Apple-like October for Xiaomi, Honor, OPPO, and vivo

![]() 11/05 2024

11/05 2024

![]() 582

582

Author | Wen Yehao

Editor | Wu Xianzhi

As the frost that had settled over the smartphone industry for years gradually melts away, the industry has regained its long-lost liveliness during the Double 11 sales.

According to Counterpoint data, domestic smartphone sales increased by 2.3% year-on-year in the third quarter of 2023, marking the fourth consecutive quarter of year-on-year growth. The first annual growth in the domestic mobile phone market in nearly five years is within sight.

Against this backdrop, vivo, OPPO, Xiaomi, Honor, and OnePlus have held product launches in quick succession. Unlike in the past, smartphone manufacturers seem more eager this time around, and the scent of gunpowder in the battle seems stronger.

On October 14, vivo unveiled the vivo X200 series; on October 24, OPPO launched the OPPO Find X8 series; on October 29, Xiaomi's 15 series debuted; on October 30, Honor presented its Honor Magic 70 series; and the day after Honor's event, OnePlus's flagship also arrived as scheduled—the density of launches was overwhelming. All flagship models have shown off their muscles, somewhat resembling a "hand-to-hand combat."

Avoiding Huawei, engaging in close combat

Unlike previous years, the unusually lively mobile phone launches in October this year carry a hint of intrigue—smartphone manufacturers seem somewhat anxious, rushing to bring their products to the table.

A simple example: Usually, the "veil" of a new phone is only lifted during the official launch event, with most parameters typically revealed through supply chain leaks beforehand.

Currently, launches have almost become a formality—some products have unboxing videos a week before their official release, fully exposed, with only the price left as the final suspense to be revealed at the event. As a result, some manufacturers have attracted endless criticism due to overly long launches and a lack of new attractions.

The visible urgency of Xiaomi, Honor, OPPO, and vivo this year may seem to be driven by the need to secure a position during the Double 11 sales. However, behind this, there may also be pressure exerted by Huawei's return.

It is reported that Huawei's Mate 70 series will hit the market in November this year, and according to supply chain leaks, Huawei plans to increase production of the Mate 70 series by nearly 50% compared to the Mate 60 series, with inventory levels far exceeding last year's.

Before that, the rivalry between Huawei and Apple constituted the fundamentals of the high-end mobile phone market in China. Huawei's exit in 2020 was also a major incentive for Xiaomi, Honor, OPPO, and vivo to pursue high-end products. However, since then, although domestic smartphone manufacturers have continued to push for higher prices through high-end flagships and foldable phones, the pie they have carved out is limited.

After Huawei's return, it has swept up the entire high-end market share. Counterpoint data shows that in the third quarter of 2023, Huawei ranked second with a market share of 16.4%, trailing only vivo. Therefore, the "impatience" of smartphone manufacturers to launch their flagship models this year may be an attempt to "get a head start" before the Huawei Mate 70 series hits the market, seizing the prime sales window. After all, no one wants a repeat of last year's "embarrassment" when OPPO was overshadowed by Huawei.

While Xiaomi, Honor, OPPO, and vivo are launching flagship models in clusters, which can to some extent avoid Huawei, they cannot escape the mutual slaughter—everyone is engaged in close combat, and whoever shows a flaw first may suffer more.

In this regard, vivo, which encountered a flare-up in its "comfort zone" of imaging, may have more to say.

As vivo's flagship for the second half of this year, the vivo X200Pro transformed from a "word-of-mouth hit" to the focus of public doubt due to imaging flare issues. As Photon Planet stated in "A Ray of Light for vivo's High-End Push," the flaws in the "imaging flagship" have made imaging capabilities, traditionally a strength of the brand, a "stumbling block" for vivo's push into the high-end market, potentially shaking the high-end and imaging mindshare accumulated over the past few years.

Vivo's remedial measures—OTA optimization and shading accessories—can alleviate the immediate problem but cannot completely bridge the gap with users, especially during a period of unprecedented competition with new models from various manufacturers being released simultaneously.

Apart from vivo, Xiaomi is also facing a formidable test this year. Although Lei Jun shone in the launch event with the Xiaomi SU7 Ultra, the pricing of the Xiaomi 15 series, which increased from the starting price of 3,999 yuan of the previous generation to 4,499 yuan, still made people nervous.

Regarding the price increase, Lei Jun tweeted on the eve of the launch event that due to the upgrade to the 3nm process this year, coupled with increased costs for supply chain RAM, ROM, and significant R&D investment, the Xiaomi 15 indeed needed a price hike.

Lei Jun is not lying. It is reported that the prices of mobile phone components such as memory and screen modules have increased significantly this year, leading to universal price increases for flagship models from major brands. However, the improvement in hardware specifications compared to last year is not significant. For example, the vivo X200, with 12GB+256GB, is 300 yuan more expensive than the vivo X100; the OnePlus Ace3Pro is also hundreds of yuan more expensive than its predecessor.

Moreover, Xiaomi has learned from Huawei and moved closer to a "luxury" positioning by introducing customized colors, diamond limited editions, and other versions in an attempt to increase the ASP of the Xiaomi 15 series.

However, for Xiaomi, which has long relied on cost-effectiveness, cost-effectiveness remains an important strategy even in the high-end market. This price increase, driven by internal and external factors, seems more likely to affect Xiaomi. Therefore, even though Lei Jun had "vented" through Weibo in advance, this "bloody" test may expose Xiaomi to more challenges.

AI phones, with increased gold content

Looking at this round of mobile phone launches, although performance, imaging, battery life, and other aspects are still competitive areas for manufacturers, each has a different focus. However, in the field of AI, all manufacturers seem to have reached a "tacit understanding" and have not been stingy with their "ink."

From "Deep Blue" defeating chess grandmaster Garry Kasparov in 1997 to the current flourishing of large models taking root, AI has been evolving, but commercialization challenges have lingered for a long time. The same is true for AI phones—in the second half of last year, so-called AI phones from various brands had already made their debut, but as of now, AI phones remain lukewarm in the consumer context.

Against this backdrop, Xiaomi, Honor, OPPO, and vivo's collective emphasis on AI seems to be premeditating a change—transforming AI from a supplementary feature to a strategic chip for smartphone manufacturers to reshape their systems and products.

The end goal is the same, but the paths are different. In the view of Honor CEO Zhao Ming, past AI lacked a "continuous" experience that was close to real user needs, and this "discontinuity" also reflected the superficial nature of past AI phones. Honor, which advocates an open approach, chooses to open its doors and collaborate with external parties to "fill in the gaps" through its YOYO intelligent entity.

Although Honor's open approach is commendable, the "degree" needs to be considered. If it is only about "leveraging force," then AI phones may only become true "API phones."

OPPO, on the other hand, seems more willing to keep core technologies in its own hands. Earlier this year, OPPO established an AI center and subsequently announced its 1+N intelligent entity ecosystem strategy. According to media reports, recently, the AI startup Wave Intelligence announced its disbandment, with multiple core team members, including the CEO and CTO, joining OPPO—a strong intention to recruit talent.

It is not surprising that OPPO is heavily investing in AI, as OPPO has also ventured into the most complex and high-threshold field of chips through Zeku, despite an unsatisfactory outcome. Although the starting line in the AI field is not as distant as in chips, perhaps this time the results will be different.

Among them, Xiaomi's attitude towards AI is worth mentioning. In the second half of last year, when AI phones were creating a buzz in the industry, Xiaomi was relatively silent. When Photon Planet visited Xiaomi stores in the middle of this year, they barely saw any signs of "large AI models"; the word "AI" could only be faintly seen deep within the parameters of the display models—in contrast, other brand stores were filled with AI-related materials.

Such low-key behavior is understandable for vivo but not common for Xiaomi, which used to be eager to "snatch the first release." This may be related to Xiaomi's automotive projects, but as the SU7 takes root in the market, Xiaomi phones have finally started to release more AI signals.

It is reported that Xiaomi's Pengpai OS 2 comes with various AI functions such as HyperAI dynamic depth-of-field wallpapers, AI writing assistants, and AI simultaneous interpretation, and "XiaoAi Classmate" has also been upgraded to "Super XiaoAi," enhancing its intelligence.

However, for common AI scenarios such as AI writing and AI document summarization, there are already more mature third-party applications on the market at this stage. Therefore, Xiaomi's AI advantage is more evident in its synergy with the IoT ecosystem. Focusing solely on mobile phones, Xiaomi, which adheres to a "gradual" approach, seems to be lagging behind players who took the lead.

After all, the core competitiveness of current AI phones has shifted from pure AI applications to the disruption of traditional mobile phone interaction logic.

Taking the common scenario of ordering takeout in users' lives as an example, although mechanically opening the takeout app, searching for restaurants, selecting items, choosing coupons, and paying have become routine, there is significant room for improvement in this process if examined closely. This naturally becomes the foothold for AI phones.

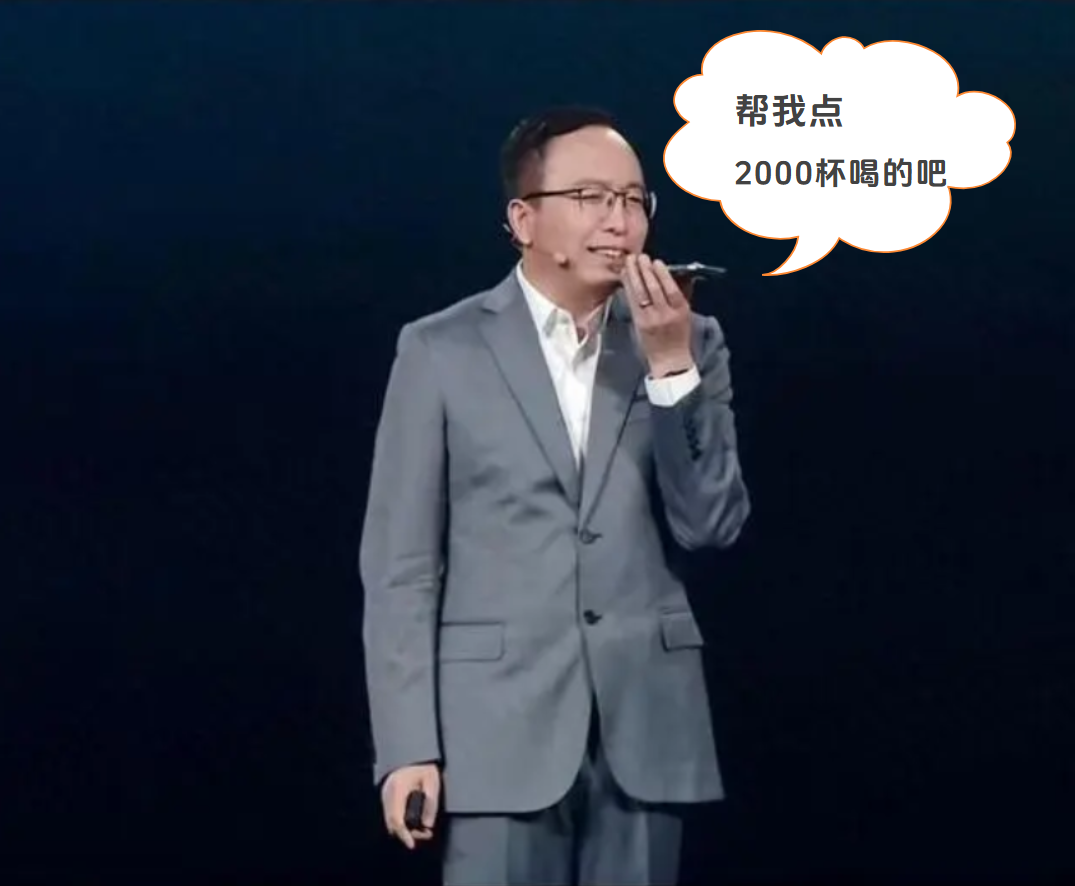

At Honor's launch event, Zhao Ming demonstrated the ability to "order coffee with one sentence." By simply saying, "YOYO, I'm sleepy, help me order a cup of coffee," the phone completes almost all operations autonomously; vivo's "PhoneGPT" can also use voice commands to make the phone jump to relevant apps to complete ordering and reservations.

This means that at this stage, AI phones are continuously evolving, integrating fragmented mobile phone operations into a "seamless experience" and finding ways to help users solve problems. This deeply embedded AI interaction is not only a reshaping of mobile phone logic but may also drive a true reshuffle in the AI phone market. AI has become an indispensable area in the mobile phone market.

Therefore, Xiaomi, Honor, OPPO, and vivo's rallying cry for AI is partly because AI has become an indispensable area in the mobile phone market. On the other hand, it is because in the current domestic market, AI, like foldable phones, is an outlet to avoid competition with Apple.

Xiaomi, Honor, OPPO, and vivo "nibbling at Apple"

Currently, Apple, which has been "squeezing the toothpaste tube" for years, is experiencing a decline in gold content. Take the iPhone 16 series as an example; multiple models broke even upon launch and saw official price cuts across the entire series on Double 11 within a month.

Against this backdrop, AI has become a "killer app" for smartphone manufacturers to attack Apple.

It is obvious that domestic manufacturers have a unique window of opportunity. Although Apple launched the iPhone 16 series with Apple Intelligence in September, Apple Intelligence was not pushed to users until the end of October with the iOS 18.1 update and did not cover the domestic market.

Recently, when asked about when Apple Intelligence would enter China, Apple CEO Tim Cook said it would require a "specific regulatory process," and Apple is still working to advance it. It is reported that Apple AI may not truly land in the domestic market until the second quarter of 2025.

Even so, according to media tests of Apple Intelligence, its AI applications are rather "unremarkable," mostly filling gaps in the past AI ecosystem without many highlights. Zhao Ming even directly stated earlier that Honor's AI experience might surpass the iPhone by "more than a mile."

In addition, Apple's neglect of older models in its AI strategy has also paved the way for domestic manufacturers to overcome another obstacle—used Apple phones. Compared to the Android camp, the second-hand trading of Apple phones is quite prosperous, with some second-hand dealers only dealing in used Apple and Huawei phones.

However, if the wave of AI phones continues to heat up, the appeal of used Apple phones may decrease significantly—after all, older models except for the iPhone 15 Pro series do not support Apple AI and will no longer have a competitive edge, thereby reducing the resistance for domestic manufacturers to push for higher prices to a certain extent.

Therefore, in addition to betting on AI, domestic manufacturers are also attacking Apple from various dimensions, trying to close the gap with Apple users and bring them under their wing.

OPPO's "One-Touch Transfer" feature allows for smooth file transfer between iPhone and Android phones; Xiaomi's 15 series also enables cross-system file sharing with iPhone, iPad, and Mac, breaking down the ecological barriers between Apple and Android to attract Apple users.

Apart from the interconnected experience, domestic manufacturers are also increasingly daring to approach Apple in design language.

In 2017, the iPhone X kickstarted the path of symmetrical screen design with equal-width borders on all four sides. For many years since then, domestic smartphone manufacturers have mostly followed the route of equal-width narrow borders on both sides or full screens, but either the internal and external diameters of the rounded corners could not be unified, or the overall design was not harmonious.

Nowadays, manufacturers such as Meizu, Xiaomi, OPPO, and others are putting effort into these design details, bringing Apple's aesthetics into their own designs.

With 30 patents, the Xiaomi 15 series achieves ultra-narrow borders with equal-width borders on all four sides, while the OPPO Find X8 series is fully "Apple-like," not only in design language but also in grip feel and matte texture, earning it the nickname "OPhone."

All this indicates that domestic manufacturers seem to have learned from the lessons of their initial high-end push in 2020 and are no longer blindly rushing to grab Apple's share. Instead, they are taking a step-by-step approach, dismantling Apple's advantages through product details and ecosystem integration to better recruit Apple users.

How this round will end is worth looking forward to.