Listed at the peak? Penalty!

![]() 10/15 2024

10/15 2024

![]() 423

423

Written by: Poetry and Stars

ID: SingingUnderStars

In the first half of this year, many securities firms and relevant responsible persons were penalized for violations in their investment banking business, with as many as 74 penalty notices issued, involving 31 securities firms, and up to 67 individuals being listed in the Category C (Penalty Classification) of the sponsor representative classification list. Among them, the Shanghai Stock Exchange and Shenzhen Stock Exchange imposed the most penalties on sponsors, with 24 and 23 individuals respectively.

What do sponsor representatives do? Essentially, they act as intermediaries between listed companies-to-be and the China Securities Regulatory Commission (CSRC), recommending companies for listing by providing guarantees to the CSRC.

As intermediaries, sponsor representatives should fulfill their role as "gatekeepers," identifying and selecting truly capable companies. However, some sponsor representatives have been found to facilitate the rapid listing of inferior companies, disrupting the normal market and harming investors.

On October 11, the Shanghai Stock Exchange issued two penalty notices to Kechuangboard company Bixing Internet of Things [688671.SH] and its sponsor. On the same day, Bixing Internet of Things announced that it had received a regulatory warning letter from the Shenzhen CSRC.

The penalty notices against the sponsor representatives stated that Li Jixiu and Li Likun, as the sponsor representatives designated for Huaying Securities' initial public offering (IPO) application project, failed to fully fulfill their sponsorship duties.

Another penalty notice indicated that due to inadequate disclosure of relevant information, failure to timely disclose the signing of material contracts, and incomplete identification of related parties, the Shenzhen Securities Regulatory Bureau decided to issue a warning letter to Bixing Internet of Things and take regulatory interview measures against the company's chairman He Yuanping, then-general manager Zhu Ying, chief financial officer Wang Jin, and board secretary Pan Haitang.

Compared to other regulatory measures such as fines and market bans, regulatory interviews are generally considered less severe. They are a means used by regulatory authorities to remind and warn companies and their executives to comply with relevant laws and regulations.

However, this does not mean that companies or individuals can ignore regulatory interviews. If they fail to rectify as required by the regulatory authorities, they may face more severe regulatory measures or administrative penalties.

01

Multiple Violations in Disclosure of Important Content

Bixing Internet of Things, sponsored by Huaying Securities, submitted its listing application on June 9, 2022, and began trading its shares on August 9, 2023.

The company primarily produces various types of perception layer instrument hardware and big data processing software systems, with products widely used in government departments, institutions, and enterprises with data and intelligent service needs in fields such as ecology, water conservancy, and agriculture.

On May 31, 2023, Bixing Internet of Things disclosed its performance forecast for the first half of 2023, estimating revenue of RMB 230 million to RMB 240 million, an increase of 1.91% to 6.34% year-on-year; and net profit attributable to shareholders of the parent company of RMB 31.4404 million to RMB 34.4733 million, an increase of 40.09% to 53.60% year-on-year.

Although the company had initially formed its semi-annual financial statements on July 11, it did not update the estimated semi-annual performance data or provide sufficient risk warnings for the differences between actual and estimated performance in the Prospectus and Prospectus Summary disclosed on July 21 and August 4.

Shortly after listing, the company announced its semi-annual report for 2023, revealing revenue of RMB 167.6648 million, a decrease of 27.10% to 30.14% from the estimated amount; and net profit of RMB 23.907 million, a decrease of 23.96% to 30.65% from the estimated amount.

Furthermore, in October and November 2023, the company signed GPU hardware procurement contracts that met the information disclosure criteria but failed to fulfill its information disclosure obligations in a timely manner.

Lastly, the company's incomplete identification of related parties may lead to the concealment of related-party transactions, increasing the risk of corporate governance.

These violations not only breach regulatory requirements but also potentially lead to information asymmetry, affecting investor decision-making and harming the interests of small and medium shareholders.

02

The True Colors of the 2024 Semi-Annual Report

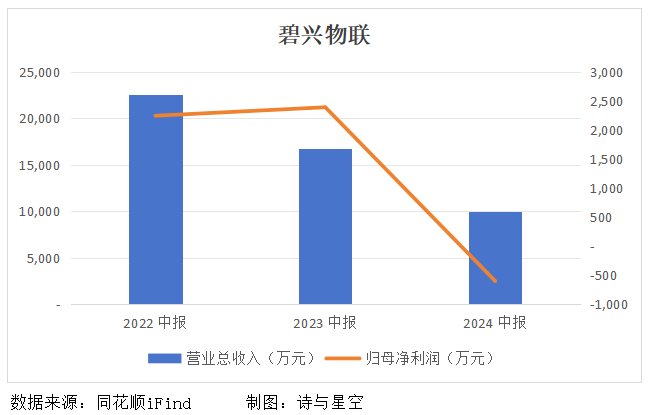

In fact, Bixing Internet of Things has experienced declining revenue and net profit since 2022. To expedite its listing, the company is suspected of deliberately concealing its first-half 2023 performance.

In the first half of 2024, the fact of declining performance could no longer be concealed. The company achieved revenue of approximately RMB 100 million, a year-on-year decrease of 40.28%; and net profit attributable to shareholders turned from profit to loss, with a loss of approximately RMB 6 million, a year-on-year decrease of 125.12%.

Regarding the loss, the company offered two main explanations:

Firstly, the overall market demand for smart environmental monitoring declined in the first half of the year, and the company's products were in a transitional phase of upgrade. Large-scale construction projects for smart environmental monitoring products decreased, and tight local fiscal funds slowed down project progress and extended acceptance timelines, leading to a decrease in revenue scale.

Secondly, slower project progress led to extended delivery cycles and increased on-site execution costs, resulting in a decrease in net profit.

In fact, the company's performance has been on a downward trend for the past three years. The Shanghai Stock Exchange inquired about the company's 2023 annual report, asking it to explain whether its main business has lost core competitiveness and whether there are risks affecting its sustainable operation.

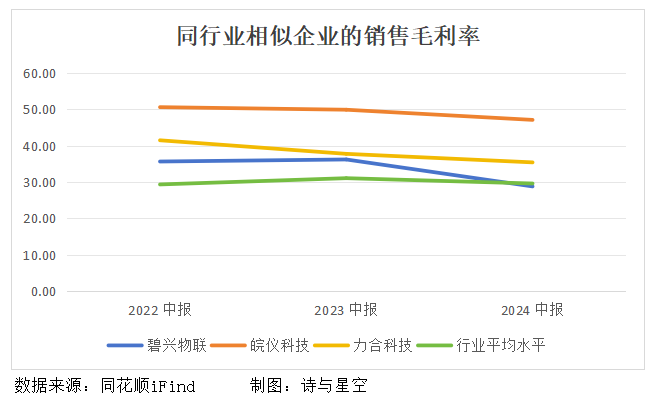

While the company attributed the decline primarily to a decrease in orders due to the macroeconomic environment and industry contraction, the change in gross margin indicated that external factors were not the sole cause.

In the first half of this year, the company's consolidated gross margin was 28.8%, a decrease of 7.4 percentage points from the previous year, showing a clear downward trend compared to similar enterprises in the same industry.

With its main business struggling with declining profits, Bixing Internet of Things embarked on exploring computing power services, which it is not proficient in, potentially risking the loss of some prepayment for procurement, raising questions about its strategy.

03

Risk of Bad Debt Loss

In October 2023, Bixing Internet of Things signed a Memorandum of Cooperation with China Mobile Shenzhen Branch and Hengwei Intelligence, agreeing to purchase GPU hardware equipment from Hengwei Intelligence to provide cloud computing GPU power services to designated users of China Mobile Shenzhen Branch. The agreement stipulated that the purchased GPU hardware equipment could only be sold to China Mobile Shenzhen Branch or its customers.

The Shanghai Stock Exchange inquired whether Bixing Internet of Things was embarking on a new business, but the company replied that this transaction was a one-time purchase and sale of computing power products, and that the company did not have the basis to independently develop computing power services beyond its existing products and business scope.

However, by the end of 2023, the company had accumulated prepayments of RMB 213.3 million to Hengwei Intelligence, resulting in a surge of 11 times in prepayments compared to the end of 2022. More crucially, the supplier was unable to fulfill its contractual obligations, and there was a risk that the remaining prepayments might not be recoverable.

According to the 2024 semi-annual report, the balance of prepayments was RMB 66.9597 million, most likely due to the final prepayment of RMB 53.325 million not being refunded.

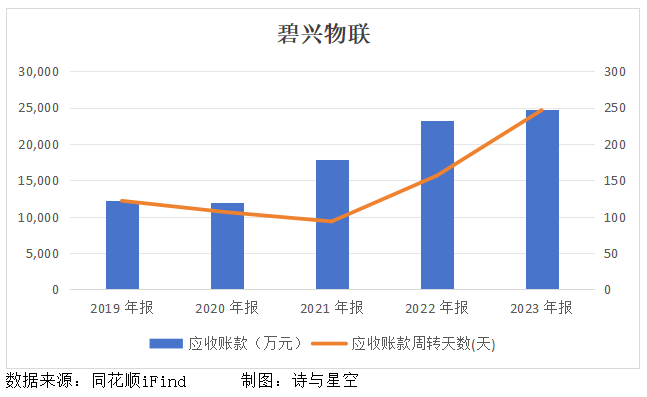

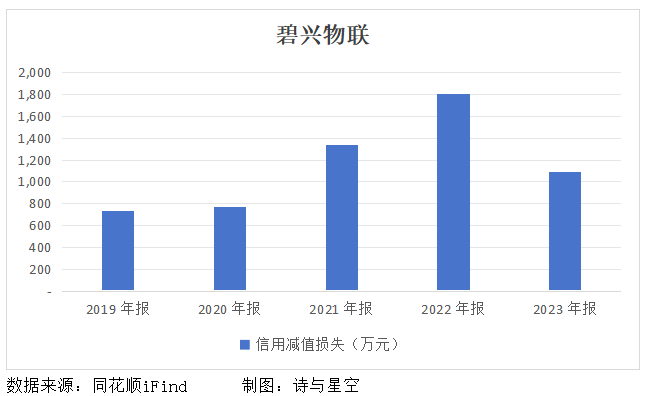

Additionally, the company's accounts receivable balance was approximately RMB 250 million, occupying a significant portion of its working capital, with approximately 50% of the balance being over one year old.

Most of the company's major customers are state-owned enterprises with lengthy payment approval processes. As the scale of accounts receivable grows, turnover days are also increasing, leading to a higher likelihood of bad debts.

In the first half of this year, the turnover days of accounts receivable further increased to 442 days. If the company fails to strengthen the management of accounts receivable and prepayments in the future, or if the credit status of customers and suppliers changes, there may be a risk of bad debt losses, which could affect the company's operating cash flow.

04

Conclusion

There are many companies that "peak upon listing," at least maintaining a good image in the year of listing. Companies like Bixing Internet of Things, which listed substandard products, require not only careful scrutiny by sponsors before listing but also stringent post-listing regulation to promote timely and accurate information disclosure.

END -

Disclaimer: This article is based on the public company attributes of listed companies and the analysis and research of information publicly disclosed by listed companies in accordance with their statutory obligations (including but not limited to interim announcements, periodic reports, and official interactive platforms). Poetry and Stars strives for fairness in the content and opinions expressed in the article but does not guarantee their accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Poetry and Stars assumes no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is original to Poetry and Stars and may not be reproduced without authorization.