Under the shadow of tariffs, Cook doesn't have a Plan C

![]() 04/15 2025

04/15 2025

![]() 531

531

Article | kiki

Cook and Apple have breathed a sigh of relief.

Under the radical "tariff war" initiated by the Trump administration, Apple, riding on the wave of globalization in the consumer electronics industry chain, has been the first to experience a rollercoaster ride of development.

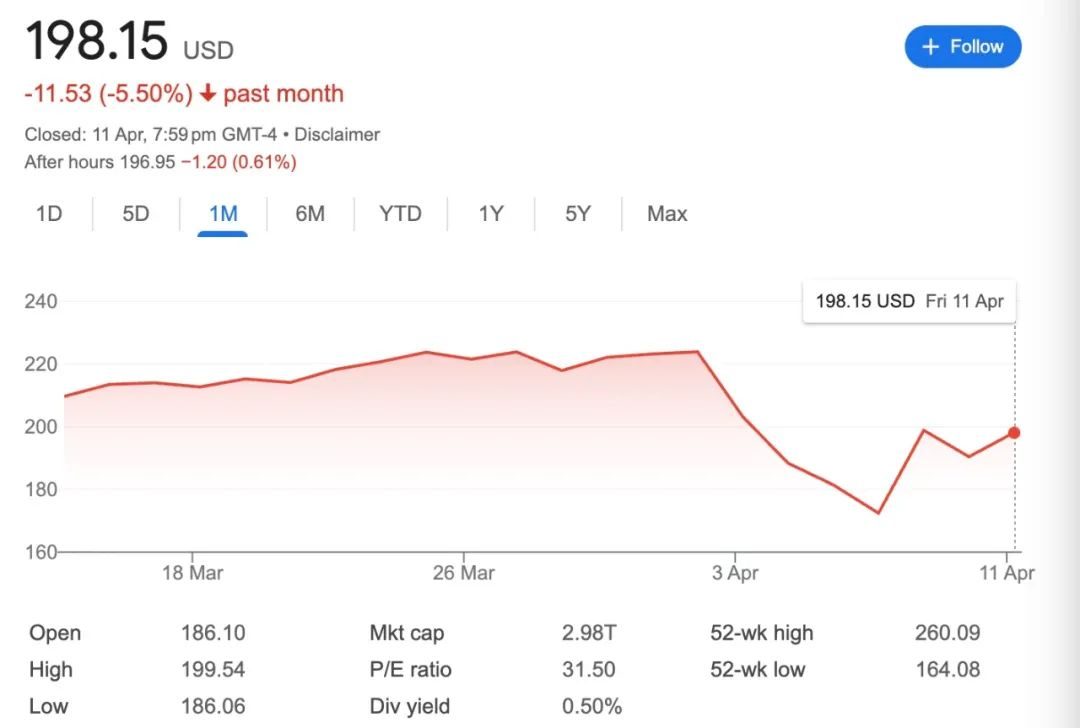

The fluctuating tariff policies first caused Apple's market value to evaporate by hundreds of billions of dollars, but then the stock price briefly rebounded due to news of tariff exemptions.

As of now, according to the latest tariff policy, the US government has agreed to exempt so-called "reciprocal tariffs" on electronic products such as smartphones, computers, and chips, meaning Apple has obtained a brief reprieve.

But the reprieve seems only temporary.

On April 13, when asked whether tariffs on Apple's iPhones would be restored in about a month, US Commerce Secretary Howard Lutnick responded, "Correct. Yes... We need our pharmaceuticals, semiconductors, and electronic products produced in the US."

Trump later wrote on social media, "The US will review semiconductors and the entire electronics supply chain in the upcoming national security tariff investigation."

To cope with tariffs, Apple's main short-term actions have been threefold:

First, increasing the number of flights from India to the US to transport iPhones, deepening relations with India by stockpiling inventory to offset the direct impact of the Trump administration's high tariffs on China;

Second, it may exert price pressure on some suppliers to pass on some of the costs brought about by tariffs;

Third, it may directly increase prices for downstream consumers.

But no matter which measure Apple takes, it is unlikely to meet Trump's expectations for the tech giant – they want to use Apple to complete the US manufacturing revival plan.

The reality is that neither the short-term measures nor long-term production in the US are feasible. Under the shadow of tariffs and more complex situations, Apple and Cook do not have a Plan C.

For now, Apple's tariff exemption has stabilized the price system on the consumer side and, to a certain extent, reduced the increase in material costs originally brought about by tariffs.

This is not the first time Trump has issued an exemption policy targeting Apple.

In August 2018, Apple CEO Cook had dinner with Trump and his wife Melania at a golf resort in New Jersey.

At the dinner table, Cook expressed his hope that the China-US trade conflict would "stay calm," arguing that tariffs would harm Apple's interests and benefit competitors like Samsung.

A month later, the US government announced an exemption from tariffs on some Apple products manufactured in China, which was one of the tech giant's gambles in the China-US trade war during Trump's first presidential term.

White House economic adviser Kudlow later said, "We've talked to Mr. Cook many times. He's really smart and has given us some good advice."

Seven years later, the resurgent tariff stick once again fills Apple's business with uncertainty. There are three paths before the "smart" Cook: raising prices, intensifying India's "de-China" efforts, or squeezing the "Apple supply chain" to absorb the impact of tariffs.

But the "short-term three-pronged approach" only treats the symptoms, not the root cause.

The first is price increases. According to Rosenblatt Securities, if Apple passes on costs to consumers, the price of a high-end iPhone could reach nearly $2,300. Amid the fear of price hikes, there have been small-scale iPhone buying sprees in both China and the US, and price hikes are precisely what Cook least wants to see.

As Apple's largest sales market, the company has maintained a stable pricing principle for many years.

Since the launch of the iPhone X in 2017, Apple has set the starting price of its flagship models at $999 (with some adjustments, such as storage fees and the introduction of larger-capacity models), but $999 has always been a fixed psychological threshold for US consumers.

If Apple chooses to raise prices, it must consider one thing: what price increase can consumers accept?

Analyst Ming-Chi Kuo points out that in the US market, new high-end iPhones account for 65% to 70% of sales. This segment of high-end users is relatively accepting of price increases by Apple, and Apple can also mitigate the negative impact of price increases by increasing subsidies through partnerships with telecommunications operators.

Secondly, if prices are not raised, Apple faces another problem: whether to sacrifice its profit margin?

If Apple chooses not to sacrifice itself, it will squeeze the "Apple supply chain," but according to the latest response from Luxshare Precision's Chairwoman Wang Laichun, all hardware manufacturers will not bear tariffs, logistics, warehousing, and other costs according to conventional trade rules.

She said at a recent investor conference, "These are not considerations for hardware suppliers. Customers have always collaborated with suppliers to enhance competitiveness and chosen more suitable partners in the process. In the past, when encountering tariff issues, there have been no instances where customers have asked suppliers to bear tariff costs."

Apple supply chain suppliers already earn hard-earned money from assembly plants. Luxshare Precision's gross profit margin has shown a downward trend since 2015, with a gross profit margin of about 12% in Q3 2024.

If Apple chooses to sacrifice itself, it will need to bear a small portion of the costs. Apple's hardware profit margin has remained at 38% for many years, leaving some room for maneuver, but how much to bear is another difficult calculation for Apple.

Finally, there is India, which Apple has been hoping for as the "next China" for many years.

An Indian official told foreign media, "Apple is definitely considering increasing investment in India." According to estimates by Bank of America analysts, if all iPhone production in India were reserved for the US, India's total annual exports of iPhones to the US would exceed 50 million units, of which about 30 million could supply the US, with sufficient production capacity.

Earlier, India's Minister of Technology Ashwini Vaishnaw stated that the value of iPhones exported from India by Apple in the previous fiscal year exceeded 1.5 trillion rupees (about $17.4 billion).

However, the reality is that the current supply chain level in India is somewhat unsatisfactory. As we previously pointed out in "Cook Wants to 'Extend the Life' of Apple in India," Apple's more than ten-year layout in India is a long game. Compared to China, India's upstream and downstream supply chain maturity and supporting infrastructure differ.

The "short-term three-pronged approach" only treats the symptoms, not the root cause. So, will Cook and Apple, as the Trump administration hopes, manufacture iPhones in the US and label them "Made in USA"?

Obviously, no. Because the cost to Apple would be too great.

As early as 2017, analysts at Chaotong Securities calculated that if Apple moved its production back to the US, it would directly reduce Apple's net profit by 10%.

Cook, who is extremely sensitive to costs, cannot be unaware of this exorbitant expense.

Although earlier this year, Apple pledged to invest $500 billion in the US over the next four years and will produce some servers and a small number of chips in the US, Apple currently has almost no large-scale production in the US.

Currently, Apple only finalizes the assembly of Mac Pro desktops in the US, but most of the assembled components are made in China, and Apple only sells a few thousand of these computers each year. However, the assembly of an iPhone involves nearly 400 individual components, which heavily rely on China.

Moreover, Cook himself does not believe in "Made in USA".

During the Jobs era, Apple was a very "American" company, and Jobs also had a dream of "Made in USA," but during the Cook era, he has led Apple's current diversified supply chain layout and strong control over the supply chain, making Apple one of the most profitable tech companies today.

Robert Lighthizer, the main operator of Trump's "reciprocal tariffs," wrote in his book "There Is No Such Thing as Free Trade":

"No country becomes great through consumption; they become great through production."

From this perspective, continuously volatile tariffs will ultimately hurt one's own people, and the most painful will be Cook and Apple, as well as the unfulfilled dream of manufacturing return to the US.