Is Falling Out of the Top Five the Price of Transformation? After a Major Reshuffle at the Top Level, Honor May Counterattack Again

![]() 05/08 2025

05/08 2025

![]() 667

667

In the post-Zhao Ming era, Honor is trudging forward with a heavy load.

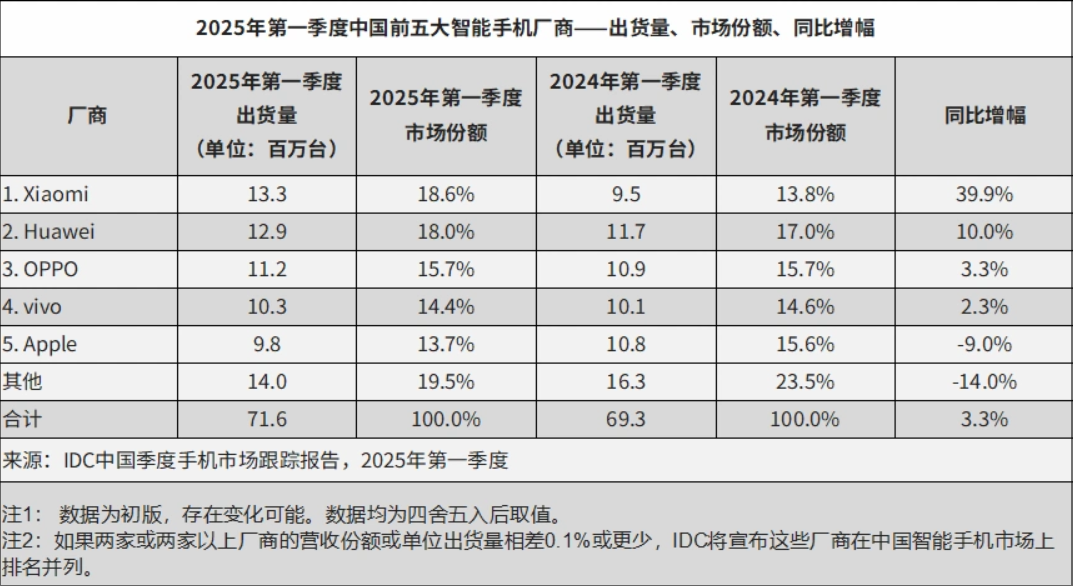

The domestic mobile phone market is fiercely competitive, with manufacturers constantly vying for market share. According to data released by the authoritative research firm IDC, in the first quarter of 2025, Xiaomi topped the smartphone shipment rankings with a year-on-year increase of 39.9%, followed by Huawei, OPPO, vivo, and Apple.

Image source: IDC

In other words, Honor has been squeezed out of the top five and now falls into the "others" category. For this vendor that was "born with a silver spoon," it has now reached a critical juncture in its development.

Major Reshuffle at the Top Level: Honor Accelerates Its Transformation

Looking at the data, Honor did not release any new smartphones in the first quarter of 2025, and it was not until April that the Honor GT Pro and Honor Power were introduced to consumers. The Honor GT Pro is a very "Honor"-like smartphone, featuring high performance, a large battery, and robust heat dissipation, all of which are familiar traits; the Honor Power directly incorporates an 8000mAh Qinghai Lake battery, targeting users who prioritize long battery life.

As for the Honor 400 series, only leaks have been seen, with no official announcements, indicating that internal personnel adjustments are also reflected in the products.

Image source: Honor Mobile Official Weibo

Entering 2025, Honor's top management underwent significant changes: Zhao Ming, a "veteran" of 10 years, resigned as CEO of Honor, and Li Jian took over the position. Other senior executives, such as Zheng Shubao, head of sales for Honor China, and Jiang Hairong, CMO of Honor China, have also confirmed their departures, and successors have been appointed.

This wave of frequent executive personnel changes is extremely rare among domestic internet giants. Coupled with the fact that Honor is at a critical juncture for its IPO, such changes will undoubtedly bring more uncertainty to the company. After all, personnel changes often represent adjustments to the company's business, and the market will worry about this uncertainty, as the uncertainty brought about by personnel changes is the most costly.

Image source: Leitech

During this period, there was also a small interlude: When rumors first surfaced that Zhao Ming was about to leave, Honor came out to refute them, stating that some media reports were incorrect; then, a day later, Honor's official announcement formally confirmed Zhao Ming's departure and Li Jian's succession as the new CEO. Honor's "back-and-forth" caused much discussion outside.

After all, Zhao Ming is too important to Honor. Since taking over the Honor business in 2015, Zhao Ming has been the flag bearer of Honor, closely associated with the brand. When Honor separated from Huawei at the end of 2020, Zhao Ming led the team to "start over" and spent more than two years returning to the peak. In 2022, Honor's smartphone shipments increased by 34.4% year-on-year, with a market share of 18.1%, ranking second.

It can be said that Zhao Ming completed the work from 0 to 1, leading Honor to separate from Huawei and successfully break through in the fierce market competition, achieving annual shipments of over 100 million units and remarkable results.

The departure of such an experienced, accomplished, and knowledgeable leader is a huge shock to the entire Honor, leaving others at a loss for a while.

Image source: Leitech

What the successor Li Jian needs to do is to take the company from 1 to 100. How to navigate through the pain after Zhao Ming's departure, regain the market's confidence in Honor's "story," boost Honor's sales, and then drive Honor's successful IPO are the core issues that the new leader Li Jian needs to address.

After all, the powerful enemies that Honor faces today are no longer the same as before: Xiaomi has obtained a second growth curve after choosing to build cars; Huawei's return performance remains strong; OPPO and vivo also have their own competitive advantages. In comparison, Honor's advantages are not very obvious.

"AI" + "Going Overseas" Become Honor's New Directions

Of course, Honor's business has not stagnated during this period, and there have been many advancements. For example, Honor actively embraces AI, first announcing the integration of the DeepSeek model and then announcing cooperation with Alibaba in the field of AI, continuously strengthening its Honor YOYO intelligent agent.

Li Jian, the new CEO of Honor, made his "debut" at the MWC 2025 conference and announced the Honor Alpha Strategy, which mentioned that Honor's positioning is no longer just a smartphone manufacturer, but a transformation into a global leading AI terminal ecosystem company: leveraging AI intelligent agents to transform traditional hardware such as smartphones, creating a new paradigm for the AI ecosystem, and driving innovation in human civilization. Honor will cooperate with giants such as Google and Qualcomm and invest $10 billion over the next five years to build an AI device ecosystem.

Image source: China Newsweek

Speaking of Li Jian, the background of this new leader of Honor is also extraordinary. Public information shows that Li Jian also has a Huawei background and rich overseas market experience. Combined with the Honor Alpha Strategy, it is clear where Honor's development direction will go next: AI and going overseas.

These two directions are also the focus of exploration for mobile phone manufacturers at this stage. After all, the domestic mobile phone market is already highly competitive. The growth achieved in the first quarter of 2025 was mainly due to the support of national subsidy policies, but it is difficult to say how long such growth driven by external factors will last.

Image source: Leitech

As mentioned earlier, Li Jian has rich overseas market experience, which is well-matched with Honor's current overseas development direction. Before this, Honor has already been deployed in overseas regions such as Europe and Southeast Asia. The European market focuses on high-end products, such as Honor's foldable screens, Magic series, and digital series, which can compete directly with products from Apple and Samsung.

Meanwhile, the Southeast Asian region targets the mid-to-high-end market segments, not only selling smartphones but also tablets, personal computers, and wearable devices.

Image source: Honor Official Website

The overseas market is regarded as the main force for Honor's future growth, and Li Jian, who has deep experience in overseas markets, also has his own insights into issues such as supply chain management and product innovation.

However, under the influence of external conditions such as tense geopolitical relations, high tariffs, and cultural differences, the difficulty of manufacturers in conducting business overseas has gradually increased, and any carelessness may lead to complete failure.

Honor is no exception. How to avoid such risks is a major challenge that Honor must face in the overseas market today.

Financing and Blood Transfusion: IPO May Become a Critical Turning Point for Honor

At the end of 2024, Honor completed its shareholding system reform, and the agenda of independent listing was finally put on the table.

Many people believe that Xiaomi is the reference object for Honor's IPO, as both started as mobile phone makers, with standard pure hardware businesses. But in fact, this is not the case. The situation Xiaomi faced at the time of its IPO was vastly different from the situation Honor faces today.

In the year of Xiaomi's IPO, it released products such as the Xiaomi MIX2S, Xiaomi 6X, and Xiaomi 8 series before the IPO and the Xiaomi Max3, Xiaomi MIX3, and Xiaomi Play after the IPO, providing the market with a full sense of "emotional value".

However, Xiaomi's share price still fell below its IPO price on the day of its listing, proving that the capital market is not very optimistic about such pure hardware companies. It was not until 2021 when Xiaomi announced its entry into the automotive industry and officially released the Xiaomi SU7 series in 2024, forming a closed loop of "people, cars, and homes," that Xiaomi's share price began to climb.

Image source: Leitech

The situation Honor faces is completely different from that of Xiaomi at that time. Smartphones account for a large portion of Honor's business structure, and other products include tablets and laptops, but these products can at most play a supplementary role.

Taking tablets as an example, according to previous media statistics, Honor's tablet market share was 8% in 2024, while Huawei's was 27% and Apple's was 26%. This gap is not insignificant; the laptop market is even more fiercely competitive, with giants such as Lenovo, Huawei, ASUS, and HP. It is indeed difficult for Honor laptops to compete for market share from these giants.

Image source: Honor Official Website

In other words, it is unrealistic to expect the tablet and laptop businesses to provide crucial support to Honor.

Moreover, the smartphone market has entered a red ocean stage, where everyone faces the same market and the same group of users. The competition that Honor faces will be even more intense. Furthermore, the valuation of pure hardware companies is generally low, which invisibly limits the height of Honor's IPO.

The Honor Alpha Strategy announced by Li Jian at the MWC 2025 conference is actually intended to restore market confidence in Honor's future, and this confidence will play a crucial role in the IPO in the future.

After all, in the end, the competition in the smartphone industry still boils down to which manufacturer has more abundant funds and better supply chain integration capabilities.

If Honor can successfully go public, it will be able to obtain sufficient funds to continue exploring new businesses.

Summary

For Honor, it is now facing "internal and external troubles": the departure of senior executives such as Zhao Ming has put the company into a period of turbulence, and the new management team still needs some time to win over the hearts of employees and integrate the supply chain; externally, there is competition from manufacturers such as Xiaomi. Frankly speaking, Honor is going through a difficult time.

However, this is not the first time Honor has encountered such a situation. At the beginning of its independence in 2021, Honor's domestic market share once fell to around 3%. When the outside world collectively counted it out, Honor staged an absolute counterattack, leading to its subsequent resurgence.

Streamlining product lines, integrating supply chain resources, leveraging AI and going overseas, and steadily completing the IPO are Honor's ultimate goals in the short term.

Last time, it was Zhao Ming who led Honor to survive against all odds. Now, the leader of Honor is Li Jian. Will this new helmsman be able to make Honor "reborn"?

Source: Leitech