"The Most Competitive" 618 Ends: Escalating Chaos and Unique Strategies

![]() 06/20 2024

06/20 2024

![]() 506

506

Written by Wang Huiying

Edited by Ziye

The longest 618 promotion in history has finally ended. What makes this one different?

Looking back, this year's 618 brought many firsts. It was the first major promotion after several major e-commerce platforms canceled pre-sales, the first to simplify discount mechanisms, and also the first after several platforms launched refund-only services.

Amid market recovery, the normalization of major promotions, users' consumption mindset becoming more rational, and high traffic costs, this year's 618 was also considered the most difficult edition by the industry.

During this year's 618, among the three major e-commerce giants, Tmall announced it was "the largest investment in history," JD.com touted "cheaper and better," and Pinduoduo increased its billion-yuan subsidy efforts.

In live-streaming e-commerce platforms, Douyin (TikTok) tested a small-scale "automatic price change" function, Kuaishou (Kwai) promoted the theme of "Every Day is 618, with Bigger Brand Subsidies than the Entire Network," and Xiaohongshu (RED) launched a dual-drive strategy combining "buyer live-streaming" and "store live-streaming".

On the other hand, as an important channel for e-commerce, live broadcasters and MCN agencies have long been regular participants in major sales events, adapting to industry changes with new moves. Taking Li Jiaqi and Mei ONE as examples, this year's 618 combined pre-sales with spot goods, introducing more segmented specials and setting up more diverse scenarios to serve consumers.

Although competition is more intense, no one can afford to abandon 618 for growth.

Since the first quarter, China's consumer market has shown a recovery trend. From January to March this year, the country's online retail sales increased by 12.4% year-on-year. Among them, online retail sales of physical goods increased by 11.6% year-on-year, accounting for 23.3% of the total retail sales of consumer goods.

Platforms are simplifying to capture more users in this recovery trend.

Behind this shift is the e-commerce industry entering its second half, with the era of extensive high-growth bonuses fading away. Platforms are engaging in intense internal competition, paying more attention to service and operational details.

At this point, the significance of the 618 promotion has become extraordinary. For merchants and platforms, through this "midfield battle," they have achieved a wave of growth and gained more insights into how to operate in the second half of the year.

1. The Battle of "Cat, Dog, and Pin" Promotions: The Direction of Internal Competition Has Changed, and the Smoke of War Has Become Thicker

What are the keywords of this year's 618?

A month ago, along with Tmall and JD.com canceling pre-sales and returning to users, canceling pre-sales became a promotional point for all major platforms.

The consensus among platforms is to say goodbye to gimmicky practices, directly sell spot goods, offer the most preferential schemes, and provide consumers with intimate services in a simple and direct manner.

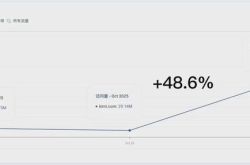

This has received positive market feedback. According to Analysys data, in the first period of this year's 618 (May 20th to June 3rd), the GMV growth rate of comprehensive e-commerce platforms led by Taobao, Tmall, JD.com, and Pinduoduo reached 14%.

But to create distinctiveness and differentiation, besides cross-store discounts, billion-yuan subsidies, and flash sales, which have become standard for platforms, the three major e-