Transsion's Ascent in Southeast Asia Hinders Vivo's Expansion

![]() 12/31 2024

12/31 2024

![]() 581

581

A year has passed, and the Southeast Asian mobile phone market has undergone significant transformations.

With Transsion's rapid rise, Vivo's path to growth has become increasingly challenging.

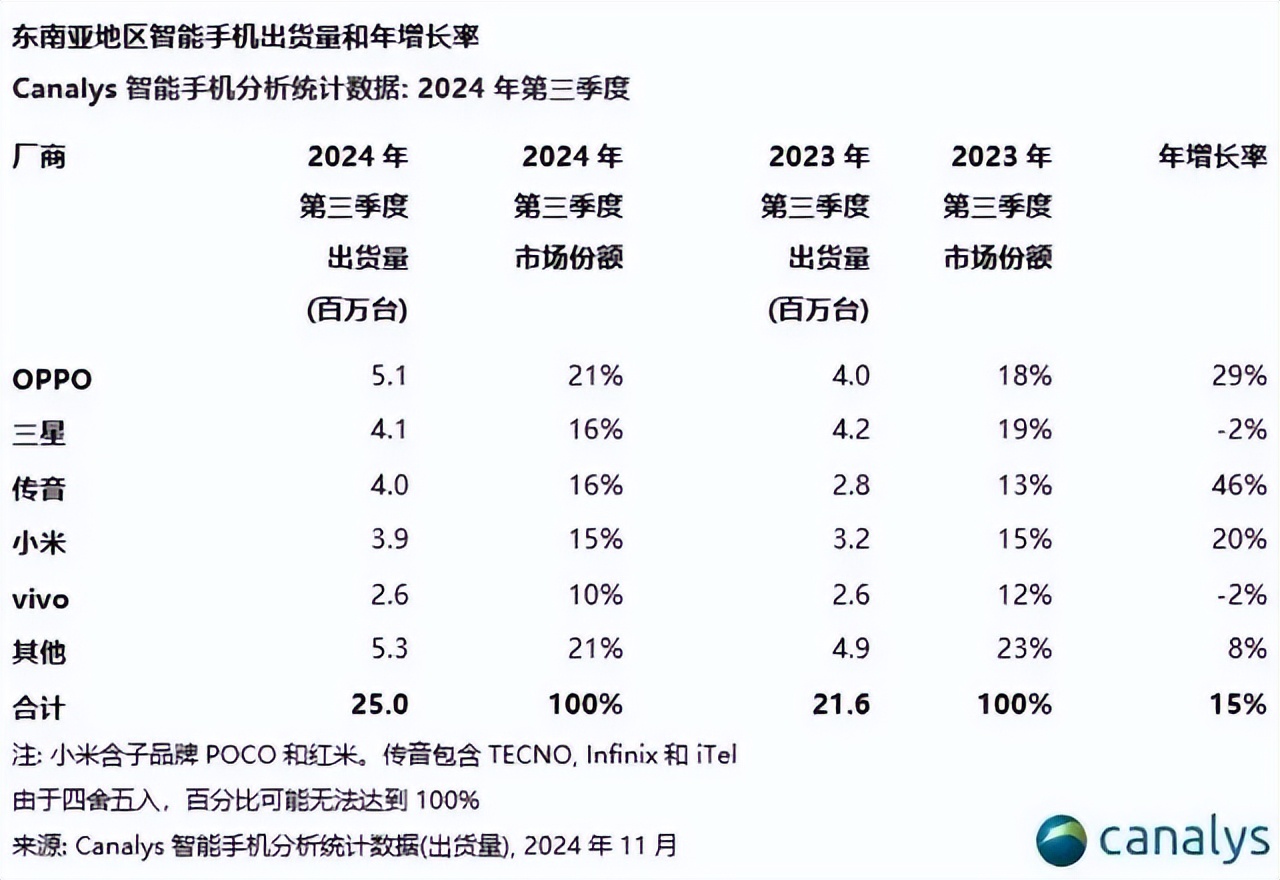

According to the latest data from Canalys, in the third quarter of 2024, Transsion ranked third in the Southeast Asian smartphone market with shipments of 4 million units and a 16% market share, almost on par with second-place Samsung. Now, Transsion has joined OPPO, Samsung, and Xiaomi in the top tier of the market, accounting for nearly 70% of the total share.

In contrast, Vivo, which was vying with Transsion for a top spot, holds only a 10% market share. Notably, at this time last year, Transsion and Vivo had similar market shares in Southeast Asia.

Amid tensions with Indian authorities, Southeast Asia has become a crucial market for Vivo to defend, and Transsion's ascendancy means Vivo will face greater hurdles in achieving local growth.

01

The Power of Beauty Enhancement

In the vast expanse of Africa, Transsion gradually gained a stronghold with localized beauty enhancement features and became the 'King of Africa.' Data indicates that in 2022, Transsion shipped 175 million mobile phones in Africa, capturing 48% of the market share.

Compared to consumers in Asia and Europe, African consumers have unique needs for beauty enhancement. Due to their darker skin tones, traditional beauty filters often fall short. Transsion heavily invested in R&D to develop beauty features tailored to African skin tones, enhancing skin tones naturally and highlighting facial features.

After the success of its beauty features in Africa, Transsion replicated this strategy in the Southeast Asian market.

In Southeast Asia, Transsion further tailored its beauty enhancement features to local skin tones and aesthetic preferences. For instance, in Indonesia, where lighter skin tones are preferred, Transsion optimized its beauty filters to give users a lighter, smoother complexion in photos. In Thailand, where a natural, fresh look is favored, adjustments were made to provide a more authentic, youthful appearance.

Additionally, Transsion attempted to replicate other African strategies in Southeast Asia. In Africa, Transsion operates different brands targeting diverse consumer groups. For example, TECNO focuses on mid-to-high-end smartphones, attracting users with higher quality and performance. ITEL caters to low-income consumers and the elderly with affordable, practical devices. INFINIX appeals to young consumers with stylish design and good performance.

In the Southeast Asian market, Transsion continued this branded tier strategy. TECNO targets mid-to-high-end consumers with premium products in terms of performance and design. INFINIX appeals to young users in Southeast Asia who demand exceptional phone design and gaming performance.

With many minor languages spoken in Africa, Transsion's phones support local languages like Swahili, enhancing user experience. Southeast Asia also boasts linguistic diversity, and Transsion has added support for multiple local languages to improve user experience.

In the Southeast Asian market, Transsion is also exploring music-related ventures. It collaborates with local music platforms or creators, pre-installs popular local music apps on phones, or introduces music-related features to cater to Southeast Asian users' love for music.

02

Market Order Consolidation

Transsion's strong performance in Southeast Asia has objectively narrowed Vivo's development space.

Currently, in the Southeast Asian market, Transsion, as an emerging player, has solidified its position among the top four alongside OPPO, Samsung, and Xiaomi.

A year ago, Transsion and Vivo were on equal footing. At that time, both companies had comparable mobile phone shipments and market shares in Southeast Asia.

According to Canalys' smartphone analysis statistics, in the third quarter of 2023, Transsion and Vivo's market shares in Southeast Asia were 13% and 12%, respectively. These figures indicate that the two companies were neck-and-neck in sales, with no significant gap.

However, over time, Transsion gradually widened the gap with Vivo due to its advantages in beauty enhancement, product cost-effectiveness, sales channels, and marketing activities.

For Vivo, the situation is dire. As competition intensifies among Transsion, OPPO, Samsung, and Xiaomi, it becomes increasingly difficult for Vivo to narrow the gap with the top four.

In addition to Transsion, OPPO, Samsung, and Xiaomi are also gradually increasing their investments in Southeast Asia. For example, OPPO has launched multiple mobile phone products tailored to the Southeast Asian market, optimizing design, camera functions, and performance to meet local consumer needs. In the third quarter of 2024, OPPO shipped 5.1 million mobile phones in Southeast Asia, capturing a 21% market share.

Samsung continues to strengthen its brand promotion and sales channel construction in Southeast Asia, enhancing brand awareness and market share. In the third quarter of 2024, Samsung shipped 4.1 million mobile phones in Southeast Asia, capturing a 16% market share.

Xiaomi expands its sales channels in Southeast Asia through a combination of online e-commerce platforms and offline stores, increasing product market coverage. In the third quarter of 2024, Xiaomi shipped 3.9 million mobile phones in Southeast Asia, accounting for a 15% market share.

03

Southeast Asia: A Non-Negotiable Market

After losing the 'crucial market' of India, Southeast Asia has become vital for Vivo.

In the Indian market, Vivo once had promising prospects. However, due to conflicts with Indian authorities over tax issues, Vivo's relationship with Indian authorities deteriorated, leading to its withdrawal from the Indian market.

In recent years, the Indian government has intensified scrutiny and regulation of Chinese mobile phone companies, conducting multiple investigations and fines against Vivo and other Chinese firms for alleged money laundering and tax evasion. In 2022, the Indian government raided Vivo and froze its bank accounts in India. Additionally, the Indian government has imposed stringent requirements on Chinese mobile phone companies like Vivo, such as sourcing more components locally and increasing production ratios in India.

Recently, there were rumors that Vivo planned to sell its Indian subsidiary, transferring a 51% stake to India's Tata Group. Simultaneously, the Indian authorities demanded that the post-acquisition joint venture be led by local manufacturers, with localized marketing networks. In simple terms, this would make Vivo India operate independently.

Under heavy pressure from the Indian government, Vivo had to make the difficult decision to withdraw from the Indian market. With struggling growth in the European and American markets, Vivo can only turn its attention to Southeast Asia.

Data shows that by 2030, the Association of Southeast Asian Nations (ASEAN) is expected to rise from the world's fifth-largest economy to the fourth-largest. The potential of the smartphone market behind this growth is evident.

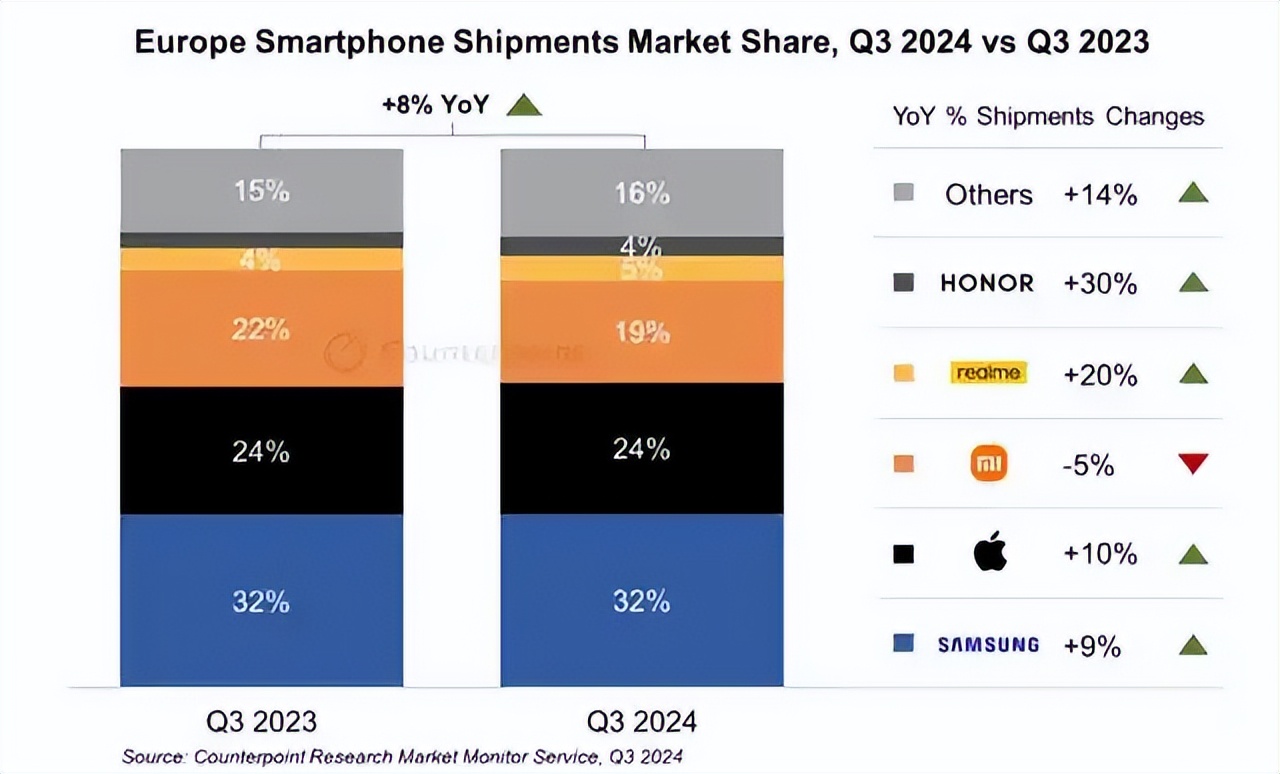

On the other hand, Vivo's development in the European and American markets has been unsmooth. Although sponsoring sports events like the European Championships has increased brand awareness, sales figures have been underwhelming.

Relevant data shows that Vivo's mobile phone shipments and market share in the European and American markets are relatively small, lagging far behind international brands like Apple and Samsung.

Taking the European market as an example, according to Counterpoint Research data, smartphone shipments in Europe increased by 8% year-on-year in the third quarter of 2024. The top three smartphone vendors were Samsung, Apple, and Xiaomi. During this period, Vivo fell into the 'others' category in Europe, failing to rank in the top five.

Globally, Southeast Asia is a market that Vivo must capture, as it has not completely fallen out of the top ranks. In the Southeast Asian market, Vivo still has a certain channel and user base. However, with continuous pressure from competitors like Transsion and OPPO, the adjustment space for Vivo may continue to shrink.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.