Anene Logistics, with 45% of its distribution centers and 15% of employees cut, has the reform finally borne fruit?

![]() 06/18 2024

06/18 2024

![]() 545

545

By Jiu Cai

When a company successfully enters the capital market and becomes a leading player in the industry, yet makes significant changes in its management, including the adjustment of core executives such as the Board Chairman and Chief Operating Officer, what will be the future of this company?

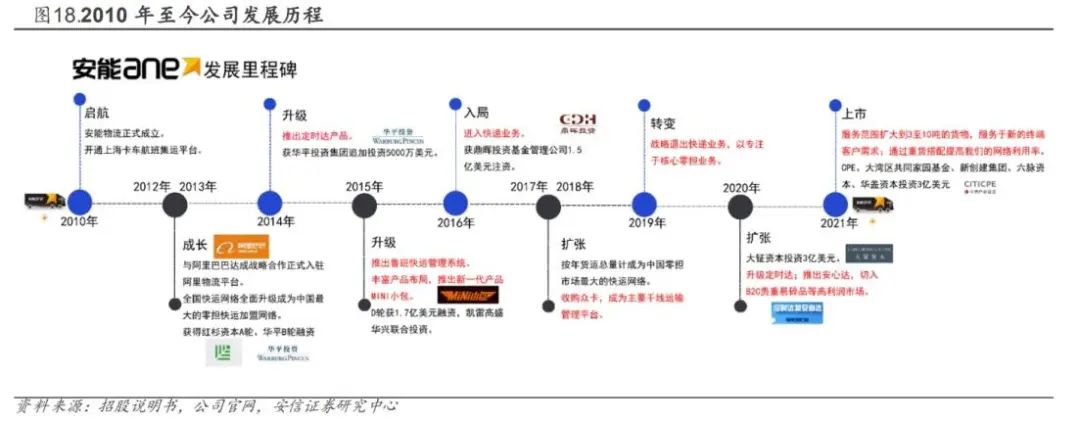

Anene Logistics, known as "the first Hong Kong-listed express logistics company," once faced such a choice. The original Board Chairman Wang Yongjun and the original Chief Operating Officer Zhu Jianhui resigned successively, paving the way for the company's reform, leading to the dissolution of the founding "iron triangle".

Recently, Anene Logistics released its first-quarter performance report for 2024, which is the company's first voluntary quarterly report since its listing.

The financial report shows that during the reporting period, Anene Logistics achieved a total operating revenue of 2.378 billion yuan, representing a year-on-year increase of 15.2%; the total volume of less-than-truckload (LTL) freight reached 2.88 million tons, an increase of 21.7% year-on-year; the gross profit margin reached 16.1%, hitting an all-time high; and the adjusted net profit was 209 million yuan, an increase of 173.9% year-on-year.

Judging from the results presented in the financial report, it seems that after the significant management shakeup, Anene Logistics has emerged from losses and successfully achieved profitability. However, for a large enterprise that has been accustomed to a certain business model, "it's difficult for a big ship to turn around," and reforms rarely succeed overnight. Whether Anene Logistics will have a smooth future or still experience fluctuations remains to be further explored.

01 Dissolution of the Decade-long "Iron Triangle"

Before answering this question, Jie Dian Finance believes it is necessary to clarify why Anene Logistics chose to make such significant changes.

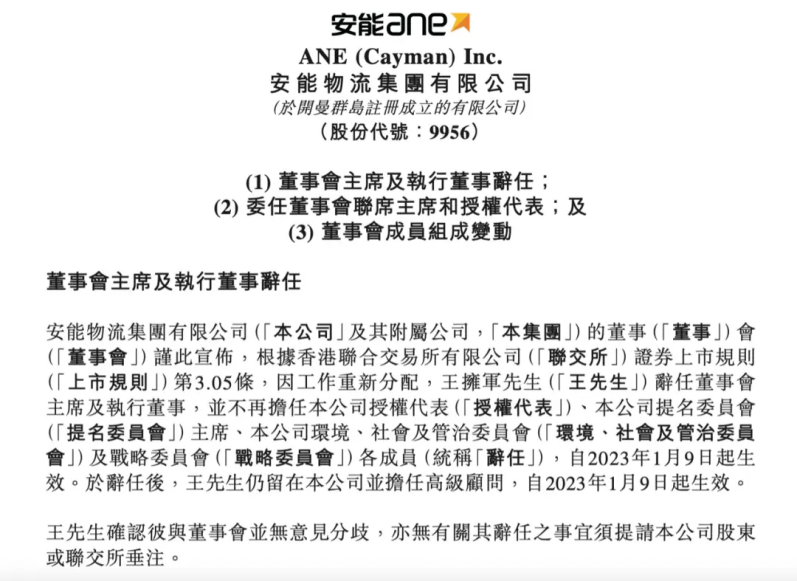

For any listed company, replacing a Board Chairman who has held the position for ten years is undoubtedly a major event.

In January 2023, Anene Logistics announced that due to a redistribution of work, Wang Yongjun resigned as Board Chairman and Executive Director, and no longer served as the company's authorized representative, chairman of the Nomination Committee, and a member of the Environmental, Social, and Governance Committee and the Strategic Committee.

The departure was complete.

Before Wang Yongjun, in September 2022, Anene Logistics's original Chief Operating Officer Zhu Jianhui also resigned, retaining only an advisory role.

Looking back, when Anene Logistics listed on the Hong Kong Stock Exchange on "Double 11" in 2021, Wang Yongjun, Qin Xinghua, and Zhu Jianhui were known as the company's "iron triangle." Among them, Wang Yongjun served as the Chairman since January 2012, responsible for the group's overall strategic development, corporate governance, and management; Zhu Jianhui was appointed as the Chief Operating Officer in May of the same year, responsible for the group's overall strategic planning and overall management and execution of business operations.

With two members of the founding "iron triangle" leaving, such a significant move often indicates that the company is making in-depth strategic adjustments. And the capital market's reaction is always the most sensitive.

On January 10, 2023, the day Wang Yongjun's resignation announcement was released, Anene Logistics's share price surged, once rising by more than 10%, hitting a new high since early March 2022.

It is obvious that the capital market welcomed this outcome. Behind the dissolution of two of the "iron triangle" lies the driving force of capital. Jie Dian Finance is so sure because shortly after Zhu Jianhui's departure, Anene Logistics's management shareholders no longer constituted the single largest shareholder group, and Dazheng Capital, which held 24.60% of the shares, became the company's largest shareholder.

With Wang Yongjun's resignation, Dazheng Capital partner Chen Weihao stepped forward and served as the co-chairman of the board along with Qin Xinghua, making everything self-evident.

Therefore, Dazheng Capital, representing the capital side, is one of the core driving forces behind Anene Logistics's reform. The reason for the capital's involvement can be seen in Anene Logistics's previous stock performance.

When Anene Logistics first listed in 2021, its issue price was 13.88 Hong Kong dollars per share, but it then fell sharply below its issue price. By November 2022, its share price had dropped to as low as 1.82 Hong Kong dollars per share, representing a decline of over 95%.

Faced with such a "disastrous" situation, the faces of Anene Logistics's shareholders must not have looked too good, which constituted the first reason for Anene Logistics's reform. However, Jie Dian Finance believes that behind the stock price decline lies a deeper reason, namely, the profound changes taking place in the domestic LTL express logistics industry where Anene Logistics operates.

In the face of industry shifts, if a company fails to respond in a timely manner, it can only expect to be eliminated. This has been proven by numerous cases, even for industry leaders. Jie Dian Finance even believes that the larger the company, the higher the risk coefficient due to the difficulty of "turning a big ship around" in the face of changes in the overall environment.

So, what changes are taking place in the LTL express logistics industry?

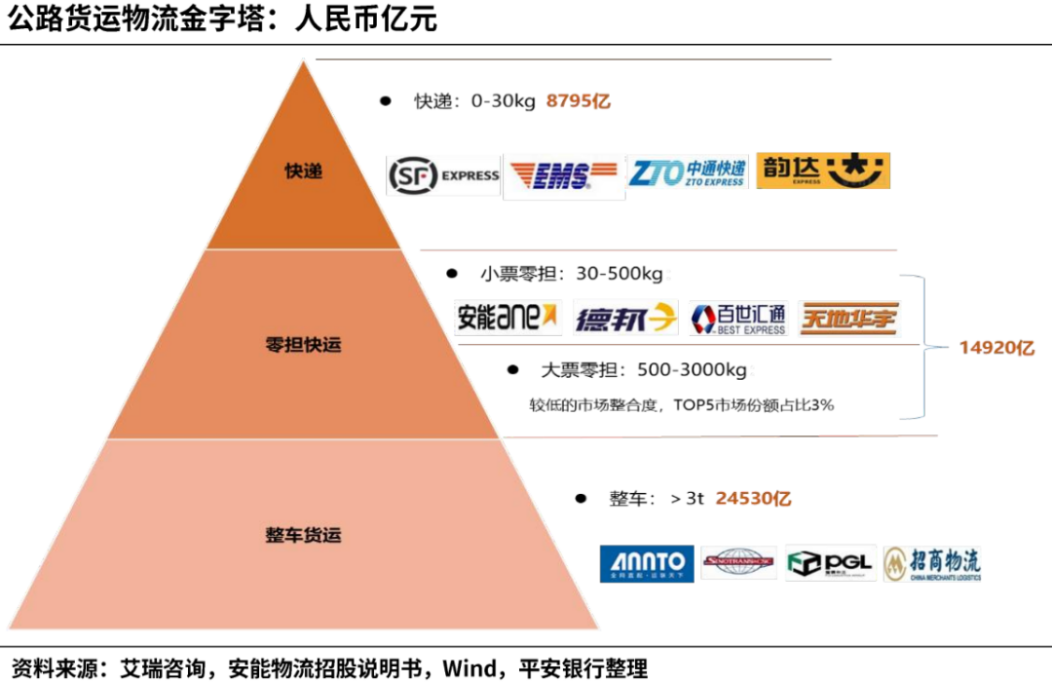

To begin with, the so-called "LTL express logistics" is generally understood in the industry as when the weight or volume of a batch of goods does not fill a truck, it can be shared with several or even hundreds of other batches of goods using the same truck for transportation. In layman's terms, the LTL express logistics industry is a market that can transport goods weighing more than 10 kg in a networked manner, similar to express delivery.

The changing trends in LTL express logistics determine the direction of Anene Logistics's reform.

02 Reform: No Choice but to Move Forward

In fact, compared to the "express delivery" industry, which consumers encounter more frequently in their daily lives, most people are not very familiar with LTL express logistics. However, the importance of this industry is no less than that of express delivery. Currently, the circulation of China's supply chain system, the connection between commercial enterprises, and the convenience of end consumers are all based on the foundation of the LTL express logistics network.

Let's first take a look at its market size and development stage.

According to a research report by iResearch, in 2022, the LTL express logistics market accounted for over 30% of China's road transportation, with a market size of approximately 1.62 trillion yuan, and is expected to further increase to 1.80 trillion yuan by 2027.

With a trillion-yuan market size, the volume is considerable. According to Jie Dian Finance's observations, the domestic LTL express logistics industry has long been in a state of "small, weak, and scattered." This is due, on the one hand, to the fragmented market demand and the predominance of price-sensitive customers; on the other hand, the development of supply-side enterprises is still in its initial stage. However, with the entry of capital in recent years, the entire industry is also facing a shift.

According to McKinsey's "2023 LTL Logistics Industry Insight Report," the domestic LTL market is facing structural transformation and upgrading, and is entering a period of "integration" in the existing market. Among them, the most mature nationwide express logistics is the only track that may give rise to a leading company with a scale of 50 billion yuan.

In fact, according to Jie Dian Finance's understanding, the development of the LTL express logistics market lags behind that of the express delivery market, and its current maturity is roughly equivalent to the level of the express delivery industry a decade ago. As a leading domestic LTL express logistics company, Anene Logistics was only established in 2010, later than SF Express and "Sitong Yida".

Moreover, in the past few years, the express logistics industry was still in the stage of capital expansion, competing for cargo volume and rapid territorial expansion, with the core being "burning money" to see who could keep up with financing scale and speed. Therefore, for a considerable period of time, the entire industry was generally loss-making.

This can be seen from Anene Logistics's performance from 2018 to 2023. Except for 2020 and 2023, all other years were losses. The losses in 2018 and 2021 even exceeded 2 billion yuan.

Currently, this model has become unsustainable. LTL express logistics is shifting from an early pursuit of scale to a pursuit of profit. This is not only a necessary stage of industry development but also an inevitable integration following changes in the current economic environment.

Domestically, under the strategic guidance of building a unified national market, the overall economic form requires a high-quality, nationwide, and fast-responding supply chain logistics system. Externally, the instability of the global economy is also forcing the industry to transform.

In 2023, the global manufacturing purchasing managers' index averaged 48.5% for the year, down 3.3 percentage points from 2022. Under such circumstances, global logistics volume growth was weak, and the entire logistics industry was struggling.

Cost reduction and efficiency improvement, as well as the pursuit of "quality and profit," are becoming a new consensus in the LTL express logistics industry.

Of course, in Jie Dian Finance's view, this consensus is applicable to most industries at present. And specifically in the express logistics industry, it also has its own particularities.

First, at the national policy level, reducing logistics costs has been written into the "Government Work Report," putting forward higher requirements for the express logistics industry, aiming to guide logistics enterprises to pursue higher efficiency, quality, and profit margins rather than simply reducing service prices.

Moreover, the LTL express logistics market mainly serves B2B customers, which are an important part of the corporate supply chain, and thus bear a more important mission. Transformation has become inevitable at the policy level.

Second, returning to the industry itself, under increasing competition, who can control costs more effectively and increase profits will have the confidence to become the final winner.

Furthermore, under such intense competition, logistics services need to have the ability for global optimization, which has prompted express delivery companies to enter the express logistics market and develop integrated logistics. Moreover, digital platform companies such as network freight transportation are also reshaping the freight logistics ecosystem, intensifying competition in the express logistics market.

JD.com acquired Deppon Express, J&T Express acquired Yimida Express through Huisens Express... Under such circumstances, traditional express logistics companies like Anene Express are facing increasing crisis, and transformation has become inevitable. Not only Anene, but also leading peers such as Deppon, Best Logistics, and Yimida are all working to reduce costs and increase efficiency, with competition entering a deeper level.

Can Anene Logistics emerge victorious from the fierce competition?

03 Initial Success, but No Room for Relaxation

Judging from the current performance, Anene Logistics seems to have found a successful path out of its loss dilemma.

In addition to the first-quarter financial report mentioned at the beginning of this article, Anene Logistics's performance in 2023 was also impressive, with total revenue reaching 9.917 billion yuan, representing a year-on-year increase of 6.2%; gross profit increased by 73.6% to 1.268 billion yuan; and net profit turned from a loss of 218 million yuan in the same period in 2022 to a profit of 407 million yuan.

Jie Dian Finance believes that Anene Logistics achieved such results for three reasons: first, its organizational structure adjustment.

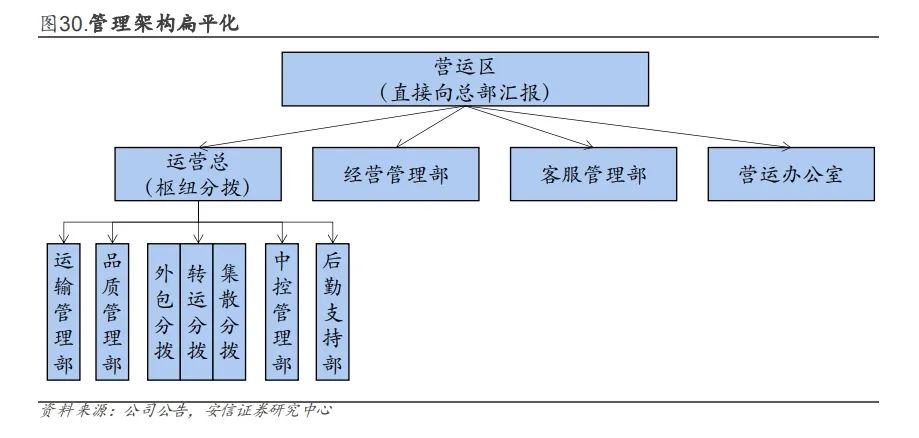

The first step of reform is to change people, and organizational structure adjustment is almost a prerequisite for all reforms. Behind the dissolution of two of Anene's founding "iron triangle" lies this logic. After the adjustment, the original multi-level organizational structure with tens of thousands of employees was streamlined into a flat two-tier structure, with decision-making power being significantly delegated to the operational areas, and a performance-oriented assessment and incentive framework was established.

Second, following the organizational structure adjustment, the follow-up business structure laid the foundation for Anene Logistics's profitability.

There is a well-known rule in the express logistics industry that the heavier the unit weight of goods, the lower their profit margin tends to be. However, under the guidance of "burning money" to pursue large scale in the past, the core driving force of most outlets was to acquire more cargo, and the heavier the weight, the more popular it was. Only by shifting the business structure's goal from scale to profit can the original motivation of grassroots outlets be changed.

In Jie Dian Finance's view, only when the company's goals align with the interests of grassroots outlets can long-term stable profitability be achieved. Currently, Anene Logistics's business structure adjustment has achieved initial success. In 2023, its average ticket weight decreased from 106 kg to 93 kg, and the volume of mini tickets and small-ticket LTL with higher profit margins increased by 9.1% and 2.4%, respectively.

Finally, in addition to organizational and business structure adjustments, Anene Logistics has also put in a lot of effort in refined operations. In fact, the shift from a crude "burning money" model to a "profit and quality" model largely depends on a company's ability to operate precisely.

In 2023, Anene Logistics reduced the number of distribution centers from 147 at the end of 2020 to 81, a significant reduction of 66 centers, representing a decline of approximately 45%. Along with this trend, the number of employees at Anene Logistics also decreased significantly, from 3,709 at the end of 2020 to 3,142 at the end of 2023, a decline of over 15%.

The purpose of this is to straighten out routes, reduce the number and duration of transfers, improve site utilization efficiency and overall efficiency, and on the other hand, reduce the number of loading and unloading operations, thereby reducing costs and damage. Of course, the reduction in the number of employees has also invisibly reduced the pressure on labor costs.

Overall, the express logistics industry has basically formed a leading pattern dominated by networks such as Anene Logistics, Yimida Express, Best Logistics Express, ZTO Express, SF Express, and Deppon Express. Jie Dian Finance believes that in the next three to five years, the concentration of the express logistics industry may further increase. If in the past, the pursuit of scale was about external strength, in the future, it will be about internal strength.

However, it should be noted that short-term profitability in financial reports is not enough to prove that Anene Logistics's reform has succeeded. In 2020, it also achieved profitability, but it did not last. Compared to past losses of over 2 billion yuan, the profitability level in 202