HR President Takes Helm: Is Honor's IPO a Game of Nerves?

![]() 01/20 2025

01/20 2025

![]() 744

744

By Leon, Edited by cc Sun Congying

After two days of rumors, company denials, and silence from the involved parties, Honor finally announced Zhao Ming's resignation, marking the mobile phone industry's first major personnel change of the year.

On January 17, Honor announced internally that Zhao Ming had submitted his resignation as CEO and related positions due to health reasons. After thorough discussion and consideration, the board decided to respect Zhao Ming's wishes and accept his resignation, appointing Li Jian as the new CEO.

Subsequently, Zhao Ming published an open letter titled "Goodbye, My Brothers and Sisters at Honor" on the company's internal network, expressing regret: "Choosing to let go and leave Honor is the most difficult decision I have ever made. There will be no more 'Ming Brother' press conferences." Zhao Ming also mentioned that "the company's four years of growth require systematic solutions to certain problems," hinting at the challenges behind his resignation.

Since being spun off from Huawei in November 2020, Honor has been effectively controlled by the Shenzhen State-owned Assets Supervision and Administration Commission. In December 2024, Honor's operating entity, "Honor Device Co., Ltd.," legally transformed into a joint-stock company, namely "Honor Terminal Co., Ltd." (hereinafter referred to as Honor Terminal). This completion of the shareholding reform signifies a significant step forward in Honor's IPO journey.

Generally, companies avoid significant personnel changes before an IPO. The China Securities Regulatory Commission stipulates that "there should be no significant changes in the issuer's main business, directors, and senior executives within the last three years, and no changes in the actual controller." Additionally, the ChiNext board has a two-year rule.

Why did Honor, eager to go public, rush to replace its seasoned veteran who has been with the brand for ten years? What are the "systematic issues" mentioned by Zhao Ming?

A Huawei technology veteran who built the first "internet phone" brand in ten years

Zhao Ming's significance to Honor is akin to Yu Chengdong's to Huawei Terminals, making him a "soul figure."

Born in Shanghai in 1973, Zhao Ming holds a master's degree in communication and electronic systems from Shanghai Jiao Tong University. In 1998, he joined Huawei as an algorithm research engineer and later held various positions, including president of Huawei's CDMA/WiMAX/TD product line, head of the Global Wireless Solutions Sales Department, representative of the Italian representative office, and vice president of the Western Europe region. He is a true Huawei technology veteran.

For Zhao Ming, the turning point in his career came in 2015. At that time, Honor, a sub-brand of Huawei, had only been established for two years, positioning itself as an "internet phone" brand, mainly competing with brands like Xiaomi. In March 2015, Zhao Ming took over as president of Honor, taking full responsibility for its business and appearing at the Honor 7i launch event.

Unlike Yu Chengdong's assertive style, Zhao Ming's approach at launch events was more cordial and engaging, aligning well with Honor's youthful positioning. With a strong technical background and marketing skills, Zhao Ming created many memorable moments at launch events, such as dropping phones and ordering 2,000 cups of milk tea. He was also willing to interact with netizens on social media, significantly enhancing Honor's influence among young people. Zhao Ming has a large fan base on Weibo, and some netizens have even stated that if Zhao Ming leaves Honor, they will switch to Huawei.

Under Zhao Ming's leadership, Honor gradually carved its own path. In 2016, the Honor Magic was officially launched, featuring a stunning all-curved design and introducing the "Magic Live" function, which can be seen as the prototype of an AI phone, supporting contextual awareness and other auxiliary functions.

With the rise of the "internet phone" concept, major mobile phone manufacturers launched sub-brands, such as Redmi and Realme, but this did not affect Honor's position. Honor's advantages can be divided into two parts: first, sharing Huawei's technology and resources, giving it advantages in technology, supply chain, and channels; second, its positioning, which is clearly distinguished from Huawei's business-oriented route, maximizing its own style and avoiding direct competition with the Huawei brand.

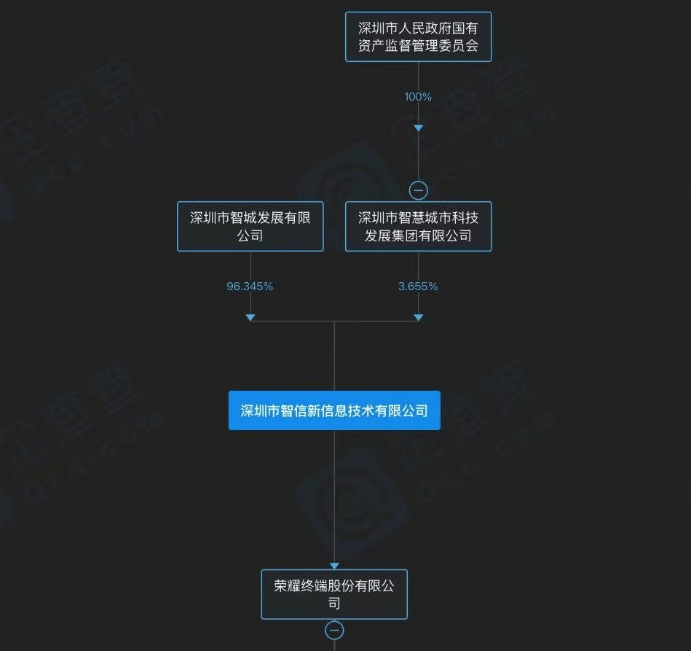

However, in 2020, due to well-known reasons, Huawei faced a chip shortage and ultimately had to sell its entire Honor business to Shenzhen Zhixin New Information Technology Co., Ltd., leading to the establishment of the operating entity Honor Terminal Co., Ltd. Zhao Ming also resigned from Huawei to become the CEO of Honor.

After the reorganization, Honor's shareholders with supply chain connections gained more influence

After being spun off, Honor embarked on its path to financing and listing. In December 2021, Honor initiated its Pre-A round of funding, with investors including Kunpeng Capital, Shenzhen Xingmeng Information Technology Partnership (Limited Partnership), Chunya United Technology Partnership (Limited Partnership), and Shenzhen Pengcheng New Information Technology Partnership (Limited Partnership). The largest shareholder behind them is the Shenzhen State-owned Assets Supervision and Administration Commission.

Additionally, Shenzhen Xingmeng Information Technology Partnership (Limited Partnership) is primarily jointly owned by mobile phone channel dealers such as Gongqingcheng Aishide Innovation Investment Partnership (Limited Partnership), Tianyin Communications, China Electronics Technology Taili Communications Technology Co., Ltd., and China Post and Telecommunications Appliance Group Co., Ltd. Most of these are also Huawei dealers and constitute the second largest type of shareholder for Honor.

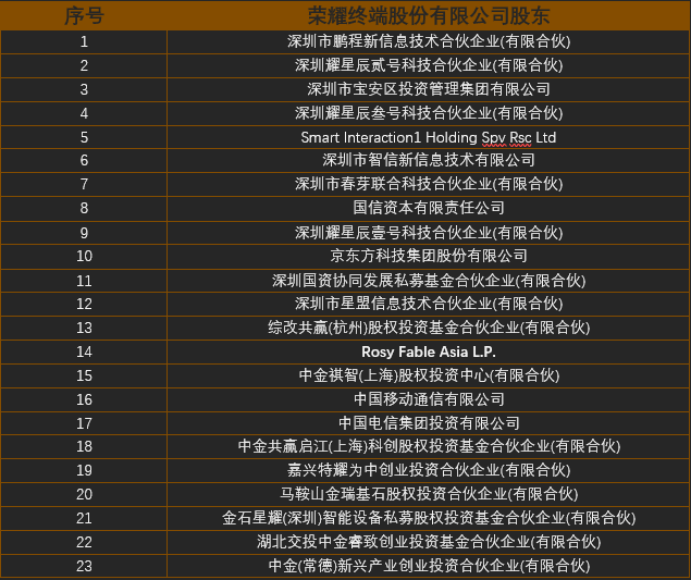

Starting in 2022, shareholders such as BOE, CICC, and Guosen Securities emerged in Honor's A round of funding, followed by state-owned enterprises such as China Mobile and China Telecom. As of January 19, 2025, Honor Terminal Co., Ltd. has a total of 23 shareholders, involving industries including investment, communications, upstream of the industrial chain, channel providers, and dealers.

In terms of shareholding structure, Shenzhen Zhixin New Information Technology Co., Ltd., as the acquirer, is the major shareholder of Honor Terminal Co., Ltd., with the Shenzhen State-owned Assets Supervision and Administration Commission as its controlling shareholder. Additionally, Honor Terminal has 26 member enterprises under its umbrella, with Zhao Ming serving as the chairman of Beijing Honor Terminal Co., Ltd. As of press time, Qichacha showed no changes in information.

In November 2023, Honor Terminal underwent its first major personnel change, with Wu Hui taking over as chairman from Wan Biao. Similar to Zhao Ming, Wan Biao also has a Huawei background, having held positions such as president of Huawei's wireless product line, president of the terminal company, and COO of the consumer business. The new chairman, Wu Hui, has primarily worked in government agencies or state-owned enterprises, including the Shenzhen Municipal Party Committee General Office and the Hubei Provincial Government, and does not have experience in the mobile phone industry.

This move by Honor Terminal was widely interpreted as giving CEO Zhao Ming more room to maneuver, leading the company's transformation from the business end and improving performance as soon as possible. Correspondingly, Wu Hui, with his rich government work experience, can play a significant role in government-enterprise communication and financing, forming a strong alliance to lead Honor to complete its IPO as soon as possible.

However, the sluggish global mobile phone market, insufficient domestic demand, and fierce competition have combined to cause Honor's growth to fall below expectations, sowing the seeds for Zhao Ming's departure.

A brief period of glory after Honor's successful transformation

In the initial stages of independence, Honor needed to fully sever its ties with Huawei, including dependencies on technology and the industrial chain. In the four years after independence, Zhao Ming, as CEO, made two strategic decisions: reshaping the brand image and building platform-level AI.

Just after being spun off from Huawei in 2020, Honor's domestic market share fell to 4%, marking its darkest moment. The following year, Honor held its first post-independence launch event, defining the positioning and strategic direction of the new Honor: building a full-scene, omni-channel, and all-population service, thereby shedding the label of an internet brand. Through deep cooperation with giants such as Qualcomm, Microsoft, AMD, Intel, and Samsung, coupled with the support of channel shareholders, Honor used a "blitzkrieg" approach to quickly launch new products and distribute them, winning the first battle after independence. According to IDC data, in 2021, Honor shipped 38.6 million mobile phones, accounting for 11.7% of the market share, returning to fifth place in China.

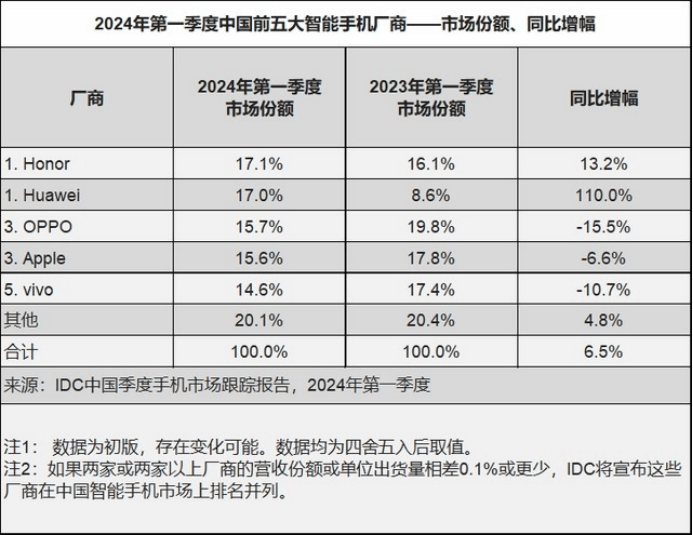

In 2022, Honor continued to maintain its growth momentum, with shipments increasing by 34.4% year-on-year, becoming the only brand among the top five in China's mobile phone market to maintain positive growth. Thanks to the addition of shareholders such as BOE and China Mobile, Honor also received further support in the industrial chain and shipments, taking a 17.1% market share in the first quarter of 2024, briefly becoming the number one mobile phone brand in terms of domestic market share.

In terms of AI, Zhao Ming adhered to the strategy of "building platform-level AI," which was quite aggressive. At the Magic7 launch event, Zhao Ming used YOYO, the intelligent agent, to order 2,000 cups of drinks via voice. YOYO then took over the phone, simulating the user's fingers to click and start ordering on the food delivery app. It is reported that Honor spent 10 billion yuan to reconstruct the MagicOS operating system. Although there may be controversy over user data invocation, the experience is very advanced, with even Zhou Hongyi praising the user experience of Honor YOYO as much better than Apple's Siri.

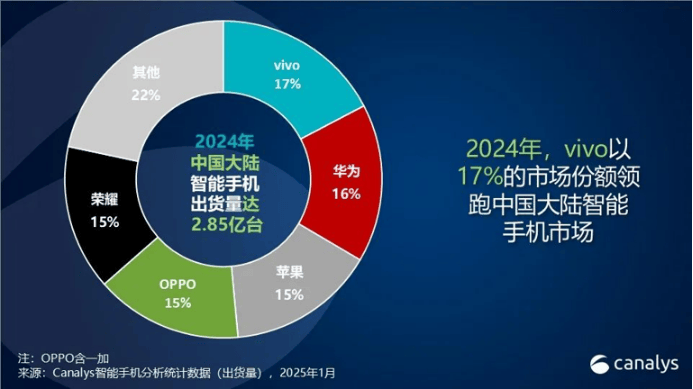

Unfortunately, due to the timing of the Magic7 series launch at the end of 2024, it did not contribute to sales in the second and third quarters. Data shows that Honor's market share in the second quarter fell by 3.7% year-on-year and by 22.5% year-on-year in the third quarter, ultimately ranking fifth with a 15% domestic market share for the entire year of 2024.

Looking at the international market, Honor achieved a self-breakthrough in 2024, with overseas shipments accounting for 50% of the total for the first time, but it did not surpass its competitors. According to Counterpoint statistics, the global mobile phone shipments ranking in 2024 was Samsung, Apple, Xiaomi, OPPO, and vivo, with Honor failing to crack the top five. Obviously, this performance is not ideal for a company seeking to list on the A-share market.

Lei Jun once said in 2024, "The global competition in mobile phones is basically over." Considering geopolitics and global trade trends, Lei Jun's view is not without merit. The global top three pattern of Samsung, Apple, and Xiaomi has taken shape, intensifying the Matthew Effect, with the market gradually converging towards the top players. The market space left for other brands will only get smaller, and competition will become even fiercer.

Can an HR leader as CEO break the deadlock?

Li Jian, who succeeded Zhao Ming as Honor's CEO, also has a Huawei background but, unlike Zhao Ming and Yu Chengdong, has not globally managed the mobile phone business line. According to public information, Li Jian joined Huawei in 2001, working in management and sales positions, and has served as a supervisor of Huawei since 2017.

In 2021, Li Jian joined Honor Terminal, successively holding positions such as vice chairman, director, and president of the Human Resources Department. Since Li Jian is primarily responsible for functional departments, some Honor employees have told the media that "Li Jian's impression within Honor is mainly that of an HR director, with low external recognition, and it is unclear whether he is suitable for external affairs."

Simultaneously, this senior management adjustment also involves other key positions: the former president of the China region, Wang Ban, was transferred to vice president of overseas and platform business, and the former president of Honor's Full Scenario Business Department, Ni Jiayue, was transferred to president of the China region. Both are former right-hand men of Zhao Ming. The new personnel appointments demonstrate Honor's senior management's purpose: stabilize the domestic market and focus on overseas expansion.

Regarding the sudden reason behind Zhao Ming's resignation, there are reports that Zhao Ming hoped to gain greater power in personnel appointments but was refused by the board, leading to Zhao Ming's resignation as a form of pressure, ultimately resulting in the current outcome. Regardless of whether this rumor is true, the fact remains that Honor is under pressure to grow, and Li Jian urgently needs to address the "systematic issues" mentioned by Zhao Ming, which is a prerequisite for Honor's IPO.

Firstly, there are the disadvantages of deeply intertwined channels. As previously mentioned, Honor's shareholder base includes numerous channel providers and dealers, which initially facilitated a swift rebuilding of channels and offline sales in the early stages of its independence. However, this strategy of tightly binding channels is now becoming increasingly unmanageable.

Multiple media outlets, including the Southern Daily, have reported on Honor's high inventory challenges. Initially, channel providers and dealers purchased large quantities of goods to bolster sales figures, aiming to swiftly introduce Honor to the market. However, this approach resembles quenching thirst with poison. Overstocking results in highly volatile offline prices for Honor phones, and the sharp price drops during destocking disrupt the entire pricing system. In the long run, consumers are likely to shy away from Honor phones that depreciate rapidly. Addressing channel distribution issues and balancing the interests of various shareholders will be the new CEO, Li Jian's, top priority.

Secondly, there is the matter of stabilizing morale. According to Honor employees, shortly before Zhao Ming's resignation, the company embarked on a "cost reduction and efficiency enhancement" drive, leading to the cancellation of several high-cost projects. Additionally, while employee contracts traditionally ran for four years, some employees are now approaching the end of their contracts without receiving renewal emails, effectively amounting to disguised layoffs. Employees are the bedrock of any company, influencing every critical aspect of product development, marketing, sales, and after-sales service. An unstable corporate environment undoubtedly hampers the enhancement of product capabilities.

From a broader market perspective, 2025 presents ample opportunities. Global mobile phone market sales surged by 6.4% year-on-year in 2024, signaling a market recovery. Canalys research analyst Zhong Xiaolei opines that China's market environment is more favorable globally, coupled with consumer subsidy policies, providing phone manufacturers with a prime opportunity to boost sales.

It is reported that national subsidies for mobile phones, tablets, and smartwatches will officially commence on January 20, offering a 15% subsidy on items priced up to 6000 yuan, with a maximum subsidy of 500 yuan per item. Sources indicate that multiple phone manufacturers have hastily prepared over ten million units to vie for market share immediately following the commencement of national subsidies.