The Five-Year 'Apple Tax' Lawsuit Reaches Its Initial Conclusion

![]() 05/09 2025

05/09 2025

![]() 628

628

Preface:

Amidst numerous pressures and uncertainties, Apple Inc.'s revenue trajectory is set to become increasingly tumultuous.

As widely acknowledged, a substantial portion of Apple's service revenue stems from the so-called "[Apple Tax]," a practice that has garnered significant criticism from external parties.

In recent years, various entities have questioned and resisted Apple's revenue model, labeling it as "[unreasonable]."

Author | Fang Wensan

Image Source | Network

The Five-Year [Apple Tax] Lawsuit Reaches Its First Conclusion

Recently, the United States District Court for the Northern District of California ruled that Apple Inc. violated a 2021 court order by failing to provide external payment options to App Store users.

The court determined that Apple [deliberately violated] the injunction aimed at curbing its [anticompetitive practices and pricing strategies].

The 2021 injunction required Apple to allow users to purchase apps via external websites, yet Apple persisted in charging up to 27% for apps bought through external payment methods, which the court deemed a [blatant circumvention].

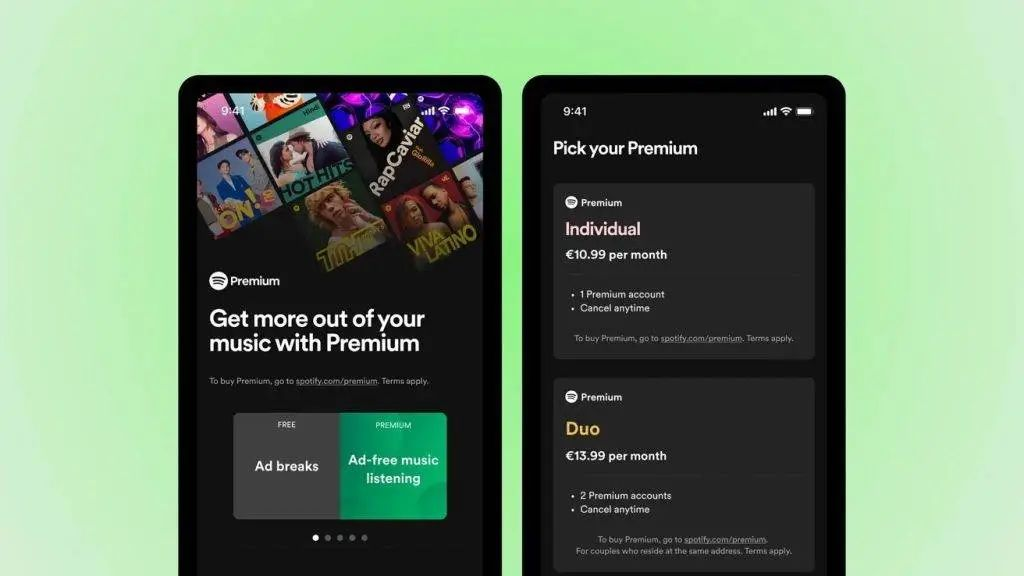

This ruling prohibits Apple from imposing fees on external app purchases and restricts its practice of preventing developers from directing users to alternative payment methods.

This marks a significant defeat for Apple Inc. in its legal battle with Epic Games.

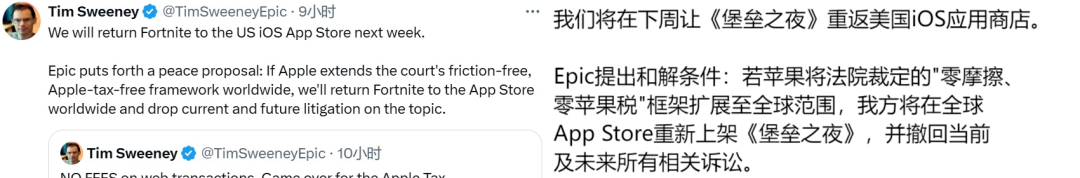

Previously, Epic Games introduced a low-cost payment option within the Fortnite game that bypassed Apple's payment system, challenging Apple's 30% commission on in-app transactions.

In response, Apple promptly removed Fortnite from the App Store, sparking litigation that has resulted in the game remaining unavailable on the App Store to this day.

U.S. District Judge Yvonne Gonzalez Rogers, who oversaw the case, ruled that Apple Inc. must immediately cease charging fees for purchases made outside of apps and is barred from restricting app developers from directing users to make purchases outside of apps.

Specifically, Judge Rogers' injunction against Apple includes:

Prohibiting the collection of [any commissions or fees] on consumer purchases made outside of apps;

Restricting developers from setting external purchase links for apps, as well as the style and format of these links;

Prohibiting or restricting buttons for external app purchases and encouragement of external purchases;

This ruling will result in Apple losing control over a significant portion of in-app purchases, and it is anticipated that an increasing number of developers and users will opt not to conduct transactions through the App Store.

Furthermore, on April 23, local time, the European Commission announced that it had fined Apple Inc. €500 million.

This action stems from Apple's restriction of app developers from directing users to third-party payment channels within its App Store, thereby depriving users of access to alternative and discounted services.

The European Commission requires Apple to immediately lift these restrictions and prohibits the company from taking similar measures in the future.

If Apple fails to implement these corrective measures within 60 days, it may face additional fines.

This is the first fine issued since the implementation of the EU's Digital Markets Act and represents another significant penalty imposed on Apple by the EU in over a year.

The Importance of Being One of the Most Profitable Businesses

For apps downloaded on iPhones/iPads that necessitate in-app purchases, users must utilize the App Store's payment method, and Apple Inc. imposes a 30% commission, known as the [Apple Tax].

This is the reason why iPhone users incur higher fees compared to Android users when making in-game purchases or acquiring membership services.

According to statistics from the third-party research firm Sensor Tower, Apple Inc.'s global revenue reached $22.34 billion in 2023, and it is widely believed that the App Store's commission is one of Apple's most lucrative businesses.

According to Apple's latest fiscal 2024 fourth-quarter financial report, the company generated revenue of $94.93 billion for the quarter.

Among this, the software services segment's performance increased from $22.3 billion in the same period last year to $24.7 billion, representing a year-on-year growth rate of 11.9%.

A research report issued by Merrill Lynch predicts that Apple's software services revenue for fiscal 2025 is expected to grow by 13% year-on-year.

Apple officially disclosed that China is currently its second-largest single-country market globally and the third-largest source of revenue.

Although Apple has not disclosed its [Apple Tax] revenue data in China, amidst declining iPhone sales, Apple's revenue in China for the fourth quarter of fiscal 2024 declined only slightly, a phenomenon attributed to the increase in software services revenue.

The continuous growth of Apple's service revenue in China is attributed to both the vast market demand and the differentiated treatment of the [Apple Tax] policy.

In the EU, the standard [Apple Tax] for enterprises is 17%, and 10% for small businesses; in the US, it is 27% and 12%, respectively; in South Korea, it is 26% and 11%, respectively.

However, in other markets, including China, standard developers are required to pay a 30% [Apple Tax], whereas new developers and small developers with annual App Store revenue not exceeding $1 million only need to pay 15%.

Conclusion:

Currently, the [Apple Tax] is confronted with unprecedented and severe challenges.

Additionally, Google pays Apple up to $18 billion to $20 billion annually to maintain its status as the default search engine in Safari.

Nevertheless, this revenue stream may also be impacted.

According to related reports, the antitrust lawsuit filed by the U.S. Department of Justice against Google's parent company, Alphabet, could prevent Google from continuing to pay substantial fees to remain the default search engine in Safari.

This year may prove to be the most challenging for Apple Inc. in recent memory.

Poor performance in the Chinese market, difficulties in advancing AI technology, challenges to the Apple Tax, fines and investigations against Apple in the EU and other regions, as well as changes in tariff policies, have introduced a great deal of uncertainty for Apple.

From smartphones to various terminal devices such as PCs and tablets, this year has been marked by numerous variables, profoundly impacting Apple Inc.

Some References: iFanr: "The Era of [More Expensive] iPhone Recharges May Come to an End, but the Apple Tax Will Not Disappear", Caijing Magazine: "As the EU Heavily Fines Apple, Small Developers in China Protest the [Apple Tax]", Netskao: "Goodbye, Apple Tax! Apple Confirms Opening Up Payments, Epic Update", TechBeast: "Apple App Store Fully Opens Up External Payments in the US", TMTPost: "Hit by Tariffs and Revenue Hit Hard, Apple Can No Longer Make Money Lying Down", GameSky: "Epic Games' Four-Year Tug-of-War Finally Faces a Hammer! Is the Apple Tax Really Cooling Off?"