Pattern changing? Behind the "suspension wave" of European and American airlines

![]() 10/22 2024

10/22 2024

![]() 512

512

After several foreign airlines announced the suspension of flights to China, SAS Scandinavian Airlines also announced the abandonment of its only direct flight to China, once again sparking industry discussions on the "suspension wave".

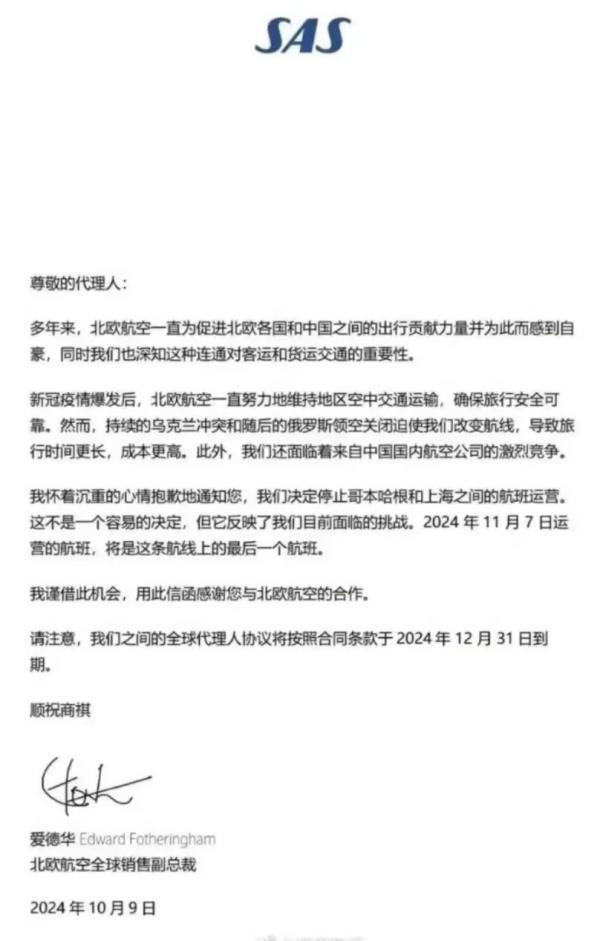

Recently, SAS Scandinavian Airlines, which had just joined SkyTeam Alliance, sent a notice to agents about withdrawing from the Chinese market, announcing the suspension of flight operations on the Copenhagen-Shanghai route from November 10, 2024. SAS stated that this decision was made due to changes in market demand and that it would continue to monitor opportunities in the Chinese market.

This marks the cancellation of SAS's last remaining route in China, following the cancellation of its routes to Hong Kong and Beijing. For affected passengers, three solutions have been proposed: accepting alternative flights, changing flights free of charge, or receiving a full refund.

Previously, SAS Scandinavian Airlines was popular among European students due to its cost-effective "youth ticket," which many chose as their preferred option for returning to China. Currently, many netizens have discovered that their November SAS flights have been canceled, leaving them with no choice but to reschedule or refund their tickets.

Regarding the actual reasons for the flight suspensions, there is a general consensus in the industry that North American and European airlines cannot overfly Russian airspace, significantly increasing flight times and operating costs for many destinations in Asia. As a result, it has become inevitable to suspend unprofitable routes and redirect resources to more profitable ones.

In the short term, the North American market is undoubtedly the focus of SAS's capacity allocation. Industry insiders have analyzed that SAS Scandinavian Airlines only has four A350 aircraft, necessitating careful allocation of its long-haul capacity. Especially given the weak currencies and declining purchasing power in Sweden and Norway, it is more likely to prioritize deploying the A350 on the more profitable North American routes. This aligns with SAS's strategic objectives since joining SkyTeam, with a focus on intermodal agreements on North Atlantic routes.

SAS Scandinavian Airlines' decision also reflects the challenges currently faced by European and American airlines in the Asian market. Pieter Elbers, CEO of KLM Royal Dutch Airlines, has repeatedly stated publicly that due to the inability to overfly Russian airspace, European airlines must spend an additional two hours flying on China routes, requiring four crew members and additional fuel. Given the high cost of aviation fuel this year, this undoubtedly increases operating costs for European airlines.

March and October are the global civil aviation "shift seasons," leading many overseas airlines to announce adjustments to their China route layouts during this period. According to FlightStats data, the number of routes has decreased by over 200 compared to the same period in 2019, a near-halving, with North American routes numbering less than half of 2019 levels.

Several airlines have already announced related news. Virgin Atlantic has suspended flights from London to Shanghai from October 26; British Airways has ceased operations on the London-Beijing route from October 26; Lufthansa will suspend flights from Beijing to Frankfurt at the end of October; and LOT Polish Airlines has suspended flights from Warsaw to Beijing Capital Airport from October 24.

However, the inability to overfly Russian airspace is not the sole reason behind the flight suspensions, as several overseas airlines unaffected by the detour have also announced cancellations.

FlightStats data shows that there were 154 international departure airports in the first half of 2024, a net decrease of 38 compared to the same period in 2019. Regionally, there were more suspensions in North America, Southeast Asia, and Eastern Europe. At the national level, the United States suspended nine routes compared to 2019, the largest decrease, while Japan, India, Thailand, and Russia each suspended 4-5 routes (with India currently experiencing a complete suspension).

The deeper reasons are related to the slow recovery of outbound tourism post-pandemic and increased market competition. After the pandemic, international capital gradually withdrew from China, and business travel and international tourism declined, compounded by a slow global economic recovery and insufficient demand to support these routes.

According to Lin Zhijie, a civil aviation expert, the number of long-haul passengers is still declining. The demand for foreigners entering China has not fully recovered; in 2019, there were 48 million foreign arrivals, while in the first half of 2024, there were only 14 million, indicating a significant decrease. This represents the basic passenger base for foreign airlines, which have been significantly impacted.

On the other hand, China's outbound tourism is still in the recovery stage. In the first half of 2024, the number of Chinese outbound tourists reached 60.71 million, representing 74.7% of the same period in 2019.

A British Airways staff member also stated that the suspension of flights to Beijing was due to a decline in the number of international travelers. In fact, after the pandemic, many foreign airlines have been less enthusiastic about resuming flights to China, especially on China-Europe and China-US routes, compared to domestic airlines. Although some airlines have not suspended flights to China, they have quietly replaced larger aircraft with smaller ones with fewer seats.

In terms of overall numbers, the number of countries served by China's airlines is now on par with 2019, but there are notable regional changes. In stark contrast to the constant suspension of North American routes, Southeast Asia remains the most densely served region, while the number of routes in West Asia, Central Asia, and Africa has surpassed 2019 levels. This is undoubtedly linked to the in-depth promotion of the Belt and Road Initiative.

As European and American airlines suspend or reduce operations on China routes, the competitive landscape in the international aviation market is also shifting. The market share of Chinese and foreign airlines in traditional European and American markets is undergoing significant changes. According to Cirium data, by the end of this year, Chinese airlines will account for 75% of seat capacity on China-Germany and China-France routes, completely dominate the China-Italy route market, and hold a 95% market share on the China-UK route.

This is inseparable from the aggressive expansion of international routes by China's three major airlines: Air China, China Eastern Airlines, and China Southern Airlines. In September, China Eastern Airlines' international passenger capacity increased by 0.61% year-on-year compared to 2019, while Air China and China Southern Airlines recovered to 89% and 92% of their 2019 levels, respectively.

However, even so, the recovery has not yet reached 2019 levels, and the first half of 2024 saw relatively slow progress. According to FlightStats estimates, China's civil aviation international passenger traffic reached 44 million in the first half of 2024 (including foreign airlines), representing 70.3% of 2019 levels.

Lin Zhijie stated that local airlines have actively responded to the national call to resume international routes, proactively deploying capacity ahead of schedule. In this process, local airlines have further increased their market share through market competition, but from a demand-supply perspective, the overall situation remains one of relative excess capacity.

Indeed, since the beginning of this year, affected by the slow recovery of international routes and excess wide-body aircraft capacity, local airlines have generally adopted a strategy of trading price for volume. This is also one of the reasons why foreign airlines with higher costs cannot sustain operations.

However, on the other hand, local airlines are also facing difficulties. Although they have provided ample supply on international routes with wide-body aircraft, seat occupancy rates on these routes have fallen short of expectations due to fierce competition. As a result, the three major state-owned airlines have seen their revenues increase without a corresponding increase in profits, becoming one of the significant factors dragging down their performance losses in the first half of the year. Especially in the second quarter, as ticket prices declined and aviation fuel prices rose, the airlines' revenues fell quarter-on-quarter, putting pressure on profits.

From the perspective of many European and American airlines that have suspended or reduced routes, outbound tourism routes are indeed facing unprecedented challenges. However, the robust growth in West Asia, Central Asia, and Africa under the impetus of the Belt and Road Initiative policy dividends underscores the resilience of Chinese tourists with high spending power, who are still in the process of recovery. Once demand returns to peak levels, it is believed that these overseas airlines will return.

Cover image sourced from Shutterstock, text images sourced from online screenshots and FlightStats