2024 Domestic Smartphone Market Performance Report: Six Top Competitors, Changing Landscape

![]() 01/07 2025

01/07 2025

![]() 510

510

Preface: As a new round of replacement cycles commences, the market is demonstrating a promising growth trajectory.

This year has not only witnessed the continued expansion of domestic brands in the high-end flagship smartphone segment but also ushered in substantial advancements in key technologies, including AI, foldable screens, and 5G communication.

Author | Fang Wensan | Image Source | Network

2024 Domestic Smartphone Market Performance Report

From January to November 2024, total mobile phone shipments in the domestic market reached 280 million units, marking a 7.2% increase year-on-year.

Among these, 5G phone shipments amounted to 241 million units, reflecting a 12.0% year-on-year increase and accounting for 86.2% of total mobile phone shipments during the same period.

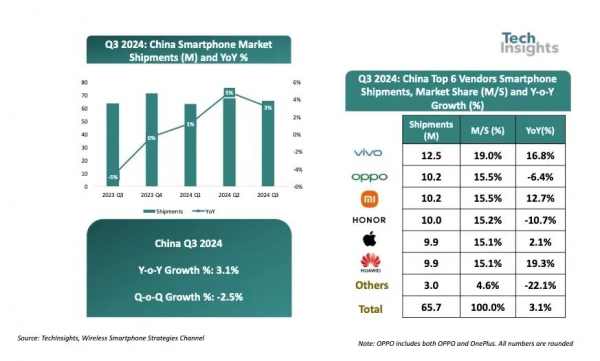

According to the latest report by market research firm TechInsights, China continued to be the world's largest single smartphone market in the third quarter of 2024, with smartphone shipments increasing by 3% year-on-year to reach 65.7 million units.

In terms of vendor market share, vivo led the Chinese smartphone market with a share of 19%.

OPPO/OnePlus and Xiaomi closely followed with market shares of 15.5% each.

Honor, Huawei, and Apple followed with shares of 15.2%, 15.1%, and 15.1%, respectively.

However, it is noteworthy that despite the increase in smartphone shipments, the number of new models declined, with 270 new models launched, a 19.9% year-on-year decrease, accounting for 68.7% of the number of new mobile phone models during the same period.

This may indicate that the smartphone market is transitioning from a focus on quantity growth to quality improvement.

While rising costs have generally increased the prices of flagship phones, high-end users have shown high acceptance, and their purchase demand remains unaffected.

Some mid-range users also opt for flagship products to extend their replacement cycles. However, others demonstrate a clear preference for cost-effective brands and products, indicating a trend towards consumption downgrading.

IDC predicts that in 2025, the market share of smartphones priced above $600 in China will reach 30.9%, an increase of 2.1 percentage points year-on-year; the market share below $200 will also increase by 2.1 percentage points year-on-year to 31.5%; and the market share between $200 and $400 will shrink to 28.0%, a decrease of 4.2 percentage points.

Entering the second and third quarters of 2024, vivo emerged as a market standout, ranking first in the Chinese smartphone market for two consecutive quarters and maintaining the lead in cumulative shipments in the first three quarters.

The robust performance of brands such as Huawei and Xiaomi also drove the overall growth of the Android market, with a year-on-year increase of 3.8%.

However, OPPO's performance slipped in the third quarter, failing to make it into the top five.

Amidst intensifying market competition, smartphone manufacturers are seeking to transform towards the high-end market to generate more profits in the higher price range.

Xiaomi's financial report revealed that the average selling price (ASP) of Xiaomi smartphones increased by 10.6% year-on-year in the third quarter of 2024.

This growth is primarily attributed to the successful implementation of Xiaomi's high-end strategy in the Chinese market.

However, due to rising electronic component costs, Xiaomi's profitability has been challenged. The gross margin of its smartphone business decreased to 11.7% in the third quarter of 2024, down from 16.6% in the same period of 2023.

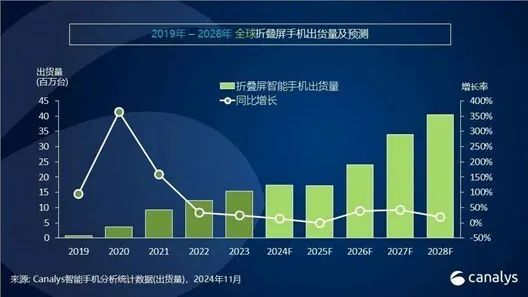

Foldable Phone Growth Hits a Bottleneck

Canalys predicts that foldable phone shipments will only achieve a year-on-year growth of 13% in 2024, and the market may experience a year-on-year decline in 2025.

Although the novel form factor of foldable phones has captured market attention in the short term, to sustain demand, the industry still needs to address issues such as product value positioning and durability.

Meanwhile, as the world's largest foldable phone market, China's growth rate has also slowed down. According to Counterpoint's forecast, foldable phone shipments in China will reach 9.1 million units in 2024, with a year-on-year growth of only 2%.

This growth rate, compared to the triple-digit growth rates of previous years, indicates a significant slowdown in market growth. Currently, no other brands can compete with Huawei and Samsung in the market. These two companies together accounted for 70% of the panel procurement market in 2023 and 2024.

Due to lack of price elasticity, limited profit margins, mediocre sales performance, and overheating issues, some smartphone brands have ceased development of flip-style foldable products.

AI Agents to Become a Powerful Tool for Brands to Retain Users

AI Agents will be the key to enhancing user experience on the new generation of AI phones and a powerful means for brands to retain user groups.

In the future, through system-level AI at the phone's core, AI Agents will significantly improve human-computer interaction and intent recognition, better understanding users' true intentions and needs, directly invoking required functions, and actively assisting users in completing related tasks.

After long-term training, AI Agents will become highly customized personal assistants for each user and continue when users replace their phones with the same brand.

Samsung released the Galaxy S24 Ultra in January 2024, equipped with its self-developed Gauss AI model, introducing innovative features such as instant search and real-time call translation.

Google released the Pixel 9 in August 2024, equipped with AI technology capable of photo restoration, smart framing, magic eraser, and other functions.

Apple released the iPhone 16 in September 2024, equipped with Apple Intelligence, providing features such as notification summaries, call summaries, writing aids, and photo organization.

Xiaomi released the Xiaomi 15 Pro in October 2024, equipped with the MiLM AI model, enabling features such as AI painting, AI writing, and AI image cutout.

Huawei released the Mate 70 Pro+ in November 2024, equipped with the Pangu AI model, enabling features such as AI dynamic photos, AI interactive themes, AI air transfer, and AI noise-reduction calls.

Cross-platform and Cross-device Collaboration Brings New Growth Momentum

By 2024, the trend of cross-platform and cross-device collaboration in mobile phones is expected to enter a new era.

With rapid technological advancements, mobile phones have transcended their original function as a single communication tool, gradually evolving into a core hub connecting numerous smart devices.

Thanks to the rapid development of cutting-edge technologies such as the Internet of Things, artificial intelligence, and cloud computing, the boundaries between mobile phones and other smart devices are increasingly blurred, and cross-platform and cross-device collaboration is becoming an irreversible trend.

Operating systems such as Huawei HarmonyOS, Honor MagicOS, vivo OriginOS, OPPO ColorOS, and Xiaomi PengpaiOS have achieved seamless connection and efficient collaboration between mobile phones and more smart devices like TVs, cars, and smart homes by building a unified ecosystem and platform.

This collaboration not only significantly enhances the user experience, allowing information and services to flow freely between different devices, but also brings unprecedented growth momentum to related industries.

Cross-platform and cross-device collaboration not only elevates the user experience but also fuels new growth opportunities for the industry.

Empowered by device computing power, AI models, and intelligent interaction, efficient office work, artistic creation, and learning assistance will become the primary directions for the implementation and development of AI tablets, facilitating the transition of tablets from entertainment devices to professional productivity tools.

Cross-system transfer will weaken the barriers of hardware 'suites', expanding the user base. In the future, more and more manufacturers and products will support cross-system file transfer, optimizing the user experience across terminals and systems.

As a breakthrough in ecological interconnection, cross-system transfer will diminish the original hardware 'suite' barriers, aid tablet manufacturers in expanding their target user base, and enhance the importance of product capabilities in acquiring customers.

Conclusion:

According to Canalys' forecast, the growth of the smartphone market will enter a stable phase starting from 2025, with the average compound annual growth rate from 2024 to 2028 expected to drop to 1%.

Although 2024 marks a market recovery, in the long run, the rapid growth of the smartphone market is unsustainable. It is anticipated that the growth momentum of the mobile phone industry will decelerate starting from 2025.

Some References: Time Weekly: "Smartphone 2024 Performance Report: AI Heating Up, Foldable Phones Slowing Down, OPPO Falling Out of Top Five", 21st Century Business Herald: "2024 Mobile Phone Market: Who is Heating Up? Who is Cooling Down?", Feixiang Network: "Insights and Outlook for Trends in the Smartphone Industry in 2024", Rin Feidai: "Farewell to the Old Era 2024: Changes and Prospects for Mobile Phone Configurations"