JD.com's Aggressive Entry into Delivery Market Sparks Countermeasures from Meituan

![]() 02/13 2025

02/13 2025

![]() 632

632

Written by | Wu Xianzhi

Edited by | Wang Pan

On February 11, JD.com's official WeChat account, 'JD Bulletin Board,' announced the launch of JD.com Delivery and initiated recruitment for 'Quality Canteen and Restaurant Merchants.' This move exemplifies a classic strategy of testing the waters before making a grand announcement.

Initially, JD.com leveraged JD Instant Delivery to venture into instant retail while simultaneously poaching personnel from Meituan Delivery. Such actions invariably provoke a response, and Meituan swiftly formulated an internal counter-strategy. At the end of 2024, JD Instant Delivery, offering a '5% commission rate,' recruited both merchants and employees. This was precisely when Meituan communicated the matter of JD.com's entry into the delivery sector and its corresponding response strategy throughout the company.

From Ele.me to Douyin Life Services, to Kuaishou Local, and now JD.com this year, the frequent entry of internet giants into the delivery sector underscores two key points: the local life market still harbors immense potential, and no player holds an absolute dominant position.

Ele.me and Meituan are in direct competition and are currently the only major players left standing. Douyin and Kuaishou entered the market by leveraging their content and traffic, venturing into home delivery after their store arrival services matured. However, due to shortcomings in algorithms and fulfillment, one retreated, while the other could only direct traffic to Meituan.

On the surface, with its warehousing and instant delivery capabilities, JD.com appears to have no fulfillment shortcomings. However, an insider noted, 'The key elements of takeout operations are speed, quality, and cost-effectiveness. First-mover advantage and scale advantage are crucial. When the existing system becomes increasingly refined, it becomes challenging for latecomers to compete.'

Having something is undoubtedly better than having nothing. JD.com's current core challenges lie in the lack of a merchant pool on the B-side and the lack of traffic and user mindshare on the C-side. JD.com needs to convey its intention to enter the delivery sector to both B and C ends, which is why it made the official announcement at this juncture.

JD.com's Poaching, Meituan's Counters

'A 20% salary increase, with other benefits to be negotiated separately.'

This is the offer made by JD.com to poach Meituan's city Business Development (BD) and Business Development Manager (BDM) personnel in major cities across the country. This differs significantly from the treatment offered by Douyin two years ago when it poached Meituan BD personnel. Not only is the salary increase slightly less, but there are also no commissions. Cheng, a Meituan BD, told Photon Planet that earlier, Douyin Life Services set up commissions for city BDs to introduce merchants at SABC levels, with 800 yuan for one S-level merchant and 400 yuan for one A-level merchant.

A Meituan BD in Jinan told Photon Planet that merchant relationships follow the BDs, so it's more accurate to say that Douyin and JD.com are poaching resources rather than just people. 'This is striking at the vital spot. Meituan's BD model has established close personal relationships between city BDs and merchants. Therefore, JD.com directly poaching Meituan BDs is tactically sound.'

Having witnessed colleagues being poached by Douyin Life Services and then laid off a year later due to business obstacles, Cheng was somewhat hesitant after receiving JD.com's offer. 'My income is not very high, and there's no way to move up, so job-hopping is the only way out.'

This situation is not unique to the north. Recently, multiple Meituan BDs and even BDMs in a first-tier city in the south have also jumped ship to JD.com.

Photon Planet understands that if a city BD's monthly salary is between 10,000 and 12,000 yuan, JD.com will offer a salary of around 15,000 yuan; if a BDM's monthly salary is around 14,000 to 15,000 yuan, they will offer a monthly salary of around 20,000 yuan.

Interestingly, there is no tension or suspicion between new and old colleagues due to their different employers. Instead, there is harmony and information sharing. Former Meituan BDs who have jumped to JD.com want to 'understand how Meituan will fight us'; while those who remain at Meituan want to know 'if JD.com is really doing this, and if the treatment is good or not.'

There is a reason why Meituan BDs are hesitant. A JD.com BD in a southern city told Photon Planet that before the Chinese New Year, it was expected to recruit four teams, with 8-12 people per team. After the new year, the business lines were consolidated into one team, with city BDs directly leading the team to interface with instant delivery merchants, and the team size was controlled at 10 people.

We learned from multiple Meituan BDs about the profile of some BDs who have jumped ship to JD.com – as the saying goes, 'A tree moved dies, but a person moved thrives.' Many BDs have been with Meituan for several years and see no hope of promotion; the second type is those whose performance has long been at the bottom and face considerable work pressure; the third type is those who have just entered the industry for a few years and have lower salaries.

Meituan has faced competition from Ele.me and Douyin, and its countermeasures have become muscle memory for the company. In response to JD.com's possible moves, in addition to keeping an eye on the development of competitive businesses, it has also internally communicated the 'countermeasures' action to BDs nationwide through verbal communication, without any written documents or files.

To encourage BDs on the front lines to seriously implement countermeasures, it has been included in the monthly performance evaluation of BDs, with a high evaluation ratio that can even affect whether they receive a 'C' rating. 'The performance evaluation of each BD's countermeasures directly affects the survival of the team.'

The so-called countermeasures refer to BDs visiting stores and communicating with merchants to provide certain delivery fee waivers or rate discounts to stabilize merchants, thereby curbing the expansion of competitors at the source. Before JD.com entered the delivery sector, the last hard competitor against Meituan was Douyin Delivery.

BDs are the core link between the platform and merchants. While JD.com's poaching can quickly accumulate a merchant pool, it is not enough to retain merchants.

We contacted a catering merchant and asked them to try to complete the JD.com Delivery onboarding process. It is unclear whether the system has just been launched and has not yet been optimized for registration, but they were unable to upload information.

The merchant said, 'It is still unknown what JD.com Delivery can offer us.'

Courier Delivery is Not the Same as Takeout Delivery

'Strike at the vital spot.' The killer move of JD.com Delivery is 'commission-free all year round.'

Three months ago, when JD Instant Delivery tested food delivery, it advertised a commission rate of 5%, which was limited in its appeal to merchants. Almost all competitors have used the 'commission' issue to extort Meituan, and if this account is not cleared up, it is easy to be misled.

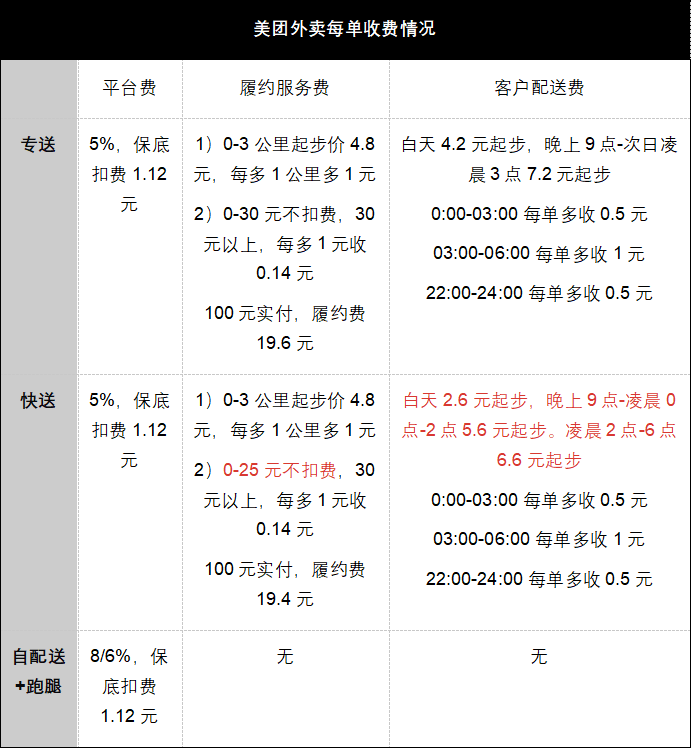

In reality, the platform only waives the already low 'platform fee,' while fulfillment service fees and delivery fees are the main expenses for each takeout order. For example, Meituan divides all fees into platform fees (commissions), fulfillment service fees (none for self-delivery), and customer delivery fees.

Caption: The author compiled and summarized based on third-party information. Actual fees may vary according to different regions and merchant types.

To further consolidate competition, over the past year, Meituan has continued to refine merchant operations, with the most important means being to enhance the service capabilities of dedicated delivery to bind core KA merchants to dedicated delivery. This is considered to be Meituan's true moat.

Scale is often regarded as the moat of a platform economy, but this actually misinterprets the concept of 'moat.' A moat refers to a company having an ability that it possesses while others find difficult to cultivate. For Meituan, there are two moats: one is the home delivery business's basic algorithm, which has been iterated over the years, and the other is a set of effective fulfillment standards for both B and C ends based on this algorithm.

Currently, most merchants accessing JD.com Delivery are instant delivery and national chain brands, with few POP merchants, and the delivery form is mostly Dada, with a small portion being self-delivery by merchants. This business situation makes it difficult for JD.com Delivery to compete with Meituan Delivery in the short term.

When Douyin Delivery entered the market, it relied on third-party logistics. However, third-party delivery often has issues such as long delivery times and untimely rider responses. As a result, many merchants switched to self-delivery, which also came with numerous problems. Not only were the delivery fees not lower than those of Meituan's dedicated or express delivery, but merchants also needed to constantly monitor the fulfillment process – whether there were riders taking orders, and if not, they needed to add money, and overdue meal preparation would lead to compensation.

At this time, the benefits of Meituan's dedicated delivery became immediately apparent. Not only was fulfillment fast and service good, but merchants could completely free themselves from fulfillment. A Meituan BD told Photon Planet that high-ticket merchants (above 40 yuan) can both afford the cost of dedicated delivery and have corresponding fulfillment needs, becoming one of the most obvious trends in Meituan's merchant operations over the past year.

Some believe that the biggest difference between JD.com and Douyin is that JD.com has a fulfillment foundation – Dada's instant delivery and JD Logistics' courier delivery. Dada's instant delivery is a crowdsourcing model, i.e., part-time riders. In the increasingly mature courier industry, part-time riders are difficult to compete with dedicated riders in terms of income and professional ability. In the words of an Ele.me representative, relying on Dada, JD.com Delivery, while not having fulfillment issues, is still 'several Ele.mes behind' Meituan at least for now.

Then can full-time JD.com couriers compete? This is actually a somewhat far-fetched hypothesis. With the popularization of 'hour-long delivery,' the difference between courier and takeout delivery has become smaller and smaller. Nevertheless, courier and takeout delivery are still two distinct things. Simply put, couriers cannot do takeout delivery, and takeout delivery cannot do couriers.

Whether it's next-day delivery, half-day delivery, or hour-long delivery, goods are dispatched according to fixed time periods, and with designated locations (warehouses, transfer stations, posts) as the center, deliveries are made to the surrounding areas. It looks like home delivery, but in reality, all courier riders have fixed responsible areas. Takeout delivery, on the other hand, has obvious time characteristics – lunch, dinner, and summer-autumn night snacks, with very random starting and ending points for delivery.

Due to the existence of dispatching, courier riders have little capacity to undertake more complex takeout deliveries under the assessment of time and door-to-door service, even if they could, their fulfillment and service capabilities may even be worse than those of third-party delivery.

Beyond delivery, another old problem for JD.com is 'traffic.'

As of now, JD.com Delivery is located under 'Instant Delivery' on the JD.com app's homepage, in other words, under the secondary page of an e-commerce app known as a 'traffic black hole.' Before takeout delivery becomes an independent app, the ceiling of JD.com Mall is the ceiling of JD.com Delivery.

'JD.com Delivery's current business is still under Instant Delivery and does not have an independent structure. There are also many issues with the app's functionality.' An insider mentioned that JD.com Delivery's positioning is courier delivery addresses, not instant. If you want to order takeout based on your current location, you need to first change the default delivery address.

Meituan Welcomes New Challengers

Multiple Meituan BDs said, 'JD.com entering the delivery sector is not a bad thing for Meituan.' From a macro perspective, having new players enter helps to hedge against antitrust pressure. 'Meituan is happy to see peers get a share of the pie, just not the biggest slice.'

Another factor is that whenever a new giant enters the local life sector, it brings a new round of growth to the industry. An analyst has calculated the impact of Douyin's entry into the group-buying market. From 2021 to 2024, the year-on-year growth rates of store GTV were 36%, -6%, 107%, and 34%, respectively. It can be seen that the group-buying market experienced its first decline in 2022, but after Douyin's entry the following year, the group-buying market experienced a surge.

When Douyin users walk up to a bubble tea shop and no longer look at the menu to order, but instead open Douyin to redeem vouchers, group-buying has quietly completed a new round of penetration. As Douyin's group-buying subsidies declined and Meituan conducted rounds of countermeasures, the market shares of Douyin and Meituan gradually stabilized. By 2024, Meituan's store business rebounded, with both revenue and profit of its core local business increasing.

This was the case with Douyin entering the group-buying market, and theoretically, JD.com entering the delivery sector will also greatly promote the growth of the takeout delivery market.

JD.com's user profile is mostly high-income individuals, predominantly male. This type of user was originally not the main consumer group for takeout delivery, but after JD.com enters the sector, they may become a new increment for the takeout delivery group. In terms of consumer behavior, they mostly purchase high-ticket categories and 3C home appliances. In addition, there are also JD Health's pharmaceutical e-commerce and other businesses such as instant retail, which are new categories that instant retail and takeout delivery are eager to explore.

As JD.com ventures into the realm of 'takeout delivery' within its own sphere of influence, it may unwittingly be granting Meituan new 'territories' as well.

Taking this into account, a Meituan employee quipped, 'Meituan would surely welcome JD.com's foray into takeout delivery, provided it doesn't encroach on our core KA merchants. No harm done!'