Who Pushed Sam's Club to the Pinnacle

![]() 11/07 2024

11/07 2024

![]() 584

584

Author | Xie Zefeng

Editor | Yang Xuran

With 47 stores in China, Sam's Club has generated sales of 84.3 billion yuan, averaging 1.67 billion yuan per store, with some popular stores earning over 3 billion yuan annually. By 2024, Sam's Club is highly likely to surpass 100 billion yuan in revenue, showcasing the robust spending power of China's middle class.

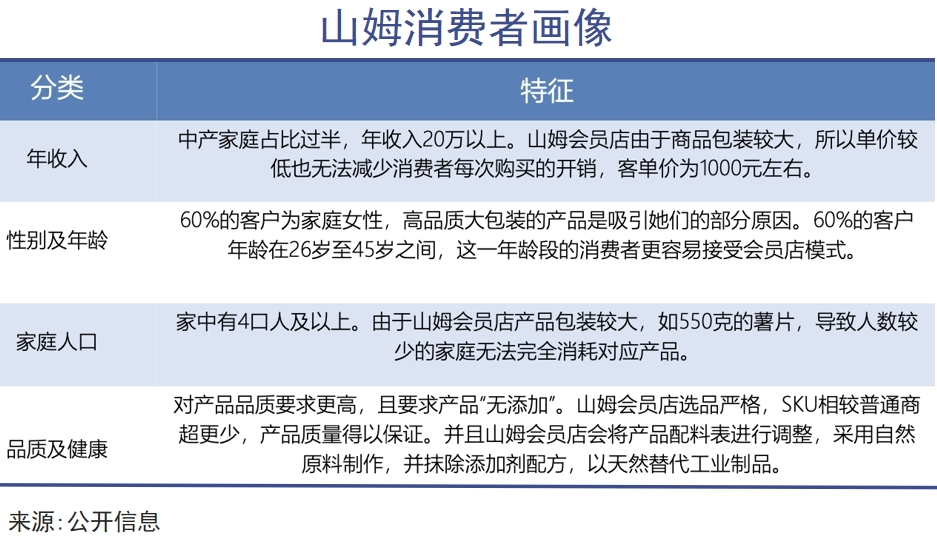

By focusing on the middle class with monthly incomes exceeding 20,000 yuan and curating high-quality products for its members, Sam's Club has bucked the retail industry's trends.

The key to the success of membership-based supermarkets like Sam's Club and Costco lies in their curated product selection and well-designed membership systems. By saving members time and ensuring high-quality products, they attract a large middle-class following, even thriving during periods of economic uncertainty, declining property prices, and capital market turmoil.

On video platforms, various "shopping guides" have become immensely popular, fostering a cult-like following for this premium foreign brand, even leading to extreme topics like "sharing Swiss rolls."

It's no exaggeration to say that Sam's Club has become a phenomenal retail enterprise in China, surpassing all industry expectations and warranting in-depth study.

Robust Consumption

Still Has Enormous Potential.

On November 3, anti-counterfeiting blogger Song Ge released a video exposing several products from Good Fella as potentially fraudulent in their ingredient lists, with lotus root starch mixed with cassava starch and no detectable "powder" in the spicy and sour rice noodles. This reignited public discourse on food safety issues.

The dimensions of "eating with peace of mind and buying with confidence" have always been highly valued by the middle class, who are less sensitive to cost-effectiveness. Sam's Club capitalized on this demand, emerging as a unique player in the challenging retail environment for urban middle-class consumers.

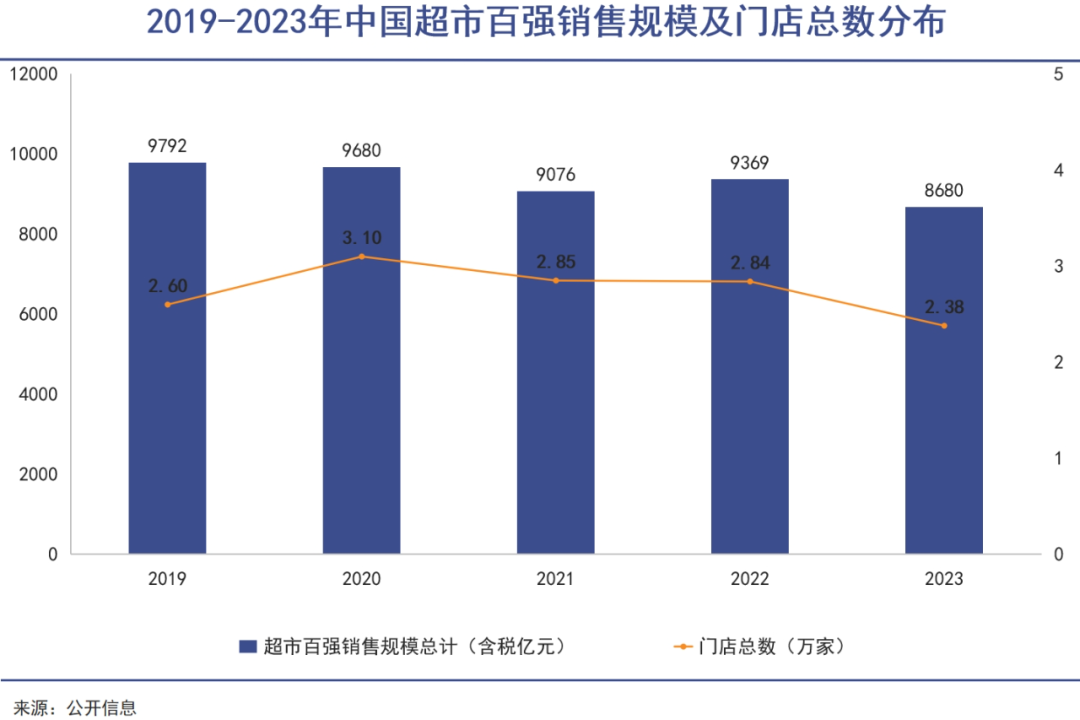

Over the past five years, the sales of the top 100 supermarkets in China have continuously declined. In 2023, sales totaled 868 billion yuan, just 88% of 2019 levels. After peaking at 31,000 stores in 2020, the number fell to 23,800 by 2023, a decrease of nearly a quarter.

Even Walmart, Sam's Club's parent company, has closed nearly 60 stores in China over the past two years. In the first half of this year, at least 17 stores ceased operations.

With the rise of membership stores, Walmart has gradually shifted its development focus to Sam's Club. Statistics show that each Sam's Club store generates over 1.6 billion yuan in sales, with nearly 50 stores accounting for two-thirds of Walmart China's sales.

In 2022, Sam's Club generated sales of approximately 66 billion yuan, which increased by 28% to 84.3 billion yuan in 2023. At this rate, it will surpass 100 billion yuan by 2024.

For the second fiscal quarter of fiscal year 2025 (the three months ending July 31), Walmart China reported net sales of $4.6 billion, a year-on-year increase of 17.7%. Net sales in the e-commerce business grew by 23%, primarily driven by the strong performance of Sam's Club and e-commerce operations.

Sam's Club's first membership store in China opened in Shenzhen in 1996, requiring a 150-yuan membership fee. In an era when the average monthly income in China was just 518 yuan and supermarkets were still a novelty, Sam's Club faced an uphill battle.

Between 2003 and 2004, Sam's Club stores in Kunming and Changchun were forced to transform into Walmart supermarkets due to poor performance, entering a dormant period that lasted over a decade.

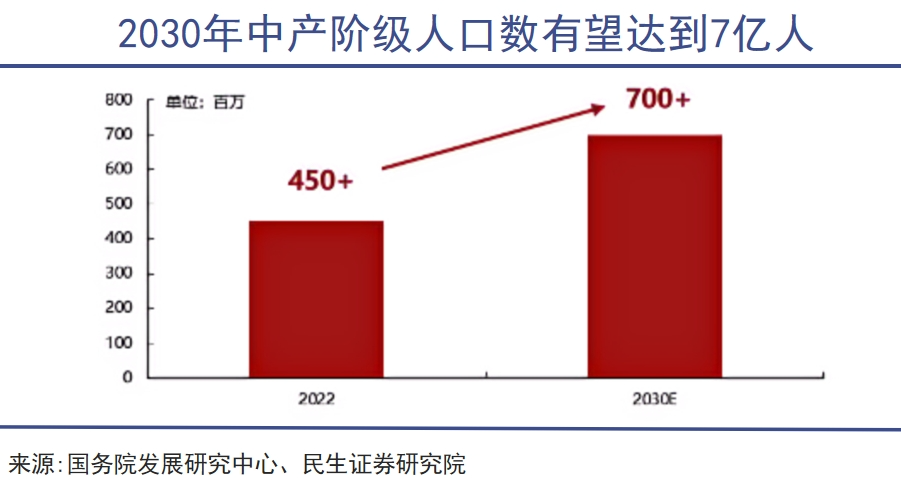

According to the transformation patterns of American supermarkets, membership stores enter a phase of rapid growth when the per capita GDP exceeds the critical threshold of $10,000. In 2019, China's per capita GDP reached $10,000, and membership-based supermarkets took advantage of the growing middle class.

In North America, large warehouse stores typically use bulk packaging and are often located in suburban areas. Customers typically drive to shop on weekends, stocking up for extended periods. Thus, the prosperity of this business model is closely related to regional car ownership.

By the end of June this year, China's private car ownership had reached 294 million vehicles, laying the foundation for large-scale one-time shopping. To facilitate shopping, both Costco and Sam's Club provide ample parking spaces. For example, the recently opened 50th Sam's Club store in Dongguan has three floors, with the rooftop and basement dedicated to parking, offering a total of 1,050 spaces.

Sam's Club focuses on economically developed regions such as Beijing, Shanghai, Guangzhou, Shenzhen, Jiangsu, Zhejiang, and Fujian, where affluence is higher, there are more middle-class individuals, and there is a greater demand for food safety and quality of life.

According to an iResearch survey, the primary reasons consumers choose warehouse membership stores are curated products (72.6%), discounted prices (67.9%), novel products (63.8%), and excellent after-sales service (59.6%). Quality has surpassed price as a consideration.

According to the Development Research Center of the State Council, China's middle class is expected to grow from 450 million in 2022 to 700 million by 2030, leaving a significant potential market of 200 million more individuals.

Currently, Sam's Club operates 50 stores in only 24 Chinese cities. The vast middle-class growth and extensive market space indicate tremendous development potential.

No Competitors

No Competitors

Solving the Impossible Triangle.

Retail faces an "impossible triangle" of price (profitability), efficiency, and service (experience). Convenience stores and small shops are accessible but often more expensive. Outlet stores offer discounts and decent service but are usually farther away.

For consumers, the triangle comprises scale (brand strength), variety (products), and localization (personalization and convenience), often an unattainable trifecta. Scale + variety equates to Walmart and RT-Mart; scale + localization, 7-Eleven; variety + localization, Pangdonglai.

Throughout retail history, each enterprise has sought to navigate the "impossible triangle." Costco and Sam's Club have achieved partial breakthroughs in a unique manner.

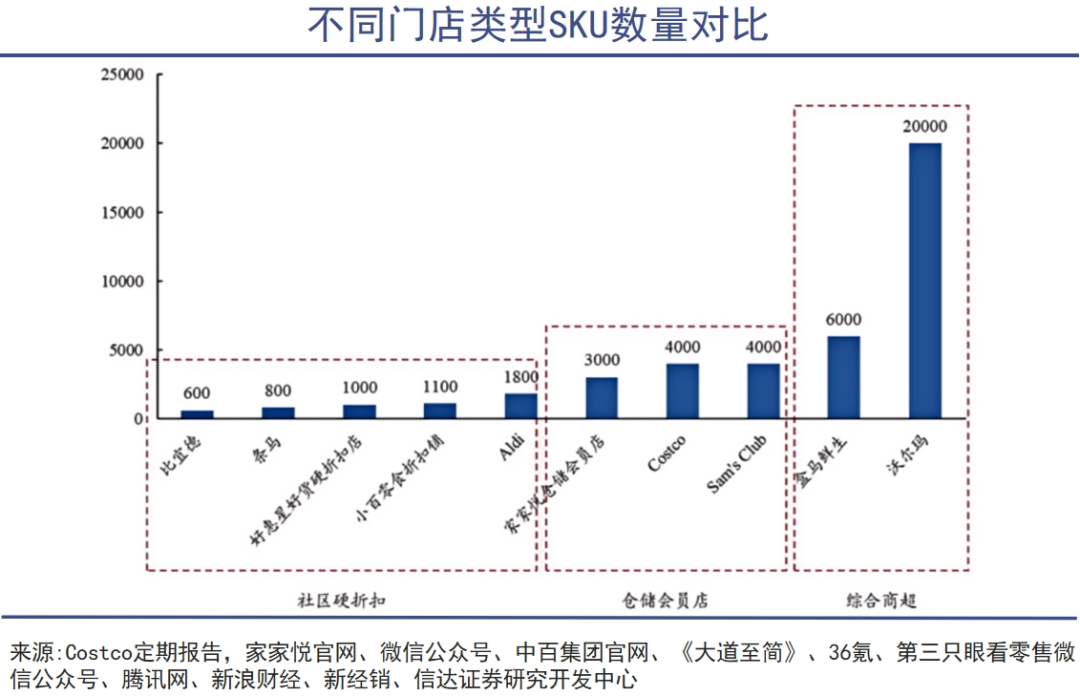

Unlike other large supermarkets with tens of thousands of SKUs, Costco and Sam's Club curate high-repurchase, high-quality products from strong brands, offering only around 4,000 SKUs but with deep selections within each category. They also collaborate with leading suppliers to create exclusive products, such as the 2024 launches of Matcha Rose Swiss Rolls, Original Earl Grey Swiss Rolls, and organic walnuts and Italian ham-flavored nuts with Qiaqia.

For localization, Sam's Club China employs a "big store + dark store" model to meet customers' immediate needs. With 50 big stores and 500 dark stores in China, online sales account for half of the total.

Source: Retail Business Finance

Dark stores are small with a curated selection of high-quality products, offering efficient hourly delivery and higher average order values (AOV) of 200 yuan compared to platforms like Pupu and Dingdong Maicai. Sam's Club model breaks the retail "impossible triangle."

In contrast, Costco resembles a "coral reef" model, with each big store serving as an ecosystem meeting members' diverse needs. With a gross margin of less than 13%, it achieves higher ROE and superior turnover efficiency, serving as a global benchmark for Chinese peers.

Recently, domestic e-commerce and retail platforms have engaged in price wars, but many players have struggled due to strategic indecision, failing to emulate Costco or challenge Sam's Club.

Hema, once seen as the most promising "Chinese Sam's Club," has experimented with over a dozen business models since its inception, including fresh food supermarkets, community group-buying, membership supermarkets, clearance stores, and boutique supermarkets. However, its influence has waned, and founder Hou Yi has stepped down as CEO.

Yonghui Supermarket, once a retail leader, has also experimented with warehouse stores, Yonghui Mini stores, Yonghui Maicai, Yonghui Life, and the Yonghui app. Unwilling to be left behind, Zhang Xuansong ultimately faced disappointment, and Yonghui was sold to Ye Guofu.

Currently, the most influential and growing retailer in China is undoubtedly Pangdonglai. Evolving from a street-side tobacco and alcohol shop over 20 years ago, it has become a retail giant in China, with sales expected to exceed 15 billion yuan in 2024, a year-on-year increase of 40%.

According to Yu Donglai himself, "Pangdonglai originally planned to earn 20 million yuan last year but ended up earning 140 million yuan." With only 13 stores, this implies that its per-store profitability surpasses all listed retail companies, showcasing unparalleled operational efficiency.

However, as mentioned earlier regarding the "impossible triangle," Pangdonglai is not a membership-based supermarket and is difficult to replicate on a large scale nationwide. Moreover, it targets lower-tier cities like Xuchang, where consumer habits differ significantly from those of middle-class urban dwellers. Therefore, Pangdonglai and Sam's Club are like parallel lines, unlikely to intersect.

With a vast customer base of high-spending individuals and strategic flexibility, Sam's Club is unlikely to face significant competition in China in the foreseeable future.

Customer Loyalty

Establishing a "Channel Brand" Faith Among the Middle Class.

The cornerstone of the membership store business model is loyal members, shifting the retail focus from the profit margin between purchasing and selling to mining member value.

This "buyer pays" model fosters a contractual bond, transforming retailers into members' "agents," strategically aligning interests. In consumers' minds, membership stores become synonymous with shared benefits.

Leveraging its large membership base, Costco and Sam's Club wield significant bargaining power with suppliers and use big data analysis to create exclusive, customized bestsellers. Currently, Costco has 71 million members worldwide, and Sam's Club China has over 5.5 million members, with an average spending of over 13,000 yuan per person.

Products like Swiss rolls, specialty fresh milk, lime juice, and American-style roast chicken have become must-buys on various shopping guides at Sam's Club. Crucially, these products adhere to high safety standards; for instance, Mengniu's specialty milk for Sam's Club meets EU standards, lime juice contains only water, lime juice, and sugar, and Haitian soy sauce is additive-free.

This contrast has led many to reconsider their choices, with some consumers claiming that Sam's Club is the only supermarket accessible to ordinary people offering the highest food safety standards.

Especially in today's fast-paced world, the middle class faces heavy work, family, and educational responsibilities, leaving little time for product comparisons. Sam's Club precisely addresses this group's needs, earning the loyalty of its fan base and being elevated to higher status.

However, aggressive promotion by social media influencers and the intentional or unintentional display of superiority have turned shopping at Sam's Club into a form of class flaunting. One netizen posted about being mocked by a colleague: "You've only been to Sam's Club for the first time? How poor!"

Each Sam's Club entrance features several value statements, the most prominent being, "Why is entry restricted to members only?" The answer: "Sam's Club is dedicated to serving members, providing high-quality products for elite lifestyles."

Sam's Club inherently segments its audience and focuses on specific customers. Based on quality products, it also positively influences customer psychology, fostering the perception that "shopping at Sam's Club is for elites pursuing quality and high-standard products. Only at Sam's Club can you find top-standard items."

However, China's current food safety standards are not inferior to those in Europe and America—at least not to the extent that segregated consumption is necessary. Most of Sam's Club China's suppliers are domestic. Moreover, Sam's Club has faced investigations by local market supervision bureaus in Chengdu, Nanjing, and Beijing for issues like spoiled beef, moldy strawberries, and paper found in bread, proving it is not flawless.

Humans tend to make decisions based on cognitive ease, avoiding complex thinking. In the industrial era of excess supply, making optimal decisions amidst information overload forms the basis for "channel brands."

Rather than attributing Sam's Club's success solely to quality, it's more accurate to say that it has successfully instilled faith in its status as a "channel brand" among China's middle class, a key factor in its success.