24 Years of Domestic Mobile Phones' Ascendancy! Apple and Samsung's Major Setbacks - Is It Due to AI and Imaging Inadequacies?

![]() 01/15 2025

01/15 2025

![]() 674

674

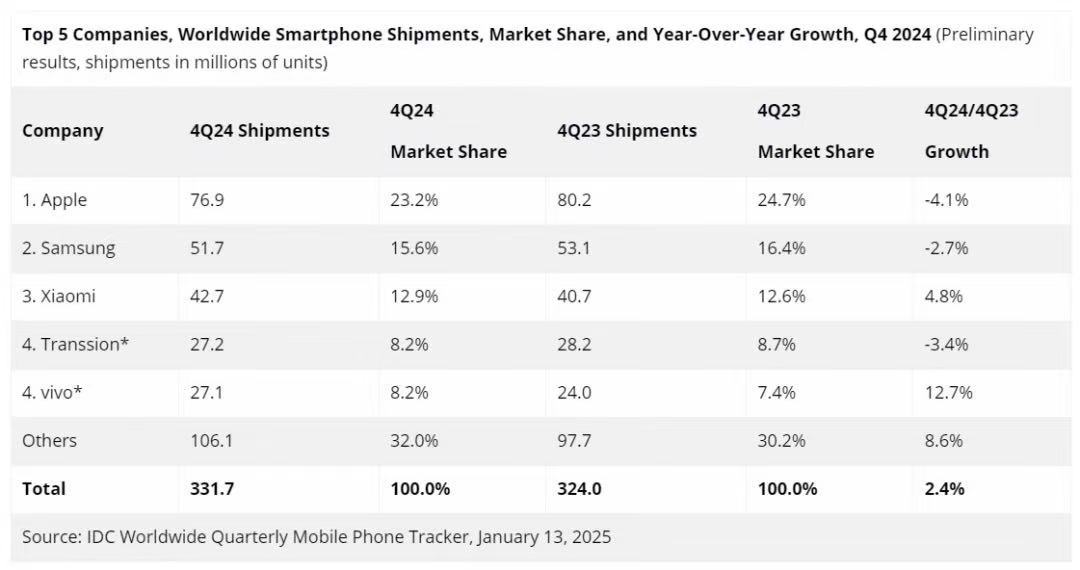

Recently, market research firm IDC released its Q4 2024 global smartphone shipment report, revealing that Apple, Samsung, Xiaomi, Transsion, and vivo topped the list. Total global smartphone shipments for this quarter increased by 2.4% year-on-year, amounting to 331.7 million units.

The fourth quarter of each year is the most anticipated period in the smartphone market. Thanks to the early release of Qualcomm and MediaTek's new flagship chips, almost all mainstream phone manufacturers have completed their flagship product iterations by this time. Perhaps due to the "encirclement and suppression" by Chinese phone manufacturers, the iPhone 16 series and Samsung's upcoming S25 series faced significant setbacks in this quarter.

(Source: IDC)

In an increasingly competitive market, phone manufacturers must find innovative breakthroughs to stabilize their market share and position.

Xiaomi leads in growth, vivo makes strides, while Apple and Samsung retreat

In the recently concluded Q4 2024, Apple once again surpassed Samsung to rank first in global smartphone shipments. However, surprisingly, the iPhone 16 series did not deliver the expected explosive growth for Apple, as its year-on-year growth in the fourth quarter actually decreased by 4.1%.

Samsung also underperformed. In the fourth quarter, lacking a new flagship Galaxy S25 series, Samsung faced direct competition from Xiaomi, OPPO, and vivo's new models, leading to a decline in its market share. The report shows that Samsung's year-on-year growth in Q4 2024 decreased by 2.7% compared to the previous year.

IDC's report highlights that Xiaomi was the fastest-growing smartphone manufacturer in Q4 2024. In the fourth quarter, Xiaomi launched its new flagship Xiaomi 15 series, with the Xiaomi 15 standard edition and Xiaomi 15 Pro performing remarkably well post-launch. Official data revealed that the Xiaomi 15 series reached a sales record of one million units within nine days of its launch, compared to nearly a month for the Xiaomi 14 series to achieve the same milestone.

(Source: Xiaomi)

Additionally, some of Xiaomi's well-regarded models also saw price adjustments in this quarter. For instance, the REDMI K70 Ultimate Edition had its price adjusted to start at 2082 yuan at the end of October 2024, a decrease of nearly 500 yuan from the original price, which spurred users to upgrade their devices.

Among the top five manufacturers, vivo's progress was substantial. Compared to Q4 2023, vivo achieved a 12.7% increase in market share, marking the most significant growth among the top five phone brands in the same quarter. In this quarter, vivo completed the iteration of its X series, launching three flagship models - X200, X200 Pro mini, and X200 Pro - the first to be equipped with MediaTek's Dimensity 9400 chip. Subsequently, in late November, vivo launched the vivo S20 series, completing the iteration of its flagship and mid-range lines.

(Source: vivo)

Strategically, vivo introduced the small-screen flagship X200 Pro Mini for the first time in its flagship series, which received positive market feedback post-launch. According to official news, the sales revenue of the vivo X200 series exceeded 2 billion yuan during its first sales period, breaking the previous generation's record.

Relatively, Transsion's performance in the fourth quarter was rather unremarkable. Although Transsion released the Infinix Hot 50 Pro+ (the world's thinnest 3D curved smartphone), itel S25, and the first small folding screen phone Infinix Zero Flip in the fourth quarter, overall, there was not much innovation, adhering mainly to the cost-effective approach. Additionally, Transsion did not follow the rhythm of Chinese mainstream manufacturers by releasing a new flagship phone in this quarter, reducing its market attention.

(Source: Infinix)

Overall, the performance of various brands in Q4 2024 was largely as expected. Xiaomi and vivo showed significant growth due to their new flagships. Although Transsion's growth slowed down, it remained stable in the top five. Samsung, which did not release a new flagship, and Apple, which had a mediocre reputation, were significantly impacted. It is evident that as Chinese phone manufacturers continue to exert their influence, Samsung and Apple need to adopt a more proactive approach to maintain their market position.

Chinese phone manufacturers are thriving, all thanks to AI and imaging?

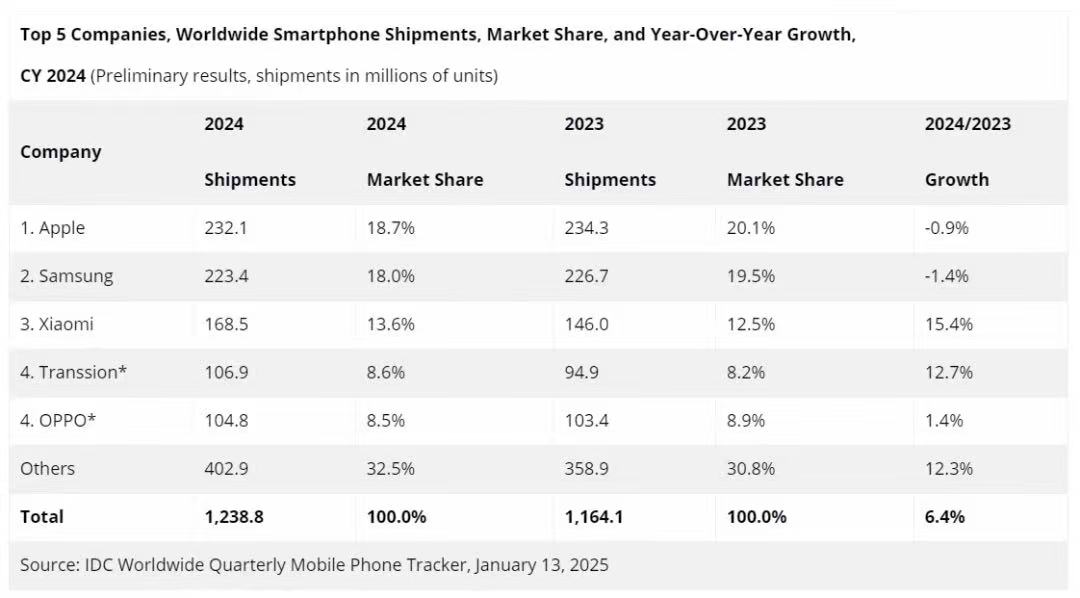

Market research firm IDC mentioned in its 2024 smartphone market report that 2024 was a landmark year for Chinese phone manufacturers. The comprehensive smartphone shipment report for the entire year 2024 shows that Apple, Samsung, Xiaomi, Transsion, and OPPO ranked top five, with Chinese manufacturers accounting for 56% of the market share.

The two international phone manufacturers, Apple and Samsung, exhibited contrasting branding strategies in 2024. Samsung raised the banner of AI early in the year, using "Galaxy AI" as its new brand slogan and collaborating with Google to create a robust AI functionality and ecosystem. This made the Galaxy S24 series Samsung's best-selling flagship phone in recent years. In contrast, Apple did not publicly unveil Apple Intelligence until its WWDC in June, and even by the time of the iPhone 16 series launch in September, Apple's intelligence had not yet been successfully rolled out globally.

(Source: Apple)

Despite having contrasting strategies, both brands consistently maintained a declining market share trend. IDC's report shows that Apple's market share decreased by 0.9% in 2024, while Samsung's decreased by 1.4%, indicating similar performance. Lei believes that Samsung's decline is mainly due to its fixed new product release schedule, failing to make dynamic adjustments in line with the release of flagship chips. Especially in 2024, facing an abundance of flagship new products released in advance, Samsung obviously fell behind.

(Source: IDC)

Chinese phone brands were very active in 2024. Firstly, they adopted an AI strategy, with mainstream brands including Huawei, Xiaomi, Honor, vivo, OPPO, and Meizu having completed the transition from "OS+AI" to "AIOS". Secondly, they employed an imaging strategy, from OPPO's LivePhoto to Huawei's Red Maple Imaging, constantly refreshing consumers' perception of mobile imaging through innovation, thereby attracting more users to upgrade their devices.

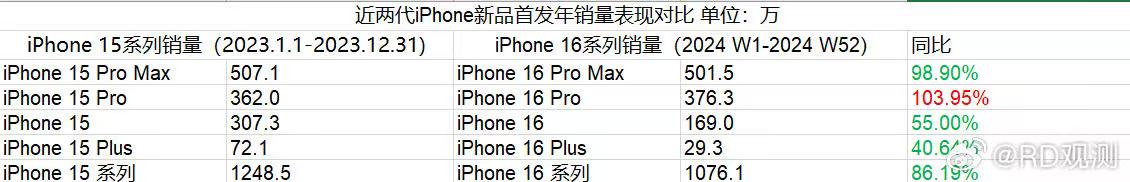

More importantly, this year, Chinese phone brands have joined the small-screen flagship race, such as the vivo X200 Pro Mini, OPPO Find X8, and Xiaomi 15, completely overshadowing the iPhone standard edition, which previously only had the advantage of a small screen. The sales comparison data of the iPhone 16 series released by Weibo RD Observation shows that the first-year sales of the iPhone 16 standard edition were only 55% of those of the iPhone 15 standard edition.

(Source: Weibo)

Among them, Xiaomi and OPPO showed the strongest performance. Xiaomi 15 innovatively introduced 40 color options, including Diamond Limited Edition and Bright Silver Edition. Coupled with the good reputation of Xiaomi's digital series in the past two years, it has formed a fixed image in the minds of ordinary consumers that "if you don't know what new phone to buy, choose Xiaomi's digital series," resulting in strong demand for this generation. OPPO, on the other hand, started from the OPPO AI phone concept at the beginning of the year and delved into "Apple-style" gameplay to attract young consumers to upgrade their devices.

As Chinese phone manufacturers continue to try new approaches and open up new racetracks, the impact on relatively conservative and traditional international manufacturers will further increase. 2025 is likely to be a year of significant reshuffling in the mobile phone market.

Major Reshuffling in the Mobile Phone Market in 2025: Some Thrive, While Others Lag Behind

Judging from the overall performance of the mobile phone market in 2024, the two international brands, Apple and Samsung, began to gradually fall behind, while Chinese phone brands grew rapidly through innovation, accounting for over half of the market share for the first time.

At the critical juncture of the reshuffling of the global smartphone market, the pressure on Apple and Samsung is gradually emerging, but the hope for a turnaround may lie in AI technology. In response to the increasingly competitive market, Apple and Samsung are accelerating their AI layouts in different ways, which is not only their current biggest breakthrough but may also determine their future position in the market.

Apple recently established a new company in Shanghai named Apple Technology Development (Shanghai) Co., Ltd. According to public information, the company's business scope covers software development, big data services, data processing, and storage support services. Industry insiders analyze that this may be a crucial step for Apple to accelerate the localization of Apple Intelligence.

Although Apple Intelligence was highly anticipated when it debuted at WWDC, its global rollout progress has been relatively slow. Apple's establishment of an AI-related company in China indicates that it is trying to enhance its AI capabilities through a localization strategy to improve user experience, especially to further solidify its position in the world's largest smartphone consumer market.

(Source: Apple)

Samsung chose a different strategy. According to the blogger Bing Yuzhou on Weibo, its upcoming Galaxy S25 series will come with the official version of One UI 7, debuting a series of powerful AI features. Notably, the new generation of Bixby voice assistant will integrate large language models, bringing a more intelligent voice interaction experience. Additionally, Samsung plans to add more productivity tools to its AI ecosystem, such as smart task suggestions and voice-driven document editing functions, aiming to further deepen the connection between mobile phones and daily work through AI.

(Source: X)

However, whether it's Apple's localization strategy or Samsung's AI innovation, their effectiveness in the short term remains to be seen. Compared with Chinese phone manufacturers, Apple and Samsung still appear relatively conservative in the speed of promoting their AI ecosystems. Chinese manufacturers have not only completed the comprehensive transformation from "OS+AI" to "AIOS" but have also achieved efficient iteration between user experience and market feedback, further consolidating their market position. Lei believes that in the coming year, if Samsung and Apple fail to show enough sincerity, such as stagnating in imaging and AI, it will be difficult for them to maintain their current market position.

In the next year, there will still be many variables in the smartphone market. Whether Apple and Samsung can break the current growth dilemma with AI will depend on their ability to find a better balance between technological innovation and user needs. At the same time, the rapid progress of Chinese phone manufacturers will continue to force international manufacturers to make more changes. As consumers, the competition between brands can spur the creation and implementation of more excellent features and hardware, which is undoubtedly a positive development.

Source: Lei Technology