"NIO: Survived the Tough Times, Ledao to Support the Future?"

![]() 09/06 2024

09/06 2024

![]() 405

405

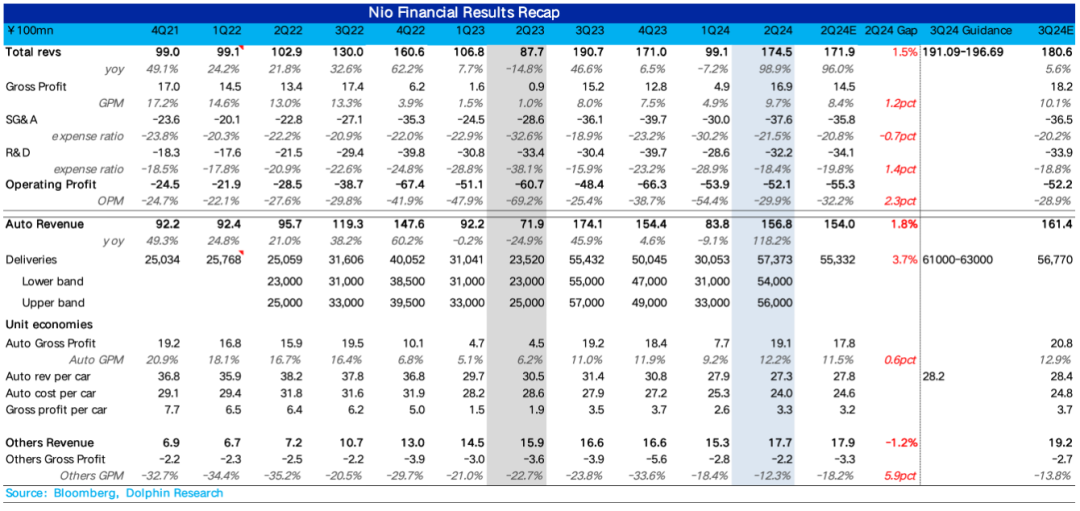

NIO (NIO.N) released its second-quarter 2024 financial results before the U.S. market opened and after the Hong Kong market closed on September 5, Beijing time. With the actual results for the second quarter in, NIO has landed safely. Let's take a closer look:

1. Automotive gross margin exceeded expectations, primarily due to cost reduction: Despite the continued decline in average selling prices due to the mix of old and new models and the "buy 4, get 1 free" promotion under the BaaS model, the automotive gross margin still exceeded market expectations. This was mainly attributed to the renegotiation of supplier contracts, leading to effective cost reductions.

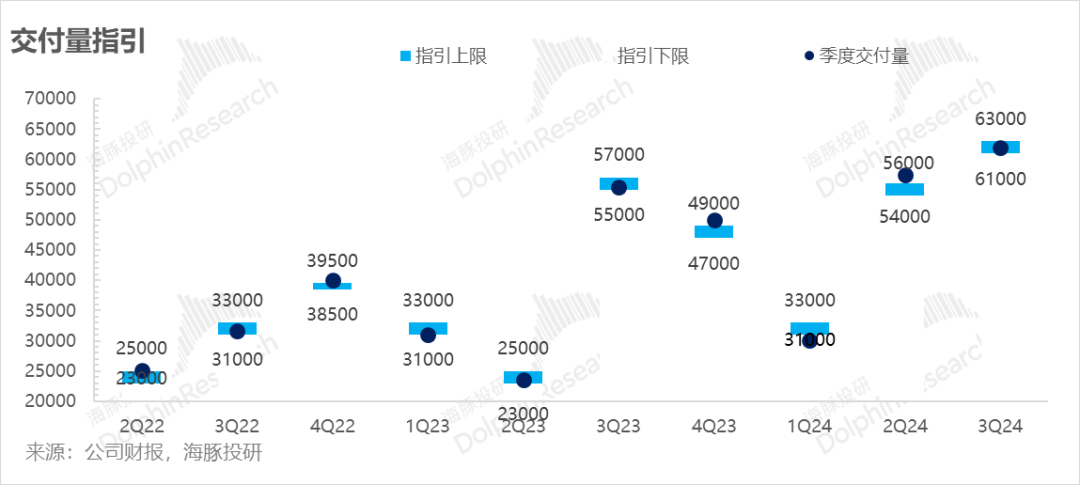

2. Third-quarter sales guidance in line with expectations: With July and August sales already known to be around 20,000 units each, the third-quarter delivery guidance of 61,000 to 63,000 units implies September sales of 21,000 to 23,000 units. This means that the L60, which started deliveries in late September, contributed around 3,000 additional units, largely in line with expectations.

3. Third-quarter revenue implies an increase in average selling price after two quarters of decline: The average selling price implied by third-quarter revenue increased by RMB 11,000 quarter-over-quarter, indicating that all old models were cleared and only 2024 models were sold during the quarter. Additionally, the impact of L60 deliveries in September on the third quarter was minimal, contributing to the rebound in average selling prices.

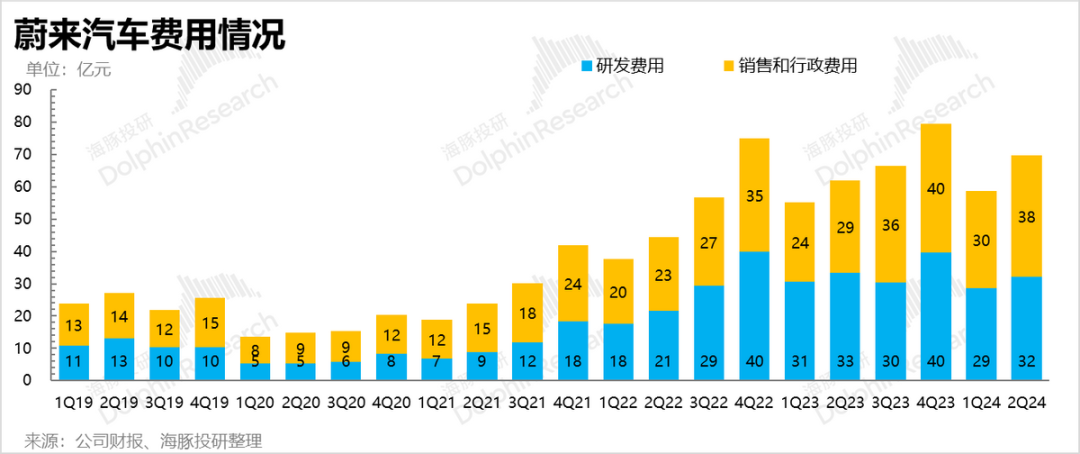

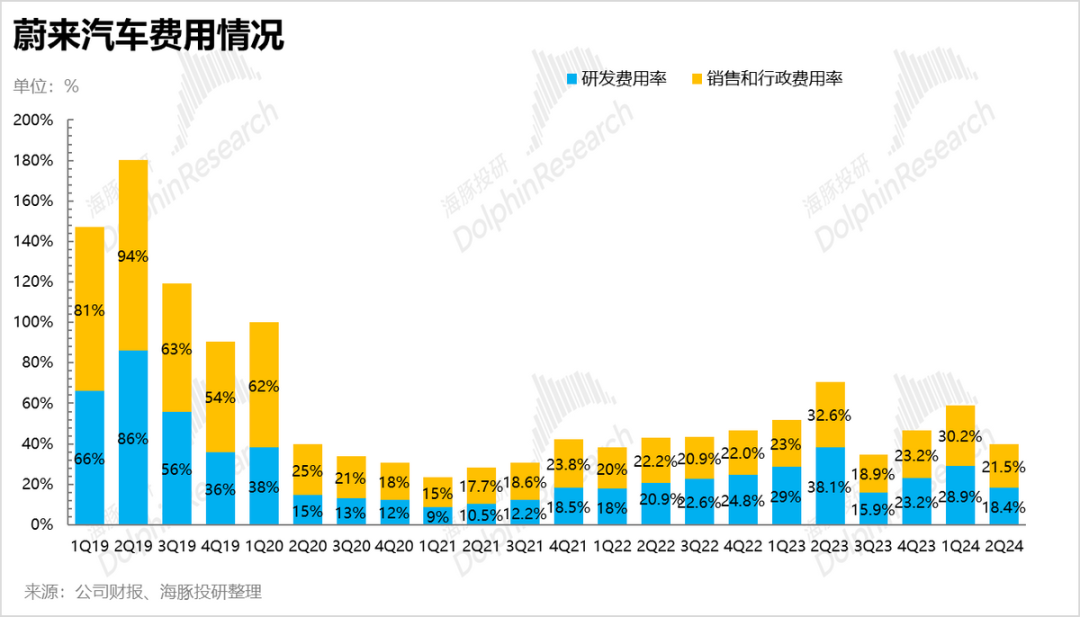

4. Operating expenses remained high, primarily due to increased sales expenses: Non-GAAP R&D expenses for the quarter were RMB 2.9 billion, within the company's guidance of RMB 3 billion. However, sales expenses increased significantly, by nearly RMB 800 million quarter-over-quarter, mainly due to: 1) the upcoming September deliveries of Ledao and the associated costs of opening new stores (105 stores) and hiring new sales staff; and 2) increased marketing expenses due to the launch of 2024 models starting in March.

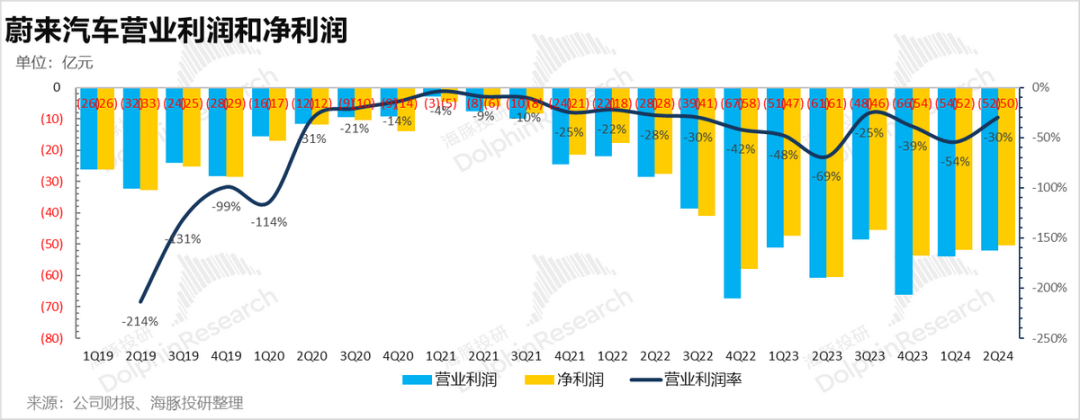

5. Operating loss exceeded RMB 5 billion in the quarter: Despite a significant quarter-over-quarter improvement in gross margin, primarily due to cost reductions in the automotive segment and loss reduction in other businesses, operating expenses remained high due to increased sales expenses. This resulted in an operating loss of RMB -5.2 billion, contributing to a decline of RMB 3.7 billion in cash and cash equivalents for the quarter.

Dolphin Investment Insights:

As the last Chinese company to report earnings, Dolphin had its doubts, but NIO has landed safely.

With sales figures already known, the positive news is that the gross margin per vehicle did not disappoint. Beyond sales growth, the company attributes this to successful renegotiations with suppliers, resulting in effective cost reductions per vehicle and a boost to the second-quarter gross margin.

Regarding the critical third-quarter guidance, NIO's main brand is expected to consistently sell over 20,000 vehicles per month. Ledao deliveries will start in late September, contributing some incremental sales, but not significantly due to it not being a full delivery month. The company's guidance of 61,000 to 63,000 vehicles sold in the third quarter is largely in line with expectations.

The average selling price implied by the third-quarter revenue guidance of RMB 19.1 to 19.7 billion is around RMB 282,000, also largely in line with expectations. This higher price likely indicates that old models have been largely cleared, and sales will consist primarily of new 2024 models. Dolphin expects the automotive gross margin to continue to improve quarter-over-quarter based on the returning average selling price.

In terms of expenses, the quarter-over-quarter increase in operating expenses was mainly driven by higher sales expenses. However, this is understandable given the launch of new 2024 models, the addition of Ledao stores, and the hiring of new sales staff. Nevertheless, with sales expenses expected to increase by no more than 20% quarter-over-quarter this year, they may continue to rise, contributing to an operating loss of RMB -5.2 billion.

Overall, while the results may not be spectacular, they are more than sufficient given NIO's 2024 P/S multiple of only 1.0 to 1.1 times based on sales expectations of 210,000 to 220,000 vehicles.

Detailed Analysis Below

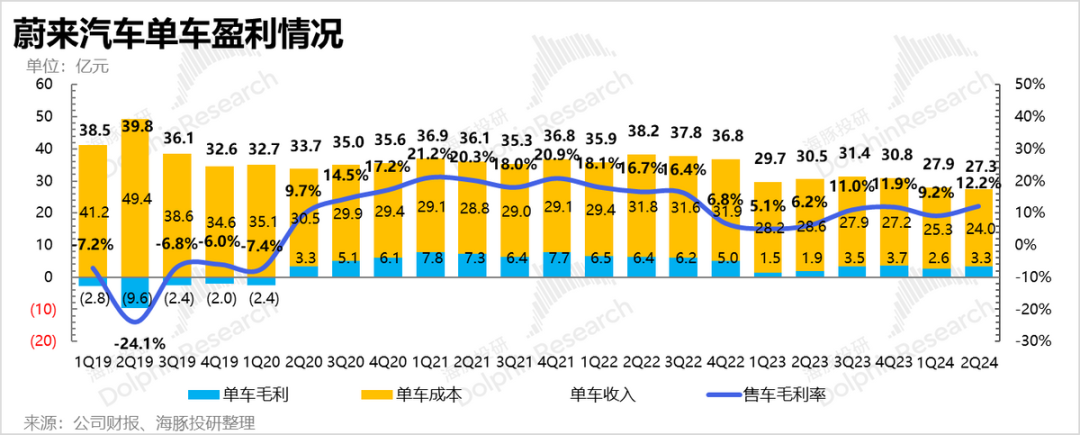

I. Automotive Profitability: Cost Reduction Was Key This Quarter

As the most crucial indicator during earnings releases, let's first examine NIO's automotive profitability.

NIO had previously provided guidance for its automotive gross margin, expecting it to return to double digits in the second quarter due to reduced promotions. Market expectations were for a quarter-over-quarter increase to around 11% to 11.5%. However, NIO exceeded these expectations with an actual automotive gross margin of 12.2%.

Analyzing the automotive gross margin performance from a per-vehicle perspective, the exceedance was primarily due to cost reductions per vehicle:

1) The average selling price per vehicle in the second quarter was RMB 273,000, lower than the market expectation of RMB 278,000. This decline was driven by several factors:

- The mix of old and new models, with deep discounts on old models (RMB 24,000 to 32,000 off across the 2023 lineup).

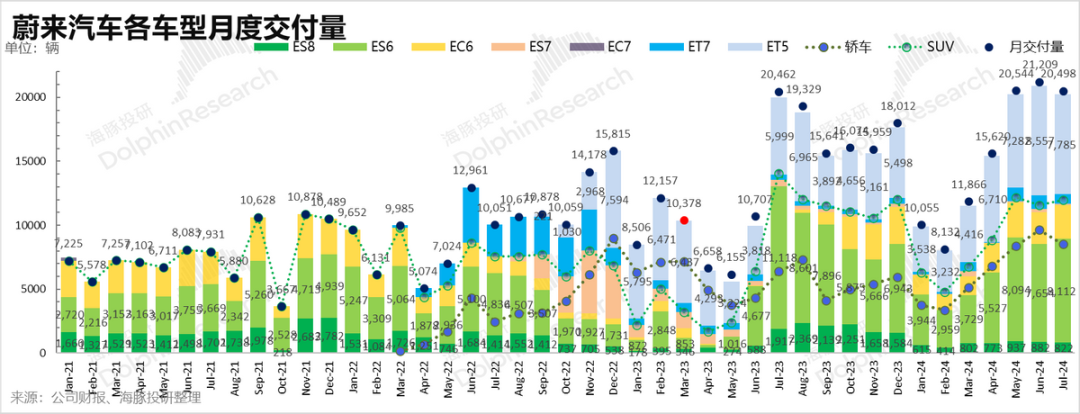

- A negative impact from the mix of models, with the two lowest-priced models (ET5 and ES6) accounting for a higher proportion.

- The introduction of NIO's new BaaS policy in March, including rent reductions of 26% to 33% and a "buy 4, get 1 free" promotion that impacted average selling prices by up to RMB 6,000 (though this promotion tapered off in June).

2) The cost per vehicle in the second quarter was RMB 240,000, lower than the market expectation of RMB 246,000. This cost reduction was the primary driver of the improved gross margin. It resulted from economies of scale from record sales of 57,000 vehicles and successful renegotiation of supplier contracts.

3) Gross profit per vehicle increased to RMB 33,000, up RMB 7,000 quarter-over-quarter, due to the combination of lower costs and stable selling prices.

II. Third-Quarter Sales and ASP Guidance Largely In Line with Expectations

1) Third-quarter sales guidance of 61,000 to 63,000 vehicles is largely in line with expectations. With July and August sales already known to be around 20,000 units each, the guidance implies September sales of 20,000 to 23,000 units. Ledao deliveries starting in late September are expected to contribute incrementally, but not significantly, given it is not a full delivery month.

2) The average selling price implied by third-quarter revenue guidance of RMB 19.1 to 19.7 billion, assuming other business revenue of RMB 1.9 billion, is around RMB 282,000, largely in line with market expectations of RMB 284,000. This marks the first increase in average selling price after two consecutive quarters of decline, driven by:

- The sale of only new 2024 models without the drag of discounted old models.

- The tapering off of the BaaS "buy 4, get 1 free" promotion in June, though it temporarily returned from September 2 to 8 with limited impact.

- Limited incremental sales from Ledao, which started deliveries in late September at a starting price of RMB 219,900.

Dolphin expects the automotive gross margin to continue improving quarter-over-quarter based on the returning average selling price.

III. Second-Quarter Deliveries Back on Track

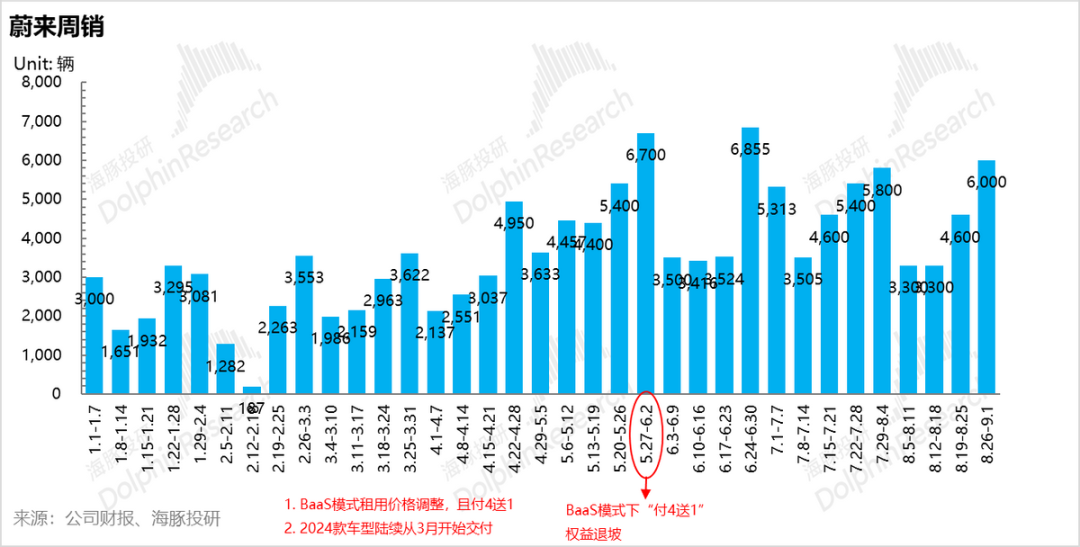

NIO delivered 57,000 vehicles in the second quarter, a 91% quarter-over-quarter increase and above its guidance of 54,000 to 56,000 vehicles. The rebound was driven by:

1) The delivery of new 2024 models starting in March, which enhanced product appeal.

2) The release of additional sales staff previously hired.

3) Adjustments to the BaaS policy, including rent reductions of 26% to 33% and the "buy 4, get 1 free" promotion, which boosted BaaS adoption from 20% to 30% to 60% to 70% and significantly increased sales and orders.

Market concerns about the sustainability of BaaS promotions were alleviated as NIO maintained monthly sales of over 20,000 units even after the "buy 4, get 1 free" promotion ended.

Overview of NIO's Performance

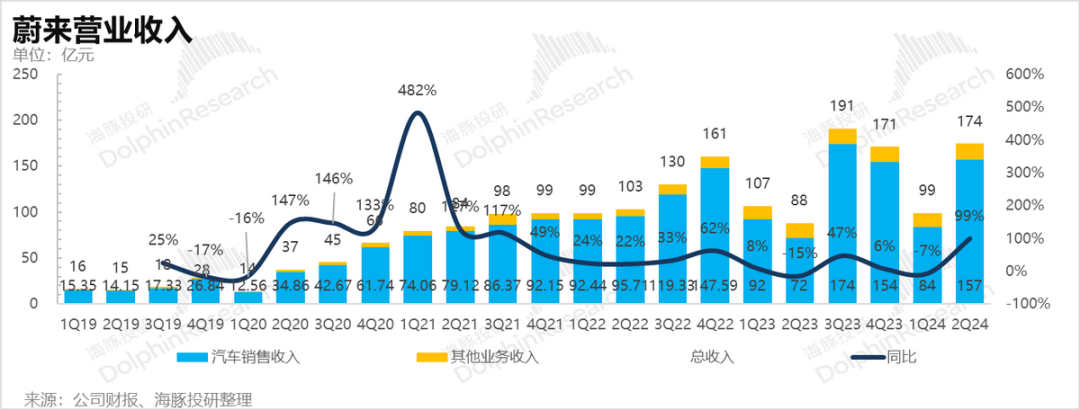

IV. Revenue Exceeded Market Expectations

NIO's third-quarter revenue was RMB 17.5 billion, a 76% quarter-over-quarter increase and above market expectations of RMB 17.2 billion. The revenue beat was primarily due to higher-than-expected automotive sales.

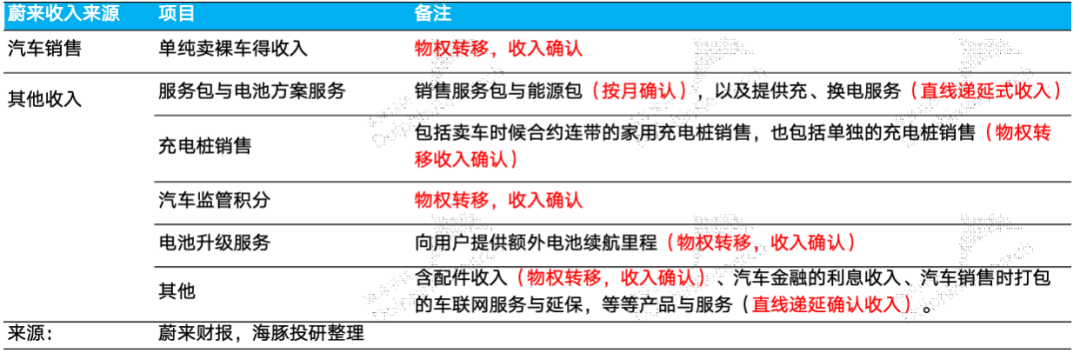

Other business revenue was RMB 1.77 billion, in line with market expectations of RMB 1.79 billion. The increase of RMB 240 million quarter-over-quarter was driven by higher parts and accessories sales, vehicle after-sales service revenue, and battery swapping income, partially offset by lower used car sales.

The overall gross margin was 9.7%, exceeding market expectations of 8.4%. Both automotive and other business gross margins were higher than expected, with the latter improving by 6.4 percentage points to -12.3%, as higher battery swapping station utilization and stronger after-sales service profitability contributed to narrower losses. Management expects other business gross margins to continue improving to near -10% in upcoming quarters.

V. Continued High Investment in Operating Expenses

Operating expenses totaled nearly RMB 7 billion, an increase of RMB 1.1 billion quarter-over-quarter. Even excluding SBC impacts, expenses increased by nearly RMB 900 million, with sales expenses seeing the largest increase. Specifically:

1) R&D expenses were RMB 3.22 billion, slightly below market expectations of RMB 3.4 billion. NIO's R&D focus remains on intelligent driving and new model development, with around 70% of R&D personnel working on intelligent technology. Recent advancements include the self-developed NX9031 chip based on a 5nm process, which offers the performance of four Nvidia Orin X chips in a single package. NIO's quarterly Non-GAAP R&D guidance of around RMB 3 billion was met this quarter.

2) Sales and administrative expenses were RMB 3.76 billion, exceeding market expectations of RMB 3.58 billion. The increase was likely driven by:

- The continued expansion of sales staff and stores, with NIO ending 2023 with 52% of its workforce in sales and marketing, the highest among new energy vehicle companies. The need for additional sales staff and stores ahead of Ledao deliveries in September contributed to higher expenses.

- Increased marketing expenses for the launch of new 2024 models.

As for NIO's sales expense guidance for this year, it is expected that the sales expense will not increase by more than 20% year-on-year (not exceeding RMB 15.5 billion for the whole year of 2024), averaging out to no more than RMB 4.4 billion per quarter for the next two quarters, which seems to indicate that it will be difficult to reduce sales expenses and they may continue to rise.

Although the gross margin improved significantly quarter-on-quarter in this quarter, due to the high investment in the three major expenses (primarily sales expenses), the operating loss for this quarter was still -RMB 5.2 billion, indicating a significant loss. The operating expense ratio increased quarter-on-quarter to -30% this quarter, mainly due to the improvement in gross margin and the decrease in the three major expense ratios brought about by sales volume release.

VI. Can NIO's Ledao "L60" drive sales beyond expectations in 2024?

The company had cash and cash-like assets of RMB 42.6 billion on its books this quarter, down RMB 3.7 billion from RMB 45.3 billion in the first quarter, mainly due to the cash consumption resulting from the adjusted SBC loss of RMB 4.5 billion in this quarter.

The market expects NIO's annual sales volume for 2024 to be around 210,000 to 220,000 units, primarily due to the recovery of sales for NIO's main brand, which has stabilized at around 20,000 units. However, the market does not have high expectations for the sales of the upcoming Ledao L60, anticipating sales of only around 15,000 to 20,000 units in 2024 (with deliveries starting in September). This is mainly because the L60 will enter the most competitive price range of RMB 200,000 to RMB 300,000 for pure electric vehicles, facing stiffer competition than NIO's main brand in the RMB 300,000+ price range. The key to exceeding sales expectations in 2024 also lies in the performance of the Ledao L60.

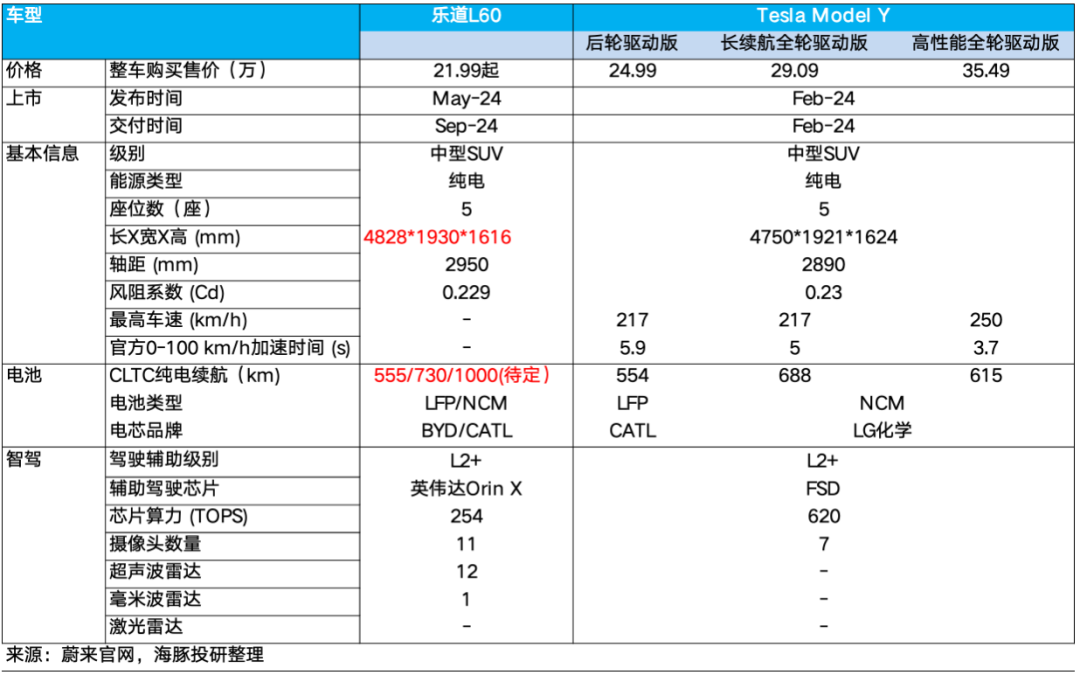

The Ledao L60 will enter the mainstream family user market, with a pre-sale price of RMB 219,900 for its first SUV model. Deliveries will begin in September, and 105 stores and around 1,000 battery swap stations have already been prepared. The main advantages of Ledao in the most competitive price range are:

1) Spacious: Compared to the Tesla Model Y, Ledao has an advantage in size, with a larger interior space and a longer wheelbase than the Tesla Model Y.

2) Price advantage: The starting price of the Ledao L60 is RMB 219,900, which is RMB 30,000 lower than the entry-level Model Y. Moreover, under the BaaS model, the price of Ledao is expected to drop to around RMB 150,000 to RMB 160,000, forming a core competitive advantage. Although NIO has not yet announced the pricing for its BaaS plan, Dolphin Insights expects that the pricing will have a significant impact on sales.

3) Energy replenishment advantage: The Ledao L60 supports both 900V high-voltage fast charging and battery swapping, allowing users to access over 1,000 battery swap stations and over 25,000 NIO-owned charging piles nationwide. The 900V high-voltage fast charging and battery swapping experience are the differentiating highlights of the Ledao L60 in the RMB 200,000 price range.

NIO is optimistic about the sales prospects of this model, expecting monthly sales to exceed 10,000 units, with long-term gross margins for Ledao potentially exceeding 15%. However, for Ledao to achieve break-even, management has guided that monthly sales will need to reach at least 20,000 to 30,000 units, indicating a long way to go at present.