Suning finally turns losses into profits, but is still far from profitability

![]() 09/10 2024

09/10 2024

![]() 495

495

With the decline of offline home appliance hypermarkets and Suning's own failed diversification transformation and repeated investment failures, the giant that once openly "declared war" on JD.com has seen its glory days fade away.

According to media statistics, Suning has incurred a cumulative loss of up to RMB 80 billion over nine consecutive years since 2014.

Finally, there was some good news in Suning's financial report for the first half of 2024.

In the first half of this year, Suning achieved its first quarterly profit in twelve quarters, with a net profit of RMB 112 million in the second quarter. However, despite turning losses into profits, Suning remained unhappy, as the company's net profit excluding non-recurring items for the entire half-year was negative RMB 530 million, a narrowing of 73.10% year-on-year but still a long way from true profitability.

Meanwhile, Suning's revenue for the first half of the year was RMB 25.783 billion, a year-on-year decrease of 24.26%. The main reason for turning losses into profits was not due to improved business performance but rather Suning's ongoing efforts to close and divest non-performing assets and businesses.

While it may be unrealistic for Suning to fully recover its former vitality, the signal of turning losses into profits has given the company a glimmer of hope.

Perhaps Suning still wants to make an effort.

Has Suning's offline DNA been "awakened"?

In the past two years, Suning appears to have shown signs of "awakening," primarily by no longer blindly pursuing online transformation but rather recognizing its offline advantages and striving to stabilize its offline base. It is reported that Suning began to streamline its offline layout starting in 2023.

For loss-making stores, such as Carrefour, large-scale closures were implemented. Data shows that in the first half of 2023, Carrefour closed a total of 106 stores, leaving only 41 remaining after counting previous closures, with a cumulative reduction in store area of 635,600 square meters.

If we calculate based on Carrefour's peak number of stores, Suning has closed nearly 90% of them.

At the same time, Suning began vigorously supporting retail cloud stores open to franchising. Data shows that in the first half of 2023, Suning opened more than 800 new retail cloud stores, bringing the total number of retail cloud franchise stores to 10,756 by the end of the first quarter of this year. Currently, Suning appears determined to reorganize its offline operations.

The reasons behind this cannot be ignored.

There is no denying that Suning can no longer compete with e-commerce giants like JD.com, Alibaba, or even Pinduoduo. Surveys show that JD.com accounts for up to 36.5% of the domestic online home appliance retail market, while Suning holds only 8.7%. During this year's 618 promotion, JD.com captured 60% of the home appliance market share.

It makes little sense for Suning to compete head-on with JD.com and others online.

On the contrary, Suning's offline advantages are notable. Compared to the lack of online traffic, Suning enjoys a strong brand influence, rich operational experience, years of supply chain accumulation, and a loyal consumer base that still trusts the Suning shopping experience in the offline home appliance retail market. To date, Suning seems to have realized that offline operations are the foundation of its business. It is reported that in 2024, Suning plans to expand into lower-tier markets and open 3,000 stores.

From a certain perspective, Suning's return to offline operations is a wise move. Public information shows that Suning is renovating and upgrading some large stores, which have higher consumer groups and average transaction prices than other ordinary stores, and even have an increased gross profit margin of 1.62%.

More importantly, the re-layout of offline operations has also provided a certain "foothold" for Suning's online strategy. Previously, Suning began exploring new approaches popular among e-commerce players, such as live streaming sales, local life services, and instant delivery. In June, more than 18% of sales in some offline stores came from TikTok traffic.

However, for Suning to regain its former position in the offline market, it must also face some challenges.

First, offline large-scale home appliance stores are quietly rising, a trend that is not lost on Suning alone; JD.com is also keenly aware. In June of this year, 34 JD.com self-operated large stores opened or upgraded, with operating areas generally exceeding 10,000 square meters, and some even exceeding 50,000 square meters.

Coincidentally, Xiaomi Home is also deploying in this space. It is reported that Xiaomi Home has partnered with over 20,000 JD.com offline stores nationwide, including JD.com Malls, JD.com Homes, and JD.com Home Appliance Specialty Stores, as well as over 10,000 Xiaomi Home offline stores, to jointly explore offline home appliance channels.

This is undoubtedly a "deadly" blow to Suning.

Moreover, Suning's current offline operations are somewhat chaotic, with the company constantly closing, opening, closing again, and then re-opening stores. Data shows that in 2021, Suning opened 132 new home appliance, 3C, and home furnishing specialty stores but closed 505. In 2022, it opened 59 new stores but closed 463.

In the first half of 2023, it closed 196 stores but opened only 55 new ones... Offline stores in other formats have also undergone similar cycles of opening and closing. Of course, starting in the traditional retail era, Suning's innate "offline DNA" seems to be ingrained in its bones.

However, whether this "talent" can once again shine requires time to verify.

Where to find "household consumption"?

Another key objective behind Suning's return to offline operations is its desire to transform from a retailer of home appliance products to a retail "service" provider offering solutions for household scenarios. In recent years, "household consumption" has become a frequent term in Suning's financial reports, meetings, and public appearances.

From some of the data disclosed by Suning, it is evident that household consumption has indeed brought considerable business vitality to the company. In August of this year, Suning and CCTV Finance launched a "Renew Your Home" live streaming event, which received over 20.69 million exposures and sold over 40,000 coupons. Consumers purchased coupons online and redeemed them in-store, with a completion rate of over 99.8% for Suning's home appliance and furnishing delivery and installation services during the same period.

Admittedly, the implementation of household scenarios means that consumers at Suning will move from purchasing single home appliances to multiple home appliances, enabling Suning to achieve combined sales of multiple categories and brands of home appliances and indirectly increase transaction prices and operational efficiency. However, as young people become less interested in real estate and marriage, where will Suning find leverage for "household consumption"?

In 2023, the primary areas of growth for Suning's home appliance sales were in renovation, marriage, graduation, replacement, and lower-tier markets. Among them, lower-tier markets have become Suning's primary region for promoting household consumption. In fact, both the desire for marriage and real estate consumption are increasingly influential among lower-tier consumer groups.

According to a survey by Zhide Research, the proportion of singles in first- and second-tier cities is much higher than that in fifth-ring cities. The top eight cities with the highest distribution of singles are Shanghai, Beijing, Shenzhen, Hangzhou, Guangzhou, Changsha, Nanjing, and Wuhan. In contrast, in lower-tier markets, wedding halls that were once popular in first- and second-tier cities have rapidly expanded beyond the fifth ring.

Regarding real estate, research by Heiyi Capital shows that 60% of county residents own their own homes, 30% live in their parents' homes, and only 6% have rental needs. Among homeowners, 58% purchased their homes in full, while 43% received financial support from their parents for purchasing or building homes. This has led to a surge in demand for home appliances in lower-tier markets.

Looking back at 2023, most of the growth in home appliance sales occurred outside the fifth ring. According to monitoring data from AVC Cloud, retail sales in the lower-tier home appliance market increased by 13.5% year-on-year from January to November 2023. Due to the high proportion of new and popular demand in the fifth-tier market, retail sales of air conditioners in domestic county-level markets increased by 17.63% year-on-year in the first half of 2023.

In contrast, retail sales of air conditioners in first-, second-, third-, and fourth-tier markets increased by only 8.38%, 6.27%, 6.78%, and 5.28% year-on-year, respectively. Suning's desire for household consumption scenarios has destined the brand to move towards lower-tier markets. In recent years, Suning has repeatedly expressed its intention to strengthen its coverage of blank counties, towns, and business districts.

However, since last year, various industries in the consumer market have actively moved beyond the fifth ring. In the home appliance sector alone, in addition to retailers like Suning, leading home appliance companies such as Haier, Midea, Gree, Hisense, TCL, Fotile, Galanz, and Joyoung have also begun to focus on township dealers.

Last year, many home appliance brands placed their promotional events directly in villages and towns. It is clear that the entire home appliance channel in lower-tier markets is already overcrowded, putting immense pressure on Suning and limiting its development space.

Furthermore, consumers in lower-tier markets are particularly sensitive to prices, requiring Suning to upgrade its supply chain. However, at present, Suning may not have complete control over its supply chain. From the perspective of its exclusive products, Suning's sales of exclusive products only accounted for 25.6% of its total sales in the first half of this year, an increase of only 1.6% from 2023.

In 2024, Suning has set numerous goals for its future resurgence, but whether these goals will be achieved depends on its market driving force. After all, times have changed, and Suning is no longer the same company it once was.

Can "learning from mistakes" truly lead to "wisdom"?

Looking back at Suning's past, there are roughly two events that led this giant company to fall from grace. The first was the price war that began in 2012. At that time, Suning was overconfident and unafraid of the pressure from GOME and JD.com, instead choosing to prolong the price war, which continually impacted its gross margin.

The second event was its lavish investments.

In 2015, Alibaba became Suning's second-largest shareholder with an investment of RMB 28.3 billion. Since then, Suning has continued to make cross-border investments, involving fields such as real estate, logistics, esports, and sports... These investments have not only failed to bring significant benefits to Suning but have instead become a burden weighing it down.

Surveys show that from 2018 to 2021, the asset-liability ratio of Suning Appliance rose sharply to 55.78%, 63.21%, 63.77%, and 89.66%, respectively. So, has Suning learned from its past experiences? The answer to this question is crucial to Suning's survival.

Let's start with the price war.

It seems difficult for Suning to escape the constraints of the price war. During the 618 promotion in the previous two years, Suning resorted to its old tricks, promising that prices for home appliances, mobile phones, computers, and other categories would be at least 10% lower than those of its competitors during the promotion period. In fact, when the entire consumer market is playing the low-price strategy, Suning has already found itself in a difficult position.

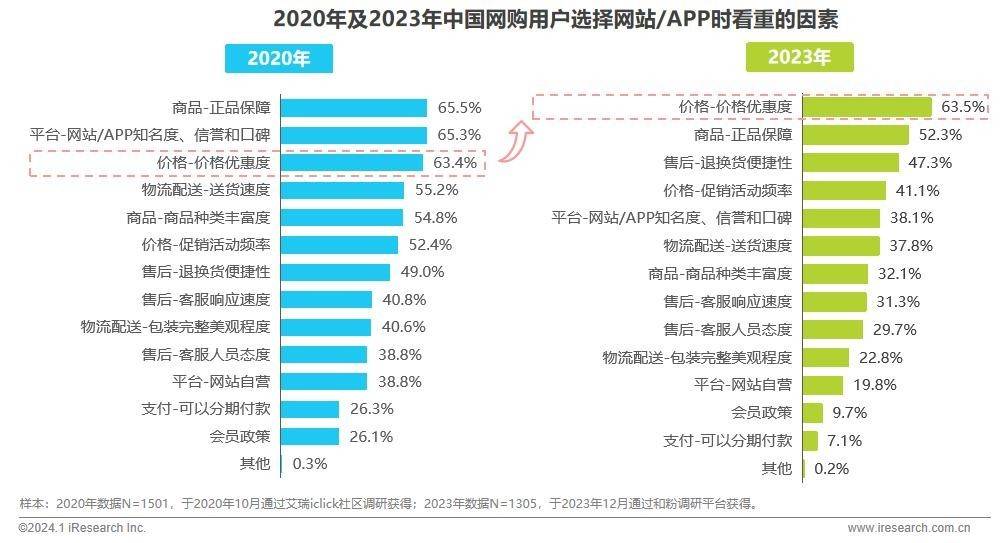

The pursuit of cost-effectiveness by e-commerce platforms is well known. According to the "2023 China E-commerce Market Research Report," among the many factors that online shoppers consider when choosing a website, "price advantage" ranks first. This means that many platforms that do not want to engage in price wars have no choice but to do so.

The home appliance sector, in particular, has taken promotions to the extreme. Taking air conditioners as an example, AVC data shows that as of June 9, 2024, the average offline channel price for air conditioners in the domestic market fell by 2.04% to RMB 4,222. From June 3 to June 9, the average prices of domestic offline and online air conditioners fell by 10.42% to RMB 4,043 and 8.89% to RMB 2,631, respectively.

The same is true for televisions. According to AVC Cloud data, the average price of 100-inch LCD TVs in June 2024 was nearly half that of January, with Xiaomi and Hisense even launching models priced at around RMB 7,000 to 8,000. Against this backdrop, Suning has no choice but to continue participating in the price war.

However, a decade ago, Suning might have been able to generate buzz with low prices. Times have changed, and the current low-price strategy is far less effective than it once was. According to a 618 consumer report released by Huonudata, 73.4% of consumers with shopping plans during the 618 period believe that when e-commerce platforms generally focus on low prices, no single platform is necessarily cheaper.

In other words, it is difficult for platforms to regain a certain level of group loyalty. This is a major concern for all retail players, including Suning, who desperately try to please consumers but often feel like hitting a brick wall.

Now let's turn to investments.

To this day, Suning still cannot resist the urge to buy and invest. According to previous statistics, Suning has undertaken nearly 10 mergers and acquisitions in three years, with strategic investments exceeding RMB 50 billion. In the first half of this year, Suning's financial report turned losses into profits primarily due to its investments. Upon closer inspection, Suning's securities investment in China Unicom yielded nearly RMB 300 million in profits.

Additionally, China Sushang Bank, in which Suning holds a 30% stake, achieved an operating profit of RMB 4.475 billion during the reporting period, directly improving Suning's profitability... Seeing the sweetness of investments, it is unlikely that Suning will abandon this strategy.

Suning remains the same Suning, a fact that even the giant company itself does not want to admit.

Consumption Frontier, formerly known as Koi Finance, provides professional, extreme, and neutral business insights. Public WeChat: xiaofeizqx. This article is original and prohibits any form of reprinting without retaining the author's relevant information.