Super Dry Goods | Full Text Record of 2024 Live Streaming and Short Video E-commerce Industry White Paper

![]() 10/22 2024

10/22 2024

![]() 522

522

Driven by the wave of digitization, the global e-commerce industry is undergoing unprecedented changes. Hangzhou, as a pioneering city for e-commerce in China, stands at the forefront of this transformation, leading the innovation and development of the e-commerce industry. This report aims to delve into the current status, challenges, and future trends of Hangzhou's e-commerce industry, with a particular focus on how artificial intelligence (AI) technology is reshaping the e-commerce ecosystem. Hangzhou, a historic city, is hailed as the "Capital of Chinese E-commerce." After decades of development, Hangzhou's e-commerce industry has evolved into a diversified and international business ecosystem. From the rise of live streaming e-commerce to the booming cross-border e-commerce, Hangzhou continuously demonstrates its innovative vitality in the e-commerce sector. However, with the continuous advancement of technology, especially the rapid development of AI technology, Hangzhou's e-commerce industry is embracing new opportunities and challenges. Through AI algorithms analyzing user behavior and purchase history, e-commerce platforms can provide more precise personalized recommendations, thereby enhancing users' purchase intention and conversion rates.

Furthermore, AI technology can generate high-quality product descriptions and marketing content, enhancing products' appeal and display effects. Looking ahead, Hangzhou's e-commerce industry will continue to lead innovation and explore new applications of AI technology in e-commerce. From AI models changing outfits to AIGC empowering operations, generative AI will comprehensively infiltrate the entire e-commerce industry chain. With the application of cutting-edge technologies such as 5G and blockchain, Hangzhou's e-commerce will create a shopping environment beyond reality, immersing consumers in a unique and engaging shopping experience. This white paper will thoroughly analyze the development trends of Hangzhou's e-commerce industry and explore how AI technology brings revolutionary changes to the industry. We believe that through in-depth analysis and research, this report will provide valuable insights and inspirations for practitioners, policymakers, and readers interested in the e-commerce industry.

01

Overview of the Development of Live Streaming and Short Video IndustryI. Basic Definitions of the Live Streaming and Short Video Industry

(1) The live streaming industry relies on internet technology, with real-time audio and video transmission as its core, encompassing content creation, platform operation, user interaction, and other aspects. It covers various content areas such as entertainment, education, sports, and e-commerce, providing users with diverse content through live streaming platforms, including music, games, variety shows, dance, food, dramas, tutorials, etc. Currently, live e-commerce and knowledge-paying live streams have become essential promotion and marketing channels for enterprises across industries.(2) Short videos refer to frequently pushed video content played on various new media platforms, suitable for viewing in mobile states and short leisure periods, ranging from a few seconds to a few minutes. They integrate themes such as skill sharing, humor, fashion trends, social hotspots, street interviews, public education, advertising creativity, and commercial customization. The short video industry encompasses content creation, platform operation, distribution and promotion, user interaction, and commercialization.

II. Overview of the Live Streaming and Short Video Industry

With the completion of network facilities, the live streaming and short video industry has rapidly emerged as an emerging industry, attracting more consumers and forming a complete industrial ecosystem. However, due to its mass participation, everyone has the opportunity to become a streamer or blogger, with a low entry threshold, resulting in a relatively simple industrial chain. The live streaming industrial chain primarily consists of upstream suppliers, midstream platforms, and downstream demand ends. Upstream suppliers include: ① Commodity suppliers such as manufacturers, brand owners, and distributors who provide products or services required for live streaming; ② MCN agencies that provide content planning, promotion, fan management, and contract agency services for influencers and self-media, akin to "celebrity agents" in the internet realm; ③ Technical support providers that offer equipment such as cameras, audio equipment, and all-in-one live streaming devices.

Midstream platforms include: ① Live streaming platforms, the core of the live streaming industrial chain, offering content publication, viewing, and interaction functions across entertainment, education, e-commerce, gaming, sports, and other fields; ② Streamers, including influencers, celebrities, and entrepreneurs, who create and publish content through live streaming platforms, attracting audiences and generating revenue; ③ Live streaming service providers that offer technical support, operation promotion, data analysis, and other services to enhance live streaming performance. Downstream demand ends encompass: ① Consumers, the ultimate demand end of the live streaming industrial chain, who fulfill their needs by watching live streams and purchasing products or services. The short video industrial chain comprises content production, distribution, and consumption. Upstream content production involves: ① Basic technical support; ② UGC (User-Generated Content); ③ PGC (Professionally Generated Content) and PUGC (Professionally-User Generated Content). Midstream content distribution primarily includes: ① Short video platforms; ② Traditional video platforms; ③ News and information platforms; ④ Social media platforms. Downstream content consumption involves: ① Short video users; ② Consumers.

According to the 53rd Statistical Report on the Internet Development in China released by the China Internet Network Information Center (CNNIC), as of December 2023, the number of video users in China reached 1.067 billion, accounting for 97.7% of the overall internet user population. Among them, there were 1.053 billion short video users, with 71.2% of these users having purchased products through watching short videos or live streams. Furthermore, in 2023, China's online live streaming users surpassed 800 million for the first time, reaching 816 million, an increase of 8.66% year-on-year, with a user utilization rate of 74.7%, up 1.4% from 2022. Specifically, as of the end of 2023, Douyin (TikTok's Chinese counterpart) boasted over 980 million users, with daily active users exceeding 700 million and daily searches surpassing 500 million. By the second quarter of 2024, Kuaishou's average daily and monthly active users reached 395 million and 692 million, respectively. Although Tencent does not disclose the number of users for its video accounts, third-party reports (from Guohai Securities) estimate that the daily active users for video accounts reached 450 million in 2023.

The vast user base, combined with the high penetration rate and user stickiness of live streaming and short videos, has brought tremendous commercial value and market potential to the entire industry. According to iResearch estimates, China's live e-commerce market reached 4.9 trillion yuan in 2023, with a year-on-year growth rate of 35.2%. Additionally, according to the China Network Performance (Live Streaming and Short Video) Industry Development Report (2023-2024) released by the China National Association of Performing Arts in June 2024, China's network performance (live streaming) market reached 209.5 billion yuan in 2023, an increase of 5.15% over 2022. Both user numbers, consumption ratios, and overall transaction sizes and vertical revenue performance indicate that live streaming and short videos have become mainstream channels for mass consumption, with profound changes occurring in users' consumption habits.

With the rapid development of the industry, the business models in the live streaming and short video industry have become increasingly diversified. This trend is evident not only in the continuation of traditional profit models but also in the emergence of new profit models and the innovation and integration of business models. These diverse business models not only enrich the content ecosystem of the live streaming and short video industry but also create more business opportunities for enterprises and individuals. Advertising Revenue: Live streaming and short video platforms generate revenue by displaying advertisements. These advertisements can come from brands, e-commerce platforms, etc., and take forms such as video ads, graphic ads, and live stream embedded ads. For example, brand collaborations on Kuaishou and Douyin share advertising revenue with streamers, realizing the monetization of commercial value. Rewards and Virtual Gifts: Users/viewers can express their appreciation and support by purchasing virtual gifts and sending them to streamers/bloggers, who can then exchange these virtual gifts for cash income. This model is widely used on platforms like Douyu, Huya, and Huajiao Live, representing the most intuitive manifestation of the fan economy. Live Commerce: Live streaming and short video commerce have become crucial business models in the industry. Streamers/bloggers showcase and recommend products through live streaming and short videos, guiding users/viewers to make purchases and earning commission income. Deep cooperation between e-commerce platforms and live streaming platforms leverages live streams to guide purchases, realizing traffic monetization. Successful cases on platforms like Taobao Live, Douyin E-commerce, and Pinduoduo demonstrate the strong profitability of live commerce. Brand Collaborations and Sponsorships: Live streaming and short video platforms collaborate with brands to generate sponsorship revenue through brand placements and customized activities. These collaborations not only enhance the quality and professionalism of live streaming and short video content but also bring exposure and sales opportunities to brands. Paid Content: Viewers can pay to watch specific live content, such as online concerts or professional courses. Examples of this model include Bilibili's "Charging Plan" and Netease Cloud Class.

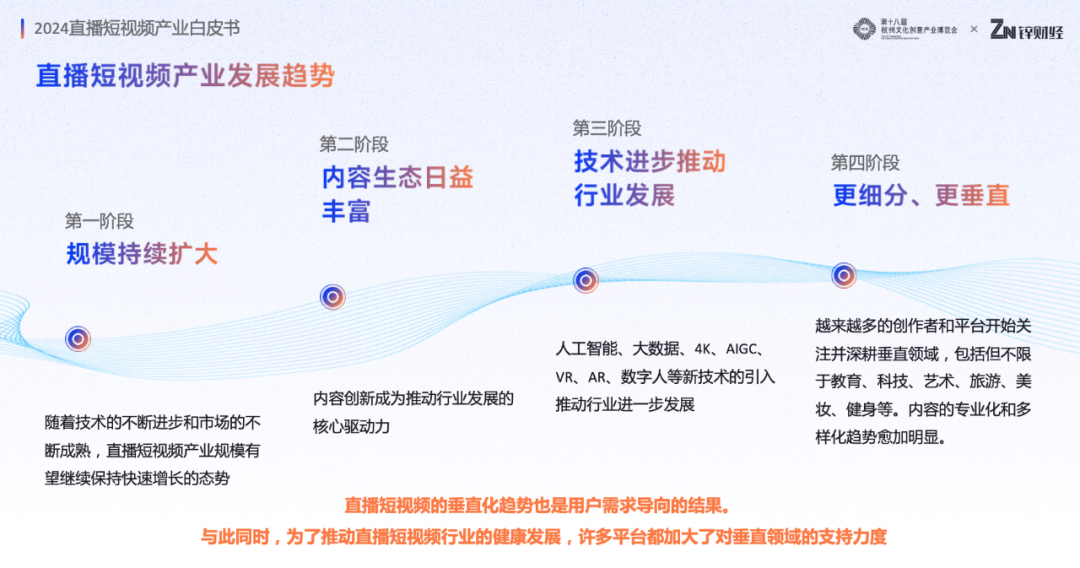

Continued Expansion in Scale: In recent years, the live streaming and short video industry has continued to grow at a rapid pace. With technological advancements and market maturation, the industry's scale is expected to maintain its rapid growth trajectory, unleashing significant market potential. Enriched Content Ecosystem: With the industry's rapid development, live streaming and short video platforms have made notable progress in enriching their content ecosystems. Content innovation has become the core driver of industry growth. Micro-short dramas, as an emerging content format, have seen rapid growth in both market size and the number of launches. The success of live streaming commerce has driven the promotion of e-commerce live streams, attracting a large number of viewers and participants. Although the user base for game live streams has fluctuated in recent years, it remains a vital component of online live streaming. Sports live streams have seen notable growth in the past two years, reflecting the potential of China's sports economy.

Technological Advances Drive Industry Development: As an emerging industry highly dependent on technological innovation, the development of the live streaming and short video industry is closely tied to advancements in AI, big data, 4K, AIGC, VR, AR, digital humans, and other technologies. The introduction of these new technologies is further propelling the development of the industry. For instance, AI in live streaming reduces costs and enhances efficiency by optimizing content production and viewer interaction through intelligent analysis and automation tools. VR and AR create virtual environments for live streams, enhancing immersive experiences and visual effects. These technologies not only improve the interactivity and viewability of live streaming and short videos but also lower creation thresholds, increase creation efficiency, and explore innovative content presentation methods, significantly enhancing user experience and encouraging more users to participate in content creation.

More Segmentation and Verticalization: As the live streaming and short video industry continues to evolve, more creators and platforms are focusing on and delving into vertical fields, including but not limited to education, technology, art, travel, beauty, fitness, and more. The trend towards content specialization and diversification is becoming increasingly apparent. In fact, the verticalization trend in live streaming and short videos is driven by user demand. With increasingly diverse and personalized user needs, they prefer to seek content related to their interests. Therefore, creators and platforms need to more precisely position their content direction to meet users' specific needs. This user-demand-oriented approach to content creation and distribution helps enhance user satisfaction and loyalty. Concurrently, to promote the healthy development of the live streaming and short video industry, many platforms have increased support for vertical fields. They encourage creators and institutions to delve deeper into these fields by providing traffic support, financial incentives, and professional training. In the future, as technology continues to advance and user needs evolve, the verticalization trend in live streaming and short videos will continue to deepen, further intensifying the "live streaming+" trend.

02

Overview of the Development of Hangzhou's Live Streaming and Short Video Industry

Hangzhou occupies a pivotal position in China's e-commerce landscape. Since the 1990s, after more than two decades of robust development, Hangzhou has consistently stood at the forefront of China's e-commerce industry. From the pioneering launch of China Chemicals Network to the emergence of Taobao and the successful listing of Alibaba Group, these landmark achievements demonstrate Hangzhou's deep foundation and continuous innovation in e-commerce. Year after year, Hangzhou continues to write legendary chapters in the e-commerce industry, becoming fertile ground for nurturing e-commerce innovation and development.

(1) In 2016, the live streaming e-commerce industry emerged, entering its infancy. Hangzhou, leveraging its unique advantages and abundant resources, continued to sow seeds of hope in this field.(2) By 2022, according to authoritative monitoring data from the Zhejiang Provincial Department of Commerce, Hangzhou's online retail sales achieved a historic milestone, surpassing the trillion-yuan mark for the first time, reaching 1.04963 trillion yuan and accounting for 38.8% of the province's total online retail sales. Both in absolute terms and as a percentage, Hangzhou ranked first in the province.(3) By 2023, according to monitoring data from the Zhejiang Provincial Department of Commerce in February 2023, Hangzhou had 32 leading comprehensive and vertical live streaming platforms, nearly 50,000 streamers, and over 5,000 registered live streaming-related enterprises, ranking first nationwide, supporting employment for over 1 million people. This translates to one streamer for every 244 people in Hangzhou and one person employed in the live streaming industry for every 12 people. Currently, Hangzhou has gathered numerous leading players in the live streaming e-commerce industry, including renowned local MCN agencies such as Qianxun, Yaowang, Wuyou Media, Ruhan, Taiyangchuanhe, Junmeng Culture, Tisu, and Ruiqu Culture. Furthermore, well-known influencers like Li Guoqing and Xiang Tai have established and joined operational companies, collectively forming a dazzling galaxy in Hangzhou's live streaming e-commerce sector. Based on platform-side big data, the "2024 Douyin E-commerce Influencer Growth Report" presents an overview of platform influencers' growth over the past year from dimensions such as influencer ecosystem, city distribution, and content.

(2) Traffic aggregation hub

A small cubicle, a mobile phone, and a fill light combined make up a 'new world.' According to data from the Zhejiang Provincial Department of Commerce, Hangzhou currently has 32 comprehensive and vertical leading live streaming platforms, nearly 50,000 anchors, and over 5,000 registered live streaming-related enterprises, ranking first nationwide in terms of numbers, driving employment for over one million people. Leveraging its superior supply chain, logistics, and e-commerce environment, Hangzhou has formed an agglomeration effect, attracting more and more enterprises to locate here. Currently, over 60% of MCN agencies nationwide are concentrated in Hangzhou, with six of the eight leading domestic MCN agencies already established in Hangzhou: Jiaogepengyou, Wuyou Media, Yaowangkeji, Qianxun, Sanzhiyang, and Xinxuan. Yaowangkeji: Yaowangkeji is a comprehensive technology enterprise with live streaming at its core. It ventured into the live streaming e-commerce sector in 2018 and completed its capitalization and A-share listing in the same year, winning multiple TOP MCN agency honors from Douyin and Kuaishou platforms. Currently, Yaowangkeji has contracted nearly 40 celebrity anchors such as Jia Nailiang, Cecilia Cheung, and Wang Zulan, and has incubated over a hundred influencers including Yu Dagongzi and Li Xuanzhuo. According to the 2024 half-year financial report, Yaowangkeji generated operating revenue of RMB 298 million during the reporting period, a year-on-year increase of 31.56%; its live streaming e-commerce business achieved a total GMV of RMB 9.3 billion during the reporting period, a year-on-year increase of approximately 50%. Currently, leveraging its leading live streaming e-commerce operational experience and supply chain advantages, Yaowangkeji is actively exploring overseas markets such as Europe. In June this year, Yaowangkeji partnered with UK influencers to set a new UK live streaming record with a single-session GMV of USD 833,000 and over 50,000 orders. Wuyou Media: Wuyou Media is a professional internet-based talent agency established in 2016. It has contracted over 100,000 talent influencers, including over 5,000 high-quality artists, with a total fan base exceeding 2 billion across all platforms. Wuyou Media has shifted its focus from MCN talent economy to empowering live streaming e-commerce with resources. Over the past few years, it has delved into converting personal IP, content IP, and product IP, signing top talents and influencers such as Liu Genghong, Guangdong Couple, Duoyu and Maomaojie, Zhang Dada, Wu Kequn, and Xiaoxiong Chumo, among others. Currently, Wuyou Media boasts 30 million-follower influencers and nearly 600 hundred-thousand-follower influencers, with a total fan base exceeding 2 billion across all platforms. Jiaogepengyou: Jiaogepengyou is a leading institution and marketing platform in the live streaming e-commerce sector established in 2020, with well-known anchors such as Luo Yonghao, Zhu Xiaomu, Huang He, Li Dan, and Qi Wei under its belt. In February 2021, Jiaogepengyou officially settled in Hangzhou Binjiang Internet Town. In the third quarter of 2024, Jiaogepengyou achieved a total GMV of approximately RMB 2.9 billion, an increase of approximately 18.84% over the third quarter of 2023; cumulative GMV for the first three quarters of 2024 reached approximately RMB 8.86 billion, an increase of approximately 18.44% over the same period in 2023. Financial reports show that Jiaogepengyou operates over 50 live streaming rooms, with a total of 68 million live streaming fans and over 86 million fans across all platforms, making it one of the institutions with the largest number of live streaming rooms in the new media sector. For e-commerce live streaming enterprises, selecting a landing city involves various considerations, such as policy support and stability, commercial atmosphere maturity and market demand, talent resource richness and attractiveness, alignment between the city's key industrial directions and innovation capabilities with corporate strategies and businesses, and the efficiency gains brought about by industrial agglomeration, which are also crucial. Hangzhou has been intensifying its efforts in live streaming e-commerce development. The 2024 Hangzhou Government Work Report proposes to continue vigorously developing new consumption, including the 'live streaming economy,' in 2024, aiming to build an international center for new consumption and strive to achieve a growth rate of over 5% in total retail sales of consumer goods and 7% in online retail sales.

(3) Platform aggregation hub

Market entities are the foundation of the live streaming e-commerce industry's development. The city that attracts e-commerce enterprises well will seize the initiative in the development of the live streaming e-commerce industry. Currently, Hangzhou has 128 e-commerce platforms, over 12.5 million online stores, 39 'unicorn' enterprises, and 317 'potential unicorn' enterprises. The convergence of a large number of live streaming e-commerce enterprises and talents has become an essential force driving consumption growth and economic development. Against this backdrop, the Hangzhou Live Streaming E-commerce Association was officially established in November 2023. Co-initiated by enterprises such as Zhejiang Taobao Network Co., Ltd., Hangzhou Yaowang Network Technology Co., Ltd., Hangzhou Wuyou Media Co., Ltd., Qianxun (Hangzhou) Holding Co., Ltd., Hangzhou Junmeng Culture Media Co., Ltd., Jiaogepengyou Youxuan Technology Co., Ltd., Hangzhou Tisu Network Information Co., Ltd., and Goumei (Zhejiang) Information Technology Co., Ltd., the association was approved for establishment by the Hangzhou Civil Affairs Bureau. Adhering to the concept of 'co-creation, co-construction, sharing, and co-progress' with member enterprises, the Hangzhou Live Streaming E-commerce Association will focus on the challenges and opportunities faced by the live streaming e-commerce industry, jointly establishing and improving a high-standard and high-awareness operational and service ecosystem for the live streaming e-commerce industry from various aspects such as industry norms and standards, talent cultivation and talent pool establishment, application of new live streaming technologies, qualification verification of live streaming practitioners, guidance on social responsibility, legal compliance of live streaming content and scenarios, and interpretation and promotion of relevant industry policies and regulations, thereby promoting the healthy and orderly development of the industry and contributing to Hangzhou's goal of becoming the 'number one city for live streaming e-commerce.' Hangzhou Yaowang Network Technology Co., Ltd. was elected as the first president unit, with Fang Jian, president of Yaowang, serving as president of the Hangzhou Live Streaming E-commerce Association. The establishment of the Hangzhou Live Streaming E-commerce Association marks a new journey for Hangzhou's live streaming e-commerce industry. An increasing number of domestic and international enterprises and brands are gathering in Hangzhou to host offline exhibitions and e-commerce activities, building one-stop business matching and product procurement platforms, and seeking new business opportunities. For instance, as the Double 11 shopping festival approaches in 2024, Taobao is hosting a Double 11 matchmaking event to bring together leading supply chain merchants and top Taobao clothing gold-medal live streamers face-to-face, preparing for the upcoming autumn and winter launches and Double 11 promotions. The Taobao Double 11 matchmaking event covers all categories and industries, including women's wear, men's wear, men's and women's shoes, underwear, luggage, accessories, watches, and glasses. Among the nearly 200 participating merchants, most come from over ten important clothing industry belts nationwide, with nearly 200 merchants and over 50 live streamers gathering at the event. The second half of live streaming e-commerce is about going global, and Hangzhou hosted the 8th Global Cross-border E-commerce Summit under the theme of 'Tide Rising from Qiantang River' on July 18th, sharing success stories and deeply discussing the rise of global brands. In 2023, the number of cross-border e-commerce brand enterprises with a scale exceeding RMB 20 million in Hangzhou surpassed 1,000, with over 200 enterprises exceeding RMB 100 million. In 2024, Hangzhou aims to achieve an annual cross-border e-commerce import and export volume of RMB 150 billion. To date, two-thirds of cross-border e-commerce retail export platforms nationwide have landed in Hangzhou, with cross-border payment institutions serving 1.5 million sellers nationwide, accounting for 40% of the country's cross-border payment transaction volume; 35 cross-border e-commerce industrial parks have emerged in Hangzhou, with Haiwaihai Cross-border E-commerce Industrial Park and Shangchengli Digital Fashion Industrial Park scheduled to open soon.

04

Artificial Intelligence Technology Triggers a New Round of Industrial Transformation

I. Impact of AI Development on the Live Streaming and Short Video Industry1. Overview of China's AI Industry Development in Recent Years

The AI industry has emerged as a cutting-edge technology sector in China in recent years. According to calculations by the authoritative research institute iResearch, China's AI industry reached a scale of RMB 213.7 billion in 2023 and is expected to exceed RMB 800 billion by 2028, with a five-year compound annual growth rate of 30.6%. China's AI industry development exhibits the following characteristics: Accelerating technological innovation: The rise of large models and generative AI technologies has brought about a fundamental technological revolution in the AI industry. These technologies, with their powerful data processing, learning generalization, and content generation capabilities, have accelerated the empowerment of AI technologies across various industries. Domestic and international technology companies, universities, and research institutes have rapidly launched and iterated large models in languages, images, videos, audios, and other fields, generating explosive impacts. Continuously expanding application scenarios: As technological innovation accelerates, AI technologies are increasingly influencing various scenarios. Currently, AI applications are rapidly diffusing into offices, design, media, law, gaming, education, automobiles, and other fields, deeply integrating with the real economy and driving new momentum for industrial transformation. Continuously optimized policy environment: Since 2019, China's AI-related policies have kept pace with technological and industrial developments, undergoing four stages: extensive piloting, framework construction, industrialization, and scenario-based implementation, effectively advancing AI from an emerging technology to standardized application. In 2023, policy layouts surrounding generative AI rapidly expanded, forming a potent combination from consolidating data and computing power foundations to promptly guiding the standardization of generative AI and then to industrial support. In summary, China's AI industry has achieved remarkable development outcomes in recent years, with a continuously expanding industrial scale, accelerating technological innovation, continuously expanding application scenarios, and continuously optimized policy environments, showcasing diverse regional development highlights. In the future, as technologies continue to advance and application scenarios expand, China's AI industry will embrace broader development prospects.

2. Overview of Hangzhou's AI Industry Development

Hangzhou is one of China's vital cities for AI industry development, achieving notable progress in recent years. Hangzhou's AI industry has grown steadily and has become a significant region for AI development nationally and globally. Hangzhou has made remarkable achievements in AI technological innovation, particularly in high-performance chips, high-speed optical networks, high-performance liquid-cooled servers, AI algorithms, and multi-modal datasets, forming industrial clusters in these sub-sectors. Hangzhou actively encourages enterprises to conduct research and development of key computing power technologies and provides policy and financial support, driving continuous AI technological innovation. By 2025, Hangzhou aims to achieve an AI industry scale exceeding RMB 300 billion, with an average annual growth rate exceeding 15% and an added value exceeding RMB 66 billion. Hangzhou's AI industry development exhibits the following characteristics: Complete industrial chain: Hangzhou's AI industrial chain is relatively complete, encompassing the foundation layer, technology layer, and application layer. Among them, the number of application layer enterprises has grown rapidly, accounting for 80% of the total. Hangzhou's AI industry is concentrated in the northeast, particularly in Yuhang District, West Lake District, Binjiang District, and Gongshu District, where a number of leading AI enterprises have emerged. Nationally leading enterprise innovation: Hangzhou boasts influential enterprises in AI, such as Alibaba, Hikvision, and NetEase, which lead the industry in smart commerce, smart cities, smart finance, intelligent computing, and other fields. Simultaneously, Hangzhou continuously nurtures new AI enterprises, promoting industrial innovation and application scenario expansion. Obvious industrial cluster effect: Hangzhou's AI industry has initially formed a dual-core agglomeration in the West City Scientific and Technological Innovation Corridor and Xiaoshan and Binjiang districts, with a multi-point layout in Yuhang District, West Lake District, Qiantang District, Lin'an District, Shangcheng District, Gongshu District, and Fuyang District. These development platforms are primarily concentrated in the main urban areas, forming an agglomeration effect for the AI industry. Strong industrial competitiveness: Hangzhou's AI industry ranks among the top nationally, with a growing competitive edge. Hangzhou hosts 36.5% of the province's core AI enterprises, accounting for 52.4% of the province's operating revenue in 2021 and 70.5% of R&D expenditures, amounting to RMB 22.58 billion. In summary, Hangzhou's AI industry has developed rapidly, with robust policy support, continuously growing industrial scale and enterprise numbers, a complete industrial chain, strong innovation capabilities, an obvious industrial agglomeration effect, and escalating competitiveness.

The applications of digital humans in live streaming scenarios are multifaceted and are becoming increasingly mature and diverse with technological advancements. Here are some primary application scenarios and advantages: Live streaming sales: Digital humans can serve as virtual anchors for live streaming sales, presenting a novel marketing approach for brand merchants. Digital humans can live stream continuously for 24 hours, unconstrained by time and location, without fatigue or slips of the tongue, ensuring stability in live streaming content. Local life services: Digital humans can be utilized in local life services such as catering and tourism, promoting and driving traffic through live streaming, thereby increasing exposure and order volumes. Corporate live streaming: Enterprises can leverage digital humans for product introductions, corporate culture promotions, and other live streaming activities, saving labor costs and enhancing live streaming efficiency. Personal IP live streaming: Individuals can create their virtual avatars through digital human technology for live streaming interactions, making it an excellent choice for those hesitant to appear on camera or lacking live streaming experience. Customer service: In the customer service sector, digital humans can serve as virtual customer service representatives, providing 24/7 customer consultation services and enhancing service efficiency.

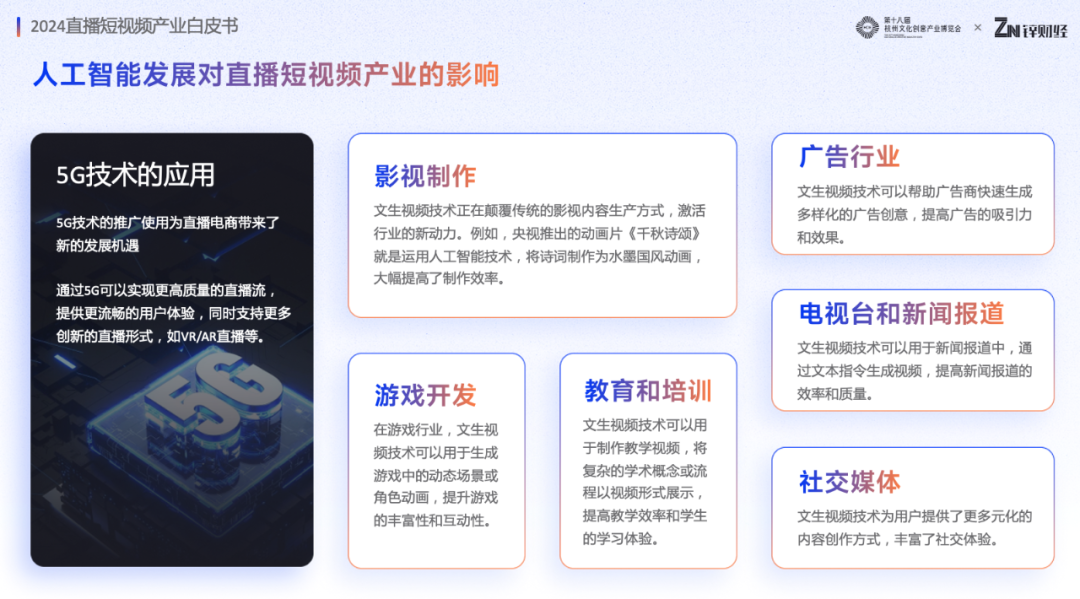

Text-to-Video technology, which leverages AI to convert textual descriptions into video content, combines the latest advancements in Natural Language Processing (NLP) and Computer Vision (CV). Through deep learning models, it understands and processes textual descriptions to generate dynamic and coherent video sequences. Here are some primary application scenarios for Text-to-Video: Content creation: Text-to-Video technology aids creators in rapidly generating video materials for films, advertisements, news reports, social media content, and other forms of digital content. For instance, OpenAI's Sora model can generate 60-second videos from simple textual descriptions in a single run, achieving an industry breakthrough. Game development: In the gaming industry, Text-to-Video technology can generate dynamic in-game scenes or character animations, enhancing game richness and interactivity. Education and training: Text-to-Video technology facilitates the production of educational videos, presenting complex academic concepts or processes in video format to improve teaching efficiency and student learning experiences. Film and television production: Text-to-Video technology is disrupting traditional film and television content production methods, injecting new momentum into the industry. For instance, CCTV's animated series 'Qianqiu Shisong' leverages AI technology to animate poetry into ink-wash style animations, significantly boosting production efficiency. Advertising industry: Text-to-Video technology enables advertisers to rapidly generate diverse advertising creative content, enhancing ad appeal and effectiveness. Television stations and news reporting: Text-to-Video technology can generate videos through textual instructions in news reporting, improving reporting efficiency and quality. Social media: Text-to-Video technology offers users more diversified content creation methods, enriching social experiences.

05

Representative Live Streaming and Short Video Enterprises in Hangzhou

Hangzhou holds a pivotal position in China's e-commerce sector. As one of the birthplaces of Chinese e-commerce, Hangzhou's e-commerce industry has continually developed and expanded, becoming one of the country's and even the world's e-commerce centers. Since the 1990s, the seeds of e-commerce have germinated in Hangzhou's fertile soil. 1999 marks a milestone year and the starting point of the 'Hangzhou Model' in the e-commerce industry. In March 1999, Jack Ma returned to Hangzhou to establish Alibaba.com; in 2005, Taobao captured a 57.1% market share, becoming the leader in China's C2C market. With the rise of renowned e-commerce enterprises like Alibaba, Hangzhou's e-commerce industry has gradually emerged as a national leader after over two decades of development. Hangzhou boasts numerous e-commerce enterprises and platforms, such as Taobao Group, Netease Yanxuan, Vipshop, and Weipaitang, as well as a plethora of e-commerce service enterprises like Youzan and Wenzihui. To date, Hangzhou has 128 e-commerce platforms, 39 'unicorn' enterprises, and 317 'potential unicorn' enterprises. The vast number of e-commerce platforms not only provides consumers with abundant product options but also offers merchants vast sales channels.

E-commerce platform enterprise case: Taobao Tianmao Group: Taobao Tianmao Group is a business group of Alibaba Group, with businesses including Taobao, Tmall, Tmall Global, Taobao Live, Tmall Supermarket, Taobao Fresh, Taobao Special, Xianyu, Alimama, and 1688, providing online retail, online wholesale, second-hand idle transactions, digital marketing, and other services. In 2024, Taobao and Tmall opened more than 6 million new stores, with a 70% quarter-on-quarter increase in new brands joining Tmall in the third quarter; Taobao's "Billion Subsidy" transaction scale grew rapidly, and the number of annual active users has exceeded 500 million to date. The number of Taobao's "Billion Subsidy" partner merchants doubled, and the number of products with transactions exceeding ten million exceeded 100,000. Over the past year, Taobao's 88VIP membership continued to grow at a double-digit rate, with the number of post-00s users increasing by 67% year-on-year, and the membership size exceeding 42 million, making it the largest paid e-commerce membership in China. The number of annual partner brands for 88VIP increased by over 300% year-on-year, with more than half of the business from top brands contributed by 88VIP. The success of Taobao Tianmao Group lies not only in its innovative business model but also in its commitment to technological progress and social responsibility, striving to make business easier for everyone.

Lazada: Lazada is one of the largest online shopping sites in Southeast Asia. In 2016, responding to Alibaba's strategic goal of globalization, Alibaba invested in and controlled Lazada, targeting the Southeast Asian market with significant potential. While the Chinese market is nearly saturated, the cross-border e-commerce industry in Southeast Asia is a new and largely untapped area. In 2023, Southeast Asia ranked first in global retail e-commerce market growth rate at 18.6%. Among the ten fastest-growing countries, Southeast Asian nations accounted for half the seats, with the Philippines, Indonesia, Malaysia, Thailand, and Vietnam all making the list. Currently, Lazada has over 160 million active consumers in Southeast Asia, with major markets in Malaysia, the Philippines, Singapore, Thailand, Vietnam, and Indonesia.

Douyin E-commerce: In recent years, relying on the platform's huge traffic and the positioning of interest-based e-commerce, Douyin's live e-commerce business has continued to grow. In terms of sales heat trends, Douyin e-commerce maintained double-digit growth in sales, transactions, and promotion heat in the first half of 2024 compared to the same period in 2023. According to 36Kr, Douyin e-commerce's GMV was around 2.2 trillion yuan in 2023, with an internal target of 4 trillion yuan for 2024. In terms of categories, apparel and underwear, smart home appliances, and jewelry and cultural relics ranked top in market share, with the overall business scale of each category continuing to expand. In particular, the sales heat of medical health and sports and outdoor categories increased by 567% and 71% year-on-year, respectively. This year, Douyin e-commerce continued to invest more, launching an app called "Douyin Mall Edition" in March, marking the first time Douyin e-commerce introduced an independent e-commerce shopping platform outside its main app. On the Douyin Mall Edition app, users can complete the entire e-commerce shopping experience, including searching for products, comparing prices, placing orders, checking logistics, and after-sales service. In the future, Douyin e-commerce will be the primary competitor of Taobao Tianmao Group and Pinduoduo.

Kuaishou E-commerce: The past year of 2023 was a year of rapid progress for Kuaishou E-commerce. Kuaishou E-commerce's total GMV surpassed the trillion-yuan mark for the first time, reaching 1.18 trillion yuan. The number of monthly active buyers on Kuaishou E-commerce increased by 22.9% year-on-year, with order volume growing by 27.7% and the number of e-commerce operators and new merchants with active sales increasing by 55% and 68%, respectively. The number of merchants with monthly GMV exceeding 2 million yuan increased by 130% year-on-year. Meanwhile, in terms of user composition, the number of southern users on Kuaishou began to increase significantly from 2023. Data shows that among the new users who joined Kuaishou E-commerce in 2023, users from East China accounted for up to 49%, and the overall proportion of southern users reached 55%. This change It's broken the stereotype of "Douyin in the south and Kuaishou in the north" and demonstrates Kuaishou E-commerce's widespread appeal across the country. In 2024, Kuaishou E-commerce will introduce diverse low-priced products through its over-100-billion-yuan New Merchants Launch Plan, comprehensive all-channel merchant incentive strategies, one billion yuan in subsidies for low-priced quality products, and 50 million yuan in incremental business incentives. It will continue to amplify the value of trust and work with merchants to bring better experiences to users. In recent years, China's e-commerce has continued to develop rapidly, with various new business forms emerging, playing an important role in enhancing economic vitality, improving resource allocation efficiency, promoting the transformation and upgrading of traditional industries, and opening up new employment and entrepreneurship channels. In recent years, e-commerce industry policies have continued to intensify, helping accelerate the development of the industry. Capital's sense of smell is always keen, and the vast prospects of the live e-commerce market naturally attract many investors. According to the "2023-2028 China Live E-commerce Industry In-depth Analysis and Development Prospect Forecast Report" by China Research and Intelligence, as of 2024, the number of registered live e-commerce-related enterprises has reached 82,103, far exceeding that of 2023 and indicating the strong momentum of industry development. The report predicts that this number is expected to climb to 96,457 by 2024. With the rise of live e-commerce, MCN agencies quickly seized this opportunity and became important players in the industry. They possess abundant influencer resources with a large fan base and high influence on live streaming platforms, generating considerable exposure and sales for brands.

MCN agency cases: Mosquito Club: Founded in 2016, Mosquito Club is a service brand focused on the e-commerce sector, committed to solving industry pain points, building an e-commerce service sharing platform, and achieving multi-dimensional innovation in service models. Through years of accumulation, Mosquito Club has formed six circles: e-commerce media matrix, e-commerce seller circle, e-commerce service provider circle, influencer circle, e-commerce mentor circle, and e-commerce best-selling author circle. These circles serve each other, forming Mosquito Club's e-commerce service ecosystem. Mosquito Club has also cultivated over 2,000 influencers, guided over 1,000 stores in content marketing, and has over 60 signed influencers.

Qianxun: Established on April 28, 2017, Qianxun is at the forefront of new content e-commerce live streaming agencies, covering a wide range of categories including beauty, lifestyle, and apparel. With tens of millions of fans on Taobao, it precisely reaches audiences through multiple dimensions. Since 2018, Qianxun has repeatedly won awards such as "Annual TOP Agency" and "2019 Excellent Partner" at the Tmall Golden Makeup Awards. It consistently ranks among the top of Ali's V-Task Agency List and Taobao Ranking Agency List. Qianxun's business covers live streaming services, super supply chains, digital systems, omnichannel marketing, IP cooperation, independent brand incubation, cross-border live streaming, etc. It is currently one of the largest live e-commerce enterprises guiding transaction volumes in China. Qianxun has established long-term partnerships with over 60,000 domestic and foreign brands and stockpiled hundreds of thousands of products. It has built a professional anchor matrix covering various fields such as beauty, lifestyle, food, and apparel, providing multi-dimensional services to consumers, supporting domestic brands, and actively promoting the healthy development of the live streaming industry.

Ruhan: Established in 2011, Ruhan is one of the earlier influencer incubation companies in China and an influential influencer marketing platform. Since successfully incubating Zhang Dayi in 2014 and pioneering the "influencer e-commerce" model, it has successively received Series A funding from SAIF Partners, Series B funding from Legend Capital, and Series C funding from Alibaba. In 2019, it was listed on NASDAQ, becoming the first Chinese influencer e-commerce stock. In 2021, Ruhan launched "Aizhongcao, a real-sharing announcement platform for influencers," providing data-driven, all-platform influencer placement services. In the field of influencer incubation, Ruhan has continued to explore businesses such as e-commerce influencer incubation, pan-entertainment advertising influencer incubation, and live streaming influencer incubation. It has successfully incubated well-known KOLs such as Chong Chong, Da Jin, Baojian Sister, Jingzhi Dayifu, and Wenruan, with over 200 exclusive influencers and 358 million fans across all platforms. The Aizhongcao platform has over 40,000 influencers.

Chenfan: Established in August 2015, Chenfan is an online influencer ecosystem platform in China. It has transformed into an online influencer cultivation platform, with systematic cultivation of online influencers' influence and integration of product supply systems. This has guided the investment of substantial funds into various fields such as cosmetics, shoes and hats, home furnishings, and snacks, striving to introduce fresh and fashionable lifestyles and meet the needs of fan consumer groups. E-commerce service providers, an integral part of the e-commerce ecosystem, are institutions or individuals that specifically provide support and services for merchants to conduct business activities on the internet. Through professional skills and services, they help merchants achieve business goals and improve sales performance. In today's highly competitive e-commerce market, e-commerce service providers play an increasingly important role. They not only provide merchants with professional technical and consulting services but also help them improve operational efficiency, expand market share, and thereby drive the development of the entire e-commerce industry. According to the database of the Network Economy Society, there were eight financing events in the retail e-commerce service provider sector in 2023, with a total financing amount of approximately 110 million yuan. In the cross-border e-commerce service provider sector in China, there were 15 financing events, with a total financing amount of approximately 640 million yuan. There were 14 financing events in the industrial e-commerce service provider sector, with a total financing amount of 740 million yuan. With the continuous development of technologies such as artificial intelligence, big data, and the Internet of Things, e-commerce service providers can use these technologies to improve operational efficiency, enhance user experience, and achieve precise marketing. E-commerce services tend to diversify and segment, tapping more consumer groups from the existing traffic pool.

E-commerce service provider cases: Youzan: Founded in 2012, Youzan is a merchant service company with five major business systems: social e-commerce, new retail, beauty industry, education, and Youzan International. Through its social e-commerce, store management, and other new retail SaaS software products, solutions, and services, Youzan comprehensively helps merchants solve problems encountered in the mobile internet era, such as promotion and customer acquisition, conversion, customer retention, repeat purchase growth, and sharing and fission. The 2024 interim report shows that Youzan's GMV in the first half of 2024 was approximately 49.9 billion yuan, an increase of approximately 2% year-on-year. Operating profit was approximately 51.22 million yuan, exceeding the total for 2023. To date, Youzan has achieved operating profitability for seven consecutive quarters. As a leading e-commerce SaaS service provider in the industry, Youzan, with years of experience in mobile retail services and accumulated technology and data, provides countless merchants with real and effective solutions, serving as a connector between merchants and users.

Baizhun: Established in 2020, Baizhun is a digital marketing service platform for WeChat Video Accounts. As an official service provider for WeChat Video Accounts, it provides full-chain Video Account operation solutions, supported by "data + service," including SaaS tool matrices, marketing services, and e-commerce services. "Baizhun Data" currently indexes over 4 million Video Account creators, 80 million Video Account dynamics, and 4 million live broadcast room data. At the same time, the "Baizhun Data" platform provides data services such as querying top-quality Video Account bloggers across the network, analyzing Video Account operation data, monitoring live broadcasts, analyzing brand placement, and optimizing Video Account traffic allocation, helping brands and agencies optimize placement strategies, monitor live broadcast data, and enhance Video Account operation and advertising placement effect monitoring. As Video Accounts enter a period of development dividends, Baizhun, as the only capitalized digital marketing service platform for Video Accounts with complete qualifications in the industry, continuously enhances data, branding, and value, helping brand owners, creators, and industry chain service providers grow together and promoting the maturity and prosperity of Video Account creation and the business ecosystem, realizing the platform vision of inspiring creativity and driving commerce.

Weimob: Founded in 2013, Weimob is a Chinese provider of cloud-based business and marketing solutions for enterprises and a precision marketing service provider. Weimob is committed to providing decentralized digital transformation SaaS products and full-funnel growth services for merchants to support their sustainable business growth. The company is headquartered in Baoshan District, Shanghai, with a main place of business in Hong Kong. By building the WOS new business operating system, Weimob creates a set of decentralized business infrastructure for enterprise digital transformation, supporting merchants' intelligent operations through a multi-end integrated product service matrix. In the first half of 2024, Weimob continued to penetrate and maintain a leading position in apparel, fast-moving consumer goods, and building materials industries, with cooperation with the top 100 merchants accounting for 43%, 21%, and 19%, respectively.

Youmi Cloud: Founded in 2010, Youmi Cloud is a professional global marketing big data platform dedicated to leading enterprises' marketing digitization through big data and AI technology. Youmi Cloud creates an intelligent engine for enterprise marketing digitization by providing multi-dimensional marketing big data services and tools, helping enterprises enhance the digitization efficiency of the entire marketing funnel, from market insights, product decision-making, marketing strategies, creative content, to promotion execution. It enables intelligent business decision-making, marketing content production, and digital asset management. Under the brand concept of "Data-Driven Marketing," it has become a leader in the global marketing big data industry after over a decade of growth. The marketing big data analysis platform under Youmi Cloud's business brand, Youmi Data, has become a "magic tool" in the short video and live e-commerce sectors, solving pain points for a large number of e-commerce customers.

06

Trends in Hangzhou's Live E-commerce Development

In recent years, the development of AI technology has brought significant changes to the live e-commerce industry. Hangzhou, as the capital of China's internet, ranks among the forefront in AI technology development, particularly in the e-commerce sector, where many e-commerce enterprises have experimented with various applications.

1. Digitization and Intelligence: With the widespread application of digital technologies such as big data, cloud computing, the Internet of Things, blockchain, AI, and 5G, the entire process of live e-commerce is being digitized and intelligentized, improving operational efficiency and consumer experience. 2. Application of 5G Technology: The promotion of 5G technology has brought new development opportunities to live e-commerce. Through 5G, higher-quality live streams can be achieved, providing a smoother user experience and supporting more innovative live broadcast formats such as VR/AR live broadcasts. 3. Rise of Digital Human Anchors: The development of AI technology has made digital human anchors possible. Digital human anchors can work continuously for 24 hours, reducing costs while providing novel interactive experiences. Companies in Hangzhou, such as Qianxun Holdings, have begun exploring AI digital human business and achieved certain market response. 4. Digitization of Supply Chains: The rapid development of live e-commerce has placed higher demands on supply chains. The construction of a flexible and digital supply chain has become a trend to better meet consumers' diverse needs and improve product iteration efficiency.

From the era of PC Internet to the era of mobile Internet, and now on the eve of the AI era, e-commerce has developed for more than 20 years. With the evolution of technology and form, regulations related to e-commerce are also constantly updated and improved. The most fundamental reason behind this is to protect the fundamental rights and interests of consumers and regulate the boundaries of responsibilities between merchants and platforms. With clear laws and regulations, the e-commerce industry can develop more stably and normatively. As the capital of e-commerce, Hangzhou is also a leader in the construction of e-commerce-related regulations nationwide, creating a good business environment and industry development environment. The standardization of Hangzhou's live e-commerce industry is mainly reflected in the following three aspects: 1. Establishment of a digital governance platform: Hangzhou Shangcheng District has launched the country's first "Live E-commerce Digital Governance Platform", which uses digital means to supervise live e-commerce, including four dimensions of live broadcast subjects, commodity monitoring, behavior detection, and digital governance, to create a green live broadcast room. 2. Formulation of local standards: Hangzhou has issued the local standard of "Green Live Room Management Regulations", which puts forward standardized requirements from the aspects of live broadcast platform specifications, merchant management, anchor management, MCN agency management, and after-sales service to promote the standardized development of live broadcast with goods. The Hangzhou Municipal Justice Bureau issued the "Compliance Guidelines for the Live E-commerce Industry (Draft for Comments)", which puts forward clear norms and guidelines including subject compliance, live account compliance, product and service compliance, and live marketing compliance. 3. Application of technical means: By leveraging blockchain technology, big data technology, and artificial intelligence technology, intelligent analysis of live e-commerce enterprise video data is conducted through the establishment of a keyword library of illegal behaviors and intelligent analysis models.

07

Conclusion

With the vigorous development of Hangzhou's live e-commerce industry, the application of new technologies, represented by AI, has become a crucial driving force for innovation in this field. The application of AI technology in live e-commerce has expanded from a single data analysis tool to multiple aspects such as user insights, product recommendations, content generation, and customer service. Through AI technology, live e-commerce can achieve a more precise user portrait, provide personalized product recommendations, thereby enhancing user experience and improving conversion rates. Simultaneously, AI technology can assist in content creation, automate the generation of live broadcast scripts and product descriptions, and increase the production efficiency of live broadcast content. During live broadcasts, the application of AI technology is also increasingly widespread. For example, through AI-driven chatbots, brands can answer audience questions in real-time during live broadcasts and provide personalized services. Additionally, AI technology can optimize inventory management, ensuring seamless integration between product supply and live promotion activities, reducing inventory backlogs and out-of-stock risks. However, despite the numerous conveniences AI technology brings to live e-commerce, it also faces challenges. Technical bottlenecks, user privacy and data security issues, and ethical concerns are obstacles that AI needs to overcome in enhancing its influence in the field of live e-commerce. To address these issues, technological innovation, data privacy protection, and cross-disciplinary cooperation will become critical directions for future AI development.

Looking ahead, with continuous technological advancements, we have reason to believe that AI will play an even more significant role in the live e-commerce sector. The deep integration of AI technology will drive live e-commerce towards more intelligent and personalized content creation and operational optimization. Meanwhile, live e-commerce will integrate with other emerging technologies such as blockchain and the Internet of Things to form a more comprehensive ecosystem. In Hangzhou, the integration of live e-commerce and AI is leading a new wave of transformation in the e-commerce industry. Through the application of AI technology, brands can not only achieve innovation in content creation and operational efficiency but also gain a deeper understanding of consumer needs and formulate more precise marketing strategies. Hangzhou's live e-commerce industry will continue to serve as a pioneer in the sector, exploring new applications of AI technology in live e-commerce and driving continuous innovation and development. With the continuous development of AI technology and the expansion of application scenarios, the future of Hangzhou's live e-commerce industry is full of endless possibilities. We look forward to AI technology bringing more innovation and value to the live e-commerce industry in Hangzhou and globally.