Why did Shunfeng Express underperform on its IPO day

![]() 10/21 2024

10/21 2024

![]() 489

489

The long road to self-proving value!

Editor: George

Author: Li Xiang

Source: Shoucai - Shoucai Financial Research Institute

Where there is a will, there is a way.

On October 4, 2024, Shunfeng Express successfully landed on Nasdaq with an offering price of $16.5. The stock opened up by over 23% and eventually closed at $18.01, representing a year-on-year growth of 9.15%. However, the next day, it fell below its offering price and entered a volatile mode. As of the close on October 17, Eastern Time, the share price was $14.97, with a market value of less than $1.1 billion.

The rollercoaster ride of the market - what is it hesitating about?

1

Small market size

Slowing revenue growth and caution about the growth ceiling

As a pioneer in the instant delivery sector, Shunfeng Express, founded in 2013, has become an industry leader and a favorite among investors after more than ten years of deep cultivation. Its investor lineup includes Matrix Partners China, CDH Investments, Shunwei Capital, and Puzi Capital, among others. Taking Puzi Capital, controlled by Wang Sicong, as an example, its continuous participation in two rounds of financing demonstrates its recognition of Shunfeng Express.

In terms of business model, unlike some competitors who focus on the B-end market, Shunfeng Express favors the C-end market. Founder Xue Peng believes that excessive reliance on the B-end market can restrict a company's independence by making it subject to platform resources, with pricing power and profitability influenced by major customers. Therefore, Shunfeng Express focuses on "independent on-demand express delivery" services, providing "one-to-one urgent delivery" services.

According to iResearch Consulting's forecast, the compound annual growth rate of China's independent on-demand express delivery market is expected to reach 27.8% from 2023 to 2028, while the overall growth rate of the instant delivery market is projected at 19.1%. Shunfeng Express holds a 33.9% market share, ranking first in the industry and far ahead of the second-place player with a 5.4% market share.

However, the overall size of this niche market remains relatively small. iResearch Consulting data shows that in 2023, the total size of China's on-demand delivery market reached 338.5 billion yuan, with the independent on-demand express delivery market accounting for only 15.6 billion yuan, or less than 4.7% of the overall market. Some analysts believe that in the instant delivery market, services with high repurchase rates are mainly concentrated in B2C scenarios such as food delivery, fresh produce, and retail convenience, accounting for over 90% of the market share. In contrast, C2C platforms like Shunfeng Express, which focus on "one-to-one" services, are relatively scarce.

Reflecting on Shunfeng Express's performance, the company, despite its leading position, needs to be cautious about hitting a growth ceiling. From 2021 to 2023, the company's revenue was 3.04 billion yuan, 4.003 billion yuan, and 4.529 billion yuan, respectively, with growth rates declining from 31.68% to 13.14%. In the first half of 2024, revenue was 2.285 billion yuan, with a further decline in growth rate to 7.65%.

2

Beware of diminishing competitive advantage - accelerate transformation

This is not good news for Shunfeng Express, which relies on economies of scale to achieve profitability despite its already low profit margins.

As the instant delivery industry matures, practitioners are placing increasing emphasis on delivery speed and standardization. Shunfeng Express's "one-to-one urgent delivery" service is no longer a novel concept, and the company must be vigilant against the gradual erosion of its competitive advantage.

Currently, there are numerous competitors offering similar "direct delivery by designated personnel" services. Taking a 10-kilometer delivery of a document weighing no more than 5 kg as an example, according to Biaodian Finance, Meituan's errand service charges 25 yuan, Fengniao Errand charges 28.5 yuan, Dada Nextday charges 30 yuan, SF Express City Express charges 32.78 yuan, and Shunfeng Express charges 29.5 yuan, placing it in the middle of the price range.

Meituan and Ele.me enjoy price advantages due to their economies of scale, which allow them to effectively spread costs. As of the end of 2023, Meituan had 7.45 million registered riders, of which approximately 800,000 completed more than 260 delivery orders annually. Ele.me had over 4 million active riders.

As of June 30, 2024, Shunfeng Express had approximately 2.7 million registered riders. Delivery services are a labor-intensive industry, and the largest portion of Shunfeng Express's cost expenditure goes towards rider salaries and incentives. From 2021 to 2023 and in the first half of 2024, Shunfeng Express paid its riders compensation and incentives accounting for 90.5%, 90.3%, 87.8%, and 85.4% of its total revenue, respectively.

Over the same period, Shunfeng Express's gross profit margins were 6.22%, 6.48%, 8.71%, and 11.3%, respectively. The company incurred net losses of 291 million yuan and 180 million yuan in 2021 and 2022, respectively, but recorded net profits of 110 million yuan and 124 million yuan in 2023 and the first half of 2024, respectively.

While the improvement in profitability is commendable, the net profit margin remains relatively weak. Shunfeng Express stated that its 2023 profitability was primarily due to increased government subsidies, with operating profit related to business operations amounting to only 11 million yuan. At the same time, the aforementioned slowdown in revenue growth is not a positive factor. The prospectus candidly admits that if Shunfeng Express fails to achieve sufficient revenue growth and manage costs and expenses effectively, it may not be able to maintain profitability or consistently generate and sustain positive cash flow.

Industry analyst Wang Tingyan noted that Shunfeng Express primarily adopts a "crowdsourcing" model, which is an asset-light operational approach. Compared to traditional employment relationships, this model offers flexibility in responding to market demand changes but also poses challenges in terms of rider loyalty, personnel management, and internal control quality assurance. Looking at the industry as a whole, the trend towards intelligent transformation and the adoption of unmanned delivery services have reduced competition costs. To maintain its leading position and fend off aggressive competition, Shunfeng Express needs to keep pace with this wave of transformation and act faster and more precisely.

This is not mere rhetoric. As of June 2024, Meituan's self-developed drones had opened 31 routes in multiple cities, completing over 300,000 delivery orders. Its autonomous delivery vehicles had also undergone routine testing and operation in various regions, completing nearly 4 million delivery orders.

Focusing on Shunfeng Express, although its official website indicates patents related to "order allocation methods, devices, servers, and storage media" in its intelligent scheduling system and "a solution based on data desensitization protection for instant logistics" in its security protection system, its substantive intelligent practical achievements are still not dominant compared to Meituan.

3

IPO is just the beginning - Strengthening quality control and risk management

Change is the only constant. In the current instant delivery market, a diversified competitive landscape has emerged. In addition to traditional express delivery, e-commerce, and food delivery giants continuing to increase their investments, companies like Huolala, DiDi Chuxing, Hello Bike, and Gaode Map have also ventured into instant delivery services, aiming to secure a share of the market.

The increasingly fierce competition indicates that the market will undergo further consolidation and reshaping, with some companies potentially facing decline or even elimination. In this context, some platforms are seeking stronger partnerships for support.

In September 2024, JD.com announced an increase in its stake in Dada Nextday, raising its shareholding to 63.2%. Beyond financial support, this move secured a stable source of orders for Dada Nextday.

Industry analyst Sun Yewen noted that in the face of fierce competition, practitioners will find it difficult to survive and develop without differentiated advantages in service or pricing. Especially as platforms like Meituan and Ele.me, which already enjoy economies of scale, begin to expand into the C2C market, Shunfeng Express needs to be vigilant against the erosion of its market share or being forced into an endless price war, which could ultimately lead to a depletion of funds and hinder its growth and stability.

According to Toubao Research Institute's "2022 China Instant Delivery Industry Research Report," in terms of overall industry competition, Meituan Delivery and Fengniao Express rely on their respective food delivery platforms to achieve significant advantages in delivery volume. UU Runners has seen a significant increase in the number of couriers. Meituan Delivery and Dada Nextday lead in terms of the number of cities, counties, and districts covered by their services. From the perspective of coverage, the number of riders, and delivery volume, Shunfeng Express has clearly lagged behind industry leaders.

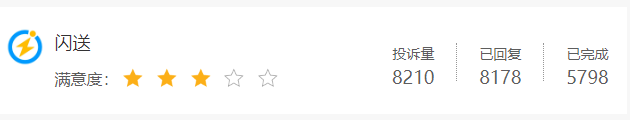

As of October 18, 2024, there have been a cumulative total of 8,120 complaints about Shunfeng Express on Heimao Complaints, involving issues such as lost items, delayed compensation and refunds, couriers questioning excessive fees, and difficulties in receiving orders.

There have also been regulatory fines. For example, in December 2019, the Ministry of Industry and Information Technology released a notification on APPs that infringed upon user rights and interests (first batch), with Shunfeng Express listed among them for multiple violations, including unauthorized collection of personal information, collection of information beyond reasonable scope, unauthorized sharing of information with third parties, forced use of targeted push notifications, and setting obstacles to make it difficult for users to deactivate their accounts. These violations not only infringed upon users' privacy rights but also their rights to choose and be informed.

From these observations, it is clear that a successful IPO is merely the beginning. Shunfeng Express still faces numerous challenges in retaining investors. Strengthening internal quality control, risk management, and compliance, as well as enhancing external performance growth, requires continuous improvement. The road to self-proving value remains long and arduous.

This article is originally created by Shoucai

Please leave a message if you wish to reprint it