1-7 month sales fell 12.9% year-on-year, FAW-Volkswagen's "oil and electricity co-progress" strategy suffered a setback

![]() 09/10 2024

09/10 2024

![]() 546

546

Omni-media matrix distribution, full industry chain of automotive digital products

2024 has been the toughest year for FAW-Volkswagen since its inception. Statistics show that FAW-Volkswagen's three major brands - Volkswagen, Audi, and Jetta, as well as their respective models, have experienced poor overall sales performance.

Written by / Li Yue

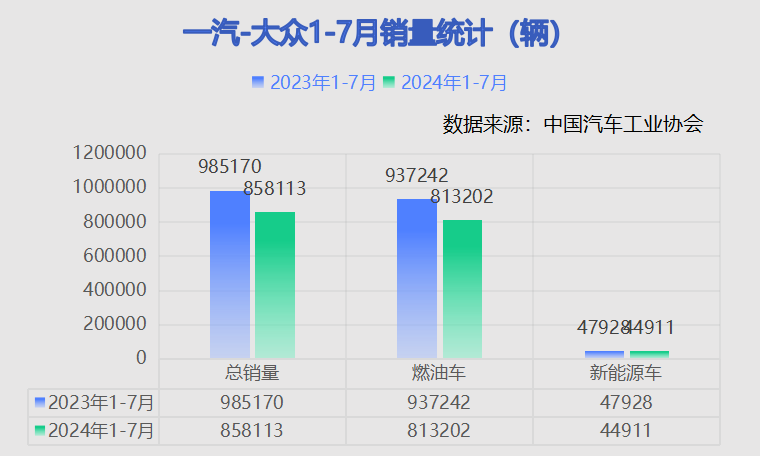

Produced by / Jieche TechnologyAccording to production and sales data released by the China Association of Automobile Manufacturers, FAW-Volkswagen's production and sales volumes in July were 108,000 and 103,500 vehicles, respectively, representing year-on-year declines of -18.19% and -23.83%, respectively. From January to July, the production and sales volumes were 900,800 and 858,100 vehicles, respectively, down -8.14% and -12.90% year-on-year.

At the beginning of 2023, FAW-Volkswagen, which had been ranked among the top domestic mainstream passenger car sales for many years, proposed a "co-progress of oil and electricity" strategy. However, the sales figures for the first seven months of 2024 indicate that its previously formulated strategic plan appears to have suffered a severe setback.

1

Sales of all three brands decline simultaneously

Decline in both "oil" and "electricity" sales

2024 has been the toughest year for FAW-Volkswagen since its inception. Statistics show that FAW-Volkswagen's three major brands - Volkswagen, Audi, and Jetta, as well as their respective models, have experienced poor overall sales performance.

From January to July, sales of Volkswagen's new Bora declined by 51.35% year-on-year, Golf A8 sales declined by 28.67%, CC sales increased by 11.92% year-on-year, Sagitar sales declined by 5.47%, Magotan sales declined by 9.07%, Talagon sales declined by 49.32%, Tacqua sales declined by 5.46%, ID.6 CROZZ sales declined by 58.87%, Tharu sales increased by 1.2%, T-Roc sales declined by 10.46%, ID.4 CROZZ sales increased by 38%, and Taos sales increased by 16.46% year-on-year.

Audi's A6L sales increased by 32.41% year-on-year, A4L sales declined by 15.73%, A3 sales declined by 3.63%, Audi Q3 sales declined by 54.92%, Audi Q4 e-tron sales declined by 35.79%, Audi Q5 sales declined by 5.3%, Audi Q2 sales declined by 68.32%, and Audi C sales declined by 99.02% year-on-year.

Jetta's VA3 sales declined by 18.38% year-on-year, VS5 sales declined by 43.15%, and VS7 sales declined by 54.37%.

Overall, from January to July, out of the 24 models currently on sale by FAW-Volkswagen, as many as 18 models experienced year-on-year declines, with only 5 models maintaining year-on-year growth (ID.7 VIZZION does not have comparable data from the same period and is not included in the year-on-year calculation).

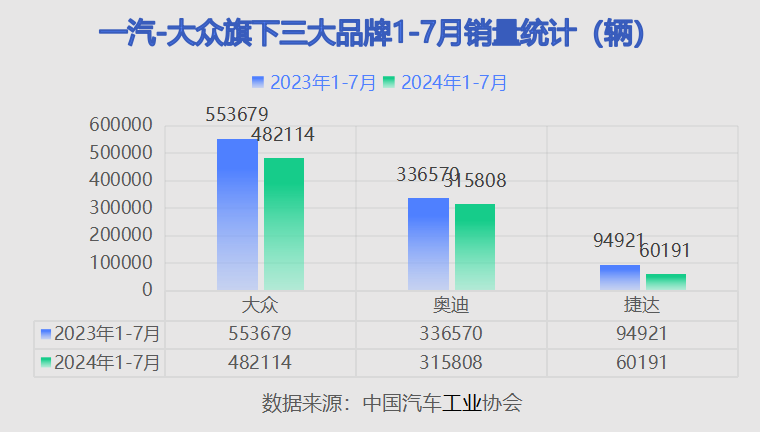

If we separately count the sales of Volkswagen, Audi (excluding imported vehicles), and Jetta, their sales volumes from January to July were 482,100, 315,800, and 60,100 vehicles, respectively, representing year-on-year declines of 12.92%, 6.16%, and 36.58%, respectively. Simply put, all three brands experienced varying degrees of sales declines during the same period, with none achieving positive growth.

If we separately count gasoline-powered vehicles and new energy vehicles, FAW-Volkswagen sold 813,200 gasoline-powered vehicles from January to July, a year-on-year decline of 13.23%, and 44,900 new energy vehicles, a year-on-year decline of 6.29%. Simply put, neither FAW-Volkswagen's gasoline-powered vehicles nor its new energy vehicles have achieved the goal of "progress."

2

Transient performance in 2023

The trio is unable to shoulder the responsibility

FAW-Volkswagen proposed its "co-progress of oil and electricity" strategy at the beginning of 2023, and its actual market performance throughout 2023 truly lived up to the name "co-progress of oil and electricity."

Public data shows that FAW-Volkswagen delivered over 1.91 million vehicles to end-users in 2023, an increase of 4.8% year-on-year, achieving an 8.6% market share and fulfilling its annual operating objectives. Sales of its three major brands - Volkswagen, Audi, and Jetta - all increased year-on-year. Volkswagen sold 1,050,017 vehicles at the terminal, achieving positive growth for the second consecutive year; Audi sold 698,188 vehicles (including imported vehicles), ranking first in growth rate among luxury brands; and Jetta sold 162,000 vehicles, setting a new record for market share.

Amidst widespread negative growth among domestic joint venture automakers in 2023, FAW-Volkswagen became the only mainstream joint venture automaker to achieve positive growth. The outside world once believed that FAW-Volkswagen had embarked on a high-quality development path for the 2.0 era of joint ventures and cooperation.

FAW-Volkswagen defined 2024 as the year of "self-improvement," with its Volkswagen brand aiming for "millions of scale, co-progress of oil and electricity, and leading efficiency." However, as China's automotive market continued to see the market share of gasoline-powered vehicles eroded by new energy vehicles in 2024, FAW-Volkswagen, as a major player in gasoline-powered vehicles, was significantly impacted, while its weakly competitive new energy products proved vulnerable.

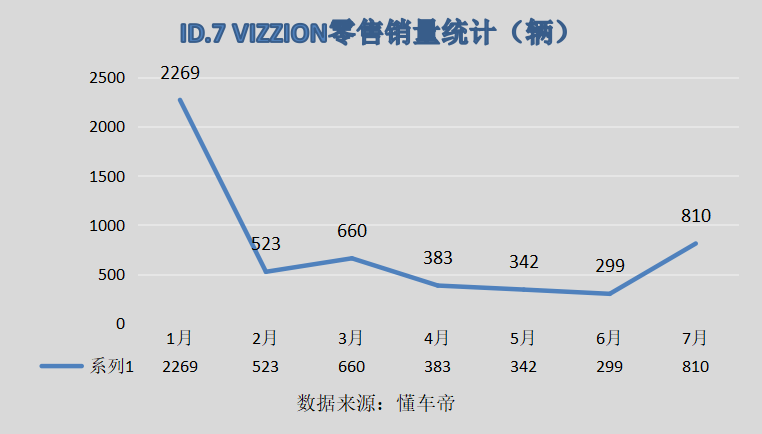

The decline of gasoline-powered vehicles was somewhat expected, but FAW-Volkswagen's electric vehicles were originally meant to make a difference. By the end of 2023, FAW-Volkswagen had launched two pure electric SUV models, the ID.4 CROZZ and ID.6 CROZZ, as well as the world's first pure electric flagship sedan under the Volkswagen brand, the ID.7 VIZZION, forming the FAW-Volkswagen electric trio.

The trio's performance was clearly below expectations. From January to July, ID.4 CROZZ sold 23,351 units, ID.6 CROZZ sold 3,082 units, and ID.7 VIZZION sold 5,235 units, totaling only 31,668 units. The dismal sales performance indicates that the trio has little product competitiveness compared to new energy vehicle competitors.

To give just one example, the poor in-car system experience of the ID.4 CROZZ and ID.6 CROZZ was disappointing, and while the ID.7 VIZZION to some extent addressed this shortcoming, it surprisingly came equipped with rear drum brakes across the entire lineup, whereas most competitors are equipped with front and rear disc brakes.

Generally speaking, when developing a new product, automakers typically conduct in-depth research on its future competitive models and benchmark models.

The so-called competitive models are the direct competitors that the new product will face after its launch. The so-called benchmark models are those whose standards the new product's quality, safety, performance, and other aspects must meet or exceed.

Volkswagen does not lack competitive or benchmark models in the electric vehicle segment, but it lacks distinct competitive advantages.

At the beginning of 2024, Nie Qiang, Deputy General Manager of FAW-Volkswagen Automobile Co., Ltd. (Business), General Manager and Secretary of the Party Committee of FAW-Volkswagen Sales Co., Ltd., said at the 2024 FAW-Volkswagen News Conference that FAW-Volkswagen aimed for "reasonable growth in quantity and effective improvement in quality" in 2024, striving to achieve sales targets of 1.9 to 2 million vehicles. With less than four months left until the end of 2024, FAW-Volkswagen has limited time to sprint towards its annual targets.

In fact, whether the annual sales target is met is not the most important thing. Any enterprise must formulate strategic plans that align with reality. Based on the current situation, it is unlikely that FAW-Volkswagen's gasoline-powered vehicles will make progress, and if its electric vehicles do not work hard enough, they will also struggle to make progress.

Wang Chuanfu, Chairman of BYD, recently predicted that the market share of joint venture brands would shrink significantly from the current 40% to 10% within the next three to five years. There are only two possible outcomes to a prediction: it either comes true or it misses the mark. If FAW-Volkswagen does not abandon its fantasy of "co-progress of oil and electricity" and truly focuses on accelerating its new energy transformation, the consequences could be dire.