Flagship Sales Showdown: Xiaomi 15 Emerges Victorious, Honor Magic7 Lags Behind

![]() 04/15 2025

04/15 2025

![]() 648

648

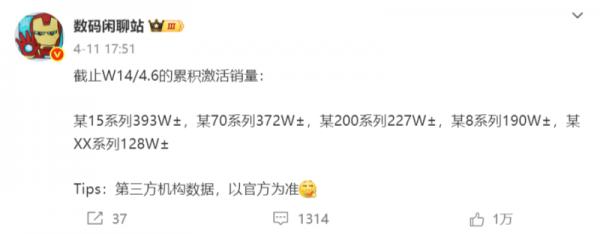

Recently, the reputable tech blogger "Digital Chat Station" shared cumulative activated sales (not shipments) figures for flagship smartphones as of April 6th. The data revealed: "Series 15: 39.3 million ±, Series 70: 37.2 million ±, Series 200: 22.7 million ±, Series 8: 19 million ±, Series XX: 12.8 million ±."

It is evident that Series 15, Series 70, Series 200, and Series 8 correspond to Xiaomi 15 series, Huawei Mate 70 series, vivo X200 series, and OPPO Find X8 series, respectively. Series XX, on the other hand, represents the Honor Magic7 series.

While Digital Chat Station cautions that the data stems from a third-party source and should be viewed with caution, those familiar with the blogger know him for his accurate leaks and minimal errors. Therefore, the cumulative activated sales data he disclosed carries some weight and truly reflects the market's reception of major flagship phones.

Among these, Xiaomi 15 series stands out as the clear winner, topping the list. Notably, Huawei's Mate series remains highly competitive in the premium market. Despite not having the first-mover advantage, it quickly catches up in sales, often surpassing others by significant margins. The Huawei Mate 70 series, launched nearly a month after the Xiaomi 15 series, failed to overtake the latter, trailing by 200,000 units. This underscores Xiaomi's firm foothold in the high-end market.

The vivo X200 series performs adequately, while the OPPO Find X8 series, though not ranking high in sales, has made considerable progress compared to its predecessor, indicating a growing understanding of the high-end market. However, the Honor Magic7 series' performance is disappointing. It not only lags far behind the Xiaomi 15 series, launched just a day earlier, but also trails the Huawei Mate 70 series, which often benefits from Huawei's momentum.

In my observation, Zhao Ming, former CEO of Honor, has publicly mentioned the Huawei Mate 70 series multiple times. For instance, upon the Mate 70 series' launch, he immediately commented, "As always powerful, an exciting collision." A few days later, Zhao Ming tweeted, "After the launch of Huawei Mate 70, Honor Magic7 has received even more attention. Consumers can definitely make the best choice by comparing multiple options."

Furthermore, Zhao Ming once stated that in 2024, many domestic phone brands launched flagship phones, including Huawei Mate 70 and Xiaomi 15, but none could surpass the Honor Magic7 in aesthetics. His confidence in his product's design is evident. Confidence is admirable, but overconfidence often leads to hubris and embarrassment.

Facts have proven that, after weighing multiple options, the Honor Magic7 series ranks last in sales among mainstream flagship phones from major brands, with a significant gap compared to those from Huawei, Xiaomi, OPPO, and vivo. It seems that it is not the most favored choice, and consumers' purchasing decisions speak volumes. It is undeniable that Honor must continue its efforts in the high-end market to gain more user recognition and narrow the gap with top-tier brands.

Regarding Zhao Ming, the rest of the story is well-known. In January this year, after a series of twists including rumors, denials, and official announcements, Zhao Ming confirmed his departure from Honor. The so-called health reasons he cited may merely be an excuse. The real reason could be related to the severe challenges Honor faced after Huawei's resurgence.

Market research firm Canalys released a list of smartphone shipments in the Chinese market for Q4 2024, revealing that Honor fell out of the top five. Flashing back to Q4 2023, Honor ranked second. In just one year, Honor's market position plummeted, and as CEO, Zhao Ming cannot evade responsibility.

Canalys' data for the Chinese smartphone market in 2024 shows that vivo led with a 17% market share and shipments of 49.3 million units; Huawei ranked second with 46 million units, a 37% year-on-year increase; Apple, OPPO, and Honor followed, ranking third, fourth, and fifth, respectively, with a 15% market share each. This indicates that whether it's a single quarter or the entire year, Honor's advantages are gradually eroding. All this transpired after Huawei's strong comeback, intensifying market competition and bringing immense pressure on Honor.

Given that smartphones are Honor's core business and the Chinese market its stronghold, it must strive to win in the domestic mobile phone market; failure is not an option. The reason is straightforward: it is not only crucial for Honor's business fundamentals but also directly tied to its highly anticipated IPO process. Under Zhao Ming's leadership, Honor experienced a downward spiral, making his resignation unsurprising. Reversing this decline has naturally become the new CEO, Li Jian's, top priority.

Making phones is no easy feat, and crafting high-end phones is even more challenging. After the leadership change, Honor must cherish every step it takes!