Apple Unveils Self-Developed Wi-Fi/Bluetooth Chip: The Underestimated Chip Empire

![]() 08/08 2025

08/08 2025

![]() 637

637

Apple, Huawei, and Xiaomi are converging on a common goal via distinct paths.

Over the past few days, Apple has been in the news for various reasons, from adopting Samsung's image sensor in the iPhone for the first time to introducing its second-generation self-developed baseband C2 in the MacBook lineup. However, one critical piece of news might have slipped under the radar for many.

According to overseas technology media MacRumors, citing reliable sources, the "most powerful TV box," Apple TV 4K, will launch a new model within the year. Not only will it be priced more affordably, but it will also be equipped with Apple's first self-developed Wi-Fi/Bluetooth chip (codenamed "Proxima"), replacing the previously used Broadcom solution.

This may seem like a minor update—after all, Apple TV has never been Apple's flagship product, and its launch was relatively low-key. Yet, this move signifies a shift in Apple's pace of expansion in the realm of self-developed chips (Apple Silicon).

Image/Apple

Beyond SoCs: Apple's Quiet Expansion into Self-Developed Chips

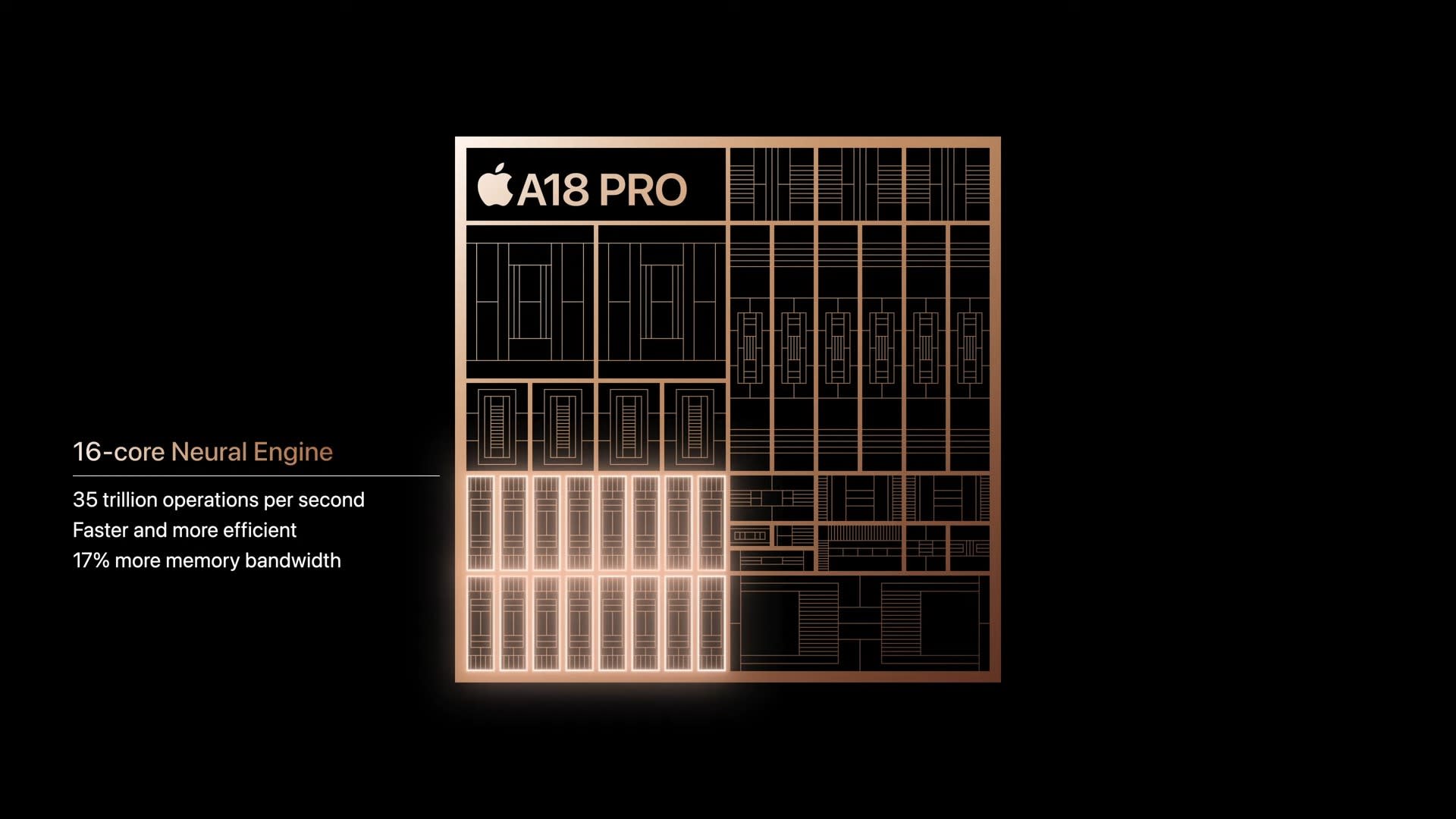

For over a decade, the world's attention to Apple's self-developed chips has centered on SoCs: The A series has given the iPhone processors that outperform competitors, the M series has revolutionized Mac energy efficiency, the H series keeps AirPods ahead, and the S series powers the Apple Watch, alongside the R series in the Apple Vision Pro, among others.

However, with the entire MacBook lineup migrating to the M series chip, Apple has achieved a unified computing platform—all products are now equipped with Apple Silicon. Simultaneously, Apple has delved deeper into both the core and peripherals of SoCs, introducing the U series ultra-wideband chip, the T series security chip, and the R1 real-time sensor coprocessor on Vision Pro, while pioneering the adoption of the C1 baseband chip on the iPhone 16e. Wi-Fi/Bluetooth chips are also an integral part of Apple's self-developed chip journey.

In fact, the new Apple TV 4K might not be the first to use "Proxima." Earlier this year, analysts such as Bloomberg and Ming-Chi Kuo predicted that the iPhone 17 series, to be released this fall, would incorporate this Wi-Fi/Bluetooth chip across all models.

iPhone 17 Pro mockup, Image/@SonnyDickson

Behind each self-developed chip, Apple is constructing a more foundational, concealed, and versatile chip matrix, possibly with one singular goal: to delve deeper into the foundational layer to enhance product and ecosystem experiences. This is not just Apple's aspiration but also a shared objective among consumer electronics giants like Huawei and Xiaomi.

During an earnings call earlier this month, Apple CEO Tim Cook reiterated, "Apple Silicon is the core of all experiences." This statement might sound familiar yet subtly different. It might not just refer to every Apple device but also the foundation of every type of experience, ultimately falling within the Apple Silicon self-developed chip system.

When we mention Apple Silicon today, most people still think of the A series in the iPhone and the M series in the Mac, but Apple's chip self-development extends far beyond that. Over the past decade, Apple has attempted to integrate self-developed chips into almost every product category, gradually embedding the concept of "chip as experience" into its entire hardware ecosystem.

The Trinity Takes Shape: Apple's Chip Empire Emerges

Currently, Apple Silicon can be broadly classified into three categories:

- Main SoC series

- Functional module chips

- Basic capability chips

Apple's SoCs across various product lines are perhaps the most recognizable, including the A series for the iPhone, the M series for the Mac and iPad Pro, the S series for the Apple Watch, and the H series (such as H1/H2) for wireless headphones. These chips handle the operating system and primary applications, serving as the brains of the devices.

Image/Apple

On the other hand, functional module chips include the W series for Bluetooth and wireless communication, the U series for UWB spatial positioning, the T series for security modules like Face ID, and the R1 sensor coprocessor for Vision Pro. These chips are often custom-designed for specific functions and do not dominate overall device computing but determine the efficiency and stability of key experiences.

Basic capability chips encompass power management chips (PMIC), display control chips, Wi-Fi/Bluetooth (wireless communication) chips, and cellular baseband chips. Unlike the A/M series, which stand at the center, they form the foundation for devices to connect to the world and operate stably.

Today, all Mac products have transitioned to the M series—achieving a unified computing platform. Apple has thus accomplished the rare feat in consumer electronics history of "unifying the CPU architecture across all devices." However, the M series is merely the halfway point in Apple's chip strategy. After achieving a unified computing platform, Apple has begun to focus more on the self-development of "edge chips":

These are basic modules that previously relied on third parties, significantly impact the user experience, but do not undertake primary control tasks.

For instance, the R1 sensor coprocessor for Vision Pro specifically processes sensor data from cameras, microphones, and IMUs and immediately transmits it to the M2 chip for further processing, enabling Vision Pro to achieve a latency of less than 12 milliseconds. Its task is to "take over input" and reduce the load on the main SoC.

Of course, compared to the R1, which is based on the M series chip and custom-tailored for the Apple Vision Pro, the C1 is closer to a traditionally self-developed chip and is inextricably linked to the actual experience of a larger user base. As Apple's first self-developed baseband chip, the C1 debuted in the iPhone 16 earlier this year. Although it currently only supports Sub-6GHz, it has initially demonstrated better power consumption performance than Qualcomm's solution, marking a crucial step for Apple to break free from baseband dependence.

Image/Apple

C2 is already on the horizon and is expected to appear in Apple products in 2026. The consensus is that the entire iPhone 18 series will introduce it and may subsequently cover MacBook and iPad product lines. The upcoming Wi-Fi/Bluetooth chip "Proxima" will also officially replace Broadcom's older solution. Although the new Apple TV 4K may be the first to test the waters, the bigger stage will undoubtedly be the iPhone 17 series released this fall.

Huawei, Apple, Xiaomi: Converging on the Same Goal, Self-Developed Chips are Inevitable

Interestingly, whether it's basebands, Bluetooth, or Wi-Fi, their common characteristic is serving the device's "connectivity" with the outside world and being crucial for device energy consumption control. Compared to past advancements in computing power, these two basic chips actually emphasize connectivity and energy consumption benefits even more. This is because the next generation of intelligent experiences, whether it's spatial computing, edge AI, or cross-device collaboration, cannot do without these two foundational capabilities.

Horizontally, these chips are also filling in the "control puzzle" within Apple's ecosystem. By no longer being constrained by external vendors like Broadcom (for Wi-Fi) and Qualcomm (for basebands), Apple can control every aspect of the system's foundation, maximizing user experience consistency and security. Vertically, Apple Silicon may not only be a hardware solution but also a product philosophy—starting from the chip, redefining how devices should work, interact, and perceive the world more intelligently.

Image/Apple

However, Apple is not the only tech giant accelerating chip self-development. Beyond it, Huawei and Xiaomi are also building their own chip chessboards and gradually embedding chip capabilities into the deepest layers of product experiences. Although the technical paths and motivations of the three differ, self-developed chips are becoming a common strategy for these consumer electronics giants.

Looking at Huawei, the Kirin SoC was once a benchmark for domestic mobile phone chips. Amid various restrictions, Huawei has persisted in chip self-development and even expanded further, with its chip system covering almost all core modules required for an entire device: from SoCs and basebands to ISPs, NPUs, PMICs, power management chips, and even AI inference accelerators, Honghu video decoding chips, and Lingxiao routing chips, among other layouts.

After the failure of the Penta S1, Xiaomi has become more pragmatic, as Lu Weibing noted, understanding "the complexity and long-term nature of chip investment." From the Penta C1, P1, G1, and Xuanjie T1 in 2021 to the official launch of the self-developed mobile phone SoC Xuanjie O1, Xiaomi has chosen to adopt a low-profile "rural surrounding the city" approach, starting with less challenging module chips to accumulate experience and cultivate capabilities.

Image/Xiaomi

In fact, the logic behind self-developed chips has always been clear: achieve product differentiation by controlling core chips and drive a self-optimizing cycle for the experience. On the other hand, Apple, Huawei, and Xiaomi have one thing in common: they are all companies with extremely diverse product lines, ranging from mobile phones, headphones, watches, tablets, TVs to in-vehicle systems, routers, and even XR devices. Multiple product lines mean more application scenarios for versatile chip modules—one self-development, multiple reuses, enhancing the overall input-output ratio.

As chip capabilities continue to delve deeper, they bring not just performance and power consumption improvements but also a company's comprehensive control over product experience and even ecosystem construction. In this sense, self-developed chips are the inevitable path towards deep collaboration and system optimization.

Final Thoughts

Returning to Apple, whether it's the C1 baseband or "Proxima," their influence extends far beyond simply saving procurement costs or enhancing performance parameters. What they truly change is Apple's control over the "connectivity" within its ecosystem.

In the past, the iPhone relied on Qualcomm's baseband, and AirPods used Broadcom's Wi-Fi/Bluetooth chips. Even if Apple set high standards for product experiences, it was inevitably constrained by the supply chain. Once these key communication chips are in its own hands, Apple can exercise more comprehensive control over power consumption, stability, compatibility, and even the collaborative experience between devices.

Image/Apple

For example, in terms of call noise reduction, audio latency, and switching speed, the experience of AirPods with the iPhone has always been ahead of the industry; these advantages will likely be further amplified in the future with the integration of unified communication chips. Another example is seamless switching between multiple devices, AirDrop speed optimization, and cross-device audio and video collaboration, which highly depend on connection efficiency, and these are precisely the areas where Apple is quietly making strides in its self-developed chips.

From the Apple Watch to Vision Pro, from the iPhone to future smart in-vehicle systems, every Apple device ultimately relies on connectivity to build a collaborative ecosystem, and control over connectivity is the foundation for Apple to create a closed yet smooth experience. The question then arises: What will be the next puzzle piece for Apple after completing this one?

Source: Leitech

Images in this article are from: 123RF Licensed Stock Photo Library. Source: Leitech