performance. Hua Fu Securities noted that current attention could be focused on low-valuation equipment leaders.

So, how should ordinary investors choose and focus on high-quality, undervalued equipment leaders? Perhaps diversifying investments through ETFs would be a good choice.

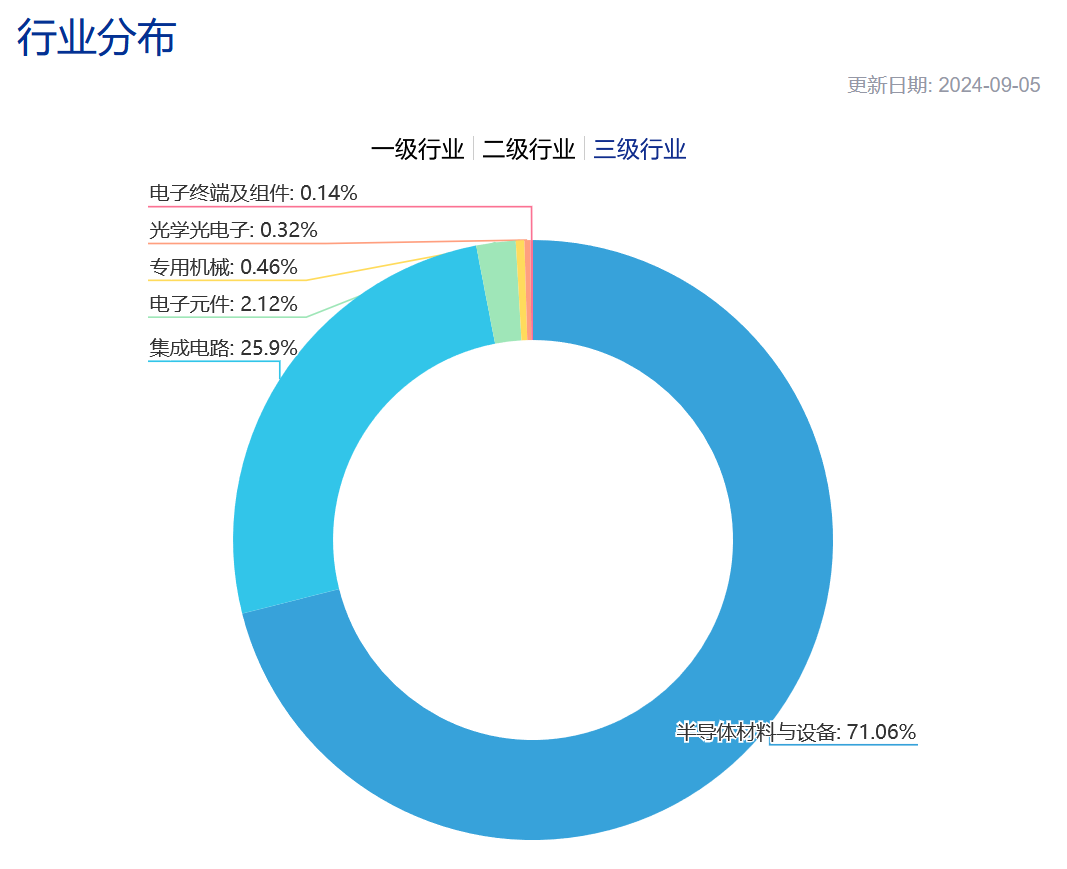

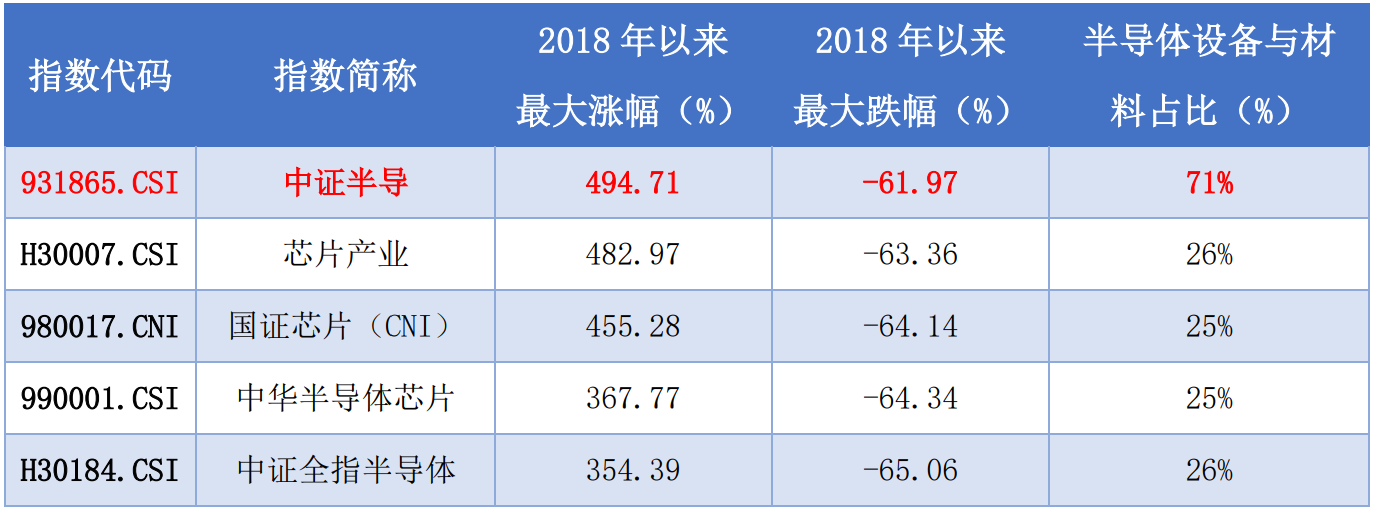

It is understood that among the semiconductor thematic indices tracked by ETFs in the A-share market, the CSI Semiconductor (931865) has a relatively high proportion of upstream equipment and materials, with "semiconductor equipment + semiconductor materials" accounting for more than 71% of the tertiary industry classification.

Figure: Tertiary Industry Classification of CSI Semiconductor (931865)

Source: CSI Index Official Website, September 5, 2024

Data shows that in the previous upcycle of the semiconductor industry before the third quarter of 2019, the maximum increase in the CSI Semiconductor (931865) interval exceeded 494%, higher than the mainstream semiconductor full-chain indices, demonstrating higher elasticity. If the semiconductor equipment sector continues its moderate recovery in 2024, the CSI Semiconductor (931865) may be worth keeping an eye on.

Figure: Market Performance of Major Semiconductor Thematic Indices in the A-share Market

Source: CSI Index Official Website, Guosen Index Official Website, Data Range: January 1, 2018, to September 6, 2024. Note: The index has been in operation for a relatively short time and may not reflect all stages of market development. Past index performance does not represent future performance and does not constitute any investment advice or guarantee of fund investment returns.

According to the information, the Semiconductor Equipment ETF (561980) tracks the CSI Semiconductor Industry Index (931865). The underlying index primarily focuses on 40 upstream semiconductor equipment and material companies. The top ten component stocks cover Northern Microelectronics, Advanced Micro-Fabrication Equipment Inc. (AMEC), Semiconductor Manufacturing International Corporation (SMIC), Will Semiconductor, Hygon, Huahai Qingke, TOPSIL, GD Microelectronics, Shanghai Silicon Industry Group, and Changchuan Technology, accounting for approximately 76% of the index, indicating a relatively high concentration.

Recently, as the A-share interim reporting season ended, all ten semiconductor equipment companies heavily weighted in the Semiconductor Equipment ETF (561980) have released their interim reports for 2024, with most reporting revenue growth.

Semiconductor Equipment ETF (561980) Top Ten Weighted Stocks Interim Report Performance Overview ↓

Source: Wind, as of September 5, 2024

Huafu Securities published a research report stating that China's total imports of semiconductor equipment in the first seven months of 2024 approached the $26 billion mark, setting a new record high for the same period. With the commissioning of new wafer fabs in 2024, China's semiconductor capacity is expected to increase by 13% year-on-year, and this growth is expected to continue at 14% in 2025, potentially accounting for nearly one-third of global production by then. From the perspective of global wafer manufacturing output, China has firmly established itself as the world's largest chip producer.

Zhongshan Securities believes that with the weak recovery at the bottom of electronic industry demand, upstream equipment materials with a domestic substitution logic that is relatively independent of the industry boom cycle may be worth noting.

If investors want to share in the benefits of the industry chain recovery, they may consider a one-click layout of the equipment sector leaders through the Semiconductor Equipment ETF (561980), which is relatively convenient.

Full Name of the Semiconductor Equipment ETF Fund: China Merchants CSI Semiconductor Industry Exchange-Traded Open-End Index Securities Investment Fund.

Risk Warning: Investing in funds involves risks. Investors should exercise caution. The above views, opinions, and ideas are based on the current situation and may change in the future. No substantive guarantee or commitment is made regarding the authenticity, completeness, or accuracy of the views and information cited from external institutions such as securities firms. The past performance of a fund does not represent its future performance, nor does the performance of other funds managed by the fund manager guarantee the performance of this fund. Investors should carefully read the fund's legal documents such as the Fund Contract, Prospectus, and Product Information Summary to fully understand the risk-return characteristics of the fund product. Based on an understanding of the product and after consulting with the sales agency for appropriateness, investors should make independent investment decisions and choose suitable fund products according to their risk tolerance, investment horizon, and investment objectives.

The above is merely a list of index constituent securities and does not constitute a recommendation for the above industries and stocks. The index constituent securities and weights may change based on market conditions. The performance of the CSI Semiconductor Industry Index over the past five years was 85.59% (2019), 83.00% (2020), 30.00% (2021), -29.65% (2022), and -3.90% (2023), respectively. The CSI Semiconductor Industry Index is compiled and published by CSI Limited. The index compiler will take all necessary measures to ensure the accuracy of the index but makes no guarantee and shall not be liable for any errors in the index. Past index performance does not represent future performance and does not constitute a guarantee of fund investment returns or any investment advice. The index has been in operation for a relatively short time and may not reflect all stages of market development.