Climbing to the top of A-share stocks as the 'King of R&D'! What is the secret to BYD's success?

![]() 09/12 2024

09/12 2024

![]() 601

601

As the end of August approaches, listed automakers have released their half-year performance reports for 2024. "Auto Insight" has compiled the half-year reports of 33 listed automakers, revealing a mixed bag of results. In terms of profitability, domestic automakers represented by BYD, Geely Auto, and Great Wall Motor have stood out, firmly establishing themselves in the first tier. However, state-owned automakers such as SAIC Motor, Changan Automobile, Beijing Automotive Group, Guangzhou Automobile Group, and Dongfeng Motor Group have seen varying degrees of decline in net profits. Among new energy vehicle (NEV) makers, with the exception of LIXIANG ONE and SERES, NIO, XPeng, and Li Auto are still struggling to escape the quagmire of heavy losses.

BYD surpasses SAIC Motor in revenue

Net profit tops automakers' list

A comparative analysis of the financial reports of 33 listed automakers reveals a series of impressive figures that have once again refreshed the public's perception of BYD.

According to BYD's financial report released on August 28, in the first half of 2024, BYD's operating revenue surpassed the RMB 300 billion threshold for the first time, reaching RMB 301.127 billion, an increase of 15.76% year-on-year. Net profit attributable to shareholders of listed companies amounted to RMB 13.631 billion, up 24.44% year-on-year. Excluding non-recurring items, net profit still reached RMB 12.315 billion, up 27.03% year-on-year, indicating that NEVs are nearly independent of subsidies. Total assets stood at RMB 686.245 billion, up 0.99% year-on-year, maintaining a stable growth trend. Notably, BYD's R&D investment reached RMB 20.177 billion in the first half of the year, up 41.64% year-on-year, setting a new record high and exceeding net profit by RMB 6.546 billion.

With over RMB 300 billion in operating revenue, BYD surpassed SAIC Motor for the first time, ranking first among mainstream domestic automakers. It is worth noting that not only BYD but also other domestic automakers have experienced rapid revenue growth. Geely Auto's revenue exceeded RMB 100 billion, also setting a new record. Great Wall Motor is just a step away from reaching the RMB 100 billion mark, with revenue increasing by over RMB 90 billion. In contrast, joint venture brands have generally struggled to grow, with the performance declines of state-owned automakers such as SAIC Motor and Changan Automobile largely attributed to their joint venture brands.

'Increasing production and revenue' is BYD's most commendable achievement and the cornerstone of sustainable development for all enterprises. In the first half of 2024, with net profits exceeding RMB 10 billion, BYD earned over RMB 70 million daily, double that of SAIC Motor. Geely Auto is the only other automaker with net profits exceeding RMB 10 billion, and its explosive growth is also noteworthy. Great Wall Motor slightly surpassed SAIC Motor, with both companies reporting net profits around RMB 7 billion. Other automakers reported net profits of less than RMB 3 billion, significantly trailing these four companies. (See Chart 1)

Furthermore, it is worth noting that despite the significant impact of price wars on industry profits, BYD's gross margin remained stable. In the first half of the year, BYD's gross margin reached 20.0%, an increase of approximately 1.7 percentage points from 18.3% in the same period last year. Notably, the gross margin for automobiles, automobile-related products, and other businesses reached 23.97%, up 3.3 percentage points year-on-year. This gross margin level is among the highest in the entire automotive industry.

BYD's outstanding market performance in the first half of the year has not only impressed the industry but also garnered the favor of capital markets. GF Securities noted in a research report that the combination of a new technology cycle, increased capacity utilization, and an expanding overseas market share supports BYD's ongoing increase in profit per vehicle. Kaiyuan Securities expressed optimism about BYD's future, citing the company's DM 5.0 technology lead, sustained overseas growth, and potential breakthroughs in high-end brands.

Industry insiders predict that with the launch of higher-margin fifth-generation DM products and premium models from brands such as Denza and FANGCHENGBAO, BYD's sales volume is expected to further increase in the second half of the year, potentially leading to higher average vehicle prices and profits.

Spending RMB 20 billion deserves the title of 'King of R&D'

Achieving product excellence through technology

Amid the transition of the automotive industry towards new energy and intelligence, technological innovation has become a crucial driving force. Exploring the secret behind BYD's rapid growth in performance inevitably leads to the strong support of technological research and development (R&D).

According to BYD's financial report, R&D investment reached RMB 20.177 billion in the first half of this year, up 41.64% year-on-year. According to Wind data, among over 5,300 A-share listed companies, BYD ranks first in R&D expenses, far surpassing industry giants such as China State Construction Engineering Corporation, ZTE Corporation, and China Mobile. As the only company with R&D expenses exceeding RMB 20 billion, BYD has truly earned the title of 'King of R&D'. (See Chart 2)

Within the automotive industry, BYD's R&D investment significantly outperforms its peers. SAIC Motor, ranked second, invested only RMB 7.675 billion in R&D in the first half of the year. New energy vehicle (NEV) makers known for their technological prowess, such as NIO and LIXIANG ONE, invested slightly over RMB 6 billion each. Geely Auto and Great Wall Motor invested over RMB 4 billion each. Among other companies, only Guangzhou Automobile Group invested over RMB 3 billion, while the rest invested less than that amount.

Based on these figures, BYD's R&D investment is roughly equivalent to the combined R&D investments of NIO, LIXIANG ONE, Geely Auto, and Great Wall Motor, more than four times that of Geely Auto and Great Wall Motor individually. Even globally, BYD's R&D investment surpasses that of Tesla (approximately RMB 16.19 billion in the same period), maintaining an absolute leading position. (See Chart 1)

Comparing R&D investment with net profit, BYD has invested more in R&D than it earned in net profit for 13 out of the past 14 years since 2011, sometimes several times more than its net profit during the same period. To date, BYD's cumulative R&D investment has reached nearly RMB 150 billion.

These substantial investments have paid off. Converted into technological reserves, they have transformed BYD into the most technologically advanced automaker in the NEV era.

'Technology is king, and innovation is fundamental' is BYD's consistent development philosophy. In recent years, BYD has continued to make strides in the NEV field, introducing a series of proprietary NEV technologies, including Blade Battery, DM-i Super Hybrid, e-Platform 3.0, iTAC, CTB (Cell to Body), Cloud-Ride, fifth-generation DM technology, and iTAC Party.

Especially since 2024, BYD has unleashed its potential. On January 16, BYD unveiled its new NEV intelligent development strategy, 'Intelligent Vehicle,' integrating electrification and intelligence through the Xuanji architecture. On May 28, BYD launched its fifth-generation DM technology, ushering in the '2-liter' era of fuel consumption and rewriting the history of global automotive fuel efficiency. On August 20, Denza introduced its 'iTAC Party' technology, redefining the benchmark for luxury NEV technology. On August 27, BYD's FANGCHENGBAO collaborated with Huawei to develop the world's first dedicated intelligent driving solution for rugged SUVs, marking a joint step towards a new era of intelligence.

These new technologies, integrated into various BYD models, have directly translated into sales. According to the latest data, from January to August this year, BYD sold a cumulative total of 2.3284 million vehicles, up 29.92% year-on-year. Meanwhile, according to MarkLines data, in the second quarter of this year, BYD surpassed Honda to become the world's seventh-largest automaker by sales, rivaling multinational giants with both traditional and NEV offerings through the strength of its NEV lineup.

Leading the way in NEV sales

BYD surges ahead

According to the latest data from the China Association of Automobile Manufacturers (CAAM), in August 2024, domestic sales of NEVs reached 1.1 million units, up 30% year-on-year, with a monthly penetration rate of 44.8%, the highest on record. From January to August, cumulative NEV sales reached 7.037 million units, up 30.9% year-on-year, with a cumulative penetration rate of 37.5%, inching closer to the 40% market share milestone.

Among the over 7 million NEV sales in the first eight months of the year in China, BYD alone contributed 33.1% of the total, far outpacing other NEV makers.

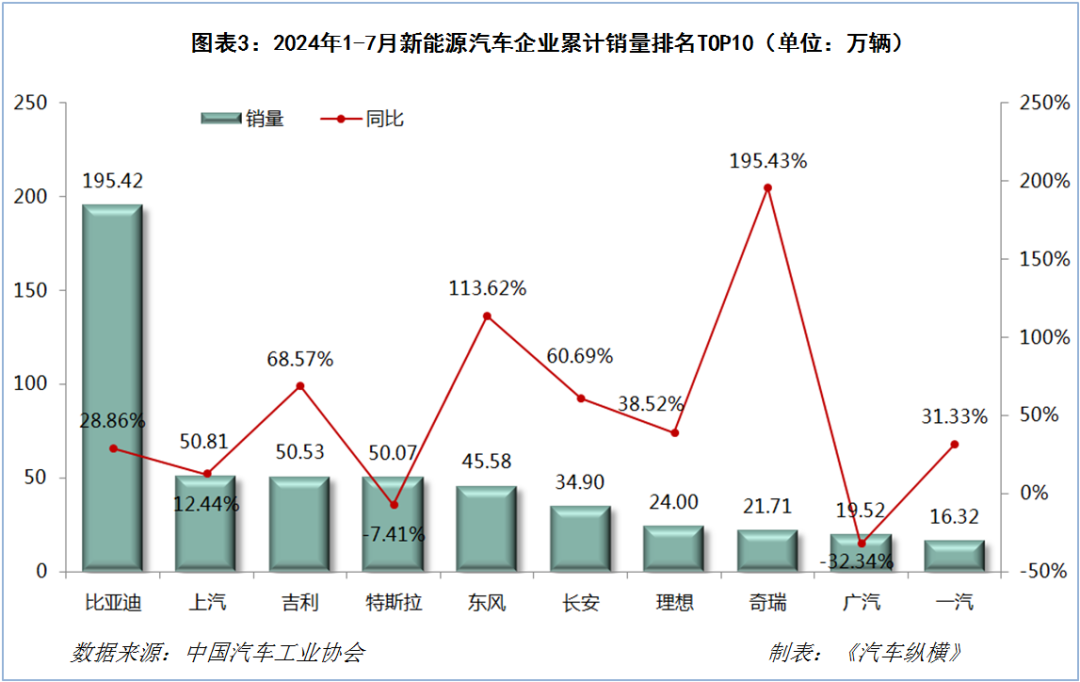

As August sales figures are incomplete, we will base our analysis on the January-July period. According to CAAM's ranking of top 10 NEV makers by cumulative sales from January to July 2024, BYD leads the pack with 1.954 million units sold (including commercial vehicles), maintaining double-digit year-on-year growth. Following BYD, SAIC Motor, Geely Auto, and Tesla each sold slightly over 500,000 units, with Dongfeng Motor barely contributing to this total. No other company surpassed 400,000 units. (See Chart 3)

The strong get stronger! BYD's NEV sales rank first not only domestically but also globally. According to CleanTechnica's ranking of global NEV passenger car makers, from January to July 2024, BYD sold 1.853 million passenger cars, nearly matching the combined sales of two Teslas, and accounting for over 20% of the global market share. In other words, one out of every five new cars sold globally is a BYD. (See Chart 4)

BYD and Tesla, the two fiercest competitors in the global NEV landscape, have undergone a remarkable transformation from Tesla's early dominance to BYD's subsequent catch-up and eventual overtaking. The two companies have grown increasingly distant from each other.

Furthermore, according to CleanTechnica's model-specific sales data, from January to July 2024, eight BYD models ranked among the top 20 globally, occupying nearly half of the list. The Song/Song PLUS (BEV+PHEV) and Qin Plus (BEV+PHEV) ranked second and third, respectively, trailing only the Tesla Model Y and establishing themselves as perennial top performers. Other models such as Haiou/Dolphin Mini, Yuan Plus EV/Atto 3, J7, Dolphin EV, and Han (BEV+PHEV) also ranked highly, all entering the top 10 and maintaining a long-term dominance. (See Chart 5)

Relying on the iteration and innovation of core technologies, as well as precise insights into consumer needs, BYD has gradually improved its multi-brand gradient layout consisting of the 'BYD,' 'FANGCHENGBAO,' 'Denza,' and 'BYD ATTO 3' brands. This layout covers a range of vehicles from family-oriented to luxury and from mass-market to personalized, meeting users' diverse and all-scenario driving needs. It accelerates the disruption of traditional fuel vehicles by NEVs, driving 'electricity below oil.' On the global stage, Chinese automakers, including BYD, are poised to shine brightly in the future.

Images: From the internet

Article: Auto Insight

Typesetting: Auto Insight