Third quarter results sneak peek! Over 70% of companies anticipate positive results (list)

![]() 10/17 2024

10/17 2024

![]() 481

481

Recently, A-share companies have reached the peak of earnings forecast disclosure for the first three quarters of 2024. According to Choice data, as of October 15, over 450 A-share listed companies have disclosed earnings forecasts for the first three quarters of 2024, with 329 companies anticipating positive results (including expected increase, sustained profitability, turnaround from losses, and slight increase), accounting for over 70% of the total.

From a specific industry perspective, with the recovery and rising prosperity of various industries, semiconductor and other industries have seen particularly significant growth in performance, while several enterprises in animal husbandry, new energy, chemicals, and other industries have turned losses into profits.

01. Net profit forecast to increase by over 30 times

In terms of net profit growth, among the 329 companies that anticipate positive results for the first three quarters, 60 companies are expected to double their net profits year-on-year, 16 companies are expected to see their net profits increase by over 300% year-on-year, and 3 companies are expected to see their net profits increase by over 10 times year-on-year, which can be described as "explosive" growth.

Specifically, among the individual stocks expected to see significant growth, Qicai Chemistry, an important producer of high-performance organic pigments in China, temporarily holds the title of "earnings growth king" among A-share companies for the third quarter. The company is expected to achieve a net profit attributable to shareholders of listed companies of 115 million to 125 million yuan for the period from January to September 2024, representing a year-on-year increase of 3064.83% to 3322.65% in net profit.

Regarding the reasons for the growth in performance, Qicai Chemistry stated that during the reporting period, through efforts such as strengthening market expansion, seizing new industry opportunities, flexibly adjusting sales strategies, and focusing on technological innovation and product application research and development, the company achieved a recovery and growth in business performance.

As a significant global supplier of vitamins, Brother Technology closely follows Qicai Chemistry. The company is expected to achieve a net profit of 30 million to 39 million yuan for the period from January to September 2024, representing a year-on-year increase of 1035.07% to 1375.60% in net profit.

Regarding the reasons for the growth in performance, Brother Technology stated that the growth in performance for the first three quarters of 2024 is primarily attributed to the increase in prices and sales volumes of some vitamin products, as well as the reduction in inventory impairment provisions for certain products.

Air China Maritime's net profit growth ranks third. The company is expected to achieve a net profit attributable to shareholders of listed companies of 81 million to 91 million yuan for the period from January to September 2024, representing a significant year-on-year increase of 943.42% to 1072.24% compared to the same period last year, when it was 7.7629 million yuan.

Regarding the reasons for the growth in performance, Air China Maritime stated that as the global economy is expected to improve in 2024, the shipping market is entering an upcycle. The recent trend of the BDI index reflects the seasonal peak in dry bulk shipping during the fourth quarter. Additionally, as older coastal vessels in China are gradually phased out under the guidance of the national "equipment upgrade" policy, leading to a reduction in shipping capacity, domestic trade freight rates are expected to increase.

In addition, several other companies, including Allwinner Technology, UMCIS, ZTOUR, Muyuan Foods, New Beiyang , Will Semiconductor, SmartSens, 6912, Yuegui Co., Ltd., Rockchip, Newhongze, Dalian Electric Porcelain, Laplace, and others, are expected to see their net profits increase by over 3 times.

02. Three stocks anticipate net profits exceeding 10 billion yuan

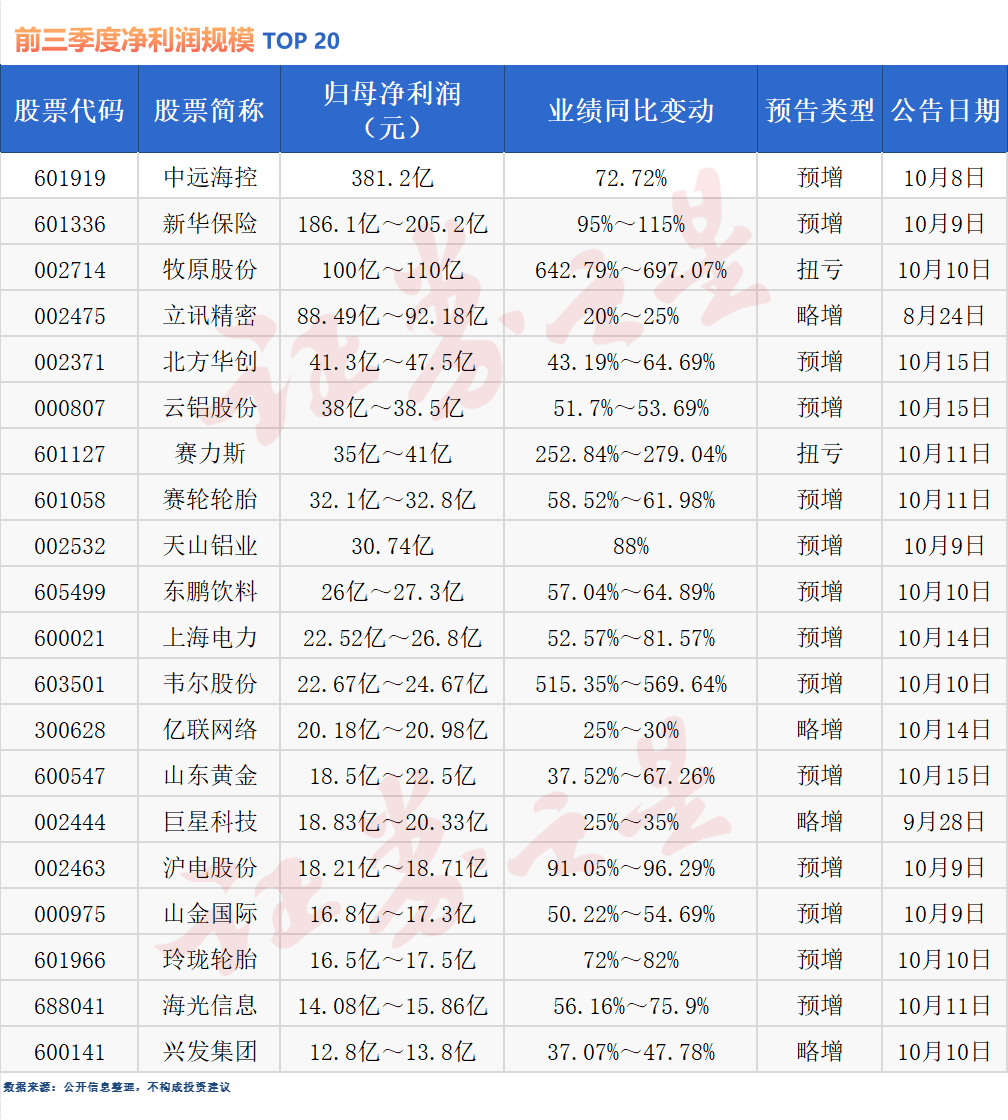

In terms of performance scale, among the 329 companies that anticipate positive results for the first three quarters, 116 companies are expected to see their net profit attributable to shareholders of the parent company exceed 100 million yuan for the first three quarters of this year; 3 companies are expected to see their net profit attributable to shareholders of the parent company reach or exceed 10 billion yuan.

Specifically, COSCO Shipping Holdings is expected to achieve a net profit attributable to shareholders of listed companies of approximately 38.121 billion yuan for the first three quarters of 2024, representing a year-on-year increase of approximately 72.72%, temporarily holding the title of "profit king." If calculated based on 270 days, COSCO Shipping Holdings earns an average of over 140 million yuan per day, earning it the nickname "money printer."

The company stated that the primary reason for the anticipated increase in performance is the moderate growth in cargo volumes in key markets, coupled with the continued impact of geopolitical tensions on shipping capacity supply, leading to overall tension in the global supply chain. COSCO Shipping Holdings focuses on the two key areas of digital intelligence and green and low-carbon development, continuously enhancing the resilience of the global supply chain.

China Life Insurance follows closely behind, issuing an earnings forecast for the first three quarters of 2024, projecting a net profit attributable to shareholders of the parent company of 18.607 billion to 20.515 billion yuan for the period. Compared to the same period in 2023, this represents an increase of 9.065 billion to 10.973 billion yuan, or a year-on-year growth of 95% to 115%.

China Life Insurance stated in its announcement that the primary reason for the anticipated increase in performance is closely related to the recent recovery of the capital market. "During the first three quarters, the company appropriately increased its investment in equity assets and raised its allocation ratio." China Life Insurance noted, "With the recent recovery and rise in the capital market, the company's investment income for the first three quarters achieved significant year-on-year growth."

Muyuan Foods, a leading pig breeding enterprise, also delivered solid performance. The company is expected to achieve a net profit attributable to shareholders of listed companies of 10 billion to 11 billion yuan for the first three quarters of this year, representing a year-on-year increase of 642.79% to 697.07%. Specifically, for the third quarter alone, the company anticipates a net profit attributable to shareholders of listed companies of 9 billion to 10 billion yuan, representing a year-on-year increase of 860.63% to 967.36%.

Muyuan Foods stated that the company's turnaround from losses to profits for the first three quarters of 2024 is primarily due to the increase in pig slaughter volumes and average selling prices compared to the same period last year, coupled with a decrease in pig breeding costs.

Additionally, several other companies, including Luxshare Precision, Northern Microelectronics, Yunnan Aluminium, Thalys, Sailun Tire, and Tianshan Aluminium, are expected to achieve net profits attributable to shareholders of the parent company exceeding 3 billion yuan for the first three quarters of this year.

03. Third quarter reports hold promise

From the industry distribution of listed companies that have disclosed third quarter earnings forecasts, it can be observed that the majority of companies anticipating positive results are concentrated in industries such as machinery, semiconductors and semiconductor production equipment, and chemicals.

A research report recently issued by GF Securities pointed out that over the next quarter, domestic conditions are expected to improve at the macro, meso, and micro levels, hence maintaining an optimistic outlook on the current "rebound" trend and recommending a low-cost allocation strategy focusing on "technology > consumption."

Ping An Securities analysis noted that as economic improvement expectations gradually become clearer, during the third quarter reporting window, sectors with improved fundamental profitability will continue to benefit. In particular, technology cultivation and mergers and acquisitions remain key priorities in the capital market, and investors are advised to focus on investment opportunities in areas such as new productivity supported by policy, high-end manufacturing, and state-owned enterprise reform.

China International Capital Corporation (CICC) stated that the peak period for third quarter reporting will begin in mid-to-late October. A-share listed companies will disclose their third quarter results intensively during this period. Following recent substantial market gains, fundamentals may become the focus of trading, and companies and industries with better-than-expected third quarter results are expected to dominate market trends.

CICC emphasized that grasping fundamental turning points and resilience may be crucial investment strategies at present. During the earnings disclosure phase, attention should be paid to: 1) Prosperous sectors where third quarter results may exceed expectations or show quarter-on-quarter improvement. 2) Sub-sectors with gradually recovering performance from the bottom of the cycle and clear industrial trends, such as TMT-related industries like semiconductors, consumer electronics, and communications equipment. 3) Industries that have achieved supply-side clearance in a moderate recovery environment, such as some upstream resources and traditional manufacturing sectors.

- End -