Adobe: A Fictitious Decline or a Victim of Figma's Surge?

![]() 08/11 2025

08/11 2025

![]() 570

570

The American stock market has witnessed numerous stocks thriving on AI applications, with APP, Palantir, and META reaping significant benefits from the AI wave. However, the AI application journey of some giants has not been as smooth.

Text-to-image technology has matured significantly, enhancing visual design efficiency dramatically. Yet, Adobe, the colossus in visual design software, finds itself in a precarious position. Its market value has halved despite a 40% rise in the Nasdaq over the past two years. Palantir, with revenues of $4 billion, boasts a market value three times that of Adobe, which has revenues of $20 billion.

Adobe, once the benchmark for SaaS, now sports a PE ratio of just 20. Moreover, Figma, which Adobe failed to acquire previously, has gone public with its market value doubling compared to Adobe's acquisition valuation, further embarrassing Adobe.

In the image design segment, Canva is catching up swiftly with AI-generated images. Although Adobe has introduced its own Firefly, Midjourney, and other services generate comparable revenues. Various large models also offer text-to-image services, making it challenging for Adobe to maintain its leading position in this area.

The text-to-video field is on the cusp of breakthroughs. Following Google's Genie3, more innovations are expected to emerge, significantly enhancing video creation efficiency. While AI-generated videos, like AI paintings, still require professional software for editing, Adobe's functionality has subtly diminished. Notably, Adobe did not pioneer these text-to-image and text-to-video technologies; in the industry's rapid technological race, Adobe finds itself merely a follower.

Adobe's decline may not be a mere illusion, but given its consistent revenue growth and no signs of customer loss, there are still opportunities for bottom-fishing. Assuming that text-to-image and text-to-video functions eventually become commonplace, Adobe's lag is not a critical issue. Based on its niche in professional secondary editing, other companies may master large models but may not necessarily excel in professional visual design functions. Thus, Adobe can still maintain a prominent position in the industry.

But beyond this scenario, what other hidden dangers does Adobe face?

1. Impaired Long-term Valuation Logic

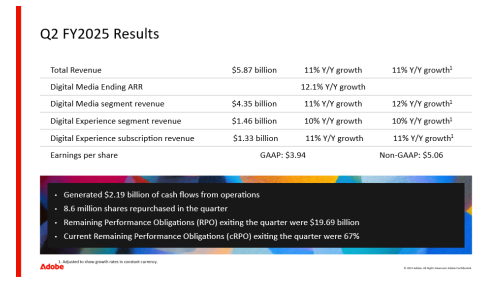

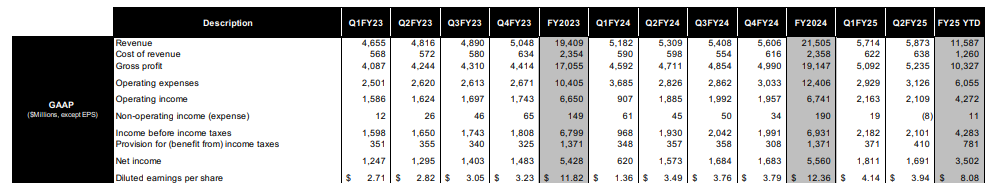

In terms of performance, Adobe is not as impressive as other popular AI companies. However, looking at the growth rate, there are no major concerns. In Q1 2025, both revenue and remaining performance obligation (RPO) maintained growth of around 11%. Many SaaS companies with little AI relevance are actually slowing down.

The company has also marginally increased its full-year earnings forecast.

Regarding growth, the media design business outpaces the digital business. The media design business includes visual design tools like PS, PR, and the PDF reader Acrobat. The digital business refers to the company's web design software Experience.

The company noted that although Firefly, its AI drawing function, generates low revenue, it has a high penetration rate, with 78% of users utilizing it. This indicates that generative AI has become a rigid demand in visual design. With Adobe's position, integrating this function into PS does not create a substantial gap with competitors. Firefly does not carry a high fee, so customers have little incentive to use two software, such as Midjourney followed by PS.

Companies providing text-to-image services externally do not possess robust secondary graphic design and editing functions. In commercial use, it is nearly impossible to complete a project solely with text-to-image; detailed adjustments are essential.

The company implies that Firefly is not lagging behind but is quite popular. With such high stickiness and potential, pricing it like PS in the future could lead to a surge in revenue. However, optimism in this regard is tempered as everyone currently offers it for free, and Adobe's products are far from being good enough for a significant price increase. Meanwhile, other companies are also striving to enhance secondary editing and fine-tuning capabilities in text-to-image functions to improve usability and commercialization. As the industry technology and final workflow paradigm in text-to-image have not yet been finalized, the expectation of market share decline will continue to haunt Adobe for an extended period.

Small companies aim to gain market share, thus increasing their valuation. Adobe, on the other hand, expects to lose market share, suppressing its valuation. This imbalance is natural in the stock market but harsh for large-scale companies that have long dominated their industries.

Adobe's PDF reader Acrobat has also been AI-enabled, significantly enhancing its functions. However, this has not translated into revenue growth as other large models can also handle PDF tasks without charging.

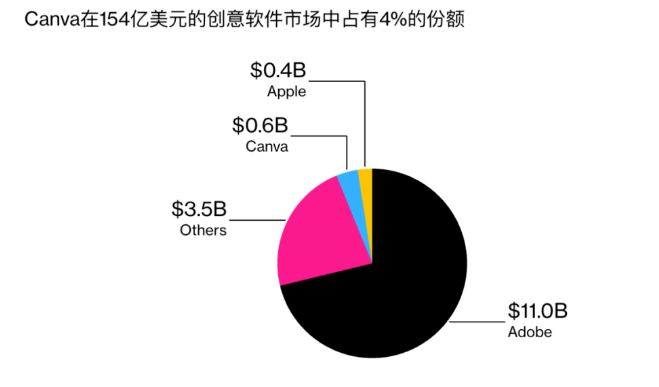

It cannot be overlooked that Canva, Adobe's rival that grew from the professional image design field rather than text-to-image functionality, continues to maintain a higher growth rate. In 2024, its market share was 1/20 of Adobe's, but it maintained a 30% growth rate in 2025, indicating that Canva's market share is still growing rapidly.

Canva's professionalism is naturally inferior to Adobe's, but the issue is that many commercial visual design needs are also unprofessional. Compared to Adobe, Canva offers a lighter operating environment, is easier to use, and also has quality AI production tools. In the long run, Canva will be Adobe's biggest rival. Before the convergence of their growth rate differences, this is likely to be a new factor suppressing Adobe's valuation.

Interestingly, after Figma's post-IPO surge, Canva may follow suit, leading to a bubble contagion phenomenon. For instance, Figma's peak market value reached $60 billion, while Canva's performance is comparable to Figma's, with almost three times better indicators. Using the same valuation method, it is not difficult for Canva to reach a market value of $200 billion upon its IPO. However, Adobe's current market value is only $140 billion.

This reflects the madness of the current US stock market bull run. But it also shows that Adobe is already very cost-effective in the long run. Two factors have been suppressing its valuation, but as long as its market share does not decline and its growth rate does not lag further behind Canva's, Adobe's valuation can easily rebound from 20 to the long-term 30 times with the disclosure of quarterly earnings.

2. The Figma Battle is Not the Focus

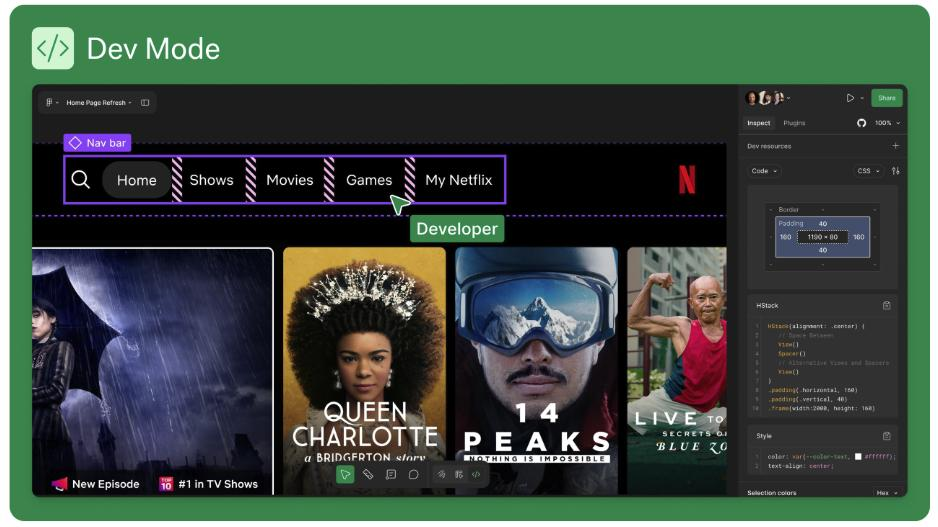

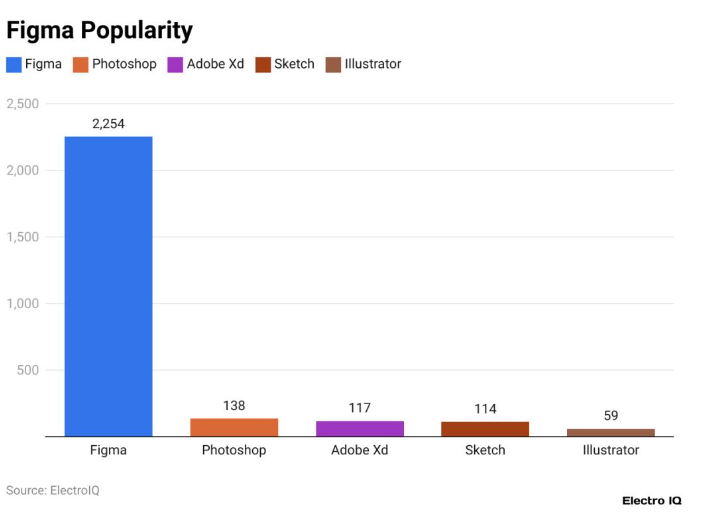

Considering the popular Figma, it would be an exaggeration to claim that it will comprehensively impact Adobe due to the huge difference in scale. However, Figma has indeed taken over Adobe's XD software, dominating the web or program UI design segment.

This segment is a subset of visual design and is not extensive. Figma's innovation lies in its platform operation without the need for locally installed software, running on the web, and emphasizing collaborative multi-person workflows. In contrast, Adobe's XD is somewhat complex.

What truly makes Figma competitive is its ability to generate code from graphics, allowing the construction of a webpage by only designing images and logic, completing tasks without code. Traditional design still involves having code first and then loading materials. Therefore, Adobe's XD appears outdated. Now, XD has essentially given up competition.

However, losing in this segment is not a significant issue for Adobe, which has a diverse portfolio of other businesses. Web UI design is essentially light visual design and does not require the extensive functionality derived from PS. What is more crucial is the usability of this tool.

Adobe once hoped to acquire Figma for $20 billion, but apparently, another monopoly would not be approved due to antitrust concerns. Theoretically, Adobe's offer was quite sincere.

Currently, Figma's impact on the UI design segment has been completed, and it will be challenging for Figma to further seize other software functions from Adobe. After all, under Canva and Figma, many non-professional visual design businesses have already been captured.

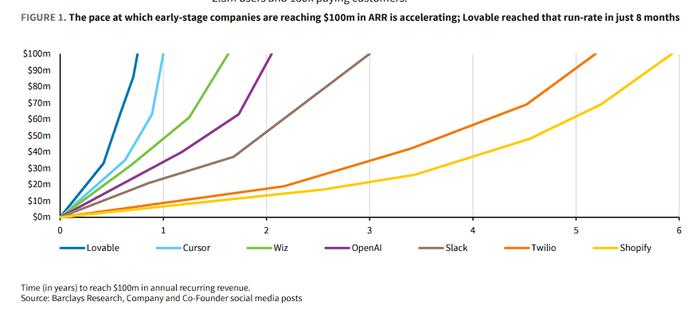

At the same time, Figma is not without competition. Such lightweight, no-code website development tools have nurtured more innovative companies with the development of large models. For example, Lovable, a no-code website building tool, has only been established for a year but has an ARR growth rate at the forefront of all SaaS.

Compared to Figma, Lovable may not be as strong in visual design, but these tools have stronger coding capabilities, emphasizing the creation of webpages with a single sentence of text, even skipping the visual design step of images, making Figma appear clumsy. This logic is the same as other companies impacting Adobe: providing less professional but more user-friendly tools for the general public. It seems that the rising tide lifts all boats, but Figma's future also faces considerable challenges.

3. The Real Issue

For Adobe, the main issue currently is an insufficient growth rate, both in revenue and profit. This problem is caused by unfavorable competition, which has not suddenly arisen but rather reflects Adobe's inability, as a large company, to maintain market share while charging high fees and profits in innovative, low-professional segments.

However, the US stock market is not devoid of "elephants dancing" this year. Monopoly or excessive scale is not the reason for no growth. The key lies in how to leverage AI to drive revenue and profit growth. If Adobe's growth rate recovers to above 20%, its takeoff is inevitable.

Like other current AI application companies, Adobe spends heavily on computing power but has not translated this into growth. One reason is the lack of customer growth. Referring to the development of Figma and Canva, Adobe has lost its mass market customers. Therefore, Adobe's long-term growth relies on a stable number of professional users and increasing ASP through coordinated sales to generate revenue.

This point actually aligns with the company's implied strategy of increasing fees for Firefly and AI video functions in the future. However, this path will only narrow further, allowing competitors to thrive and have more motivation to explore professional services. Therefore, Adobe needs some changes, such as exploring better pricing models:

In the past, the transition from software buyouts to SaaS subscription payments was a major innovation in the software industry. However, in the AI era, the subscription model is not the whole story. AI monitoring is more granular, allowing for payment based on the depth and duration of operations, precisely pricing professional and non-professional users. Large models do not need to be paid by the day but by tokens, which is a form of granular pricing. Granular pricing based on the usage frequency of different software functions can actually rejuvenate Adobe, whose path is narrowing.

I once proposed that successful AI application companies all have their own exclusive and powerful small models. Palantir and Applovin are examples of this. Meta may seem to be fiddling with large models every day, but its revenue and profit growth rely on optimizing advertising business efficiency, essentially using precise advertising small models like Applovin. For Adobe, whose team cannot lead Aigc models, precise pricing of such models is the way to win. For features that everyone has, it is unrealistic to expect to maintain high pricing and market share.

Additionally, it is noted that Adobe's profit margin has not improved during this wave. Although the gross margin is already high and cannot be changed much, the sales and distribution expense ratio remains high. It is crucial to use AI to enhance sales efficiency because Meta has achieved revenue growth while reducing sales expenses. This internal control is unrelated to industry technological trends, indicating that Adobe has not deeply integrated AI, which may be the company's true future.

Conclusion

It is not difficult for Adobe, with a market value of $140 billion, to multiply its value, as there are precedents. However, the problem is that the company's AI integration is insufficient, and its AIGC technology is not at the forefront of the industry. But its accumulated expertise in professional secondary editing functions gives it a high fault tolerance rate. As long as it can find some exclusive small models, whether in products or internal controls, it can make a comeback.

For instance, precise product pricing or improving product marketing efficiency can immediately reverse revenue and profit growth rates. However, the reality is that Adobe has not achieved this, and its valuation will continue to be suppressed until the text-to-image and text-to-video models are finalized. Adobe remains a company that will not experience a major turnaround without change.