How Will Tariffs Affect the iPhone? Answering Key Questions

![]() 04/08 2025

04/08 2025

![]() 657

657

On April 2, 2025 (local time), the United States announced a 34% tariff on Chinese goods effective April 9. This tariff move, aimed at addressing the trade deficit, sparked significant international outcry, prompting American consumers to rush to buy imported goods before the new policy took effect. China retaliated with a 34% tariff on U.S. imports, sending shockwaves through global stock markets. So, what does this tariff hike mean for consumers in the U.S. and China?

Q1: Will the base model of the iPhone sell for over 20,000 yuan in the United States?

Impossible.

While the new tariff policy will undoubtedly lead to a price increase for the iPhone, it is highly exaggerated to suggest it will reach 20,000 yuan (about $2,737). The iPhone 16 base model is priced at $799. Even adding sales tax, state tax, and a hypothetical 200% punitive tax (which is highly unlikely), the final price would be approximately $2,640.

How much tariff will be added to a $999 iPhone exported from China to the U.S. under the new policy? Let's break it down.

The U.S. tariff policy includes a "20% exemption for American components," meaning products with over 20% U.S. content are exempt from import tariffs. In other words, if more than 20% of the imported product's raw materials, components, or technology come from the U.S., only the "non-American" portion is taxed.

According to a Nikkei Asian Review teardown, the hardware cost of the $999 iPhone 16 Pro is approximately $568, with the most significant costs being the TSMC-manufactured A18 Pro chip ($135) and the Samsung-supplied OLED screen ($110).

Nikkei did not provide the "American content ratio" for the iPhone 16 Pro but noted that the previous generation iPhone 15 Pro Max had approximately 33% U.S. components (33% from the U.S., 29% from South Korea, 10% from Japan, 9% from Taiwan, China, and 2% from mainland China). If the iPhone 16 Pro has a similar supply chain, and a 30% average tariff is applied to non-American components, the tariff on hardware costs would increase by only $130.

Image source: Apple

Since the iPhone is produced in mainland China, these 33% U.S. components will face an additional 34% retaliatory tariff upon entering China. Including the tariff on direct raw materials, the factory cost of the iPhone in China will rise to $628. Applying a 30% average tariff on non-American components to this $628, the final hardware cost for the U.S. market would be $753, representing a roughly 32% increase from the initial $568.

This is a rough estimate to illustrate the tariff's impact on the final selling price. Apple has its own cost-pricing strategies, and most analysts predict a 40% price increase in the U.S. However, regardless of other factors, a base model iPhone selling for 20,000 yuan is highly unlikely.

Q2: Will the price of iPhones increase for Chinese consumers?

Yes, but not to 20,000 yuan.

As the iPhone is manufactured in China, customs classification considers the country of origin. Unless Apple finalizes production in the U.S. for "local assembly," the iPhone will not be subject to a 34% retaliatory tariff on the entire device.

However, since the iPhone sources components from the U.S. (about 33%, as mentioned), these components will face a 34% retaliatory tariff upon entering China, increasing the iPhone's component cost and final price.

Image source: Leitech

Apple can adjust its supply chain based on domestic market conditions. For instance, models for the Chinese market could use more Chinese suppliers, while U.S. models could incorporate more American suppliers, making the iPhone "Chinese in China and American in the U.S." to minimize tariff-related costs.

However, these are cost-based considerations. Multinational companies can spread additional tariff costs from the U.S. market to others, leading to across-the-board price increases.

Q3: Has Apple's global supply chain network completely collapsed?

Not entirely.

The tariff increase has put significant pressure on Apple's global supply chain but does not mean Apple will abandon its global layout for local production.

First, companies globalize their supply chains to diversify risks and optimize costs (production and transportation), not just to avoid tariffs. Apple's supply chain spans multiple regions, including China, Vietnam, India, Mexico, and Europe, a layout unaffected by short-term tariff measures.

Second, Apple's supply chain includes large suppliers like TSMC, Samsung, and Sony, which have invested heavily in their fields. The high sunk costs of transferring industrial chains make it difficult for a single country to replace them.

Image source: Apple

Moreover, transferring industrial chains involves realistic development considerations. Apple has tried building factories in the U.S. for Mac Pro desktops, using high premiums to cover ultra-high labor costs. However, the Texas factory's progress is slow, with capacity less than 1% of total demand.

In the short term, Apple may strengthen regional production strategies, setting up closer production lines for the U.S. market, like in Mexico, and using the USMCA to mitigate tariff impacts. However, Apple's supply chain globalization trend will not fundamentally change due to this.

Q4: Will tariffs be imposed on hardware, and what about software?

Not currently for software, but corporate tax avoidance costs are rising.

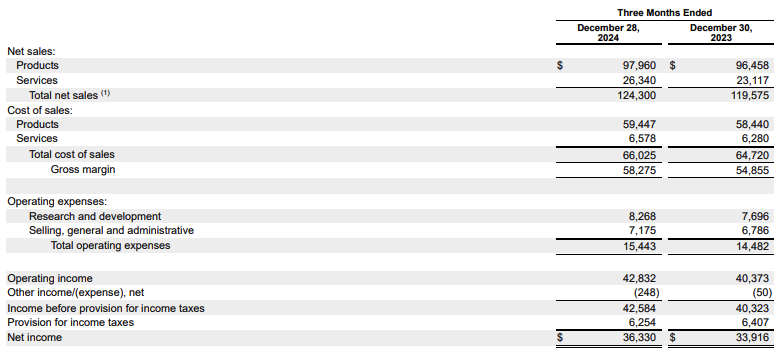

While hardware tariffs dominate discussions, Apple's software services are also in focus. In Apple's 2025 Q1 financial report, "Services" accounted for 21% of net sales, totaling $26.34 billion. However, "software services" do not involve physical goods and are not subject to the 34% tariff.

Image source: Apple

In China, Apple's service revenue is clearly taxed due to local requirements. In contrast, the European market has become a tax haven for U.S. companies using transfer pricing. Many companies use cross-border services to pool income in Europe, leveraging tax incentives in Ireland and the Netherlands, and transferring profits to "tax havens." Last year, a U.S. brand faced a record €13 billion fine from the EU due to this complex financial structure.

In response, European countries propose a global minimum corporate tax rate of 15% to prevent multinational corporations from creating losses and transferring profits. For domestic consumers, a 15% global minimum corporate tax rate has limited significance—as long as relevant departments clarify commodity attributes under the cross-border SaaS model, software categories can also establish tariff protection.

Q5: Will daigou (proxy purchasing) make a comeback after retaliatory tariffs?

No.

For products like the iPhone, manufactured in China, unless Apple spreads high tariff costs from the U.S. to the global market, the 34% tariff's impact on American components alone is insignificant for the final selling price in China.

Image source: Leitech

Moreover, for Chinese-origin products, "daigou" evades value-added tax rather than the tariff affecting DDP (Delivered Duty Paid). Currently, mobile phone retaliatory tariffs impact U.S. consumers more than domestic ones (without cost sharing). Even if "daigou" appears, it would be from countries like Canada, with lower tariffs and adjacent to the U.S., unrelated to domestic consumers.

Final Thoughts:

This tariff confrontation forces Chinese enterprises to strengthen their industrial chains, emphasizing that China cannot solely be a "world factory." In key areas like chips, screens, and operating systems, China must develop its technological reserves. Overseas brands should avoid serving a single market to minimize single-market turmoil's impact on total revenue.

Ultimately, in the context of global economic turmoil, "raising taxes requires a strong fist." In globalization, where one move affects all, no country or industry remains untouched in a tariff war.

Source: Leitech