Baidu's stock soars, Luobo Quickrun unfazed by driver opposition

![]() 07/12 2024

07/12 2024

![]() 548

548

The opposition from drivers is not the biggest problem facing Luobo Quickrun. In fact, during the days when Luobo Quickrun was the subject of heated debate on social media, Baidu's Hong Kong-listed shares soared, with a single-day increase of 10%, marking the largest single-day gain in over a year.

The hidden concern for Luobo Quickrun lies in safety. The world's first fatal accident involving a self-driving car occurred in the United States in 2018. In March of that year, a self-driving car operated by Uber hit a pedestrian, killing them. Following the accident, there was intense public outcry against self-driving technology, forcing Uber to halt its autonomous driving research and development, lay off employees, and eventually sell its autonomous driving business two years later.

For an emerging technology, safety is the final barrier for people to truly accept it. The ride-hailing industry has been developing for 14 years and has only recently seen an influx of IPOs. They could have gone public earlier, but two successive serious safety incidents involving Didi Hitch 6 years ago shattered this expectation, causing the entire ride-hailing industry to contract. ven though various data indicate that ride-hailing accidents occur at a lower rate than taxis and are easier to trace.

Author | Zhang Wen

Editor | Jiang Jiao

Cover | "Arrival"

01

When exactly will be the inflection point for the autonomous driving industry? Different companies and individuals have different views, but most point to two to three years from now.

Cui Dayong, CEO of ride-hailing company T3, said that 2027 will be the turning point year for autonomous driving in China. Zhang Ning, vice president of autonomous driving company Pony.ai, believes that autonomous driving will gradually enter large-scale commercialization from this year to around 2026. He Xiaopeng, CEO of Xpeng Motors, also said that while the current capabilities, regulations, and business loops for Robotaxi are not yet in place, they are accelerating, and he expects the turning point to arrive in about two years.

The turning point has not yet arrived, but people's panic has already been ignited.

Luobo Quickrun, which has deployed over 400 self-driving cars in Wuhan, is the direct source of this panic. Its 7x24 continuous operation, more standardized driving, cleaner cabins, and cheaper prices have instilled fear in drivers.

Under the amplifying effect of social media, even people not in Wuhan have begun constantly questioning whether they will be replaced. The media has relentlessly questioned the technological iteration, asking "What about 10 million drivers?" Will they be abandoned? Will they face unemployment? Should technological advancement slow down? Is the cyberpunk future really becoming a reality?

Strictly speaking, it is still premature to discuss whether self-driving technology will replace human ride-hailing drivers. Excluding taxi drivers, China's current daily ride-hailing orders are roughly 30 million. In the first quarter of this year, Luobo Quickrun's national daily average orders were only 10,000, making it difficult to say that the replacement point has arrived.

Even in Wuhan, where Luobo Quickrun has the largest scale, the more than 400 self-driving cars deployed there pale in comparison to Wuhan's daily average of 29,400 ride-hailing vehicles in operation. Adding the 1,000 new-generation mass-produced self-driving vehicles that Baidu plans to deploy in Wuhan this year, this number is still far from threatening ride-hailing.

Not to mention that they are still in the red. Baidu's fifth-generation Apollo Moon self-driving cars, which are currently in operation, are based on modified Beiqi ARCFOX vehicles, with a total cost of around 480,000 yuan. The upcoming sixth-generation model, developed specifically for self-driving scenarios, has a cost reduced to 250,000 yuan.

Chen Zhuo, general manager of Baidu's autonomous driving business unit, said that at the beginning of last year, they lost a lot of money per vehicle per day. By the beginning of this year, as the scale expanded, the losses were reduced by more than half. With the gradual deployment of thousands of sixth-generation self-driving cars, their revenue growth rate will accelerate, and they are already very close to the tipping point of breakeven. They plan to achieve breakeven in Wuhan by the end of the year and enter a period of profitability in 2025.

Currently, Luobo Quickrun's low price of almost 1 yuan per kilometer is more about encouraging users to try it out. LatePost calculated that the daily operating cost of Luobo Quickrun's fifth-generation self-driving car is between 372 and 471 yuan, which is significantly higher than the current income per vehicle per day. Similar to most new things in their early stages, the price of self-driving cars will gradually increase as they mature.

The claim that Luobo Quickrun can break even in Wuhan has also been questioned by industry insiders. He Xiaopeng said, "Saying that it can break even soon is because many accounts have not been settled." He explained that the capability requirements for Robotaxi are significantly higher than L4 and that they also face comprehensive issues such as operational regulations and social acceptance, making it no easy feat.

Baidu began developing autonomous driving over a decade ago and formally established its autonomous driving division in 2015. Over the past decade, it has invested more than 150 billion yuan in autonomous driving research and development, none of which has yet reached the return period.

Most industry research institutions also put the real landing of Robotaxi in the coming years. According to calculations by the McKinsey Future of Mobility Center, autonomous driving will account for about 13% of total passenger miles in China by 2030, and this figure will reach 66% by 2040.

Currently, the experience of Luobo Quickrun is difficult to match that of human taxis. For example, it can only stop at fixed stations, has a more conservative driving strategy, travels slower, and has longer waiting times. A user who has taken Luobo Quickrun over 200 times said on social media that Luobo Quickrun's strategy is "when in doubt, just wait, waiting for others to yield."

Passengers' curiosity about new technology makes them willing to tolerate these shortcomings. In the early days of ride-hailing, passengers and drivers often argued over pickup locations, which is almost non-existent in Luobo Quickrun's operations. Sometimes when the self-driving car's stopping location is off, they are willing to jog a few steps to catch up and will not be dissatisfied with the extra step of entering their phone's last four digits into the car window.

Some passengers prefer Luobo Quickrun's clean and tidy interior, avoiding conversations with drivers, smoke smells, pick-up lines, and road rage, not to mention the cheaper price.

02

The opposition from drivers stems more from fear of the unknown. During the years when ride-hailing companies offered crazy subsidies, taxi drivers everywhere also opposed ride-hailing, but now, except in some transportation hubs, it is almost impossible to hail a taxi on the street – almost all taxi drivers receive orders through their phones. In November last year, the Beijing Evening News reported that the difficulty in hailing taxis has led to difficulties for elderly people who do not use smartphones in getting rides.

Unlike the regulatory lag in the early days of ride-hailing, regulatory authorities are strongly supportive of Robotaxi, with documents such as the "Innovative Development Strategy for Intelligent and Connected Vehicles," the "National Guidelines for the Construction of the Vehicular Network Industry Standard System (Vehicle Intelligent Management)," the "National Guidelines for the Construction of the Vehicular Network Industry Standard System (Intelligent Transportation Related)," and the "National Guidelines for the Construction of the Vehicular Network Industry Standard System (Intelligent and Connected Vehicles) (2023 Edition)" all proposing standards to support the implementation of autonomous driving technology.

First-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, as well as provinces and cities such as Hunan and Hubei, are also actively conducting road tests and deploying Robotaxi. Luobo Quickrun has been deployed in 11 cities nationwide, with Wuhan being the largest. The latest news is that Beijing has announced the opening of a commercial pilot for "driverless" intelligent and connected passenger vehicles in the city.

Policy support and iterative advancements in self-driving technology are accelerating the arrival of Robotaxi. McKinsey predicts that the inflection point will occur between 2025 and 2027, when the cost of operating autonomous taxis will be lower than that of human-driven taxis. Li Yanhong also said, "In the past, everyone believed that autonomous driving would progress step by step from L2 to L5, but now L4 may be the first to enter commercial use after L2, not L3."

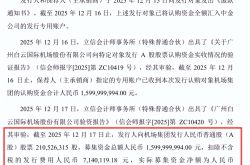

The opposition from drivers is not the biggest problem facing Luobo Quickrun. In fact, during the days when Luobo Quickrun was the subject of heated debate on social media, Baidu's Hong Kong-listed shares soared, with a single-day increase of 10%, marking the largest single-day gain in over a year. Since July, Baidu's share price has risen from 83.9 Hong Kong dollars to 99 Hong Kong dollars. Domestic stock market concept stocks related to self-driving have also seen consecutive trading halts, driving up the share prices of new energy vehicle companies such as Xpeng, Li Auto, and NIO.

The hidden concern for Luobo Quickrun lies in safety. The world's first fatal accident involving a self-driving car occurred in the United States in 2018. In March of that year, a self-driving car operated by Uber hit a pedestrian, killing them. Following the accident, there was intense public outcry against self-driving technology, forcing Uber to halt its autonomous driving research and development, lay off employees, and eventually sell its autonomous driving business two years later.

A similar accident occurred in October last year involving Cruise, the autonomous driving subsidiary of General Motors. Although the Cruise self-driving car was only involved in a human-caused car accident while driving on the road, it still led to Cruise suspending related operations until April of this year, when it resumed operations on a small scale.

So far, there have been no serious casualties in China's self-driving road tests. Visiting Luobo Quickrun's official website, one is greeted by bold letters stating, "0 major casualties in 100 million kilometers," "There has never been a major safety accident caused by autonomous driving resulting in casualties." Baidu proudly claims that Baidu Apollo autonomous driving is safer than human driving.

Today, they claim that the autonomous driving technology reconstructed based on large models can achieve safety levels 10 times higher than human drivers, approaching the safety level of domestic large aircraft C919.

Most automotive industry insiders also believe that autonomous vehicles are safer. Compared to uncontrolled pedestrians and human drivers who may violate traffic rules, autonomous vehicles strictly adhere to traffic regulations, are more conservative, and less prone to accidents. Zhang Ning, vice president of Pony.ai, said in June this year that the autonomous driving capability in ordinary scenarios has met expectations four years ago. Over the past three to four years, how to navigate high-density human-vehicle interactions, driving in urban villages, and other long-tail scenarios has been the gradual solution that autonomous driving needs to address.

For an emerging technology, safety is the final barrier for people to truly accept it. The ride-hailing industry has been developing for 14 years and has only recently seen an influx of IPOs. They could have gone public earlier, but two successive serious safety incidents involving Didi Hitch 6 years ago shattered this expectation, causing the entire ride-hailing industry to contract. Even though various data indicate that compared to taxis, ride-hailing accidents occur at a lower rate and are easier to trace.

New energy vehicle companies have already encountered similar issues. Over the past year, they have continuously accelerated the rollout of intelligent driving features, boasting about their AEB active braking and urban NOA capabilities at press conferences. However, successive accidents have led to criticisms of their overzealous marketing of intelligent driving features. Earlier,car manufacturers preferred to refer to their intelligent driving capabilities as "autonomous driving." In 2021, after a NIO vehicle was involved in an accident on a highway, NIO stopped using this term and switched to "intelligent driving."

Tesla was originally scheduled to launch its Robotaxi business in August this year. Last night, news emerged that Tesla plans to push back the launch date to October. This news sent Tesla's share price plunging by 8.44%.

Humans are always hesitant and have lower tolerance for new technologies, even if they are safer, more convenient, and more comfortable. One major accident involving new technology can quickly set it back to square one. But regardless, it is always better to proceed with caution.