Can Foxconn Industrial Internet achieve a magnificent transformation under NVIDIA's concept?

![]() 10/09 2024

10/09 2024

![]() 550

550

Introduction: As NVIDIA's core supplier, how is Foxconn Industrial Internet faring recently?

By Li Ping | Written by Lishi Business Review

1

The Questioned 'First AI Stock'

Since 2023, with the continued popularity of ChatGPT, major cloud service providers have continued to increase their investments in AI, propelling NVIDIA, the 'shovel seller,' to great heights on U.S. stock markets. NVIDIA's market value briefly surpassed giants like Microsoft and Apple to become the world's most valuable company. Driven by NVIDIA's success, AI, computing power, and related concepts in the A-share market have been eagerly sought after by investors. Among them, Foxconn Industrial Internet, often referred to as NVIDIA's 'shadow stock,' has benefited significantly, with its share price surging by over 300%.

As a key partner of NVIDIA, Foxconn Industrial Internet has been developing and mass-producing high-performance AI servers such as NVIDIA's H100 and H800 for customers since 2023. It also holds a significant share in shipments of the next-generation AI server GB200, which utilizes the Blackwell chip. Since 2024, the rollout of large models by North American cloud service providers has further increased demand for AI servers, leading to a surge in orders for Foxconn Industrial Internet from overseas cloud service providers like Microsoft and Amazon.

However, as speculative investment in AI stocks continued, many investors began to worry about a bubble in the AI sector. Especially in the second half of the year, the commercialization of AI large models did not live up to expectations, causing some investors to question the future of AI. In this context, the share prices of AI stars like NVIDIA and AMD have shown signs of fatigue, with AMD's share price falling by nearly 70% in the past six months, further fueling panic selling in AI stocks.

When one door closes, another opens. Since reaching an all-time high in July 2024, Foxconn Industrial Internet's share price has been on a downward trend, falling by over 30% at one point, erasing over RMB 200 billion in market value. The 'First AI Stock' seemed to lose its luster overnight. It was only during the recent surge in the overall stock market that its share price rebounded.

In fact, over the past year and a half, Foxconn Industrial Internet's share price has experienced a rollercoaster ride, doubling, halving, and then doubling again. Riding the AI wave, Foxconn Industrial Internet, like an elephant at the wind's mercy, has transformed from obscurity to popularity, from a 'sweatshop' to a 'beacon of technology'—or perhaps just a fleeting dream.

2

The Elephant Catching the Wind

In 2015, Terry Gou, unwilling to limit himself to contract manufacturing, spun off Foxconn's Internet of Things, robotics, and AI-related businesses into a new subsidiary, Foxconn Industrial Internet. In 2018, Foxconn Industrial Internet successfully listed on the A-share market. According to Gou, 'Foxconn is no longer just a contract manufacturer; it aims to build an industrial internet and is at the forefront of cutting-edge technologies like AI and big data.'

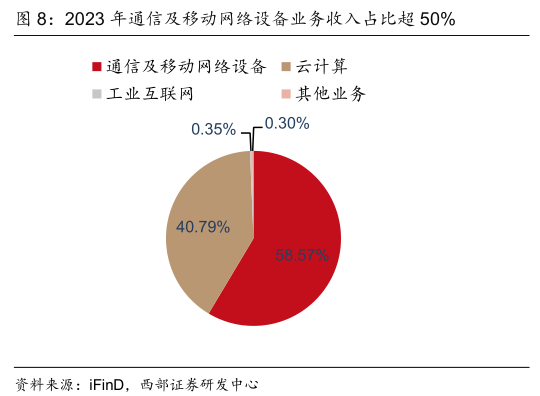

As the vanguard of Foxconn's transformation, Foxconn Industrial Internet's main businesses encompass communications and mobile network equipment, cloud computing, and the industrial internet. In 2023, these three segments generated revenues of RMB 279 billion, RMB 194.3 billion, and RMB 1.646 billion, respectively, accounting for 58.57%, 40.79%, and 0.35% of the company's total revenue.

The communications and mobile network equipment segment, Foxconn Industrial Internet's traditional business, includes high-speed switches and routers, precision structural components, and networking equipment, with customers such as Apple, Cisco, HPE, Huawei, and Amazon. Initially, this segment accounted for over 60% of the company's total revenue, making it the primary source of income.

Compared to its traditional business, Foxconn Industrial Internet's cloud computing business has garnered more attention. Its offerings include cloud servers, high-performance servers, AI servers, edge servers, and cloud storage devices, with customers including NVIDIA, Amazon, JD.com, and Alibaba.

The industrial internet business is Foxconn Industrial Internet's third major segment, encompassing manufacturing consultancy, smart factory solutions, digital manufacturing operations, and cloud and platform services. In 2023, the company empowered three additional world-class Lighthouse Factories, bringing the total to nine. Due to its low revenue contribution, this segment has a limited impact on the company's overall performance.

In Gou's vision, Foxconn Industrial Internet encapsulates Foxconn's most valuable businesses and shoulders the responsibility of driving the group's high-tech transformation. However, as its two core businesses (communications and mobile network equipment, cloud computing) rely heavily on contract manufacturing, Foxconn Industrial Internet's profitability is limited.

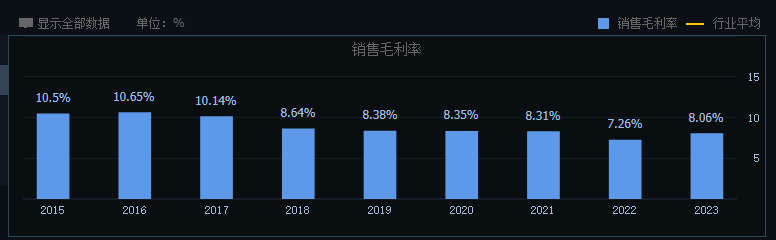

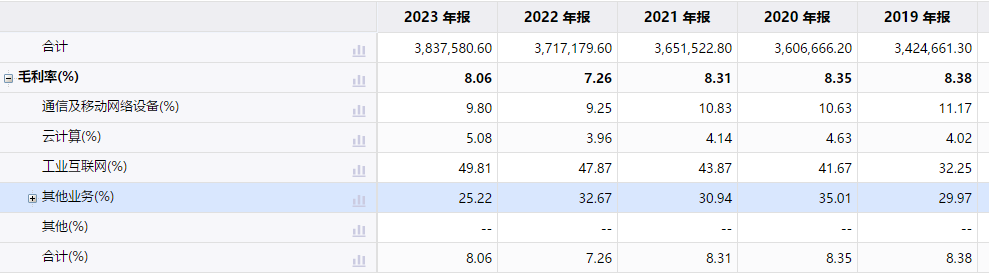

Data shows that from 2018 to 2022, Foxconn Industrial Internet's gross profit margins were 8.64%, 8.38%, 8.35%, 8.31%, and 7.26%, respectively, consistently remaining in the single digits and declining year over year. In comparison, Foxconn's gross profit margin hovered around 6%, indicating that while Foxconn Industrial Internet's profitability has improved, it remains limited.

Therefore, in the eyes of many investors, Foxconn Industrial Internet, listed on the A-share market, has not fundamentally deviated from its contract manufacturing business model, leading to long-term sluggishness in its share price. From June 2018 to October 2022, Foxconn Industrial Internet's share price plummeted from a high of RMB 24.15 to a low of RMB 6.67, erasing over RMB 320 billion in market value over four years.

In 2023, with the emergence of ChatGPT and increasing investments in AI worldwide, Foxconn Industrial Internet's share price soared. In March 2023, its share price surged by 90% within a month. By July, the company's market value had reached RMB 520 billion, doubling in five months.

However, since the second half of 2023, Foxconn Industrial Internet's share price began to decline, halving within seven months, causing significant losses for investors who chased high prices.

In retrospect, compared to NVIDIA's stellar financial performance, Foxconn Industrial Internet's operating results paled in comparison to its share price surge, contributing to its volatile share price movements.

3

A Difficult Transformation

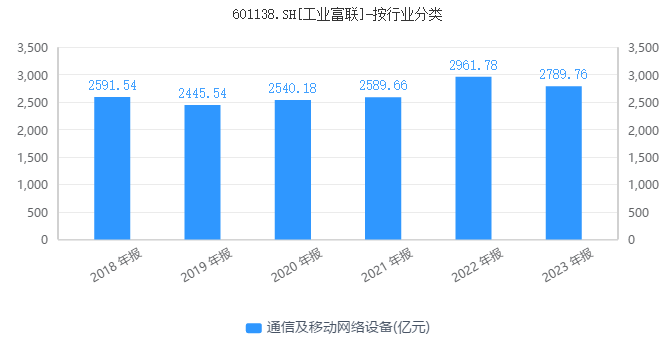

In 2023, Foxconn Industrial Internet reported revenue of RMB 476.34 billion, a year-on-year decrease of 6.94%, marking the first decline since 2020. Its net profit was RMB 21.04 billion, up approximately 4.82% year-on-year. Across its business segments, revenues from communications and mobile network equipment, cloud computing, and the industrial internet all declined year-on-year, with the core communications and mobile network equipment segment seeing a nearly RMB 20 billion drop.

Within the communications and mobile network equipment segment, high-end precision structural components, primarily smartphone accessories like phone cases and frames, are the core business, with Apple as the largest customer. From 2018 to 2021, affected by declining smartphone shipments, this business stagnated for four consecutive years. While it improved in 2022, it fell back into negative growth in 2023.

It is evident that despite the AI concept, Foxconn Industrial Internet failed to deliver satisfactory results in 2023, leading to a 'double whammy' situation for investors.

In 2024, the rapid development of large language models (LLMs) and generative AI drove strong demand for downstream AI servers, prompting a rebound in Foxconn Industrial Internet's share price. On July 11, the company's market value hit an all-time high of RMB 560 billion, doubling from its early-2024 low of RMB 240 billion.

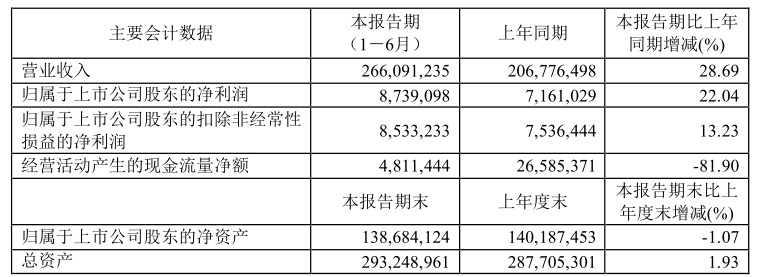

Although the elephant once again caught the wind, Foxconn Industrial Internet's half-year financial results were unremarkable. According to its latest financial report, in the first half of 2024, the company generated revenue of RMB 266.091 billion, up 28.69% year-on-year, and net profit attributable to shareholders of RMB 8.739 billion, up 22.04% year-on-year. In the second quarter, revenue reached RMB 147.403 billion, up 46.11% year-on-year, with net profit attributable to shareholders of RMB 4.554 billion, up 12.93% year-on-year, and non-GAAP net profit of RMB 4.261 billion, down 1.58% year-on-year.

In terms of half-year results, Foxconn Industrial Internet's revenue and net profit hit record highs for the same period since its listing, primarily driven by the surge in demand for AI servers. In the first half of 2024, cloud computing revenue grew by 60% year-on-year, with cloud service provider revenue accounting for 47% of total revenue, up 5 percentage points from the same period last year. AI server revenue accounted for 43% of total server revenue, growing by over 230% year-on-year.

Compared to the fast-growing cloud computing business, the communications and mobile network equipment segment grew by only a single-digit percentage in the first half of the year. Among them, revenue from 400/800G high-speed switches grew by 30% year-on-year, with 800G switches starting shipments in 2024, covering composite structures for Ethernet, IB networks, and NVlink Switches.

Historically, the communications and mobile network equipment segment has been Foxconn Industrial Internet's largest revenue source. However, with the explosion of AI server demand, the company's revenue structure has undergone significant changes. Notably, in the second quarter of 2024, cloud computing revenue accounted for 55% of total revenue, surpassing communications and mobile network equipment to become the company's primary source of income.

However, the second-quarter non-GAAP net profit data suggests that Foxconn Industrial Internet may be facing a dilemma of increased revenue without commensurate profit growth, primarily due to exchange gains and losses. Additionally, the gross profit margin of 6.73% in the first half of 2024 was significantly lower than the full-year 2023 level of 8.06%, adding to the company's profit pressure.

In reality, despite the seemingly prestigious label of AI servers, Foxconn Industrial Internet's server business is essentially an assembly job with both ends outsourced. On one hand, the company procures core components like CPUs and GPUs from upstream suppliers like NVIDIA and AMD. On the other hand, its downstream customers are primarily global cloud computing giants like Google, leaving Foxconn Industrial Internet with limited bargaining power.

It is evident that Foxconn Industrial Internet plays the role of a contract manufacturer in the supply chain, resulting in a meager gross profit margin. Data shows that in 2023, the gross profit margin of Foxconn Industrial Internet's cloud computing business was approximately 5%, significantly lower than that of its communications and mobile network equipment business (9.8%). Consequently, the rapid growth and increased share of cloud computing revenue have actually lowered the company's overall gross profit margin.

Long considered NVIDIA's 'shadow stock' in the A-share market, Foxconn Industrial Internet's profitability pales in comparison. According to NVIDIA's latest financial report, the company generated revenue of USD 30 billion in its second fiscal quarter, up 122% year-on-year, with net income of USD 16.6 billion, up 168% year-on-year. Its overall gross profit margin was 75.7%, with the GPU business achieving a gross profit margin of 90%.

Recently, amid doubts about the future of AI, NVIDIA CEO Jensen Huang stated in a Goldman Sachs technology forum that demand for AI chips is at an unprecedented high, and that the company's latest 'most powerful AI chip,' Blackwell, is in high demand and currently in short supply.

Spurred by Huang's remarks, NVIDIA's share price surged by over 8% on September 12. As of the most recent trading day's close, NVIDIA's market value has surpassed USD 3 trillion once again.

As NVIDIA's share price strengthens, Foxconn Industrial Internet's share price has also begun to rebound. However, despite branding itself as a 'high-tech' company, Foxconn Industrial Internet essentially earns a hard-earned living from assembly lines. To truly fulfill its strategic positioning as a provider of high-end intelligent manufacturing and industrial internet solutions, Foxconn Industrial Internet still has a long way to go.