Apple's AI Revolution Looms, and OPPO Feels the Heat

![]() 02/19 2025

02/19 2025

![]() 675

675

Source | YuanSight

Amidst the intensifying buzz around AI in business, Apple has finally forged an alliance with Alibaba.

On February 13, at the World Governments Summit 2025 in Dubai, United Arab Emirates, Alibaba co-founder and Chairman Joe Tsai addressed rumors of a collaboration between Alibaba and Apple. He stated, "Apple requires a local partner for their mobile phone services in China. They've always been very selective and have spoken with numerous Chinese companies. Ultimately, they chose to do business with us. We're incredibly fortunate and honored to collaborate with such an esteemed company as Apple."

iPhone 16, which bolsters Apple's AI capabilities in the Chinese market, has emerged as what CEO Tim Cook describes as a "game-changing" product in a certain sense. Once perceived as lacking innovation, Apple is poised to make a strong return to the spotlight with AI.

However, this development also puts pressure on all Android competitors, particularly those brands that flaunt themselves as "Apple alternatives" and strive to capture the minds of Apple users. Among them, OPPO stands out with the strongest "Apple flair."

From industrial design to user interface, and from marketing strategies to brand tone, OPPO bears the mark of Apple. Especially in the Chinese market, where iPhone prices soar and the pace of innovation slows, some users begin to seek alternatives, and OPPO has adeptly captured this demand.

With affordable prices, exceptional photography, and experiences that surpass Apple in certain aspects (such as fast charging), OPPO has successfully lured a cohort of users.

Nevertheless, as iPhone 16 arrives as an "AI-laden powerhouse," OPPO's narrative of being an "Apple alternative" appears increasingly dim under the shine of the "genuine Apple."

01

iPhone's AI Catch-Up

For a long time, AI has been absent from Apple's narrative. While Android manufacturers have made AI a cornerstone of their phones, emphasizing generative AI, AI photography, AI assistants, and other functions, Apple has remained composed.

Siri, launched years ago by Apple, can be seen as the precursor of AI functionality, but Apple's pace in the AI domain has always lagged behind. This is due to Apple's unwavering commitment to user privacy and data security, as well as its relatively conservative approach to AI technology accumulation. Furthermore, compared to technology giants like Google and Microsoft, Apple's investment in underlying AI technology and algorithms, along with its contributions to the open-source community, have been relatively modest.

iPhone 16 finally breaks this mold.

According to leaked information, the iPhone 16 series will be fully equipped with "Apple Intelligence." This isn't a simple functional overlay but a suite of deeply customized AI solutions tailored to Apple's ecosystem and user habits.

It not only encompasses AI processing capabilities on the device side but also emphasizes the synergy of cloud AI, striving to provide a smarter and more personalized experience while safeguarding user privacy.

More importantly, to address the challenge of implementing AI functions in the Chinese market, Apple has unusually opted to collaborate with Alibaba, a local Chinese internet giant. With the computational power and localized data processing capabilities of Alibaba Cloud, the AI functions of iPhone 16 are anticipated to better align with the needs and usage habits of Chinese users.

Data from consulting firm Counterpoint Research reveals that in the high-end market (above $600) of China's smartphone market in 2023, Apple's share reached 67.1%. This indicates that Apple occupies an absolutely dominant position in China's high-end mobile phone market. Canalys' report also underscores that despite fierce competition from Android manufacturers, Apple maintained its top spot in China's high-end market in the first quarter of 2024.

The significance of the collaboration with Alibaba extends beyond the technical realm. It marks a crucial strategic shift for Apple: from a "closed ecosystem" in the past to a "limited openness."

For Apple, AI isn't just a cherry on top but a core strategy pivotal to the future competitive landscape. After all, amidst the slowing growth of the smartphone market, AI has emerged as a new battlefield for major manufacturers to vie for users.

IDC's forecast report highlights that by 2027, AI mobile phone shipments are expected to exceed 500 million units, accounting for over 40% of total smartphone shipments.

The "AI breakthrough" of iPhone 16 is a significant step for Apple in this strategic direction. It not only compensates for its shortcomings in the AI field but, more importantly, infuses new vigor into Apple's ecosystem and enhances the long-term competitiveness of the iPhone.

The "fully loaded" iPhone 16 will undoubtedly pose a direct threat to the entire Android camp, especially those brands that tout themselves as offering "high-end experiences." Android manufacturers that once relied on differentiated experiences to establish their edge now need to confront an Apple with a comprehensively upgraded AI capability, significantly increasing the difficulty of competition.

02

Marginalization Hard to Hide

As the "AI-laden" iPhone 16 looms, OPPO seems to have received some "good news" as well.

Canalys' latest report shows that the Southeast Asian smartphone market rebounded strongly in 2024, with shipments reaching 96.7 million units, an 11% year-on-year increase, ending a two-year decline. OPPO led the market for the first time, accounting for an 18% market share with shipments of 16.9 million units, a 14% year-on-year increase.

The success in the Southeast Asian market underscores OPPO's overseas strategy. For a long time, OPPO has regarded the Southeast Asian market as a crucial strategic location. Through precise market positioning, localized marketing strategies, and continuous product innovation, OPPO has achieved remarkable results in the Southeast Asian market.

However, the success in the Southeast Asian market cannot obscure the challenges faced by OPPO in the Chinese market.

OPPO was once the king of offline channels in the Chinese market. Leveraging its robust channel capabilities and precise marketing, OPPO made inroads into the offline market and once held the largest market share in China.

But in recent years, with the rise of online channels and shifts in consumer habits, OPPO's traditional advantages are gradually eroding. IDC data indicates that in the first quarter of 2024, smartphone shipments in the Chinese market fell by 6.6% year-on-year. OPPO's market share was 15.7%, ranking fourth, trailing Honor with 17.1% and vivo with 16.4%. By the third quarter, OPPO had directly fallen out of the top five.

More importantly, OPPO has always struggled to truly break through in the high-end market. Although the Find X series impresses with its design and technology, OPPO's brand image among high-end users still lags behind brands like Apple and Huawei.

Canalys data shows that in the Chinese mainland market, in the price segment above $600 (approximately RMB 4,355) in the third quarter of 2024, Apple ranked first in the high-end market with a 52% market share, despite a 5% year-on-year decline, its leading position remains unshaken. Huawei followed closely with a 33% market share, a 34% year-on-year increase, showcasing strong growth momentum.

OPPO, once seen as an "Apple alternative," appears to be in an awkward position in the high-end market.

On one hand, it attempts to shed the stereotypes of being a "factory girl's phone" or a "low-end phone" and strives to break into the high-end market, with the Find X series being a pivotal attempt at premiumization.

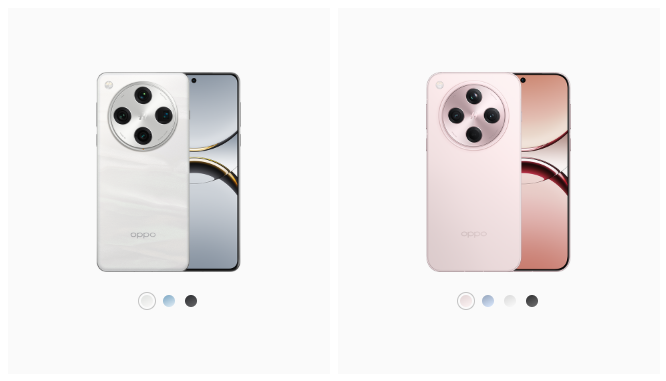

OPPO Find X8 series

On the other hand, its brand genes and user base determine that it's difficult to completely shake off the shadow of being an "alternative." OPPO, which relied on imitating Apple's design and marketing strategies in its early years, has made continuous strides in technological innovation but has always struggled to truly match Apple in brand tone.

This brand image, heavily influenced by Apple, may have been a significant catalyst for OPPO's rapid rise in the early days. But in today's market environment, it may become a burden. As the real Apple becomes stronger and more appealing, the previous narrative of being an "alternative" seems somewhat pale and impotent.

Especially in the era of AI, when iPhone 16 embraces "Apple Intelligence" as its core selling point and redefines the high-end smartphone experience, OPPO's previous layout in the AI field doesn't seem to have generated a strong enough voice.

More concerningly, in the minds of high-end users, OPPO's brand image appears to be gradually blurring. OPPO, once renowned for its "photography" and "fast charging," has also appeared somewhat lost in product differentiation in recent years. In the fiercely competitive Chinese market, OPPO's market share and brand voice are at risk of being marginalized.

03

The Path to Breakthrough

Faced with the AI evolution of iPhone 16, OPPO isn't sitting idle. The company is also actively seeking change, trying to find a new breakthrough path amidst the AI wave.

The most direct action is to increase R&D investment. OPPO founder Chen Mingyong has publicly stated that in the next three years, OPPO will invest 50 billion yuan in the R&D budget, focusing on tackling core technologies. AI is undoubtedly one of the key directions.

At the product level, OPPO is also striving to shed the "Apple flair" and forge differentiated competitive advantages. The Find X series, targeting high-end flagship devices, continues to innovate in imaging, design, fast charging, etc. The Reno series, on the other hand, emphasizes youth and fashion, catering to the needs of young users.

The ColorOS system is also endeavoring to distance itself from the "iOS-like" shadow by incorporating more self-developed technologies and unique features. Pantone color cards and aquatic design are OPPO's attempts to differentiate itself at the system level.

The overseas market has also become an important growth engine for OPPO. Counterpoint data reveals that OPPO ranked first in market share in Southeast Asia in Q2 2024. In the European market, OPPO is also expanding steadily. Its global layout provides OPPO with a broader market space.

However, whether these efforts will help OPPO successfully break through in the AI transformation remains uncertain. OPPO faces a self-revolution that concerns its future.

In terms of the AI technology roadmap, deciding between self-development and cooperative wins to compete with giants like Apple, as well as whether to fully invest in the large model field or focus on edge AI, will directly determine OPPO's future competitiveness.

In terms of brand image shaping, shedding the "alternative" label and crafting a more unique and high-end brand image is also crucial for OPPO to enhance its competitiveness in the high-end market.

At the product strategy level, OPPO needs to continue innovating in its advantageous areas such as imaging, fast charging, and design to create products with differentiated competitive advantages.

Although the ultimate impact of iPhone 16's AI enhancements is still unknown, it at least serves as a wake-up call for OPPO and other Android manufacturers. The previous "alternative" model may have come to an end. How to find one's own survival path in the era of AI is a question that OPPO and others must answer.

OPPO's future is fraught with uncertainties and suspense. The battle to "hunt down iPhone 16" is far from over.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.