Renesas Electronics FY2024: Revenue and Profit Decline, Strategies for Transformation

![]() 02/11 2025

02/11 2025

![]() 744

744

Produced by Zhineng Zhixin

Renesas Electronics has released its financial report for FY2024, revealing a mixed picture:

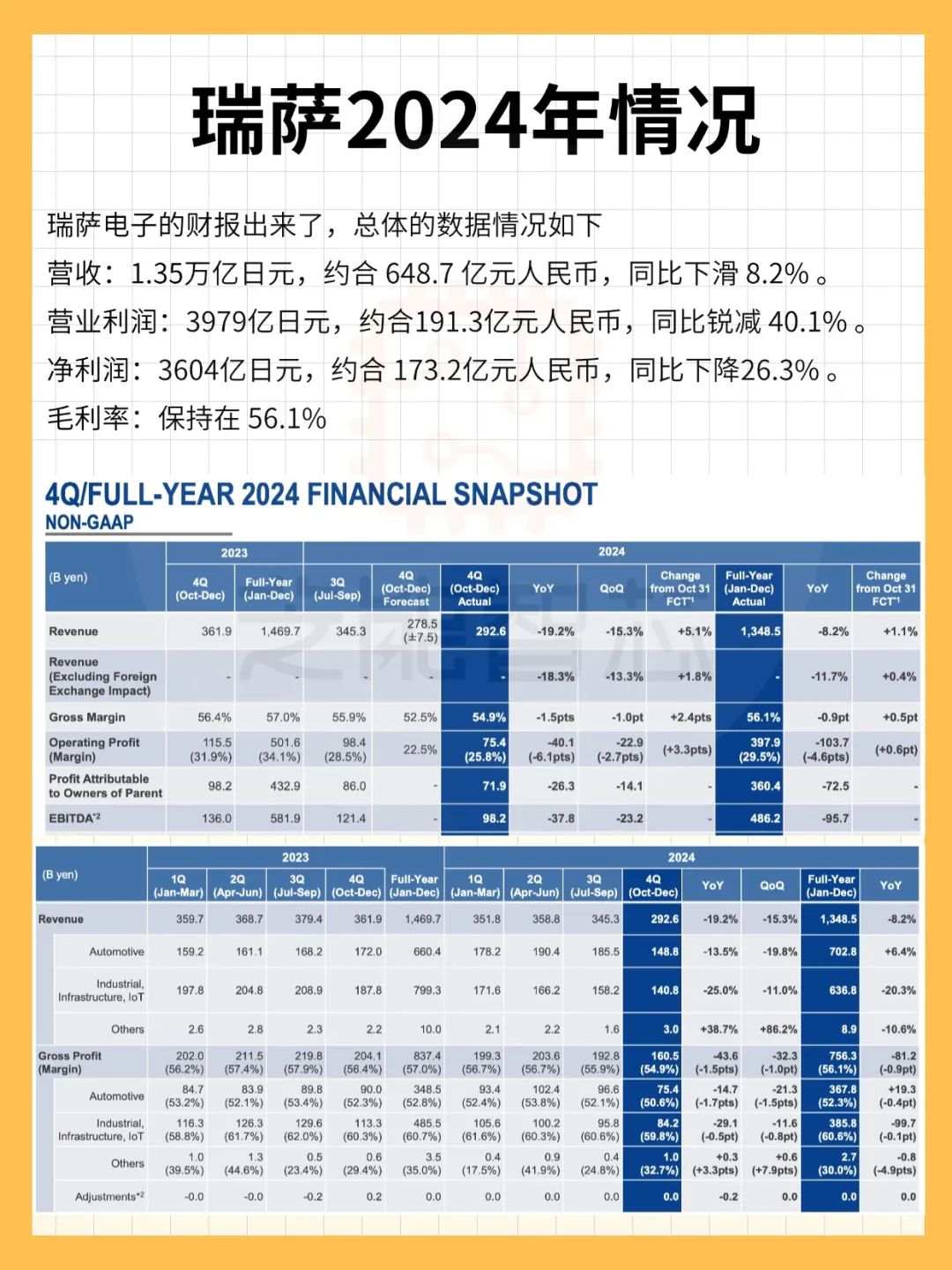

● FY2024 Revenue: 1.35 trillion yen (approximately 64.87 billion yuan), down 8.2% year-on-year.

● FY2024 Operating Profit: 397.9 billion yen (approximately 19.13 billion yuan), a steep drop of 40.1% year-on-year.

● FY2024 Net Profit: 360.4 billion yen (approximately 17.32 billion yuan), down 26.3% year-on-year.

● FY2024 Gross Margin: Maintained at 56.1%.

As a key player in the global automotive chip market, Renesas Electronics faced significant challenges in FY2024, with declines in revenue and profit highlighting the impact of market volatility and industry downturn.

In this article, we delve into Renesas Electronics' current situation, challenges, and future potential through an analysis of its financial overview, business segments, and key financial indicators.

Part 1

Financial Overview:

Declining Revenue and Profit Amidst Cyclical Industry Challenges

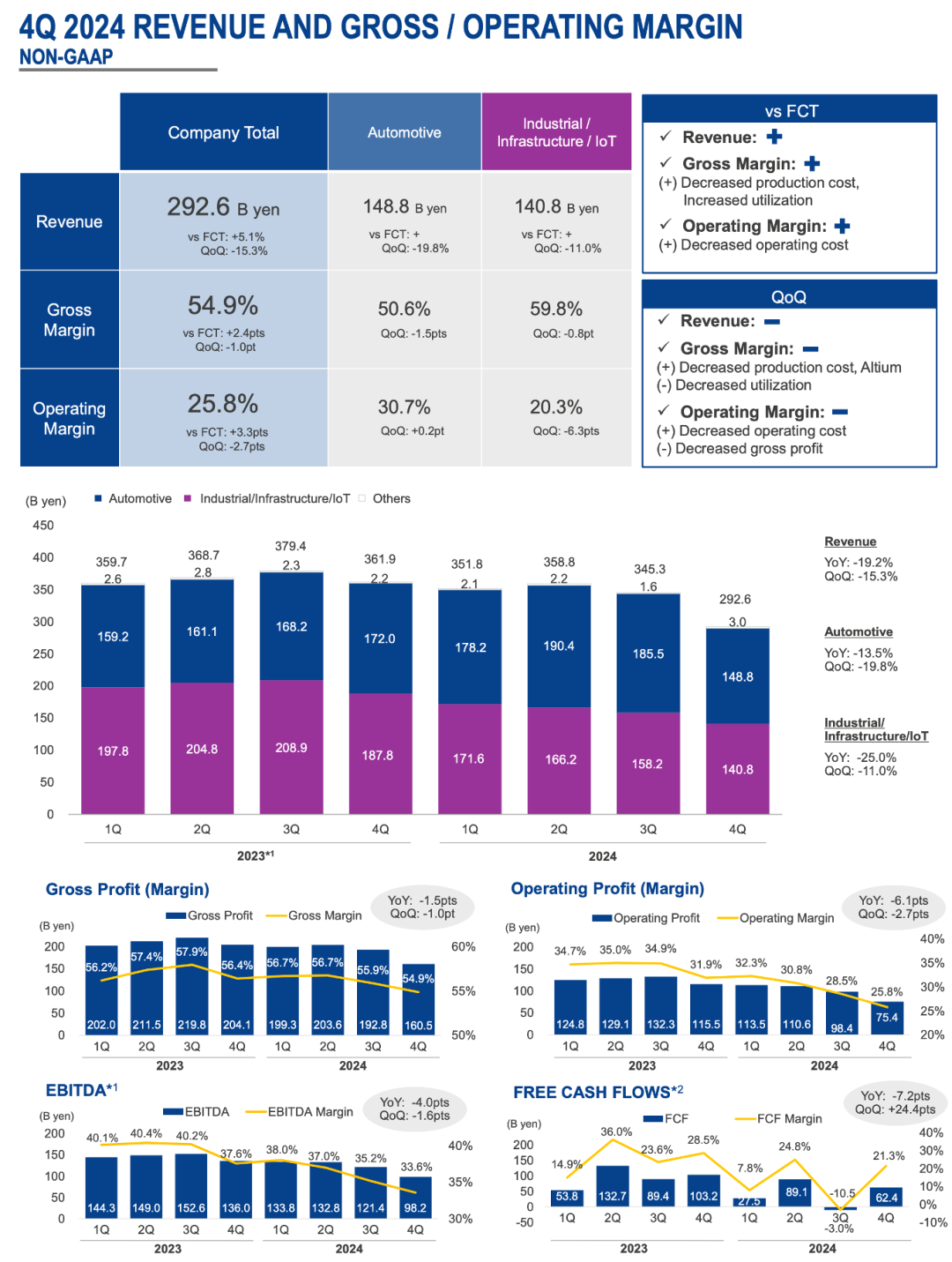

● Renesas Electronics' total revenue for FY2024 stood at 1.3485 trillion yen, an 8.2% decline from FY2023. Excluding currency effects, the actual decrease amounted to 11.7%, reflecting significant operational pressure amidst a global economic slowdown and weak market demand.

● More alarmingly, the company's operating profit plummeted from 501.6 billion yen in the previous fiscal year to 397.9 billion yen, with the operating profit margin dropping from 34.1% to 29.5%.

● The decline in net profit was even more pronounced, falling by 72.5 billion yen from 432.9 billion yen to 360.4 billion yen.

These financial declines underscore the difficulties faced by Renesas Electronics during the industry downturn, which was exacerbated by macroeconomic fluctuations, supply chain pressures, and subdued demand.

● Automotive Business: Stable Growth Amidst Intelligent and Electric Trends

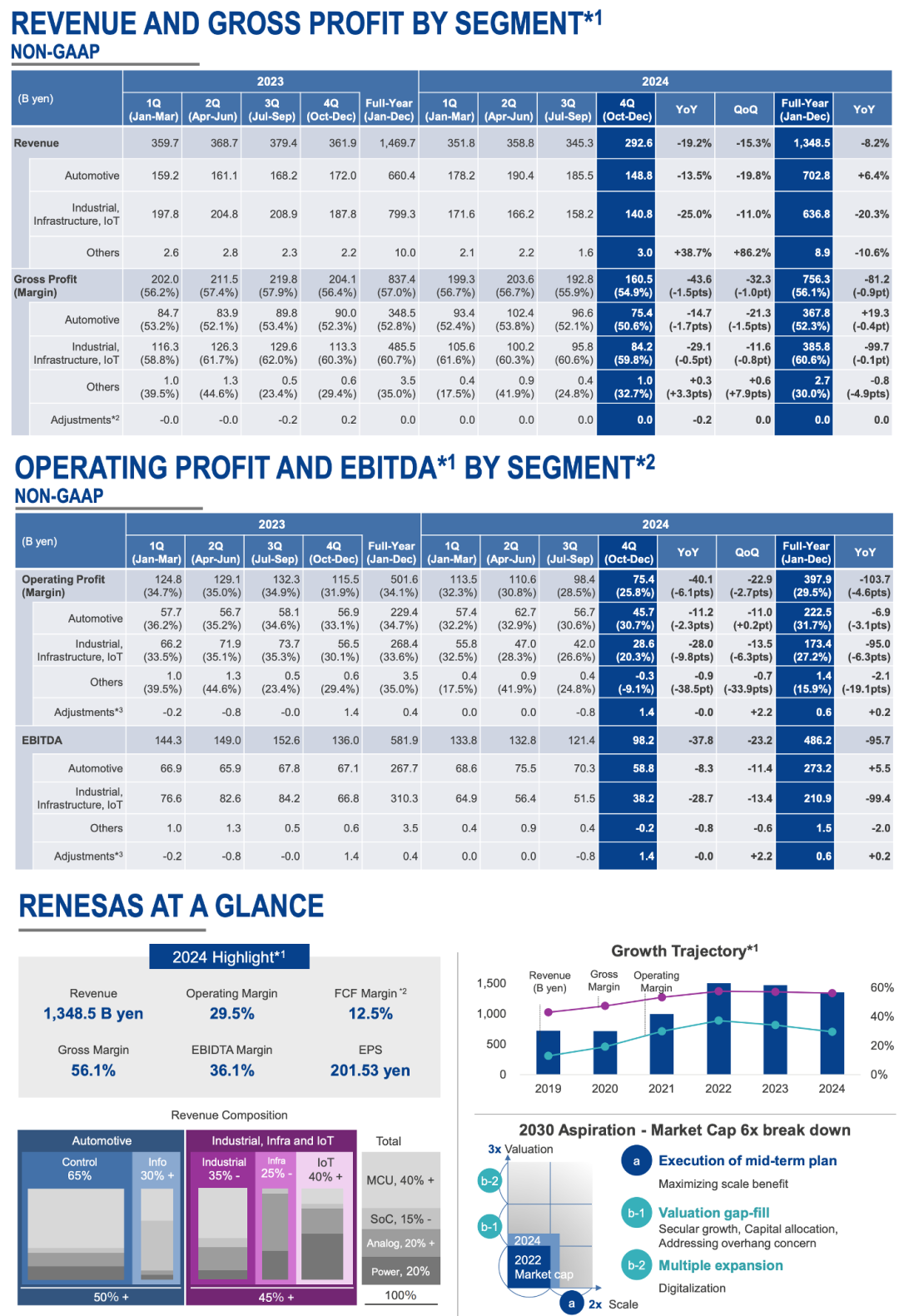

Despite the overall challenges, Renesas Electronics' automotive business, its core segment, demonstrated stable growth. FY2024 revenue in this segment reached 702.8 billion yen, up 6.4% year-on-year, driven by the recovery of the global automotive industry and the growing trend towards intelligent and electric vehicles.

Renesas capitalized on its strong technological foundation and market presence in areas such as intelligent driving and in-vehicle infotainment systems, benefiting from the surging demand for semiconductors in these domains.

However, regional market performances varied significantly.

◎ The European market, after adjusting inventories in Q4, is poised for a rebound in FY2025.

◎ The Japanese market saw moderate growth with some customer demand recovering, though it still fell short of expectations.

◎ The Chinese market experienced an early surge in demand due to the Spring Festival holiday, but a sequential decline is anticipated in Q1 FY2025. Nonetheless, with the increasing adoption of new energy vehicles, the Chinese market holds immense long-term growth potential.

● Industrial and IoT Business: Weak Demand and Inventory Adjustments Impact Revenue

In contrast to the automotive segment's steady growth, Renesas Electronics' industrial, infrastructure, and IoT (IIoT) business faced considerable pressure in FY2024, with full-year revenue declining by 20.3% to 636.8 billion yen.

This downturn was primarily due to the slowdown in global economic growth, weak market demand, and ongoing inventory adjustments.

Reduced corporate investment appetites led to decreased semiconductor demand in the industrial sector. Additionally, the process of inventory adjustments, particularly in the AI and cloud infrastructure sectors, significantly contributed to the revenue decline despite optimistic long-term prospects.

Renesas Electronics' gross margin slipped slightly from 57.0% to 56.1% in FY2024, with the fourth-quarter gross margin further decreasing to 54.9%.

This decline was primarily attributed to changes in product mix, particularly in the IIoT segment where the proportion of lower-margin products increased, and reduced capacity utilization due to some production lines operating below full capacity. While Renesas made efforts to control costs by adjusting sales and production plans, it could not effectively reverse the downward trend in gross margin.

The net profit margin dropped more significantly, from 29.5% to 26.7%, due to continuous investments in R&D and the amortization of acquisition costs. These investments, while putting pressure on short-term profits, are expected to pave the way for future technological innovation and market expansion.

Renesas Electronics' asset base expanded in FY2024, with total assets rising from 3.167 trillion yen to 4.4904 trillion yen, mainly fueled by acquisition activities. The company significantly increased its intangible assets and goodwill through acquisitions of companies like Altium and Transphorm.

However, liabilities fluctuated significantly, with total liabilities increasing from 1.1614 trillion yen to 2.0474 trillion yen before slightly declining to 1.9481 trillion yen. The increase in interest-bearing liabilities led to a higher asset-liability ratio, indicating an increased reliance on borrowing.

By optimizing its capital structure, Renesas Electronics maintained a relatively stable financial position, enabling operational resilience amidst short-term challenges.

Part 2

Future Outlook:

Transformational Strategies and Technological Innovation Driving Long-term Growth

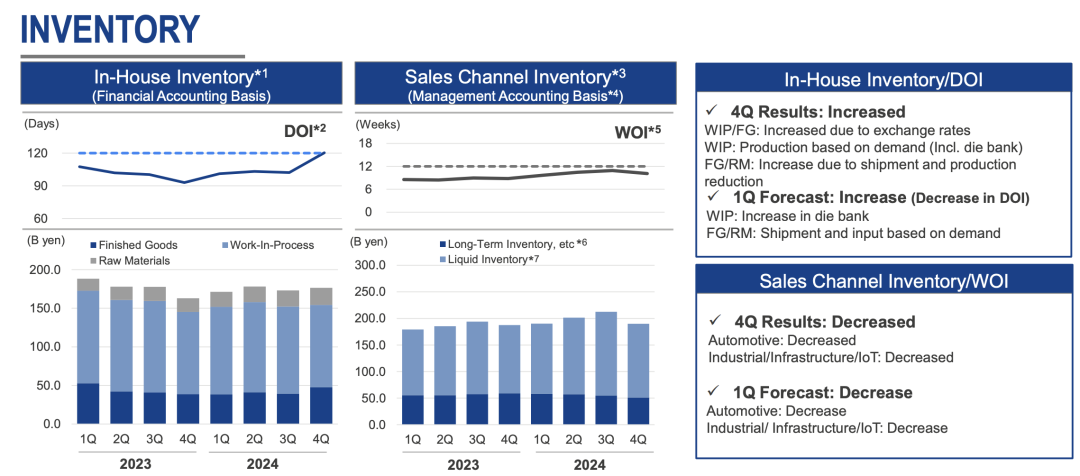

Inventory management was particularly crucial for Renesas Electronics in FY2024. While inventory increased in Q4, it is anticipated that days of inventory (DOI) will decrease as demand recovers in Q1 FY2025.

Renesas adjusted the definition of inventory in sales channels from book value to net sales price, enhancing transparency and flexibility in future inventory management.

Despite short-term profit pressures, Renesas Electronics has not hesitated to invest in R&D.

◎ In the field of automotive intelligence, Renesas is actively pursuing the development of high-performance SoCs, continuously bolstering its competitive edge in the automotive chip market.

◎ The company is also increasing investments in IoT and AI technologies, aiming to launch products tailored to emerging market demands.

Technological breakthroughs in these areas are expected to serve as a new growth driver for Renesas Electronics in the future.

Summary

Renesas Electronics' performance decline in 2024 underscores the cyclical nature of the semiconductor industry and the real challenges posed by weak global demand. Nonetheless, stable growth in the automotive sector, continuous technological innovation and R&D investments, along with refined inventory management, lay the groundwork for its eventual recovery.