"AI Six Tigers" Reach the Next Milestone

![]() 07/04 2025

07/04 2025

![]() 858

858

Each of the "AI Six Tigers" is forging its unique path.

One of the "AI Six Tigers," MiniMax, recently concluded its "Technology Showcase Week."

From June 17th onward, MiniMax unveiled a series of core technology and product updates spanning various domains such as foundational models, video generation models, and multimodal agents, comprehensively demonstrating its holistic technology roadmap of "Model - Multimodal - Application."

Amid MiniMax's "frenetic updates," market rumors surfaced about its planned IPO in Hong Kong, making MiniMax the second company among the "AI Six Tigers" after Zhipu AI to be rumored to be rushing towards an IPO; however, the company has not yet commented on these speculations.

Image source: Weibo screenshot

Despite being in the hottest sector at present and boasting star-studded resumes, MiniMax and other "AI Six Tigers" enterprises all confront the same challenges: product homogenization, immature commercialization, and profitability issues.

01. The "Six Tigers" on the IPO Fast Track

The "AI Six Tigers" (Zhipu, Dark Side of the Moon, Baichuan Intelligence, MiniMax, Stepwise Stars, Zero One Universe) symbolize the domestic large model era over the past two years. They are the earliest startups to secure over $1 billion in funding, each possessing self-developed large models with over 100 billion parameters, and benchmarking against GPT-4, Llama, and other leading international large models.

All of the AI Six Tigers can be considered "capital darlings." Behind MiniMax stand esteemed shareholders such as Sequoia China, Alibaba, Tencent, IDG Capital, and miHoYo, representing a top-tier lineup of capital from both industries and institutions. After receiving a $600 million funding round led by Alibaba in 2024, MiniMax's valuation surged past $2.5 billion (approximately RMB 17.9 billion); recently, some media outlets have reported its valuation at approximately $3 billion.

Image source: Tianyancha screenshot

MiniMax's appeal to capital stems not only from being in the hottest AI sector but also from its founder's impressive background and the company's "resilient" products.

Founded in 2021 by Yan Junjie, former Vice President of SenseTime, this AI technology company long showcased its most notable product, an AI virtual companion application called Talkie, aimed at the overseas market. In just the first eight months of last year, Talkie's global downloads swiftly surpassed 10 million, outpacing Character AI to become the fourth most downloaded AI application in the US market. According to media reports, Talkie alone generated $70 million in revenue for MiniMax from user payments and advertising in the previous year.

To mitigate the risk of relying on a single product, MiniMax released the video generation model "Hailuo Video I2V-01" and launched Hailuo AI in September 2024.

AIGC, as the first sector to take off after GPT, was already somewhat "overlooked" by the time Hailuo AI was launched. Additionally, in the video generation sector, Kuaishou's Keling AI led the pack, with ByteDance's Seeweed and PixelDance trailing behind. As a product from a startup, Hailuo AI was not held in high esteem by the market at that time.

However, Hailuo AI's "Fat Cat" IP videos later became a hit, propelling Hailuo AI into the limelight. According to "AI Product Ranking Data," since its launch, Hailuo AI has ranked first among video generation products in global rankings for six consecutive months, surpassing Kuaishou's Keling AI and ByteDance's Jimeng AI.

Image source: Xiaohongshu screenshot

Recently, MiniMax held a "Technology Showcase Week," unveiling five groundbreaking products over five consecutive days, covering areas such as foundational models, multimodal technology, and general agents.

Supporting its foundational capabilities, MiniMax released and open-sourced the self-developed MiniMax-M1 series of models. In terms of supporting algorithms, MiniMax introduced a new CISPO reinforcement learning optimization algorithm. In the area of multimodal generation, MiniMax launched the new-generation video large model Hailuo 02, featuring high-fidelity physical simulation and the ability to directly generate 1080P video quality. Hailuo Video Agent achieves "zero-threshold professional video generation" through natural language-driven global, full-process toolkit invocation. The voice model Speech 02 also underwent functional updates, with Voice Design allowing users to describe their envisioned timbre through natural language, achieving precise control over multiple dimensions.

Image source: Weibo screenshot

However, during this same period, MiniMax was not the only "AI Six Tiger" to showcase new model capabilities and Agent products. On June 17th, Dark Side of the Moon released the new open-source code large model Kimi-Dev-72B, and shortly after, it also unveiled its first Agent, Kimi-Researcher.

On July 2nd, Zhipu, which is also on the IPO fast track, officially released and open-sourced the visual language large model GLM-4.1V-Thinking, leading the way by open-sourcing GLM-4.1V-9B-Thinking. Simultaneously, Zhipu announced a total strategic investment of RMB 1 billion from Pudong Venture Capital Group and Zhangjiang Group, with the first tranche recently completed.

At this juncture, the once high-spirited "AI Six Tigers" have either scaled back their operations or shifted their focus, while others persist and seek listing financing.

02. Racing Against Whom?

Racing against time, peers, and capital is the current reality for the "AI Six Tigers."

"The only invincible martial art is speed." This aptly describes enterprises in the AI sector. For instance, one of the key reasons MiniMax's Talkie gained popularity was its swift launch.

In October 2022, one month before ChatGPT exploded in popularity, Talkie's predecessor, an AI agent product called Glow that could directly engage in conversation, had already been launched. At that time, MiniMax was still testing its self-developed large language model with 30 billion parameters, and numerous bugs needed resolution.

Talkie, launched early, was more of a companion gaming application than an AI application, so user stickiness and willingness to pay were both strong, making ToC charging a natural choice for its commercial revenue model.

Product positioning, technological preemption, and precise market targeting were critical to Talkie's success, but these are not easily replicated by peers or even MiniMax itself.

For example, MiniMax's Hailuo-02 model revised its membership system, with annual subscription fees reaching a maximum of $1499.99 (RMB 10,788), requiring payment to access the full video generation function. The steep cost increase raised the threshold for video secondary creation, instantly deterring many video creators and sparking widespread user dissatisfaction and complaints.

Image source: Hailuo screenshot

Similarly, for the paid subscription model, there is a vast difference in the willingness to pay between Talkie and Hailuo-02 users. Besides price factors, this also stems from product substitutability. "AI products are now too homogeneous. Conversation, image/video generation are the most common sectors, so we see various large models rushing to launch and offer similar conversation, search-related functions, or conversation-derived features, leading to severe product homogenization," said Xiao Lin (pseudonym), an AI industry practitioner.

Severe homogenization makes users feel they have many options. Once a product starts charging, users can easily switch to other free products. Therefore, the "price war" between peers has already commenced even before the products start generating revenue.

Take conversational large models as an example; products such as ERNIE Bot, Kimi, and IMA have already been launched, but why did Deepseek rekindle interest in large language models? "Because it demonstrates the thinking process, which is not necessarily a technological leap but an improvement in user experience, where users see the large model's thinking process and have more interactive experiences," said an Agent practitioner.

Image source: Canned Stock Photo Library

Therefore, AI products must be "fast enough" or possess "unique features." If they don't win the race against time, they must differentiate themselves from competitors.

But whether racing against time or competitors, the ultimate problem to solve is profitability.

Despite several monetization strategies at their disposal: subscription (ToC), data licensing (ToB), APIs, or advertising (ToB), the profitability of the "AI Six Tigers" is not particularly outstanding at present.

Product strength, differentiation, and profitability are questions MiniMax and other "AI Six Tigers" must answer.

03. Who Will Be the Next Super App?

Looking back at the development of the internet, demand-driven services (search, social media, e-commerce, etc.) gave rise to first-generation super apps like BAT. Later, differentiated new-generation super apps emerged in various niche sectors, such as Pinduoduo and Xiaohongshu.

So, what will super apps look like in the AI era?

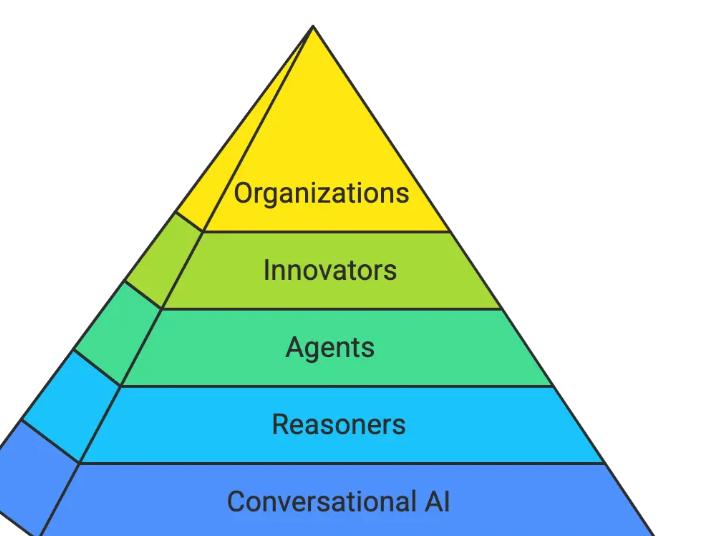

OpenAI seems to have provided a model answer to this question by previously releasing a five-level roadmap for AGI, revealing the complete evolution path of artificial intelligence from a "chat tool" to a "strategic commander." Simply put, in the first stage, AI is just a conversational tool that can "speak human language," enabling communication without deliberate programming languages. In the second stage, AI becomes a knowledgeable "doctor" with more accurate and faster responses and outputs. In the third stage, AI becomes a super assistant capable of not only "chatting" but also "acting." From here on up, AI is not just a tool to be manipulated but can propose ideas or even manage a multinational company.

Image source: Juejin Technology Community

From this perspective, AI is currently in the transitional period between the second and third stages. In other words, the "AI Six Tigers" have reached another critical juncture in their race against competitors and time, and the Agents they have presented may be the key "players" in winning this checkpoint.

A serial entrepreneur in the AI sector told "Fun Business Explained" that, in simple terms, a Chatbot answers questions, while an Agent executes instructions. For example, if you need an Agent to create a year-end summary PPT for you, this instruction can be broken down into several tasks: summarizing and refining the text of a year's work, selecting a PPT template, inserting illustrations and designing, arranging page numbers, and creating the PPT. A human would naturally break down this task and even start writing wherever they feel like it, but for an Agent to execute it requires multimodal coordination. The task breakdown, division of labor, thinking, and completion in the middle are technical challenges that directly affect task completion.

"Why are many people in China working on general AGI? Because there is still no 'killer app' for general AGI, forming a monopoly situation like OpenAI. So, from a market perspective, this blue ocean is vast," he said. "On the other hand, in terms of technical difficulty, a general AGI plus knowledge bases and private databases in vertical sectors can be transformed into a vertical Agent. Unless a company has already anchored itself in a vertical scenario and laid a solid foundation for commercialization, premature verticalization actually stifles its other possibilities."

Image source: Canned Stock Photo Library

Whether it's MiniMax's Agent products or Kimi's recently small-scale beta-tested Kimi-Researcher, they are products that align with the concept of general AGI. This also shows that the Six Tigers share a similar mindset in wanting to be the first to claim a piece of this pie.

The evolution from chat to Agent also indicates that AI has gradually upgraded from competing on "hardware" such as data, researchers, and R&D expenses to also competing on "soft power" such as positioning, market, and user experience while maintaining strong hardware capabilities. In this sector, the seeds for the next super app may already be sprouting.