Rebound leader: A-share chips, Hong Kong stocks pharmaceuticals

![]() 10/28 2024

10/28 2024

![]() 547

547

In this round of market conditions, the sharp volume decline on October 8 poured cold water on all investors chasing gains. This bull market has always been marked by overheating and corrections, but after a round of adjustments, some strong-performing sectors have gradually emerged.

Among them, the A-share chip sector led the way to new highs, while the Hong Kong stock market has yet to see new highs across all sectors, but the number of pharmaceutical sector stocks reaching new highs ranks among the top.

Chips and pharmaceuticals have always been growth-oriented sectors and were two popular sectors in past bull markets. In the long-term bear market, they have consistently hit new lows due to a lack of compelling narratives. This current performance can be seen as a shift from a dividend-focused defensive style to a growth style.

However, previous rallies in these sectors have always been fueled by industry booms, driving significant gains for industry leaders. Do the current conditions in these two industries still support this trend? What can we see behind their leadership?

I. Which chip and pharmaceutical stocks have reached new highs

Currently, the A-share chip sector has several stocks that have reached new highs, including SMIC, Cambricon, and Hygon, whose main businesses are chip foundry and chip design respectively.

The fundamentals of some of these companies, such as Cambricon and SMIC, have been criticized, as their performance is not outstanding within the chip sector as a whole. They are certainly not the best in the industry.

The core reason for their new highs is more related to their STAR Market listing status (with ticker numbers starting with 688). The market prefers technology stocks listed on the STAR Market, and during industry rallies, stocks with ticker numbers starting with 688 tend to outperform their peers, resulting in significant market value and price appreciation gaps.

The chip broad-based index and funds linked to chip indices, such as chip ETFs, have broken through their previous highs on October 8, making them one of the few sectors to reach new highs. This underscores that chips have been one of the most profitable sectors during this period.

However, it is also worth noting that the Hong Kong stock market's semiconductor sector index has not reached a new high. Although there are not as many stocks in this sector as in the A-share market, most of SMIC's tradable shares are listed in Hong Kong, and they have not followed the uptrend.

Each such surge in the semiconductor sector is more of a memory of past bull markets, where investors tend to flock to chips during technology rallies. As for why stocks listed on the STAR Market (with ticker numbers starting with 688) outperform, they have also become the most actively traded stocks. Are these the new funds entering the market, with most investors trading them?

On the contrary, due to the nature of the STAR Market, it is more difficult for average traders to participate in these stocks. Such gains are likely driven by larger investors, such as fund institutions.

It is harder for non-STAR Market companies to rally because average investors are more involved, and they tend to take profits or exit at breakeven points after recovering their investments, making it difficult for stock prices to rise quickly. In contrast, the STAR Market does not face as much selling pressure.

Such behavior is hardly rational and resembles herd behavior. However, the high trading volume differs from past core asset herding, suggesting that there is significant institutional trading activity concentrated in these stocks. Everyone seems to be playing the same game.

It can be seen that Chinese institutions are still using the same old playbook, adhering to the herd mentality that has persisted since 2018 and placing relatively low demands on fundamentals. This has led to a significant number of funds underperforming the index over the past few years, causing investors to lose more money. This trend is unlikely to change in the future. If I'm not mistaken, the institutional holding ratio of these 688 stocks will increase significantly after their fourth-quarter reports are released.

Turning to Hong Kong stocks, some notable new highs have been reached by companies like Ascletis, Everest Medicines, and Zai Lab, among others.

The Hang Seng Healthcare Index has not outperformed the broader Hang Seng Index and remains relatively unremarkable.

This reflects the industry's unique characteristics. The pharmaceutical industry is highly fragmented, with different segments such as chemical drugs, biopharmaceuticals, medical devices, traditional Chinese medicines, and CXO each having their own unique logic. Some segments suffer from insufficient demand, while others face external pressures. As a result, it is difficult for the entire pharmaceutical sector to experience a holistic boom.

Despite the lack of a sector-wide rally, companies with solid fundamentals have generally outperformed the index.

The three companies mentioned above are all innovative drug developers that have entered a positive growth trajectory this year. They have high growth rates and are rapidly commercializing their core products. Crucially, they have experienced significant declines in recent years, making their new highs this year particularly noteworthy.

From a valuation perspective, their price-to-sales ratios are not particularly attractive, and profit margins are not strong, making price-to-earnings ratios less informative. However, their high growth rates and consistently strong performance are undeniable.

In a bear market, investors focus on earnings and safety margins, and high growth rates alone are not enough to justify high valuations. However, in a bull market, valuations can be stretched as long as growth rates remain strong.

While the performance of the chip sector may have some cyclical reversal components, no company has yet surpassed its 2021 earnings peak. In this context, innovative drug companies represent a more growth-driven narrative.

However, such trends are still relatively rare. Many innovative drug companies with unremarkable businesses have fallen back to their bull market starting points, and the market has not provided a premium for the entire sector.

Interestingly, companies with significant declines and improved fundamentals can reach new highs, while those with poor fundamentals return to their starting points.

What about companies with decent fundamentals but not significant declines?

These are innovative drug leaders that have been on a steady growth trajectory for several years and have not experienced significant stock price declines, such as BeiGene, Innovent Biologics, and CanSino Biologics.

Their stock price performance is largely tied to the progress of their core products and the level of earnings surprises. However, it seems that their performance is largely decoupled from the broader bull market, as they experience limited trading volume and minimal price volatility.

These companies, along with HengRui Medicine, Mindray, and WuXi AppTec, represent China's leading pharmaceutical companies, comparable to the chip sector leaders mentioned earlier. However, institutions have shown little interest in these companies, in contrast to the heavy herding that has occurred in the pharmaceutical sector in the past. This is quite intriguing.

II. Have industry booms and reversals arrived?

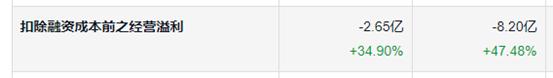

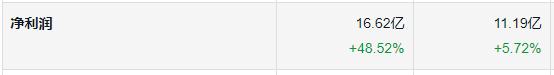

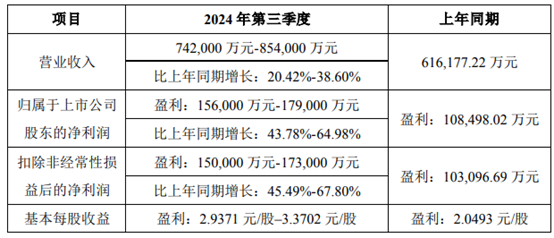

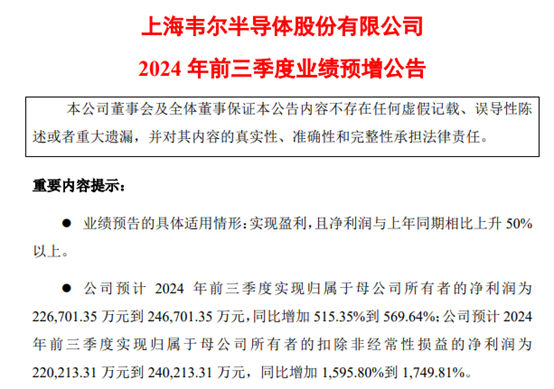

Examining recent third-quarter financial reports, it is clear that the industry is indeed experiencing marginal improvements. Among chip leaders, Northern Microelectronics, Hygon, and Weir Corporation have all seen accelerated earnings recovery, with year-over-year growth rates improving quarter by quarter.

Looking at the overall revenue growth rates across sectors, it is evident that the computer and electronics industries rank first and second among all A-share sectors.

Based on the third-quarter earnings forecasts of leading companies, it can be inferred that the gap between their revenue growth rates and the market average is widening. This is primarily due to macroeconomic factors, as the third quarter data was weaker than the second quarter, making it difficult for most companies to maintain sequential growth in Q3. Consequently, over half of listed companies are likely to experience further declines in year-over-year growth rates in Q3.

The key reasons for this can be attributed to the recovery in business sentiment for consumer electronics and automotive chips, as well as the increasing domestic substitution rate in the chip industry, which has driven the earnings of these leaders. In particular, chips related to mobile phones, PCs, and automobiles are at the bottom of the cycle, and now terminals are showing signs of recovery, especially for mobile phones and PCs. This has driven a rebound in demand for many non-AI chips. This trend can also be cross-validated by the Q3 financial reports of many non-leading semiconductor companies listed in the U.S.

The reason why chips and computers have emerged as leaders is not just due to bull market inertia but also because they are currently the companies with the most significant marginal improvements in earnings. The reversal of the consumer electronics cycle has played a significant role.

However, one question remains: why did chip stocks mostly underperform despite several quarters of earnings recovery alongside the recovery of mobile phones and PCs? There are two main reasons. First, the AI boom last year led to a surge in semiconductor stocks, and despite some declines over the past two years, valuations remained relatively high. Second, while earnings have improved, a closer look reveals that most semiconductor companies are still trading at premium valuations, even after significant declines in the first two quarters of this year. It is only in a bull market that valuations become less of a concern, as investors focus solely on growth potential.

Following chips and computers, the next sectors to rally have been photovoltaics and renewable energy. The logic here is also one of cyclical reversal, but while semiconductors have already delivered earnings growth, photovoltaics are still in their early stages, and the growth rate of the power equipment and renewable energy sector currently ranks fifth from the bottom among all sectors. It is uncertain whether Q3 will see a reduction in losses or an expansion of them. Semiconductors are rallying on the strength of their current growth rates, while photovoltaics are relying on expectations of future growth.

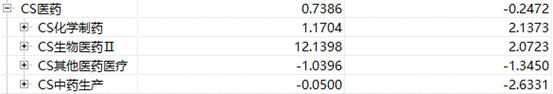

Turning to pharmaceutical stocks, the sector's overall performance has been lackluster, with continued pressure from medical insurance cost control and the post-pandemic environment.

While overseas revenue growth is increasing for some Chinese companies, it is not clustered, with only a few companies within the industry capturing 100% of the overseas revenue growth.

Excluding the overseas growth component, the average revenue growth rate for A-share chemical and biopharmaceutical companies is only 2%, with most revenue coming from the Chinese market.

However, the domestic revenue growth rates for several leading innovative drug companies (all from Class 1 new drugs) have reached over 20%. BeiGene's revenue in China grew by 27% year-on-year in the first half of this year, while Innovent Biologics, which has virtually no overseas revenue, grew by 55%.

This underscores the rapid market share gains being made by innovative pharmaceutical companies. However, the stock performance of these leading innovative drug companies has been underwhelming, with no significant outperformance. The key issue lies in their inability to translate revenue growth into profits. To address this, they must either quickly generate profits or further accelerate revenue growth. Failure to do so will result in mediocrity.

Within the pharmaceutical industry, there is a significant divergence in growth rates, with some companies performing well and others poorly. This has led to poor index performance, but the top-performing companies are thriving. Therefore, the opportunities in the pharmaceutical industry currently lie in medium to large enterprises increasing their revenue growth rates or profit margins to drive stock prices upwards. For small and medium-sized enterprises, the goal is to transition from no revenue to rapid product sales, creating scale and lifting stock prices and long-suppressed valuations back to levels seen during the industry's boom period several years ago, such as the 10-20 billion range.

The logic behind pharmaceutical stocks is not inherently weak, and they have the potential to attract the same kind of herd mentality that has surrounded chip stocks. For the industry as a whole, the investment logic to explore now is which companies have the potential to transition from no revenue to a stable business model, with rapid growth in core product sales. These companies could generate incremental revenue from either the overseas or domestic market, and there are more than just the three mentioned above.

In every pharmaceutical market rally, there are always more companies that ride the wave without significant fundamental improvements than those with genuinely improved fundamentals. Theoretically, there is still room for the innovative drug sector among small and medium-sized companies to expand its scale.

For CXO companies, which make up a significant portion of the industry's earnings, their poor performance is driven by both cyclical and policy factors. Policy factors are more unpredictable than cyclical ones, adding to the uncertainty. However, from a stock price perspective, CXO companies have experienced similar declines to those seen in the photovoltaic sector. While two factors are suppressing their stock prices, a marginal improvement in either the cycle or policy environment could potentially lead to a reversal.

Conclusion

While the market indices have not yet recovered to their previous highs, the bull market sentiment remains strong. Investors are resolutely pursuing high growth and focusing on companies with high growth rates. This logic is evident in the performance of sectors such as chips and computers, and it also applies to Hong Kong-listed pharmaceutical stocks, although the details are still somewhat messy at this stage. Some stocks have reached bubble levels, while others have yet to start their rallies.

In the A-share market, excellent fundamentals have not created significant differences in stock prices, while in the Hong Kong stock market, the situation is slightly more accurate but still limited to a small number of outperforming stocks. This may not necessarily represent a rational correction. The market could be wrong, but it could also be a trial-and-error phase at the beginning of a bull market. As capital rotates and quarterly earnings are disclosed, the market will gradually identify the rational directions for growth. Pursuing high marginal growth should be the goal of investors in the coming period.