Global High-End Mobile Phone Market: Apple Claims 66%, Samsung 18%, Huawei 7%, Xiaomi 2%

![]() 02/19 2025

02/19 2025

![]() 578

578

In the vast smartphone landscape, the mid-to-low-end segment is notorious for its razor-thin margins, with some products even incurring losses solely to attract consumer attention. Conversely, it is the high-end market that serves as the true profit generator.

This has spurred domestic brands such as Xiaomi, Honor, OPPO, and VIVO to relentlessly pursue a foothold in the premium segment in recent years.

Currently, devices priced above $600 are classified as high-end. In 2024, this segment accounted for approximately 25% of the market, contrasting sharply with the 75% share held by models priced below $600.

So, how does the global high-end market share break down?

Recently, market research firm Counterpoint Research shed light on this with a pertinent report.

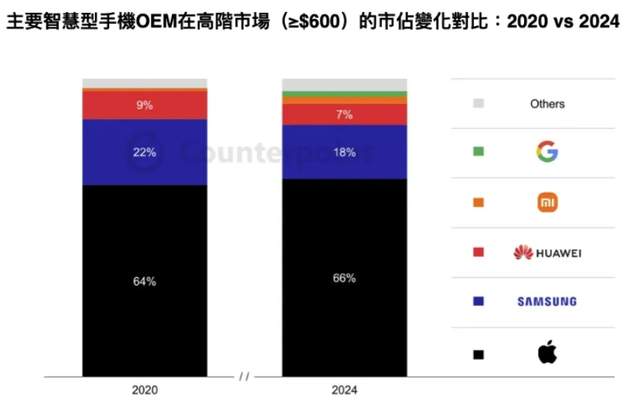

The image above illustrates the specific market shares and rankings for 2020 and 2024. Apple reigns supreme with a commanding 66% share in 2024, encapsulating roughly two-thirds of the global high-end market—an increase of 2 percentage points from 64% in 2020.

In contrast, Samsung has witnessed a decline, slipping from 22% in 2020 to 18% in 2024, marking a 4-percentage-point drop.

Huawei ranks third with a 7% share, down slightly from 9% in 2020, indicating a 2-percentage-point decrease. This underscores that Huawei has yet to fully recover its former market strength.

Xiaomi holds a 2% share, doubling its 2020 figure of 1%, but its overall presence remains modest, posing minimal threat to the top three.

Following Xiaomi is Google, while Honor, OPPO, and VIVO failed to crack the top five, suggesting ample room for growth in their high-end market endeavors.

Notably, the proportion of high-end phones has surged since 2020. In 2020, devices priced above $600 accounted for just 15% of the market, whereas in 2024, this figure jumped to 25%.

Evidently, the appetite for high-end devices is on the rise. Consequently, domestic brands must intensify their efforts. Failing to secure a substantial share in the high-end market will mean ceding the lion's share of profits to Apple and Samsung.