RDI Robotics to Launch IPO in Hong Kong: Can Its Dual-Track Strategy Succeed?

![]() 08/08 2025

08/08 2025

![]() 544

544

Summary: RDI Robotics, a global leader in visual perception smart robots, is set to launch an IPO in Hong Kong.

The company has generated nearly RMB 1 billion in revenue over the past three years, distinguishing itself in the lawn mowing robot sector. However, it has incurred losses totaling nearly RMB 200 million during this period and seen a decline in gross profit margins, posing significant pressure.

The smart robot market is still nascent, with players quickly entering the field. The challenges of RDI Robotics' dual-track strategy remain, necessitating the maintenance of customer stability in its core business while accelerating the volume of lawn mowing robots.

Below is the full text:

RDI Robotics to Launch IPO in Hong Kong

On May 30, 2025, Shenzhen RDI Robotics Co., Ltd. submitted its prospectus to the Hong Kong Stock Exchange, aiming for a listing on the Main Board. The joint sponsors are Haitong International and Guotai Junan International.

Founded in 2017, the company is headquartered in Nanshan District, Shenzhen, and was established by Zhou Wei and Guo Gaihua, alumni of Huazhong University of Science and Technology.

Chairman Zhou Wei is a serial entrepreneur. In 2008, he and Guo Gaihua founded Wuhan Ruobite Robotics Co., Ltd., focusing on special-purpose robots for commercial clients. In 2012, they established Lehang Tianxia in Shenzhen, specializing in intelligent balance vehicles.

Currently, Zhou Wei serves as Chairman of RDI Robotics, overseeing strategic planning, business policies, and capital operations. At 38, he was recognized as one of Forbes China's 30 Under 30 entrepreneurs in 2015 and named a Youth Leader in Strategic Emerging Industries in the Guangdong-Hong Kong-Macao Greater Bay Area in 2022.

Co-founder Guo Gaihua is responsible for strategic planning, R&D management, business direction, and daily decision-making. In 2018, he received the title of Shenzhen Local Leading Talent from the Shenzhen Human Resources and Social Security Bureau. Together, they hold approximately 31.96% of the company's shares, reflecting a concentrated shareholding structure.

To date, RDI Robotics has completed multiple rounds of financing, attracting investors such as Huaye Tiancheng, Source Code Capital, Mingshi Investment, Yuanjing Capital, China Unicom-CIC, and Jiuyu Capital.

Notably, Yuanjing Dingheng, affiliated with Alibaba CEO Wu Yongming, participated in the C round of financing and currently holds a 1.79% stake.

As an alumni enterprise of Huazhong University of Science and Technology, investment institution Huaye Tiancheng, co-founded by Sun Yelin and Yang Huajun, has supported RDI Robotics from the A round of financing to its current listing efforts.

According to data from CIC, in 2024, RDI Robotics became the world's largest smart robot company specializing in visual perception technology, with over 6 million smart robots equipped with its technology.

From 2022 to 2024, RDI Robotics served seven of the world's top ten household service robot companies and all five of the world's top commercial service robot companies.

Revenue Approaching RMB 1 Billion, Yet Profitability Remains Under Pressure

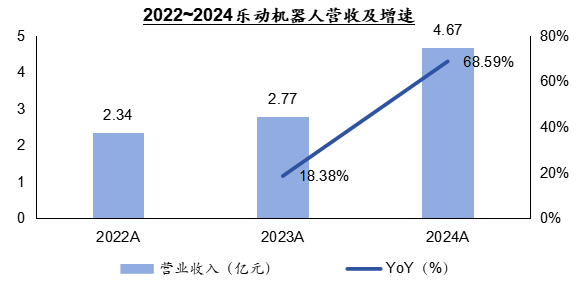

The prospectus reveals that from 2022 to 2024, RDI Robotics' revenue amounted to RMB 234 million, RMB 277 million, and RMB 467 million, respectively, marking a compound annual growth rate of 41.37%.

Data Source: RDI Robotics Prospectus

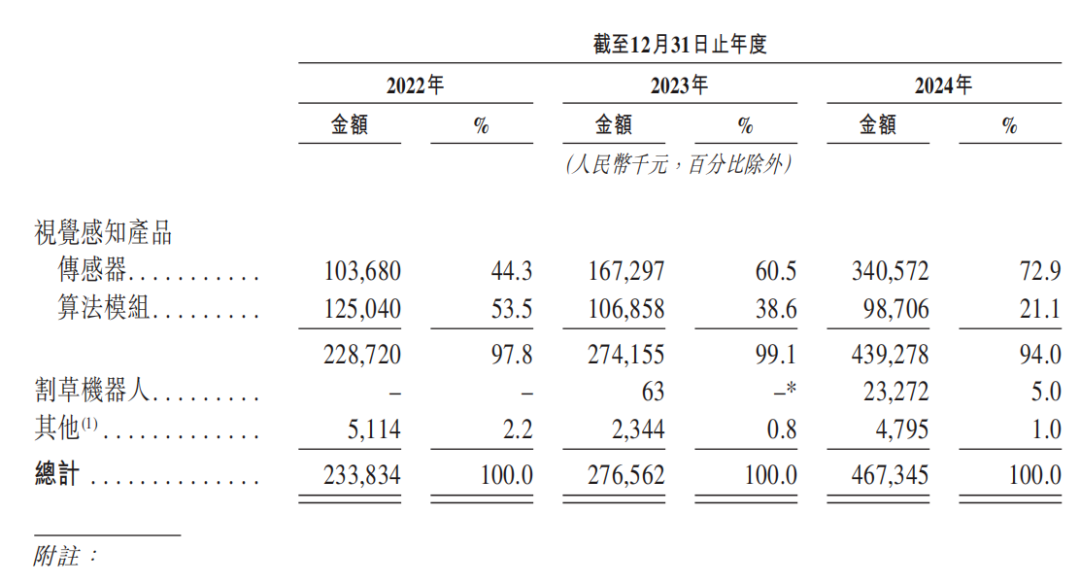

Currently, RDI Robotics' business is primarily divided into two segments: visual perception products and lawn mowing robots.

According to the prospectus, the company's primary growth driver remains visual perception products, encompassing sensors and algorithm modules. In 2024, these two segments collectively contributed RMB 439 million in revenue, accounting for 94.0% of the company's overall business.

In recent years, the company has accelerated its focus on the second growth curve. Last year, the lawn mowing robot business generated RMB 4.795 million in revenue, accounting for 4.98% of the company's total business. The second-generation lawn mowing robots are expected to commence mass production in 2025, with the success of this product line being crucial for driving the company's revenue growth. Given the current competitive market, the company's market expansion capabilities will be vital in attracting initial customers.

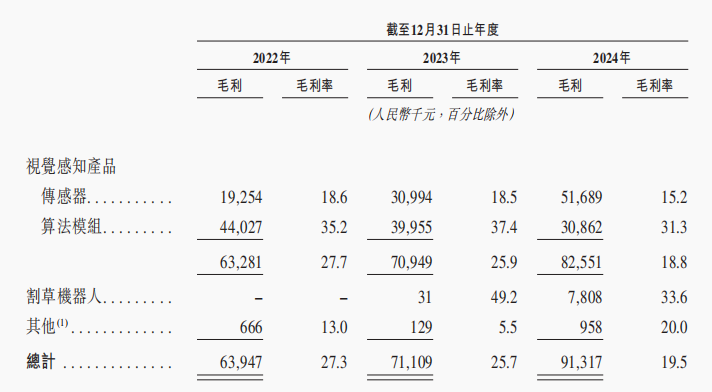

During the reporting period, sensor products exhibited gross profit margins of 18.6%, 18.5%, and 15.2%, respectively. In contrast, algorithm modules recorded higher gross profit margins during the same period, at 35.2%, 37.4%, and 31.3%, respectively.

However, as the revenue share of the algorithm module business has declined annually, the company's overall gross profit margin has also shown a decreasing trend during the reporting period, from 27.3% in 2022 to 19.5% in 2024.

Although the gross profit margin of the company's lawn mowing robots reached 49.2% and 33.6% in 2023 and 2024, respectively, this segment accounts for a relatively low proportion of the business and has yet to drive an increase in the overall gross profit margin.

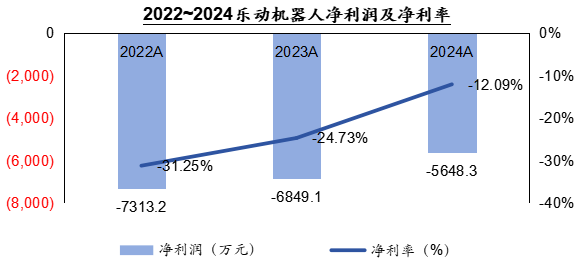

Apart from gross profit margin, the company's net profit has not yet turned positive.

From 2022 to 2024, RDI Robotics' net losses amounted to RMB 73.132 million, RMB 68.491 million, and RMB 56.483 million, respectively, indicating a narrowing of losses but still significant profitability pressures.

Data Source: RDI Robotics Prospectus

Additionally, the company's current liabilities have increased annually. From 2022 to 2024, the company's current liabilities were RMB 84.752 million, RMB 139 million, and RMB 242 million, respectively, while its cash and cash equivalents were RMB 242 million, RMB 27.585 million, and RMB 46.95 million, respectively, suggesting certain debt repayment pressures.

In terms of customer composition, during the reporting period, RDI Robotics' revenue from its top five customers accounted for 67.4%, 65.1%, and 54.3% of its total revenue, respectively. The largest customer contributed 28.3%, 16.5%, and 15.3% of its revenue, respectively, indicating a high degree of customer concentration.

In the future, RDI Robotics must focus on turning its net profit positive, enhancing its cash flow support capabilities, and ensuring revenue stability.

The Smart Robot Market: A Battlefield for Giants

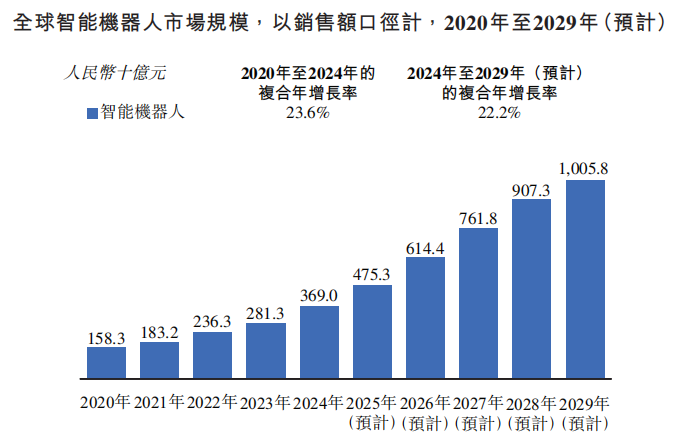

According to CIC data, the global smart robot market was valued at RMB 369 billion in 2024, with a compound annual growth rate of 23.6% compared to RMB 158.3 billion in 2020. It is estimated that the global smart robot market will reach RMB 1,005.8 billion by 2029, with a compound annual growth rate of approximately 22.2%, indicating substantial market potential.

Behind the booming smart robot sector, players are nearly simultaneously eyeing this lucrative market.

This means that as the market grows in volume, it will soon demand high quality, necessitating continuous performance improvements in smart robots' perception, decision-making, and execution processes, from underlying technology to upper-level application implementation.

In 2025, RDI Robotics achieved mass production of its second-generation intelligent lawn mowing robots, incorporating AI large model algorithms. From the beginning of this year to May 23, its total sales of intelligent lawn mowing robots exceeded 15,000 units.

Based on its business layout in visual perception technology, the company's visual products can better meet the application needs of lawn mowing robots, leveraging integrated growth and competitive strength.

However, in the field of visual perception technology, the market's main participants also include established players such as Hesai Technology and RoboSense, limiting the company's market share.

Currently, the application of lawn mowing robots in China is limited, while overseas markets present significant demand potential. RDI Robotics is further expanding its overseas presence.

The prospectus shows that RDI Robotics' business has covered end-users in over 50 countries and regions globally, establishing in-depth cooperation with over 300 robot companies worldwide.

However, in terms of revenue performance, the company's overseas revenue currently accounts for a relatively low proportion, necessitating further attention to market development for the second growth curve.

Additionally, companies such as Ecovacs, Dreame, and Anker Innovation have already established a certain degree of competitiveness in both domestic and overseas markets with their lawn mowing robots. As a latecomer, RDI Robotics must accelerate its catch-up efforts after achieving economies of scale.

From a business model perspective, the company's entry into the lawn mowing robot market is indeed beneficial for improving gross profit margins and increasing market competitiveness in this segment in the future. However, there may be a potential crisis where some customers turn into competitors, negatively impacting the main business against the backdrop of the company's second growth curve not yet taking off.

The smart robot market holds both potential and hidden concerns.

Closing Remarks

Currently, the smart robot market has yet to form high levels of competition. With the market landscape unsettled, everyone is rushing to gain speed.

Beyond speed, profitability, mass production capabilities, and product quality are core indicators for evaluating related companies in the market.

In the future, RDI Robotics will continue to face challenges with its dual-track strategy, necessitating the maintenance of customer stability in its core business while accelerating the volume of lawn mowing robots.

- XINLIU -