Profit surged over 700 times in the first quarter. What's the background of Montage Technology?

![]() 06/17 2024

06/17 2024

![]() 629

629

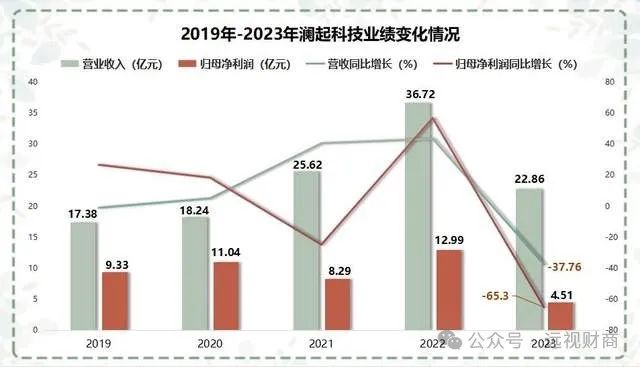

Recently, the semiconductor industry has successively released its financial reports for the first quarter of 2024. Compared to industries with less than ideal performance, under the apparent recovery of the electronic consumer market and the AI technology wave, four semiconductor manufacturers have achieved a surge in net profit of several dozen times in the first quarter. Among them, Montage Technology, whose main business is interconnect chip products, saw a year-on-year increase of 74117.63% in net profit, attracting significant attention from the industry.

This explosive performance of net profit surging over 700 times in the chip industry is remarkable, even compared to vaccine and nucleic acid testing companies that made a fortune overnight three years ago. Such a meteoric rise has prompted people to ask: What's the background of Montage Technology, and how can it achieve such outstanding performance?

The significant increase in net profit had been预告ed earlier, and the positive effects of the recovery in performance have begun to emerge.

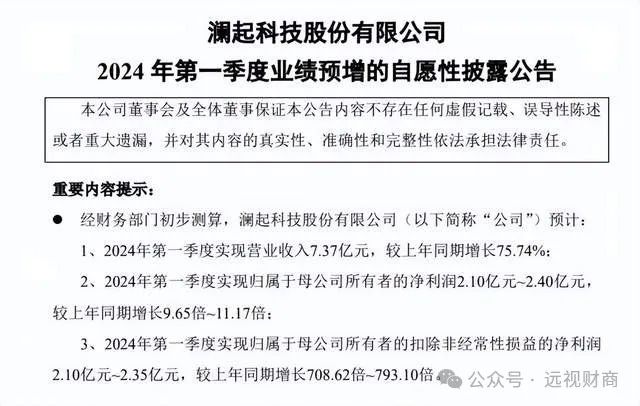

Before the first-quarter results of various semiconductor companies were announced, Montage Technology disclosed a first-quarter earnings preview report, forecasting that it would achieve operating revenue of 737 million yuan in the first quarter of 2024, representing a year-on-year increase of 75.74%. The net profit attributable to the parent company's owners was expected to be between 210 million yuan and 240 million yuan, representing a year-on-year increase of 9.65 to 11.17 times. However, after excluding non-operating gains and losses, the net profit was expected to be between 210 million yuan and 235 million yuan, representing a year-on-year increase of 708.62 to 793.10 times.

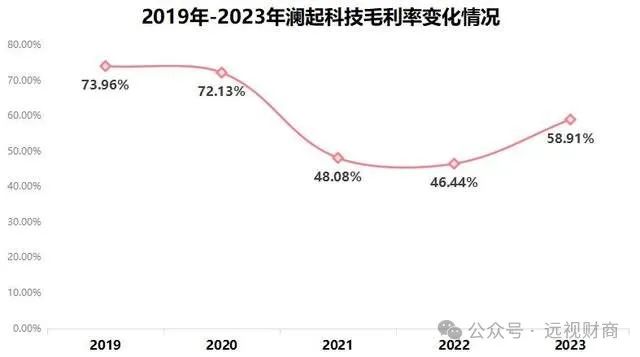

This preview was undoubtedly a significant news, which seemed to stir up waves in the industry and sweep away the sluggishness of consumer electronics in previous years. Since the beginning of 2024, demand for memory interface chips has started to recover strongly, and Montage Technology's new products have begun to ship in large quantities, resulting in significant growth in performance. Among them, the quarterly shipment volume of PCle Retimer chips reached approximately 150,000 units, exceeding 1.5 times the annual shipment volume of the product in 2023. The quarterly sales revenue of MRCDMDB chips exceeded 20 million yuan for the first time. The strong performance also demonstrates Montage Technology's internationally leading attributes in data processing and interconnect chip design, providing high-performance, low-power chip solutions in the fields of cloud computing and artificial intelligence. The interconnect chips and JinDai servers account for 96% and 4% of revenue, respectively. This clearly indicates that the disadvantage of destocking pressure faced by the industry due to the decline in server and computer industry demand last year has ended. As the demand for ordinary servers remains stable, the demand for AI server memory modules is showing a recovery growth, and performance is starting to rebound.

Before the official financial report was released, Montage Technology's earnings preview can be described as giving investors a sufficient reassurance. The early preheating of the earnings preview led to a significant increase in the stock price at the opening, with intraday gains exceeding 13%. As of the close of trading on that day, the stock price rose 9.72% to close at 47.15 yuan per share.

Memory interface chips may not be a business that ordinary people understand.

It is undeniable that in the past three years when the COVID-19 pandemic was most severe, Montage Technology was severely undervalued in terms of performance, stock price, market capitalization, and price-to-earnings ratio due to the sluggish market and excess demand. Especially in the fourth quarter of 2023, once the results were disclosed, the second-largest shareholder reduced their holdings, selling a total of 35.6 million shares in a year. However, there are always gains and losses, and shareholders who increased their holdings last year in unfavorable circumstances can be said to have made very accurate bets this year.

Just considering the company's mainstream product, memory interface chips, most people know little about it because they generally do not encounter such technical issues. In fact, ordinary personal PC products, mobile phones, and other small consumer electronic products have relatively small amounts of data and computations, and they do not have high requirements for memory size, data transmission speed, and stability. However, for some business-oriented applications and technically demanding PC tools, it is necessary to increase core hardware on the memory interface of products with high computational power such as servers. Simply put, the more advanced the server, the larger the memory capacity, and the more memory interface chips will be needed.

Therefore, to improve system stability, products like Montage Technology, which is a leader in the industry, are needed. This is why its customers can cover the globe, serving core DRAM manufacturers such as Samsung, SK Hynix, and Micron.

Scarcity determines explosive growth.

A few years ago, Chinese companies, especially technology and digital products, were still suffering from being "choked" by foreign countries, which is still fresh in people's minds. The rise of Montage Technology from a rising star on the STAR Market to a chip leader is also a microcosm of the growth of Chinese companies.

If you have not truly understood the chip industry, many people may not understand why a company that produces consumer electronics accessories can achieve a profit growth of over 700 times. This astonishing speed is even more impressive than that of vaccine and nucleic acid testing companies during the pandemic. However, if you realize that Montage Technology is the world's largest manufacturer of memory interface chips, with outstanding technical strength and profound experience in the market, and almost no rivals among its peers, you will understand why Lenovo became the national pride of the PC industry many years ago, and now in the chip industry, Montage Technology can also lead the way with outstanding performance.

Because the products involve multiple supporting chips for multiple generations and have certain advantages in core indicators such as supported rates, and some products have advantages in first-mover and scarcity, Montage Technology has taken a significant lead in fourth-generation chips when others are still using second- or third-generation products, becoming a pioneer in the industry and receiving widespread attention from the market. Naturally, the products occupy an important position, and high-growth performance follows logically.