2025 Semiconductor Industry Observations: Heightened Sales Centralization, Chinese Firms Gradually Making Breakthroughs

![]() 07/07 2025

07/07 2025

![]() 704

704

Produced by ZhiNengZhiXin

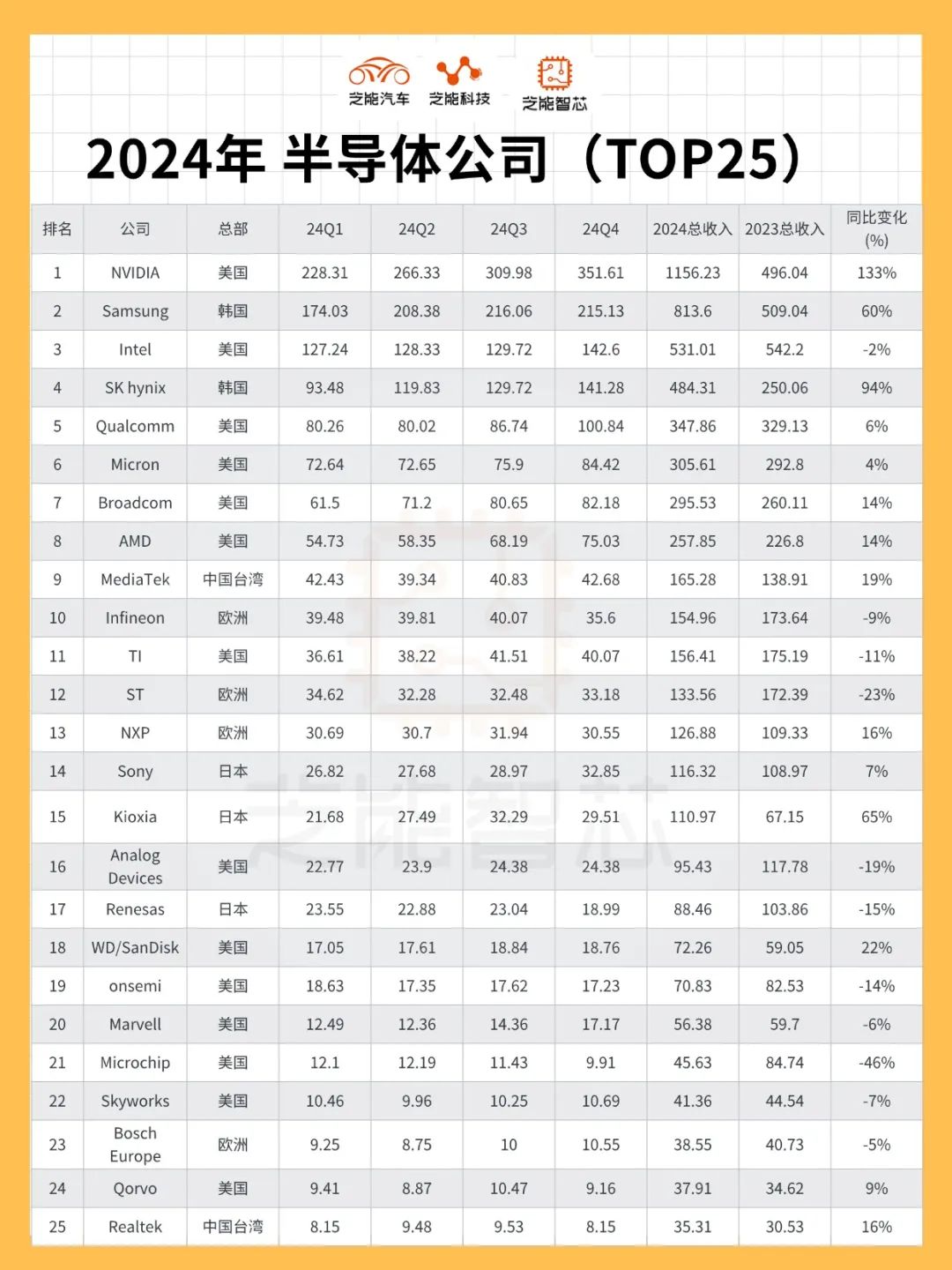

Global semiconductor sales surged by 22% in 2024, with the top 50 vendors witnessing a remarkable 26% revenue growth, significantly outpacing the overall market. NVIDIA emerged as the market leader with its AI chips tailored for data centers, while China's CXMT made its debut in the global top 50.

In the first quarter of 2025, there was a slight dip of 2% compared to the previous quarter, and most companies adopted a more cautious stance for the second quarter outlook. Key growth areas included AI, memory, advanced packaging, and power management, while global trade policies and geopolitical dynamics continued to exert pressure on market dynamics.

Part 1

Global Landscape Transformations

and Industry Evolution Fueled by Technology

In 2024, the global semiconductor market exhibited a growing trend towards centralization. The top ten suppliers accounted for two-thirds of total sales, an increase of nearly 20 percentage points since 2010, while the top 50 vendors controlled 92% of the market share.

NVIDIA topped the list with sales of $115.6 billion, registering an 89% year-on-year increase and maintaining its dominance in the high-end data center market within the AI accelerator sector.

Technologically, its H100 and B100 series are built on TSMC's 4N/3nm process, equipped with HBM3e high-bandwidth memory, and enable multi-GPU parallelism through NVLink and PCIe Gen5, positioning them as the core platform for generative AI training and inference.

High volatility resurfaced in the storage sector.

◎ SK Hynix and Samsung witnessed growth of over 70% and 60%, respectively, driven by the demand for HBM and NAND inventory replenishment.

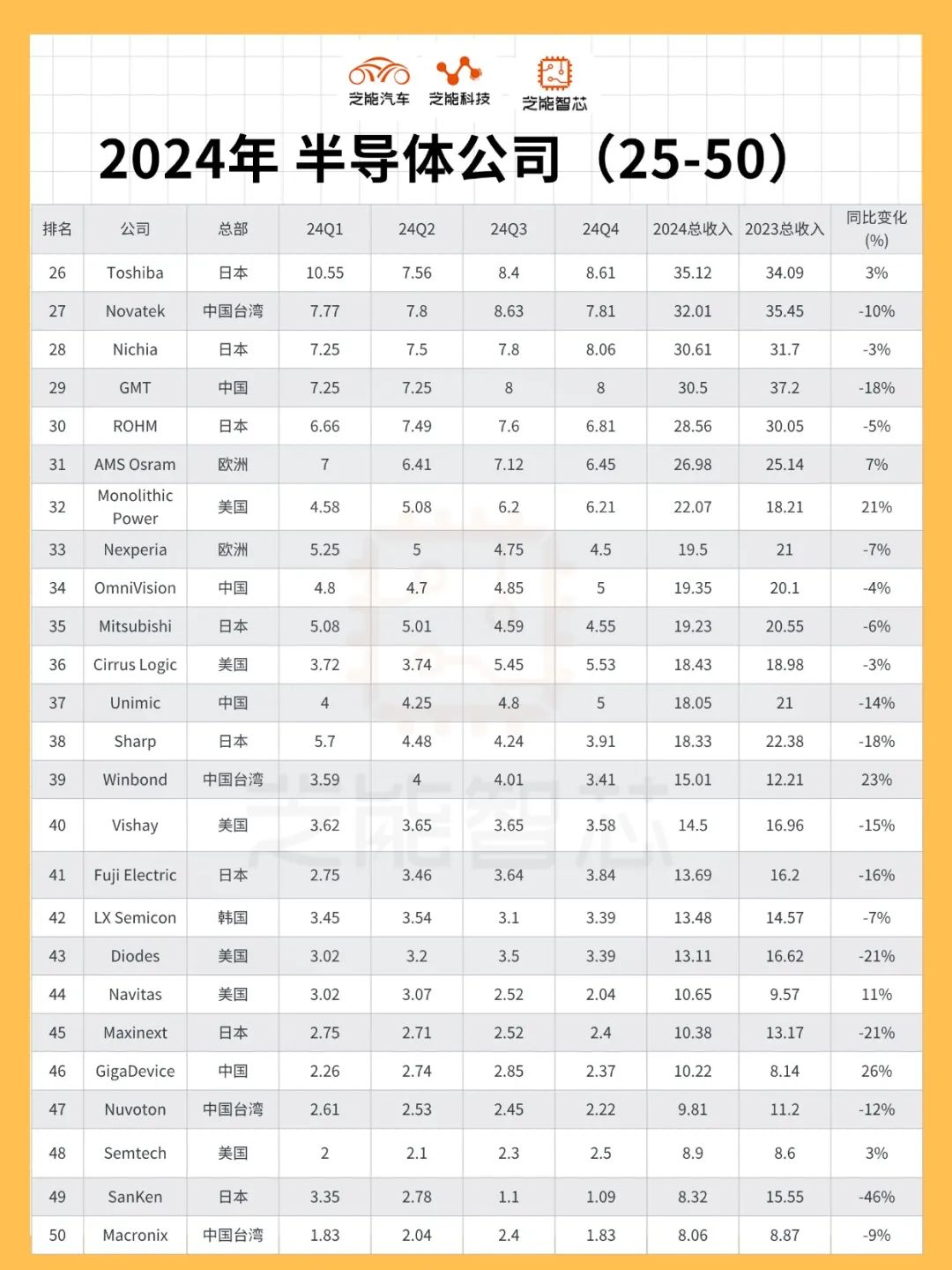

◎ CXMT made its debut at the 34th position with a staggering 214% increase, supported by the maturing of its proprietary DRAM technology platform and the rapid rise in market share of its DDR4/DDR5 products in China's local system market.

In the realm of analog and power management chips, Monolithic Power Systems saw a surge in shipments of its highly integrated DC-DC modules, fueled by demand from AI servers, propelling its ranking to 37th.

These chips emphasize low power consumption and thermal management optimization, support multiple power supply rails, and are widely deployed in NVIDIA GPU motherboards and large-scale switch products.

The overall market declined by 2% quarter-on-quarter in the first quarter of 2025, with only NVIDIA and MediaTek sustaining continuous growth.

◎ NVIDIA posted a 23% quarter-on-quarter and 89% year-on-year increase, further consolidating its top position.

◎ MediaTek benefited from the rebound in orders for mid-to-high-end 5G SoCs and Wi-Fi 7 chips, achieving continuous positive revenue growth, signaling initial success in its product layout transition towards AI and high-frequency communications.

◎ In contrast, established players like Samsung, SK Hynix, and Intel experienced double-digit revenue declines due to memory price corrections and seasonal fluctuations. Intel continues to push forward with its 18A process, aiming to regain market share in cloud computing and high-performance computing through advanced technology.

From 2024 to 2025, the semiconductor industry's core drivers remained focused on four key areas: AI chips, high-bandwidth memory, advanced packaging, and power management.

The overall technological evolution trend is accelerating towards heterogeneous integration and system-in-package (SiP), with leading enterprises consolidating their monopoly, while smaller players face dual challenges of product transformation and manufacturing capability reconstruction.

Part 2

Technological Advancements of Chinese Enterprises

and Paths to Global Breakthroughs

Chinese semiconductor enterprises are gradually ascending the ranks towards the global top 50.

◎ Undoubtedly, the standout performer in 2024 was CXMT, whose DRAM products, leveraging its proprietary process platform, are gradually breaking free from reliance on foreign IP and EDA tools.

DDR4 products have gained a foothold in the PC and embedded markets, while DDR5 has also been introduced into servers and AI inference cards, emerging as a significant force for substitution in the Chinese market.

◎ GigaDevice ranked relatively high with total sales of $1.02 billion. Its Nor Flash and MCU products continue to expand in the industrial and automotive markets, with its core competitiveness rooted in its stable embedded platform and cost control capabilities. Especially in the low-power MCU segment, its 32-bit platform has achieved compatible replacement with certain models from STMicroelectronics and Renesas Electronics.

◎ The re-entry of Taiwanese companies such as Winbond Electronics, Powerchip Semiconductor, and Nanya Technology also underscores the region's continued vitality in mature processes and niche storage areas. These manufacturers are predominantly deployed in processes above 25nm, focusing on SRAM, SLC NAND, and specialty DRAM tailored to IoT and industrial automation needs.

◎ While Chinese AI chip companies have yet to enter the top 50 in sales, they have carved out differentiated technology routes in specific areas like edge inference, video analysis, and AI acceleration. For instance, Cambricon's MLU series adopts a Chiplet architecture, supports 8-channel DDR5 and a custom AI instruction set, and is positioned in the domestic data center substitution market.

The global breakthroughs of Chinese companies are still challenged by limitations in EDA/IP, high-end manufacturing, and customer structure. Especially in advanced packaging, back-end testing, and reliability verification, the supply chain needs further refinement.

In the medium to long term, companies with self-developed architectures, ecological control capabilities, and the advantage of local application binding are more likely to achieve breakthroughs in global niche markets.

Summary

The semiconductor market in 2025 embodies dual characteristics of technology-driven growth and geopolitical resonance. Leading enterprises like NVIDIA are reshaping the industry landscape amidst the AI wave, while Chinese enterprises are gradually making breakthroughs through cost competitiveness, substitution strategies, and independent innovation. The key variables for the next cycle hinge on the rebalancing of system integration, AI architecture evolution, and global market accessibility.