Instant retail boom, reassessing Meituan

![]() 09/09 2024

09/09 2024

![]() 474

474

Meituan has delivered an impressive set of half-year financial results, with instant retail, as a new business model in recent years, standing out particularly.

It's worth noting that Meituan's strategy has always been characterized by "long-term patience." As a key bet for years, instant retail has seen rapid growth in recent years, driving new momentum for the company.

1

Record-high quarterly revenue

Meituan achieves its best quarterly performance ever.

On August 28, Meituan announced its financial results for the first half of 2024, with significant increases in revenue, profit, and transaction volume.

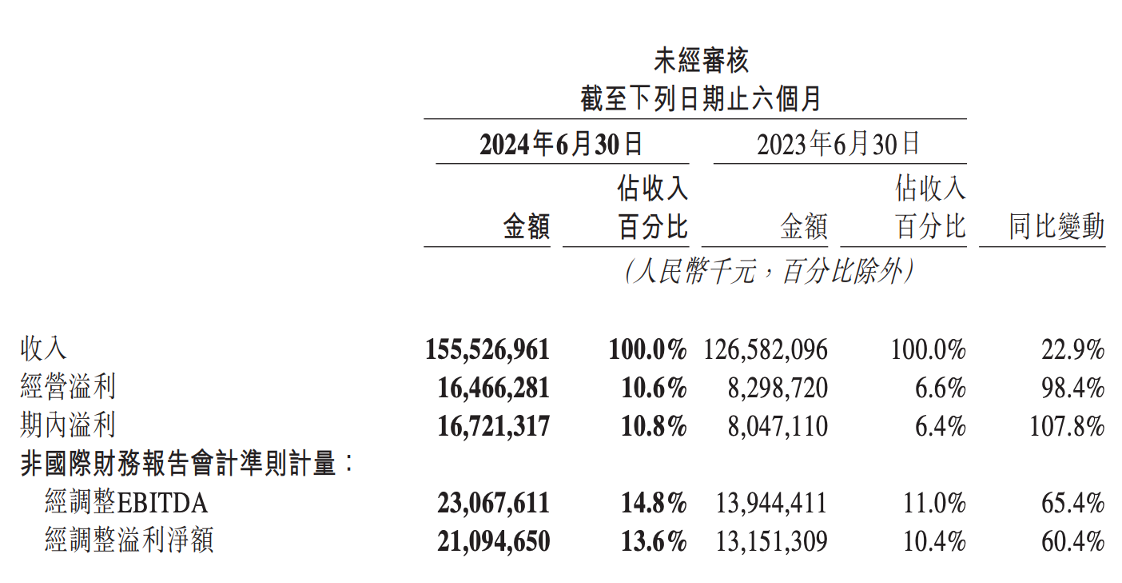

According to the financial report, Meituan's revenue for the first half of 2024 reached RMB 155.5 billion, a 22.9% increase from RMB 126.6 billion in the same period last year. Operating profit was RMB 16.5 billion, a substantial 98.4% increase year-on-year, while adjusted EBITDA was RMB 23.1 billion, up 65.4% from the same period last year.

Revenue in the second quarter was particularly notable, marking the company's best quarterly performance since its listing. Specifically, revenue reached RMB 82.3 billion, a 21% increase from the same period last year, with operating profit of RMB 11.3 billion and adjusted EBITDA of RMB 15 billion, a 95.2% year-on-year increase.

Meituan's strong growth in the first half of 2024 is attributed to the stability of its core business. Data shows that total revenue from core businesses reached RMB 115.3 billion, a 12% increase from RMB 94.1 billion in the same period last year.

In recent years, Meituan has refined its operations across various local life sectors, enhancing supply diversity and user convenience, thereby establishing effective business barriers. It has gained market dominance in food delivery, group buying, dine-in services, flash sales, and more, fostering an image of speed and variety among consumers.

More importantly, Meituan's abundant merchant supply and service quality have fueled an explosion in orders. In the second quarter, transaction values and order volumes in the leisure and entertainment category grew by over 60% year-on-year, while beauty and medical aesthetics categories saw transaction values increase by over 50%.

According to the financial report, Meituan's annual transaction frequency per user has seen a continuous increase for 15 quarters since mid-2020.

One particularly noteworthy aspect of Meituan's business structure is the explosion of instant retail, which the company has been cultivating for years. In the second quarter of this year, the number of instant delivery transactions reached 6.2 billion, a 14.2% increase from 5.4 billion in the same period last year. Notably, Meituan's daily peak order volume for instant retail hit a new high in August, exceeding 98 million orders.

This is a milestone achievement for Meituan.

As is well known, Meituan's philosophy and business operations have always been guided by "long-term patience." The sustained and stable growth in order volume underscores the strategic resilience of Meituan's business.

In the second quarter of this year, Meituan recorded 6.2 billion orders, with a daily average of 68 million orders. The peak order volume is expected to exceed 100 million in the coming year.

2

Explosion of Six Major Categories

Instant retail emerges as the second growth curve for Meituan's home delivery business.

Instant retail has emerged as a definitive lifestyle trend, significantly transforming Meituan's business landscape.

It is evident that consumer habits are evolving. Nowadays, instant retail has become the preferred consumption mode among young people.

This shift in consumer behavior is also reflected in the user profile of Meituan Flash Sale.

According to a report released by Meituan Flash Sale last year, orders placed between 10 p.m. and 8 a.m. accounted for 20% of daily orders. Specifically, from 10 p.m. to 2 a.m., the trend of "special forces" storage was prevalent, with consumers returning home late at night and still finding time to tidy up. From 2 a.m. to 6 a.m., "night owls" stayed up late to watch soccer matches, enjoying cold beer and snacks. And from 6 a.m. to 8 a.m., "early birds" started their day with a nutritious breakfast.

It can be said that the evolution of instant retail has fundamentally altered the local commerce landscape. Reports indicate that peak ordering hours for consumers in first- and second-tier cities fall around 9 p.m., traditionally a closed period for traditional retail stores.

Changing consumption habits have created numerous new opportunities. Responding to this, Meituan is innovating in the consumer sector, with Waima Songjiu (a liquor delivery service) being born out of contemporary consumer habits.

Launched in 2021, Waima Songjiu boasts "25-minute delivery anywhere, anytime for any drink," covering beers, foreign liquors, wines, and Chinese spirits. In the first half of this year, Waima Songjiu achieved robust GTV growth, with over 700 stores nationwide.

In fact, Meituan Flash Sale's impressive performance in the first half of this year is also attributed to its instant delivery concept and business reach extending into various industries.

According to Guosen Securities, the instant retail market reached RMB 500 billion in 2023, with a retail penetration rate of 1.1%. It is projected to exceed RMB 1 trillion by 2026, with a CAGR of 26% from 2023 to 2026.

Instant retail currently encompasses six major categories: pharmaceuticals and family planning products, supermarket chains, convenience stores, fresh produce and fruits, 3C digital appliances, and flowers, aligning with Meituan APP's six featured services: "Healthcare & Pharmacy," "Supermarket & Convenience," "Quality Department Stores," "Vegetables & Fruits," and "Romantic Flowers."

Taking online pharmacy purchases as an example, since July this year, Beijing's medical insurance system has been integrated into Meituan Pharmacy, allowing insured individuals to directly use their medical insurance personal accounts for purchases. This has brought direct convenience to users.

Currently, Meituan Pharmacy's online medical insurance drug purchase service is available in Beijing, Shanghai, Shenzhen, Guangzhou, Qingdao, and other cities, covering dozens of pharmacy chains.

At the same time, Meituan Pharmacy is undergoing upgrades and renovations. In August this year, Meituan Pharmacy launched a new digital solution, the "HEALTH" business growth model, aimed at enhancing brand influence for pharmaceutical companies and improving service efficiency for pharmacies.

In terms of financial performance, Meituan's instant retail segment is poised to deliver further surprises. As Meituan Pharmacy's integration only began in July, its full impact on second-quarter growth has yet to be seen. It is anticipated that consumer adoption will surge in the third and fourth quarters.

3

The Moat of Instant Retail

Meituan is the pioneer and deepest player in instant retail.

Since 2018, Meituan has been pushing its Flash Sale business, followed by the announcement of its "Retail + Technology" strategy in 2021, committing to increased investment in grocery and department store sectors. In 2023, Meituan Senior Vice President Wang Puchong reiterated the vision of "everything delivered to your doorstep," marking a new era of instant delivery for Meituan.

Wang Puchong stated, "By 2026, Meituan Flash Sale aims to have 30,000 stores with daily sales exceeding RMB 10,000 and 100 brands with annual sales exceeding RMB 1 billion."

Years of strategic planning have given Meituan a significant advantage in instant retail. According to its financial report, Meituan Flash Sale has achieved robust growth, with annual transaction users maintaining steady growth and order frequency accelerating rapidly.

As a typical two-sided market, seizing the initiative in instant retail is crucial for industry players.

Since 2020, Meituan has also begun incubating Lightning Warehouses, embarking on a digital transformation for merchants, helping them digitize store inventory. This has created opportunities for Meituan in the convenience store and supermarket categories.

In 2022, Meituan unveiled the FAST instant retail brand management methodology, providing merchants with guidance on instant retail operations.

In the instant retail landscape, Meituan enjoys advantages across the entire supply chain, including merchants on the supply side, consumers on the end-user side, and riders facilitating delivery.

More fundamentally, as user numbers, transaction volumes, and rider delivery counts grow proportionally and rapidly, fulfillment efficiency improves, creating a cost barrier for instant retail.

In reality, Meituan's potential in instant retail has yet to be fully realized. Beyond the growth potential inherent in categories like pharmaceuticals and convenience stores, Meituan itself is evolving.

During Meituan's financial results conference call, it was revealed that "we have integrated core local business operations across product development, R&D, and marketing. Notably, our upgraded membership plan, 'Super VIP,' has stood out as our first marketing initiative to integrate marketing efforts into our core local business.""

Launched in August last year and tested in select cities starting in May this year, the Super VIP membership was fully rolled out in July."

The introduction of Super VIP membership represents a significant improvement within the Meituan ecosystem. By connecting user data and benefits, it enables cross-selling across businesses. For instance, by integrating benefits, Super VIP membership can spur renewals of supermarket and convenience store subscriptions among food delivery users. Simultaneously, by bridging the gap between dine-in and home delivery services, it offers consumers more cost-effective options, enhancing user loyalty, scale, and purchase frequency.

As of July 4, over 5 million merchants had signed up for the Super VIP program, covering 13 leisure, entertainment, and dining scenarios such as recreation, fun activities, and food group buys.

Multiple merchants have benefited from the Super VIP program. Data shows that within a week, Super VIP orders accounted for 25% of total orders at the must-try restaurant "Chongba Niu Fu," with an 8% increase in average order volume per person. Meanwhile, health and wellness brand Shenyuantang saw a 556% month-on-month increase in transaction value on Meituan compared to June.

Conclusion

The rise of instant retail has not only provided Meituan with a new growth trajectory but also fortified its competitive moat.

As consumer habits rapidly evolve and the demand for instant delivery continues to soar, the market must reassess Meituan's business model and strategic outlook.

In the fiercely competitive landscape, it is worth contemplating how Meituan can maintain its edge in its future growth trajectory.