Why do fashion products take the lead in Taobao Tianmao's overseas expansion?

![]() 09/23 2024

09/23 2024

![]() 598

598

Source | Bohu Finance (bohuFN)

From the sluggish "Singles' Day" to the stagnant "618" shopping festival, consumer demand has been continuously weak in recent years, and the domestic e-commerce market's high growth trajectory has ceased. Platforms have had to turn their gaze overseas, leading to intense competition among cross-border e-commerce players.

The 'Four Little Dragons of Going Overseas' include Alibaba's AliExpress, Pinduoduo's TEMU, Douyin's TikTok Shop, and the new fast fashion giant SHEIN. However, besides these players, JD.com, which has been absent from cross-border e-commerce, and Alibaba, which is already present, both hope to gain more from overseas markets.

At the end of July this year, Taobao Fashion announced the "Global Free Shipping Plan for Major Fashion Products," which is reportedly an S-level project involving all team members. Recently, insiders from Taobao revealed that Taobao Tianmao intends to further intensify its overseas expansion strategy by upgrading the original "Global Free Shipping Plan for Major Fashion Products" to the "Taobao Tianmao Overseas Growth Plan," expanding global free shipping from fashion products to the entire industry.

JD.com has launched the 2024 China Original Fashion Recruitment Program, aiming to discover and support Chinese original designers and fashion brands, helping them expand into broader international markets. Simultaneously, JD.com announced an investment of 1 billion yuan focused on fashion products to enhance product optimization, flexible supply chains, and other aspects.

It's not difficult to understand why e-commerce platforms are eager for overseas growth, but why have both Taobao Tianmao and JD.com chosen to start with the "fashion track"? What attracts platforms to sell clothes overseas, and is the fashion industry a perfect testing ground?

01 Taobao Tianmao and JD.com Crowd into 'Fashion Going Overseas'

China's fashion industry has a long history of going overseas. Since the 1980s, due to China's unparalleled labor cost advantages and industrial chain strengths in the apparel industry, domestic apparel manufacturers have undertaken textile outsourcing from Japan and Europe and the United States, exporting through capacity models. Chinese fashion brands also flourished during this period.

However, the rapid development of domestic e-commerce platforms has intensified competition within the domestic fashion industry, compressing profit margins for many manufacturers. As a result, more fashion brands have begun to view going overseas as an essential strategic direction for seeking business growth, such as well-known brands like Li-Ning, Anta, and Bosideng.

In recent years, with the rise of the 'Four Little Dragons of Going Overseas,' Chinese fashion manufacturers have gained more convenient access to overseas markets. Take SHEIN as an example; it started in the apparel sector and introduced the "small order, quick return" supply chain model, where small batches of products are initially tested, and terminal data feedback is used to determine which products can become bestsellers, with quick replenishment orders placed subsequently.

Behind this model lies the support of China's mature and well-established apparel manufacturing industry. In Panyu, Guangzhou alone, over 500 apparel manufacturers specifically supply SHEIN.

However, it also shows that China has immense apparel production capacity. What's lacking is not "supply" but "demand." Apparel manufacturers hope to find new avenues, which is why both Taobao Tianmao and JD.com have chosen fashion as an entry point to further deploy cross-border e-commerce strategies.

Firstly, domestic demand for fashion products has slowed, but there are still dividends in overseas expansion. In the first half of this year, China's retail sales of apparel products above a designated size totaled 515.63 billion yuan, up 0.8% year-on-year, with growth slowing by 14.7 percentage points compared to the same period in 2023.

As domestic economic growth slows, consumer demand for fashion products has also decreased concurrently, with "high return rates" becoming a trending topic in the fashion industry this year. Some fashion merchants have reported return rates as high as 80% during this year's 618 shopping festival, setting a new record and far exceeding the 50% "break-even" point for profitability. It could even be said that "selling one piece results in a loss of one piece."

However, from a global perspective, Statista data shows that the global apparel market size reached $673 billion in 2023, twice the size of the global furniture market ($330 billion).

Secondly, going overseas is not only "another possibility" for most fashion manufacturers but has also become a new growth engine for e-commerce platforms. Currently, the three e-commerce giants – Alibaba, JD.com, and Pinduoduo – are facing operational bottlenecks.

In the first half of this year, Alibaba's revenue growth stagnated, with a slight decline in net profit. Specifically, the Taobao Tianmao Group generated revenue of 113.373 billion yuan, down 1% year-on-year, making it the only business group with negative revenue growth among Alibaba's six major business groups.

While JD.com maintained profit growth, its revenue growth also stagnated, with revenue from its core electronics and household appliances business declining by 4.65% year-on-year.

Although Pinduoduo experienced significant revenue and profit growth, the year-on-year growth rates in both metrics began to slow in the second quarter. Management even stated during the earnings call that a long-term trend of decreasing profits is inevitable.

Therefore, domestic e-commerce platforms are further integrating resources to break through domestic growth bottlenecks. Taking Alibaba as an example, despite slower domestic e-commerce revenue growth, its overseas e-commerce revenue increased by 45% to 27.448 billion yuan in the first quarter of 2024. Alibaba's AliExpress has surpassed overseas e-commerce giants like Amazon and eBay from the United States, becoming Europe's largest e-commerce platform.

For Taobao Tianmao, fashion is its most advantageous category, accounting for over 35% of retail sales on the platform and representing its largest channel. It's not surprising that e-commerce platforms, including Taobao Tianmao, prioritize the fashion track for overseas expansion. Only a sufficient scale of merchants can support the development of cross-border e-commerce.

Lastly, the fashion category is more aligned with overseas expansion trends. The fashion industry has always been a competitive sector for overseas merchants, and the robust demand for fashionable apparel in overseas markets has given rise to diverse and specialized sub-sectors.

After years of development, e-commerce platforms, especially those actively promoting the source factory model in recent years, have accumulated mature experiences in payment, logistics, after-sales service, and flexible supply chains, laying a foundation for the overseas expansion of non-standard products like apparel.

02 Overseas Markets Become New Gold Mines for E-commerce

Fashion merchants have a need to explore new overseas channels, while e-commerce platforms like Taobao Tianmao and JD.com intend to further deepen their cross-border e-commerce presence. It's a natural match between the two sides.

However, for most fashion manufacturers, transitioning from traditional manufacturing to e-commerce poses significant challenges. Therefore, Taobao Tianmao introduced the "Global Free Shipping Plan for Major Fashion Products."

In simple terms, existing Taobao Tianmao merchants do not need to open separate stores. By joining the plan, they can sell products globally through multiple apps like the overseas version of Taobao, AliExpress, and Lazada. After receiving orders from overseas consumers, merchants only need to ship the goods to domestic consolidation warehouses for confirmation of receipt, while retaining autonomous pricing and ownership rights.

Moreover, Taobao Tianmao promises 0 returns, 0 refunds, and 0 shipping insurance, sharing the domestic high return and shipping insurance costs with merchants.

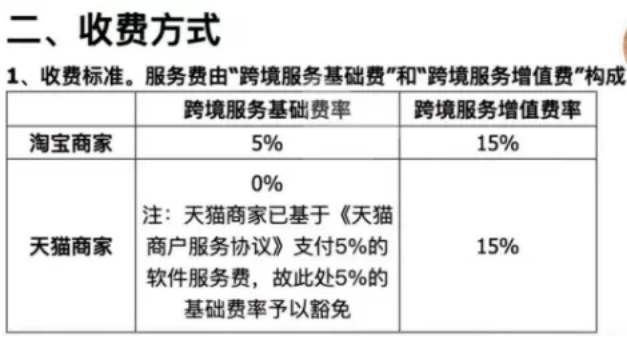

However, this model is not unfamiliar to most cross-border merchants. Essentially, it's another form of "semi-managed model," where the platform provides a "safety net" for merchants, who in turn pay a 20% commission, including a 15% cross-border value-added service fee and a 5% basic service fee.

Although JD.com has not disclosed more details on how it will support fashion merchants in going overseas, it has always emphasized the "direct sales model" in the domestic e-commerce market, ensuring product quality and logistics after-sales through self-operation. If JD.com further explores cross-border e-commerce, it's likely to offer merchants a "managed model" as well.

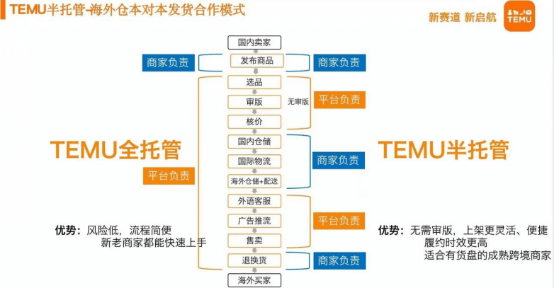

In recent years, the "semi-managed model" has emerged rapidly, with AliExpress pioneering the trend, followed by TEMU and SHEIN, both of which have launched pilot programs in the United States.

The shift from a "fully managed model" to a "semi-managed model" in cross-border e-commerce platforms is primarily based on operational strategies and costs.

On the one hand, the fully managed model deprives merchants of autonomy, passively involving them in the platform's operational strategy aimed at "explosive orders," which can constrain merchants and exacerbate conflicts with the platform.

On the other hand, as the number of merchants joining the platform gradually increases, the platform's operational and management capabilities approach their limits. According to estimates by the China International Capital Corporation (CICC) team, under the fully managed model, TEMU incurred an operating loss of approximately $8.2 per order in the U.S. market in the third quarter of last year and approximately $10.3 per order in other regions.

Therefore, appropriately ceding some "operational rights" can alleviate the platform's burden in logistics, warehousing, and other aspects.

However, since the "semi-managed model" has become the prevailing trend in cross-border e-commerce, how can Taobao Tianmao and JD.com differentiate themselves? In fact, Taobao Tianmao's "Global Free Shipping Plan for Major Fashion Products" differs somewhat from the semi-managed models of platforms like SHEIN and TEMU.

Firstly, pricing power lies with the merchants. Under the managed models of TEMU and SHEIN, merchants do not have pricing power. Some merchants have reported that TEMU's operational policies can be quite aggressive, with products being delisted if merchants do not accept price negotiations, even in the semi-managed model.

In contrast, Taobao Tianmao chooses to give merchants pricing power. Without pricing power, merchants essentially work as "employees" of the platform. With pricing power, merchants fully own their brands, significantly impacting their motivation and enthusiasm.

Secondly, there are differences in operational strategies. When cross-border platforms become brand owners, they tend to focus on creating bestsellers, occupying markets through low-price strategies, and leveraging economies of scale for profitability.

However, under the Taobao model, merchants as brand owners have the right to choose different positioning, from high-end to low-end. For instance, Taobao store Huashangge specializes in "Neo-Chinese" style, with price points ranging from 1,500 to 5,000 yuan. Low-price strategies are not the sole competitive advantage for platforms or merchants.

Lastly, there's a greater focus on the Chinese market. It's reported that the first phase of Taobao Tianmao's "Global Free Shipping Plan for Major Fashion Products" will cover Asian regions like Singapore, Malaysia, South Korea, Hong Kong, Macao, and Taiwan, with plans to expand to Japan, Australia, and Canada in the future, where there are significant Chinese populations.

Compared to TEMU and SHEIN, which prioritized entering the North American market, Taobao Tianmao's first overseas expansion step into Chinese-speaking markets leverages its logistical advantages. For example, Alibaba's domestic e-commerce platform Lazada also focuses on the Southeast Asian market. Additionally, the "Chinese aesthetic" aligns seamlessly with fashion merchants within the Taobao Tianmao ecosystem, reducing the difficulty for merchants venturing overseas for the first time.

03 Compliance, Supply Chain, and Sustainability

While Taobao Tianmao's "Global Free Shipping Plan for Major Fashion Products" considers differentiation in business models, overseas destinations, and target consumer groups, whether the "free shipping plan" can expand from fashion to all categories and gradually reach a global scale remains to be seen, pending market and merchant feedback. Before that, Taobao Tianmao and JD.com cannot ignore the challenges and issues faced by other cross-border e-commerce platforms.

Firstly, there's the issue of compliance. In April and May this year, both SHEIN and TEMU were officially recognized as very large online platforms by the European Union, requiring them to comply with the strictest provisions of the EU's Digital Services Act within four months. Additionally, insiders revealed that the European Commission proposed eliminating the duty-free threshold for imported goods below 150 euros, targeting Chinese e-commerce apps like TEMU.

While cross-border e-commerce platforms leverage price advantages to penetrate overseas markets, they have long been in the crosshairs of regulatory agencies worldwide. Industry insiders believe that the delayed IPOs of some companies are related to stricter European and American policies on data security and tax standards.

Therefore, cross-border e-commerce players must make greater efforts to comply with regulatory requirements in overseas markets. Otherwise, violations could result in hefty fines or stricter tax regulations.

Secondly, there's the question of whether products can adapt to overseas markets. For example, while platforms like TEMU have swept overseas markets with low-price models, they've also received numerous negative reviews, with users complaining about poor product quality, mismatched items, shabby packaging, and package tampering.

Whether in fashion or other categories, excessive price competition inevitably leads to compromised product quality. Most overseas consumers demand low prices with high quality, not cheap and low-end products. Long-term exports of inferior products will ultimately impact platforms and the reputation of Chinese brands.

Moreover, as a non-standard product, the fashion category requires consideration of cultural differences among local consumers. For domestic merchants, their supply chains must adjust accordingly, including styles, designs, fabrics, and more. Adaptability will be crucial for platforms and merchants to succeed overseas.

Lastly, there's the sustainability of platforms. Currently, most cross-border e-commerce platforms attract users through policies like advertising, low prices, free shipping, and free returns. On the merchant side, they enhance scale advantages through managed models, effectively "extracting value" from merchants to subsidize overseas consumers to a certain extent.

However, the sustainability of this model is increasingly questioned. While advertising blasts and low-price subsidies can bring initial spikes, platforms ultimately need to return to daily operations.

Data shows that Temu's growth rate in the U.S. market is starting to slow. In August this year, Temu's sales grew by 37% year-on-year, down from 45% in July and a peak of 99% in the second quarter of last year.

The same applies to Taobao Tianmao. Global free shipping and logistics support are essentially low-price subsidy strategies that can attract a significant number of overseas users in the short term. For instance, since the launch of free shipping for fashion products, user volume in Malaysia increased by 10% month-on-month in August, but its sustainability requires further observation.

Taobao Tianmao partners with insurance companies offering "local return services" to ensure merchants can offer "0 returns, 0 refunds." However, amidst rising global logistics and supply chain costs, this move will inevitably increase the platform's operational pressures. Ultimately, there will be an ongoing battle between "global free shipping" and "return rates," making merchant quality even more crucial.

Regardless, Taobao Tianmao and JD.com's exploration of global cross-border e-commerce diversity through "fashion going overseas" is a worthwhile innovation for fashion merchants and the e-commerce industry.

For Chinese fashion merchants, besides capacity and product exports, "Chinese brands," "Chinese design," and "Chinese aesthetics" are also expected to go overseas alongside "global free shipping." For China's e-commerce industry, this could help shed the stereotype of being solely focused on "low prices."

In recent years, China's e-commerce platforms have suffered from intense domestic competition. Moving from domestic to overseas markets serves as a reminder: overseas competition isn't solely about price wars. Cross-border e-commerce platforms must find breakthroughs in brand building, product models, and ecosystem development to better address challenges in compliance, supply chains, and sustainability. To make overseas markets a genuine "second growth curve," e-commerce platforms must further develop differentiated competitive advantages, recognizing that a sharp tool makes good work.

*The cover image and accompanying illustrations belong to their respective copyright owners. If copyright holders believe their works are not suitable for public browsing or should not be used free of charge, please contact us promptly, and we will make immediate corrections.