China's Electric Vehicles: The Rising Stars in Europe, Rivaling Tesla

![]() 05/23 2025

05/23 2025

![]() 630

630

Introduction

Tesla's dominance in Europe is facing a steep decline, opening up opportunities for Chinese automakers to shine.

"In the European market, China's electric vehicles are poised to supplant Tesla's position," noted Marek Belka, former Prime Minister of Poland, at the 2025 Tsinghua PBCSF Global Finance Forum. He emphasized that the entry of Chinese electric vehicles into Europe has been a topic of considerable discussion, and given that Tesla is not a European company, there are no major obstacles to this shift.

Indeed, Chinese electric vehicle companies have surged ahead in the European market in recent years, expanding their influence through technological innovation, supply chain integration, and localization strategies, posing significant challenges to established local automakers.

Belka's remarks underscore a transformative shift: the discourse power in the European electric vehicle market is evolving.

Behind this trend lies China's automotive industry's reconstruction of its perception in the European market, achieved through technological revolution. From followers to rule-makers, Chinese electric vehicles, though unlikely to immediately displace Tesla and traditional giants, will undoubtedly continue to rise in influence in the long run.

01 Tesla's European Dilemma

In 2008, Tesla delivered its first Roadster in Europe, marking its entry into the market. With advanced technology and stylish design, Tesla quickly captured the attention of European consumers, achieving substantial sales and occupying a significant market share in many countries, becoming a benchmark in the electric vehicle sector.

For over a decade, the Model Y was the sales champion in Europe, while the Model 3 broke sales records in multiple countries upon its launch. Today, over a million Tesla vehicles traverse European roads, making it a formidable competitor to Volkswagen and the leading electric vehicle manufacturer in Europe.

However, Tesla's performance in the European market in 2025 has faltered.

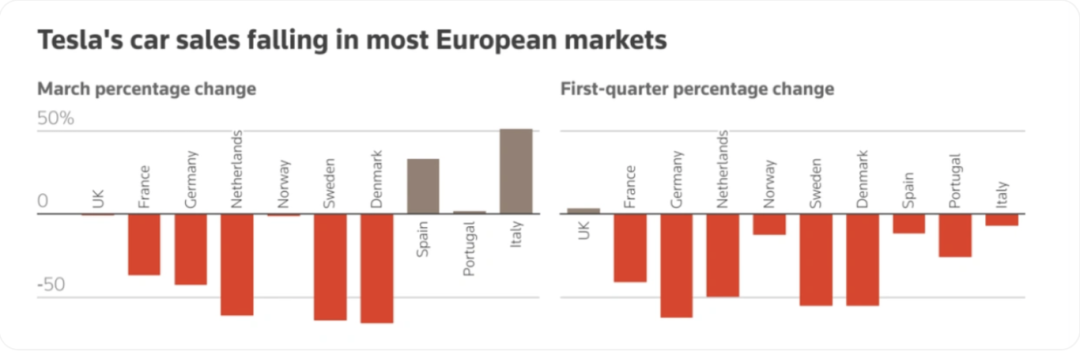

Data reveals that Tesla's sales in Europe plummeted by 36% year-on-year in the first quarter of 2025, reaching only 53,200 vehicles. Core markets such as Germany and France witnessed declines exceeding 60%. In the first four months of this year, Tesla's sales in Europe fell sharply by 38% year-on-year, from 101,000 vehicles to 62,000.

The Model Y, expected to boost sales, saw its April sales halve from nearly 10,000 vehicles last year to 4,743, a drop of 51.1%. The Model 3 also performed poorly, with April sales of 3,094 vehicles, a year-on-year decline of 35.1%.

Surprisingly, this downturn occurred amidst rapid growth in overall electric vehicle sales in Europe.

Tesla's sales crisis stems from multiple converging factors: lagging product iterations, heightened political risks, subsidy cuts, and insufficient localization, all of which have weakened its competitiveness.

In terms of products, Tesla's replacement speed can be described as "turtle-like." Taking the popular Model Y as an example, this model has not undergone a major facelift in five years, leading to prolonged consumer waiting times and decreased market appeal.

According to Tesla's official website, the delivery cycle for the refreshed Model Y Rear-Wheel Drive version is 2 to 4 weeks, and the Long Range version is 3 to 5 weeks. The current extended waiting time for vehicle delivery indicates that new Model Y orders have not significantly exceeded estimated production capacity, suggesting a less than optimistic market response compared to previous supply shortages.

Furthermore, Musk's publicly supported political actions have sparked resentment among European consumers, leading to vandalism of Tesla stores, cars, charging piles, and other facilities in multiple European cities. Additionally, the U.S. tariff policy affects Tesla's globalized supply chain, and the rumored arrival of the low-cost Model 2 seems distant...

These adverse factors have contributed to the collapse of Tesla's sales in the European market.

In contrast, traditional European automakers such as Volkswagen, BMW, and Mercedes-Benz have accelerated their transformation towards new energy vehicles, launching multiple competitive electric vehicle products. Leveraging their profound engineering expertise and vast user base, these automakers have made significant progress in a short period.

Simultaneously, the rise of Chinese electric vehicles cannot be overlooked. Brands like SAIC, BYD, NIO, and Xpeng have won the favor of domestic and foreign consumers with rapid technological iteration and cost-effective product strategies, gradually eroding Tesla's original market share.

This shift has transitioned the European electric vehicle market from a "Tesla monopoly" to a "multi-power competition" stage, enabling Chinese electric vehicles to increase their influence in the European market after technological upgrades and system construction. Some European netizens even joked: "While Musk is busy building relationships with Trump, Chinese automakers are taking advantage of the situation to insert charging piles into the heart of Europe."

02 Market Share Alternation and System Reset

The European market is one of the top three markets for Chinese vehicle exports. In 2024, China exported 5 million passenger vehicles, with 1 million units destined for the European market. In the first quarter of this year, the registration volume of Chinese brand vehicles in Europe increased by 78% year-on-year, reaching a record high of 150,000 units, with a market share of 4.5%.

Models from brands such as BYD, MG, Great Wall Ora, and Chery have achieved impressive sales performance. BYD sold over 10,000 vehicles in 14 countries including Spain, Italy, France, the UK, and Germany, far exceeding Tesla's sales of around 6,000 vehicles. The MG4 outperformed European competitors like the Volkswagen ID.3 and Renault Megane E-Tech.

Behind these sales figures lies the key to breaking China's intelligent manufacturing deadlock.

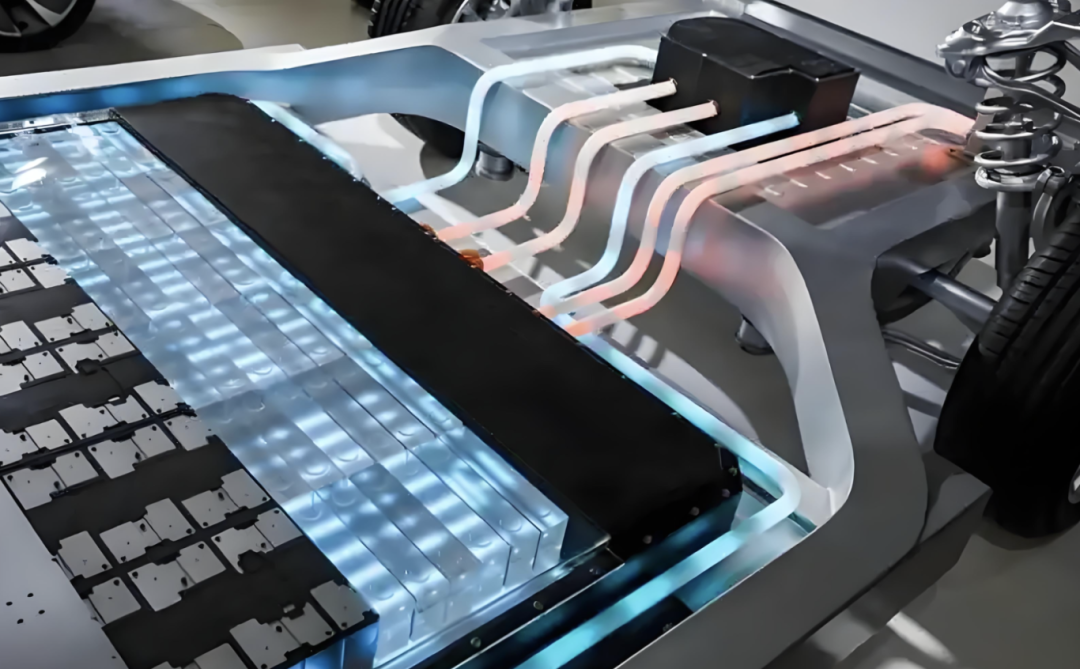

Firstly, there is the revolutionary advance in battery technology.

Contemporary Amperex Technology Co. Limited's (CATL) 4C supercharging technology for its Shenxing battery and BYD's Blade Battery's CTB integrated design are redefining Europe's cognitive standards for power batteries. When the technological generation gap surpasses brand prestige, market balance inevitably shifts. Executives from the Volkswagen Group have admitted: "The cost of Chinese batteries is 35% lower than that of European local products, but their energy density is 15% higher." This advantage of stronger technology and lower costs poses a dilemma for European automakers.

Secondly, there is the comprehensive disruption of the intelligent ecosystem.

Huawei's ADS 3.0 intelligent driving system, NIO's NOMI GPT interaction engine, Li Auto's Smart Space 3.0... Chinese automakers have elevated intelligent cockpits from functional modules to "mobile third spaces." In contrast, Tesla's Model Y cockpit interaction logic lags behind by several years, with growing complaints about the "technological generation gap" on European user forums.

Additionally, precise adaptation through localized innovation is a significant advantage.

For example, the MG4 developed a snow mode tailored to European road conditions, the BYD Dolphin comes standard with European-standard tow hooks, and the Great Wall Ora Ballet Cat introduced a queen co-pilot seat conforming to European women's driving habits. This strategy of technology localization is dispelling the stereotype that "Chinese cars don't understand Europe." Coupled with the higher OTA upgrade frequency of Chinese automakers, allowing products to evolve in sync with user needs, European consumers are constantly refreshing their perception of Chinese electric vehicles during actual use, deepening the influence of Chinese cars.

Furthermore, the reconstruction of the supply chain, exemplified by GuoXuan High-Tech's investment in a 20GWh battery factory in Germany; the channel revolution with NIO House entering Paris's Champs-Élysées; and standard output with Huawei and DJI participating in the formulation of the EU's V2X communication standards are enabling Chinese automakers' advances to reshape the European automotive industry ecosystem.

With these fortifications in place, Chinese electric vehicles have the confidence for substantial growth in the European market.

In 2024, the market share of Chinese brand pure electric vehicles in the European Union exceeded 18%, a nearly tenfold increase from 2020. The market share of Chinese brands in the European electric vehicle market reached 11% and is expected to rise to 20% by 2027. Among them, BYD's share in Europe jumped from 0.4% in 2022 to 8% in 2024.

The essence of this explosive growth lies in the re-evaluation of product value by European consumers.

Recently, a European Commission spokesperson stated that China and the European Union have agreed to study setting a minimum price for electric vehicles made in China to replace the electric vehicle tariffs imposed in 2024. This "minimum price" trade strategy not only maintains fairness in the European market but also creates space for legal trade.

Many European insiders believe that, amidst the United States' abuse of tariffs, China and Europe may swiftly resolve some trade disputes to prevent trade frictions from escalating. Simultaneously, the EU's replacement of tariffs with a fixed minimum price may prompt more Chinese electric vehicles to enter Europe and compete with Tesla in the market.

Leveraging technological iteration, cost advantages, and localization strategies, Chinese electric vehicle companies are on their way to reshaping the European market landscape. While it may be challenging to completely replace Tesla in the short term, they have already established a dominant position in the mid-to-low-end market and are gradually penetrating the high-end market. If they continue to break through brand perception and technological barriers, they will have the opportunity to challenge Tesla's position in the future.

Editor-in-Charge: Li Sijia, Editor: He Zengrong